Cardano stuck at $0.5: Will ADA’s uphill battle end soon?

- Cardano was unable to reclaim a key level as support.

- On-chain metrics indicated network-wide accumulation, but whales were slower than the 2020 rally.

Cardano [ADA] saw a move past a local resistance zone at $0.5. T

his region was also an imbalance left on the daily timeframe when prices plunged below it on the 24th of April, unable to convert the psychological level to support.

At the time of writing, something similar was repeating itself. Even though the price bounced above it on the 20th of May, it fell below it again and was trading at $0.482.

Do the on-chain metrics have a more encouraging outlook?

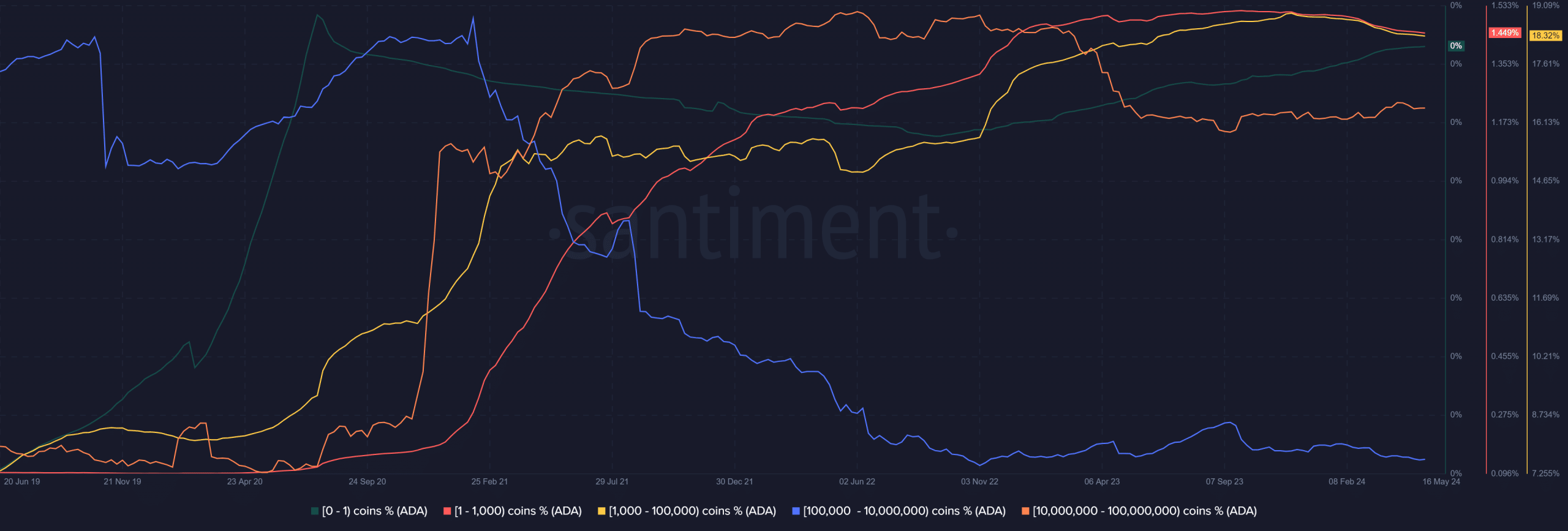

The supply distribution did not reflect a whale accumulation yet

Source: Santiment

The supply distribution showed that wallets holding 1k-100k ADA have declined since 30th November 2023.

Wallets with 10M-100M ADA saw a sharp downturn in January 2023 but have slowly climbed higher in 2024.

Compared to the 2020-21 rally, the growth of both these cohorts was diminished. History might not repeat itself, and such a vast increase in whale holdings might not occur.

Yet, as things stand, the whale wallets were not too keen on adding Cardano to their hoard.

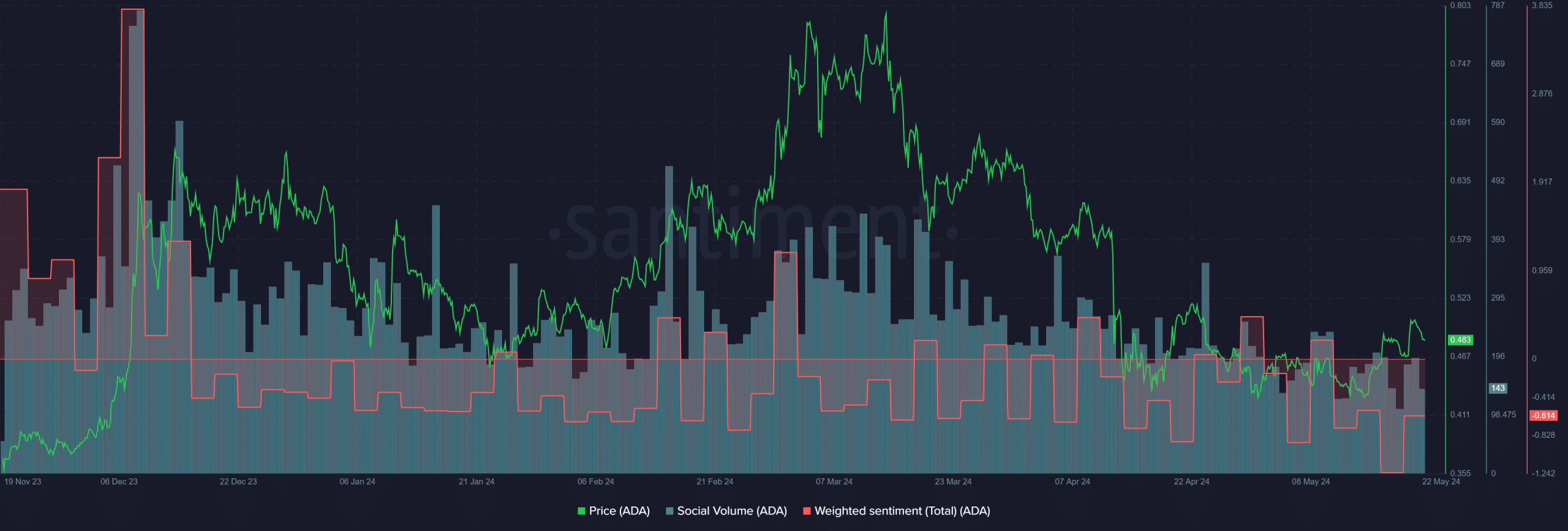

Source: Santiment

The social metrics were also underwhelming. The social volume has trended downward for more than two months. The weighted sentiment has been negative for the majority of the time since March.

Do the liquidation levels offer hope to the bulls?

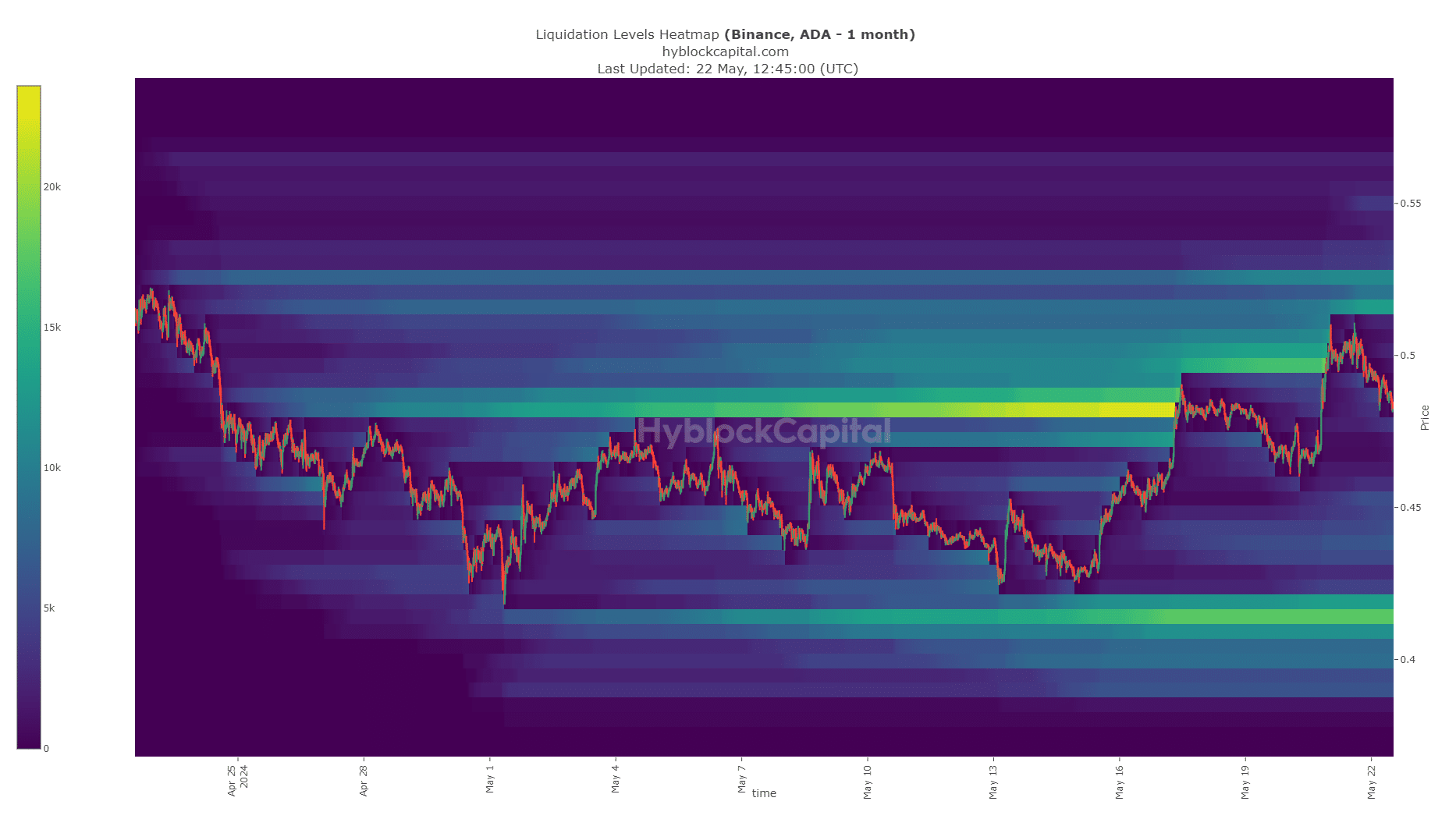

Source: Hyblock

The liquidation heatmap with a 1-month look-back period showed that the $0.5 was an important zone of liquidity. It got swept and subsequently, ADA saw a rejection.

This indicated that consolidation around $0.477 before the next rally to $0.525 is possible.

Such a consolidation would give time for more shorts positions to build up, increasing the available liquidity overhead.

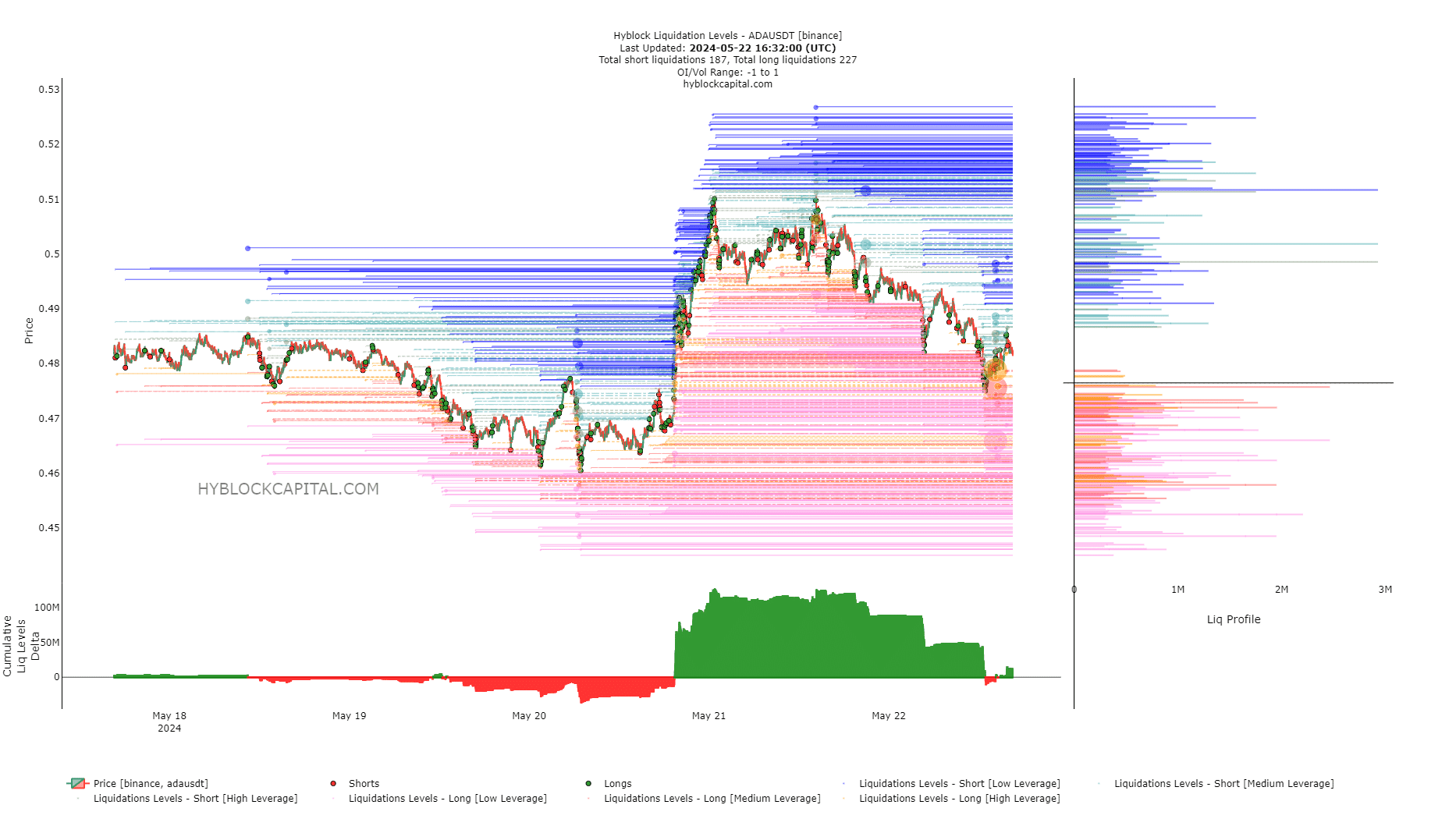

Source: Hyblock

The liquidation levels showed that the short and long positions were more or less balanced in the near-term. The recent pullback from $0.51 wiped out the late long entrants.

Is your portfolio green? Check out the ADA Profit Calculator

The liquidation levels profile showed that more long positions were imminently vulnerable than shorts.

The large clusters at $0.479 (high leverage), $0.475 (medium leverage) and $0.466 (low leverage) were the next downside targets.