Is Bitcoin at risk from Ethereum ETFs? Peter Schiff explains

- Schiff’s remarks come amid Bitcoin’s brief move above $70k.

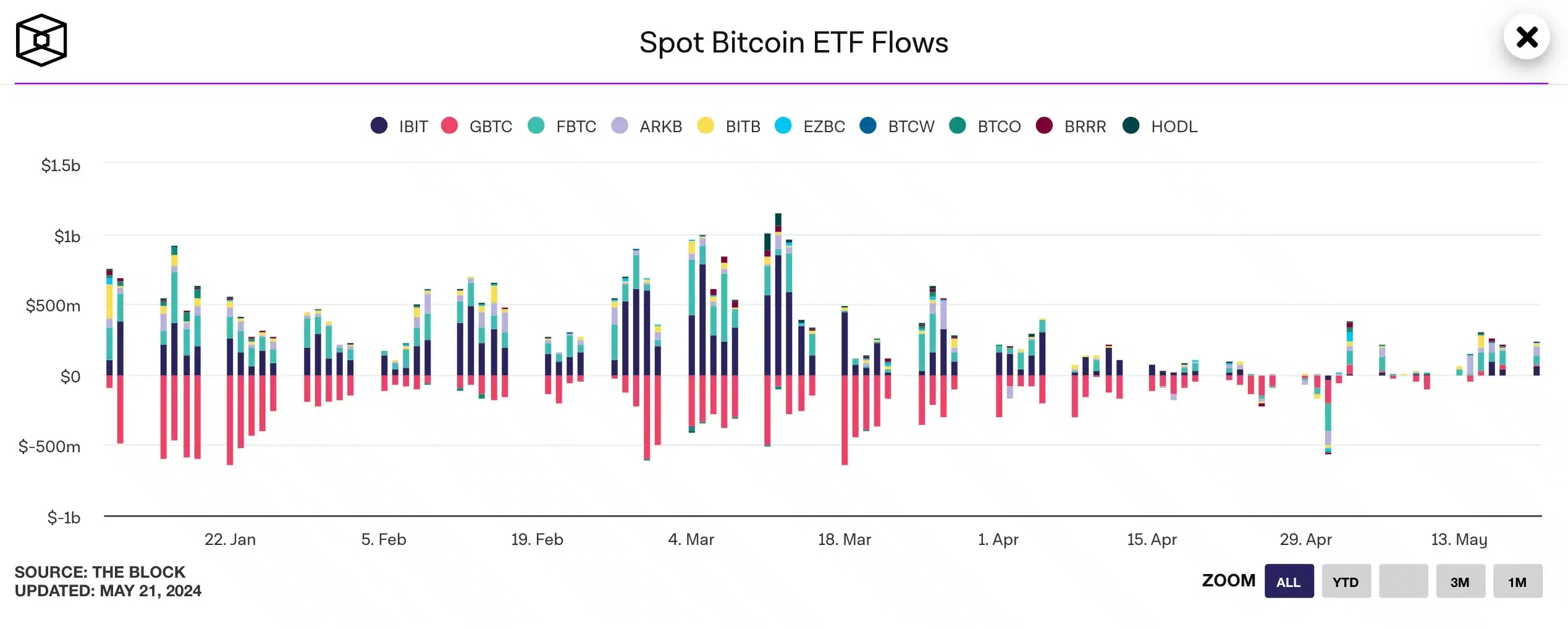

- Bitcoin spot ETFs attract significant institutional investment despite the concerns.

As the world awaits the approval of an Ethereum [ETH] spot exchange-traded fund (ETF), prominent Bitcoin critic Peter Schiff has taken the opportunity to attack Bitcoin [BTC].

Schiff sees an upcoming bearish trend for BTC

In a 21st May post on X (formerly Twitter), Schiff suggested that Bitcoin could become bearish if the Ethereum spot ETF is approved. He said,

“#Bitcoin gained renewed strength from rumors that an #Ethereum ETF will likely be approved. But any money to buy new Ether ETFs will most likely come from existing Bitcoin ETFs. Investors who decided to make an allocation to #crypto won’t increase that allocation to buy Ether.”

Schiff highlighted that although the recent rumors about an Ethereum ETF approval have boosted Bitcoin’s value temporarily, things could turn out differently.

He believes that the funds for these new Ethereum ETFs will likely come from the money currently invested in existing Bitcoin ETFs.

In his view, investors who have already allocated funds to cryptocurrency are unlikely to increase their overall investment in the crypto market just to buy Ethereum ETFs.

Instead, they might shift their investments from Bitcoin to Ethereum, which could negatively impact Bitcoin’s price.

Should you trust Schiff’s remarks?

Needless to say, Schiff’s remarks sparked a lot of criticism, starting with Rajat Soni, a Bitcoin educator, who claimed,

“Peter… Bitcoin’s price doesn’t go up because of Ether. Ether’s price goes up because of Bitcoin. If you don’t understand this, your opinion is irrelevant.”

However, Santiment’s latest tweet echoed Schiff’s remarks.

“#Ethereum is seeing the most #bullish crowd sentiment since September with the #SEC likely to approve the first #ETF’s, and $ETH’s price surge. Meanwhile, #Bitcoin & #Solana sentiment is slightly #bearish.”

Bitcoin ETFs see massive inflows

Despite the criticism and uncertainty, Bitcoin spot ETFs have remained a favorite among institutions. On 21st May, Bitcoin ETFs experienced net inflows totaling $305.7 million.

Leading the pack was BlackRock with an investment of $290.0 million, followed by Fidelity with $25.8 million. Bitwise and VanEck, however, saw outflows of $4.2 million and $5.9 million, respectively.