BTC ETFs: Grayscale GBTC inflows near $1B in 1 week, analyst says…

- Institutional interest in Bitcoin grows, adding liquidity despite Grayscale’s recent high-fee withdrawals.

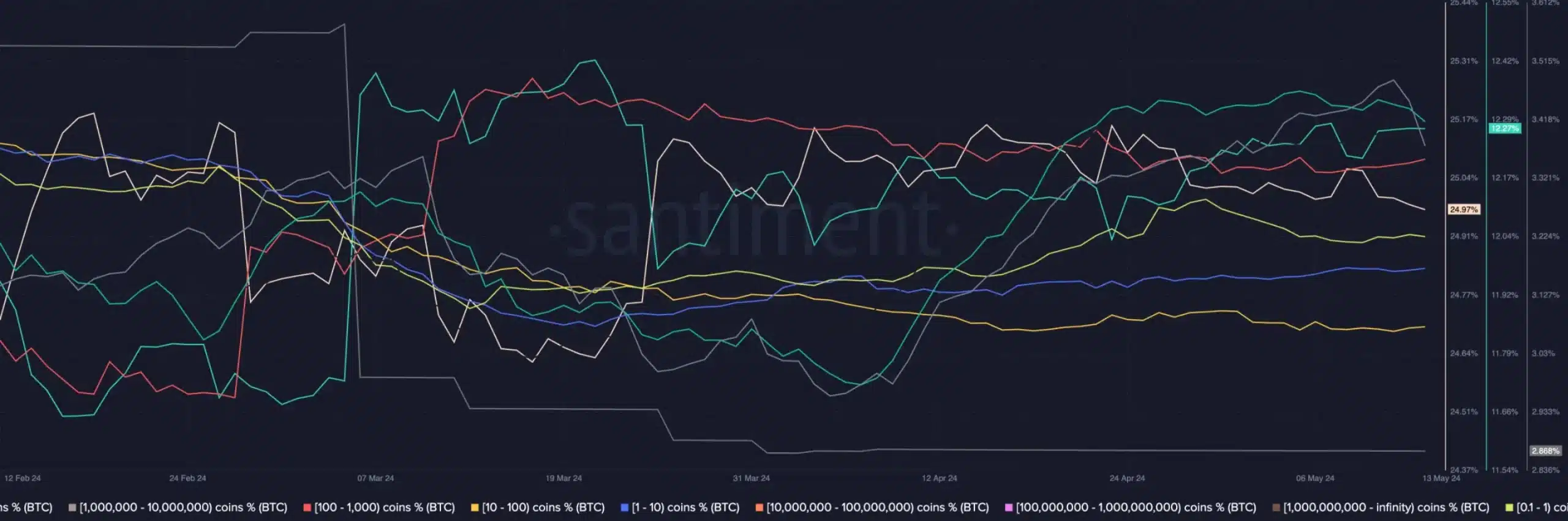

- Retail investors accumulate Bitcoin, enhancing decentralization, while whales show less interest.

Bitcoin [BTC], the leading cryptocurrency, is beginning to recover from a week-long slump, currently valued at $67,093 with a 1.28% increase in the past 24 hours.

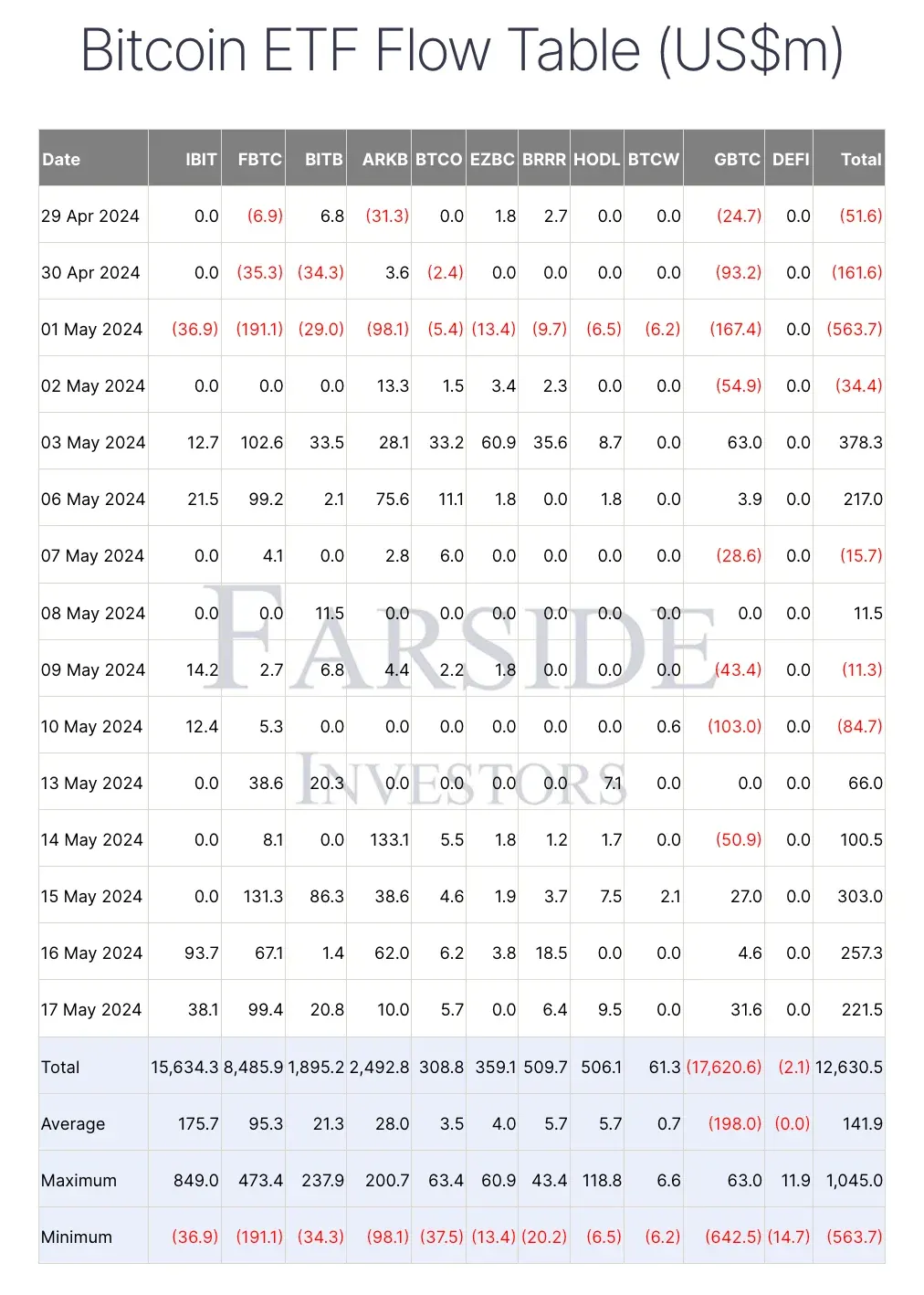

Additionally, on the 17th of May, Farside Investors reported that Grayscale’s spot Bitcoin ETF (GBTC) saw inflows of $31.6 million, and GBTC now oversaw more than $18 billion in assets.

Well, Grayscale has faced major challenges since converting from a trust to a spot ETF in January. However, three consecutive days of inflows have been a boon for GBTC.

What are the execs saying?

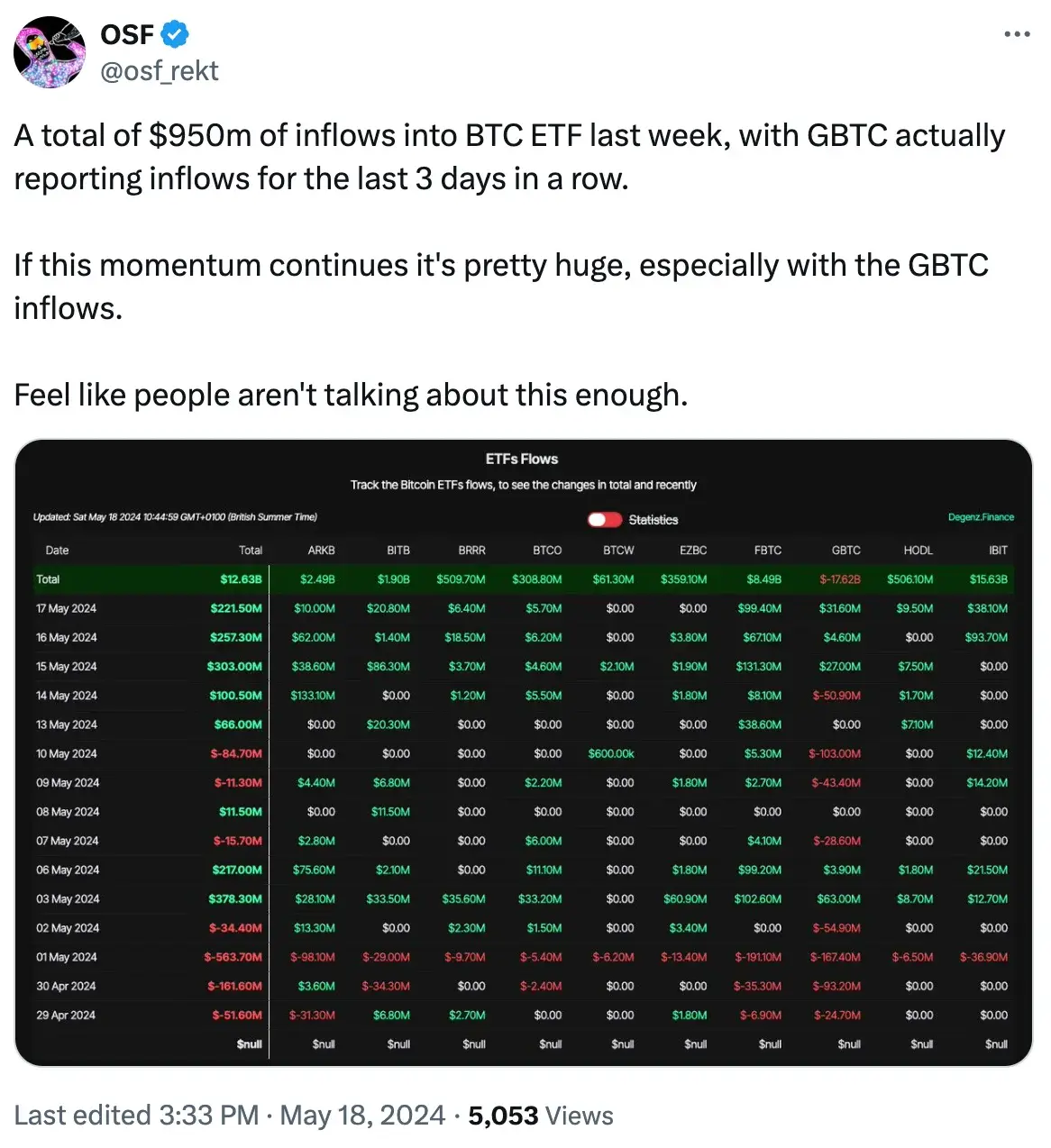

Seeing a positive outlook of GBTC among investors, an X (formerly Twitter) user, @osf_rekt said,

This transition has resulted in over $17 billion in withdrawals, largely due to higher fees than other options.

Additionally, a series of bankruptcies within the crypto industry over the last two years compelled companies to withdraw funds to meet creditor obligations.

Interestingly, on the 15th of May, all spot Bitcoin ETFs, apart from BlackRock’s iShares Bitcoin Trust (IBIT), reported inflows.

Simultaneously, on a similar day, Grayscale’s GBTC notably recorded its first inflows in a week, drawing in $27 million.

This highlights that institutional investors are showing interest in Bitcoin, bringing liquidity, while crypto whales remain less enthusiastic.

Increased in retail investors

Data from Santiment, analyzed by AMBCrypto, indicate that while whales slowed accumulation, retail investors are increasing, promoting network decentralization.

This trend of retail accumulation could benefit Bitcoin in the long run by promoting greater network decentralization.

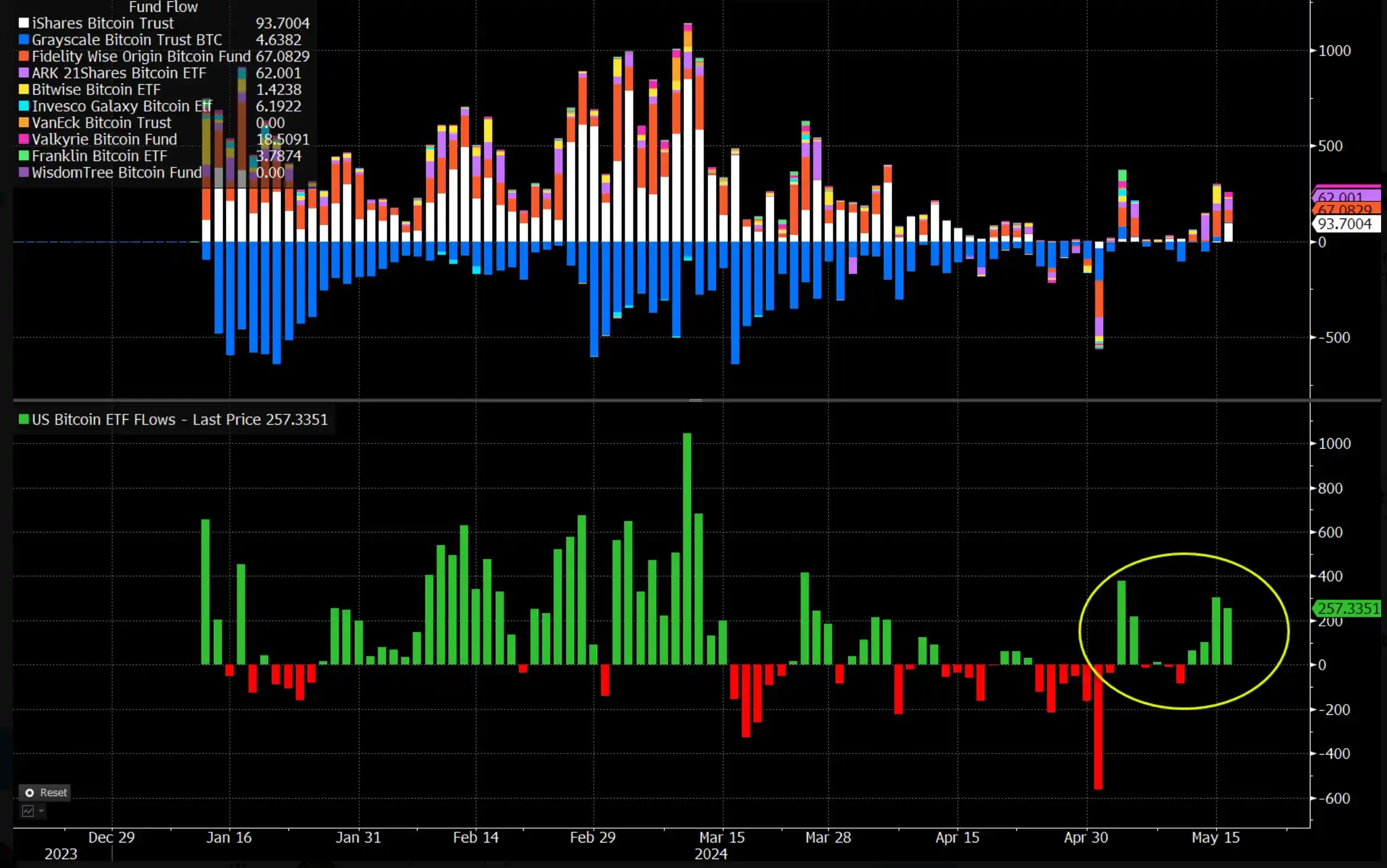

Highlighting May’s positivity for spot Bitcoin ETFs, Eric Balchunas, Senior Analyst at Bloomberg, noted,

“The bitcoin ETFs have put together a solid two weeks with $1.3b in inflows, which offsets the entirety of the negative flows in April- putting them back around high water mark of +$12.3b net since launch. This key number IMO bc it nets out inflows and outflows (which are normal).”

Offering advice to investors, he further commented,

“Last two mos show why best not to get emotional over flows which come in and out, part of ETF life, but a) i think they’ll net out positive long-term b) the flow amts on either side are small relative to aum maybe (1-2%) so it’s never SO OVER or SO BACK if you think about it.”