How Ethereum ETFs will help ETH finally cross $4.5K

- Ethereum’s recent retracement follows a significant price rally, with ETF approvals seen as bullish.

- Market volatility and trading activity suggest a complex, potentially bullish future for Ethereum.

Ethereum [ETH], a leading cryptocurrency and blockchain platform, has shown significant market activity in recent weeks.

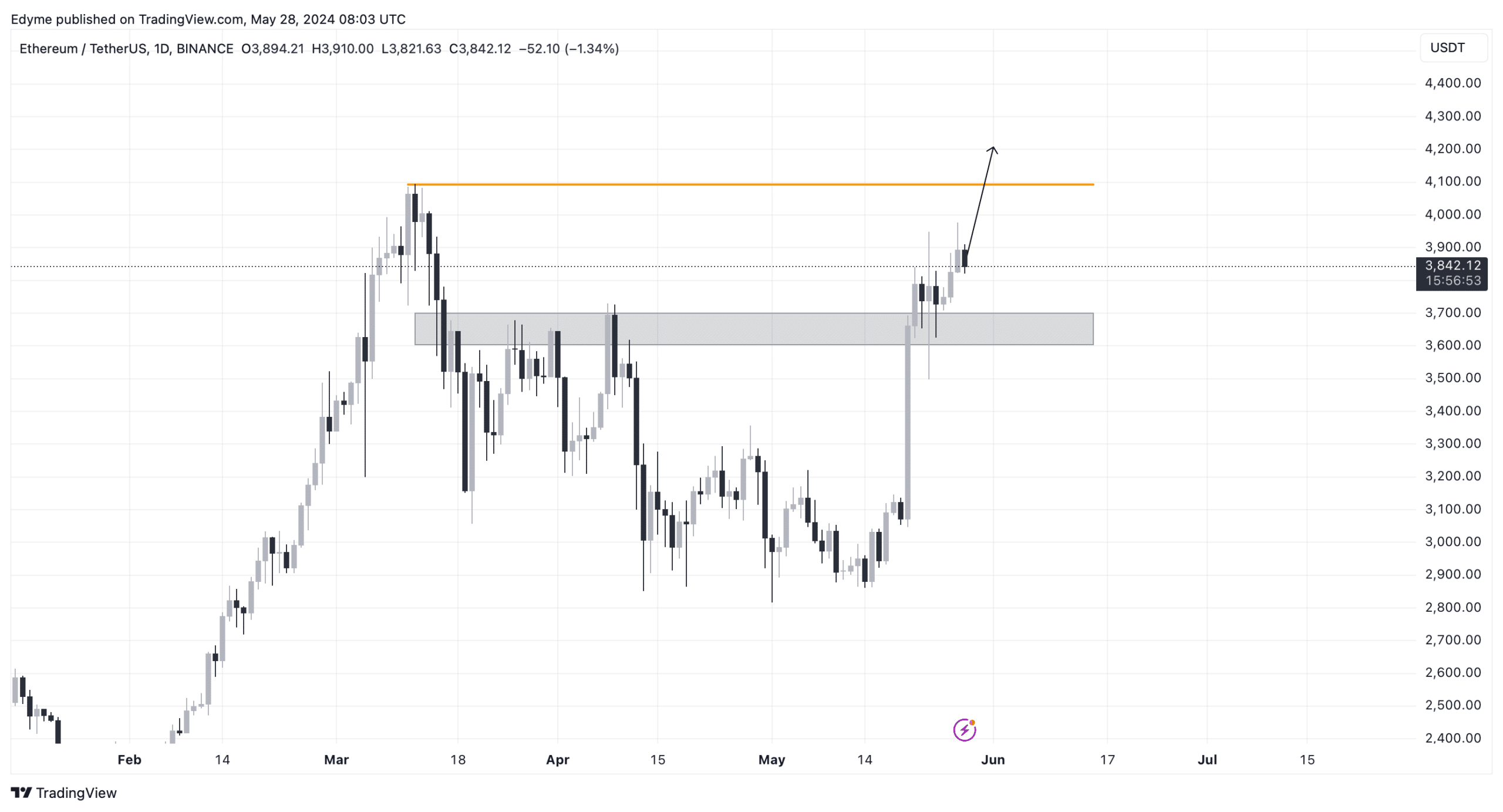

After a notable rally of approximately 31.5% over two weeks, raising its value to over $3,900, Ethereum has experienced a slight retracement, settling around $3,845.

This fluctuation comes amidst broader market movements and regulatory developments that may influence the asset’s future trajectory.

Crypto research firm Kaiko has shed light on these developments, particularly focusing on the potential impact of the U.S. Securities and Exchange Commission’s (SEC) approval of spot Ethereum ETFs.

This approval is seen as a positive step for Ethereum, despite potential short-term market adjustments.

The implications of such regulatory advancements extend beyond immediate price effects, potentially shaping Ethereum’s position in the financial markets and influencing investor sentiment significantly.

Ethereum: Market reactions

Kaiko’s analysis reveals that the introduction of Ethereum ETFs might initially trigger selling pressure due to potential outflows from existing investment vehicles like Grayscale’s Ethereum Trust (ETHE).

The firm currently manages over $11 billion in assets.

Historical data from similar scenarios suggested that such outflows could significantly impact daily trading volumes.

However, as witnessed with Bitcoin ETFs, initial outflows were eventually offset by subsequent inflows, indicating a possible stabilization post-ETF launch.

Will Cai, Head of Indices at Kaiko, emphasized the broader implications of the SEC’s decision, noting it as a declaration of Ethereum’s commodity status rather than a security.

This classification not only affects Ethereum’s trading and custody but also sets a precedent for the regulation of similar tokens in the U.S., likely fostering a more stable regulatory environment.

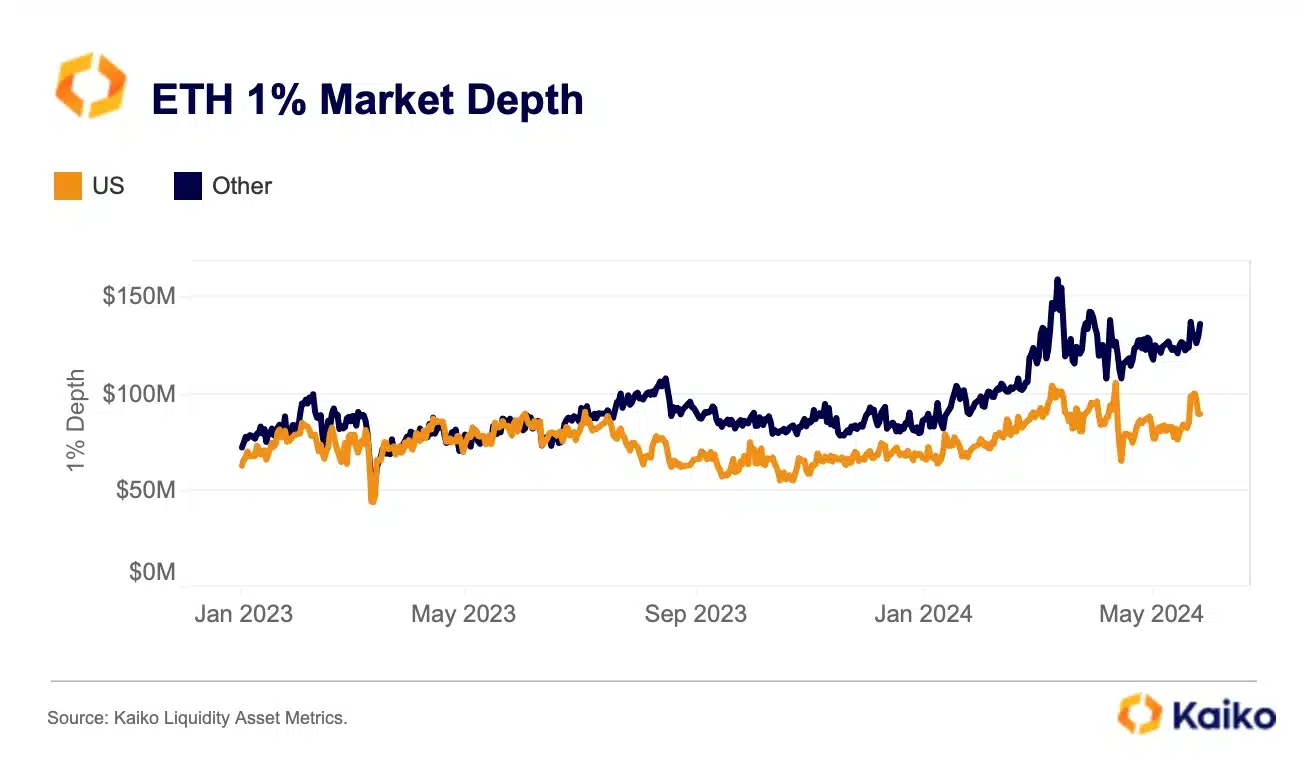

Meanwhile, according to Kaiko, the market depth of Ethereum on centralized exchanges stood at approximately $226 million at the time of the report – 42% lower than levels before the FTX collapse.

Only 40% of this is focused on U.S. exchanges, a decrease from about 50% seen in early 2023.

The research firm noted:

“Overall, even if inflows disappoint in the short term the approval has important implications for ETH as an asset, removing some of the regulatory uncertainty which has weighed on ETH’s performance over the past year.”

Volatility insights

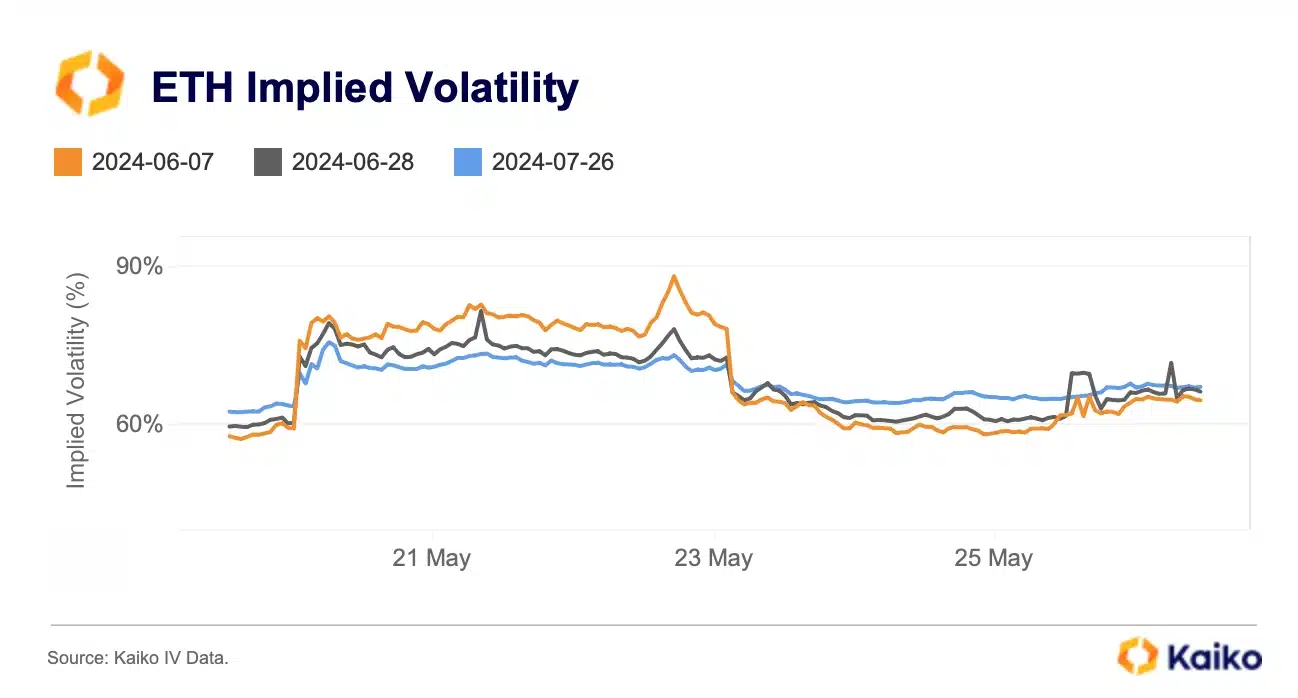

Further insights from Kaiko highlighted Ethereum’s volatility trends. Notably, Ethereum’s Implied Volatility surged dramatically in late May, indicating heightened market activity and investor interest.

This was accompanied by an inversion in the volatility structure, where short-term volatility exceeded long-term expectations—a common indicator of market stress or significant trading activity.

In derivatives markets, Ethereum has shown remarkable dynamics.

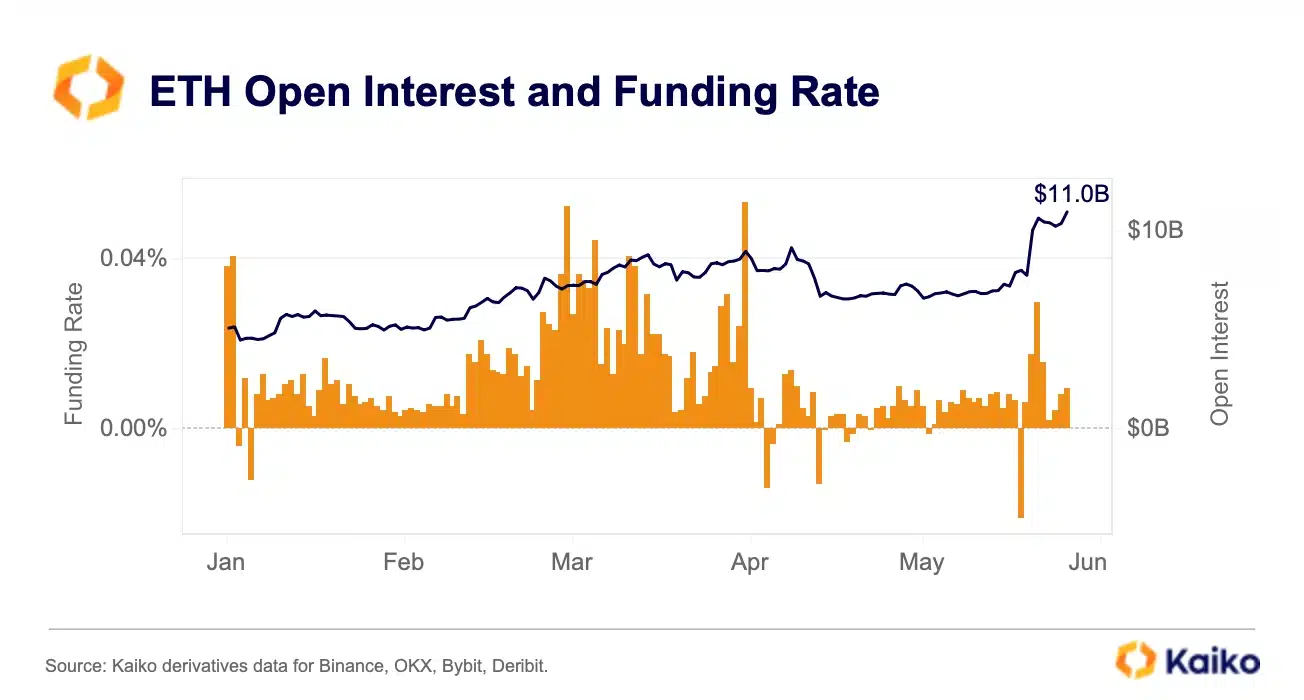

The Funding Rates for Ethereum’s perpetual Futures experienced a sharp increase from their lowest in over a year to a multi-month high within just a few days.

Concurrently, Open Interest in these futures reached a record $11 billion, suggesting robust capital inflows and increased trading activity.

Despite these promising signs, some metrics suggest caution.

Is your portfolio green? Check out the ETH Profit Calculator

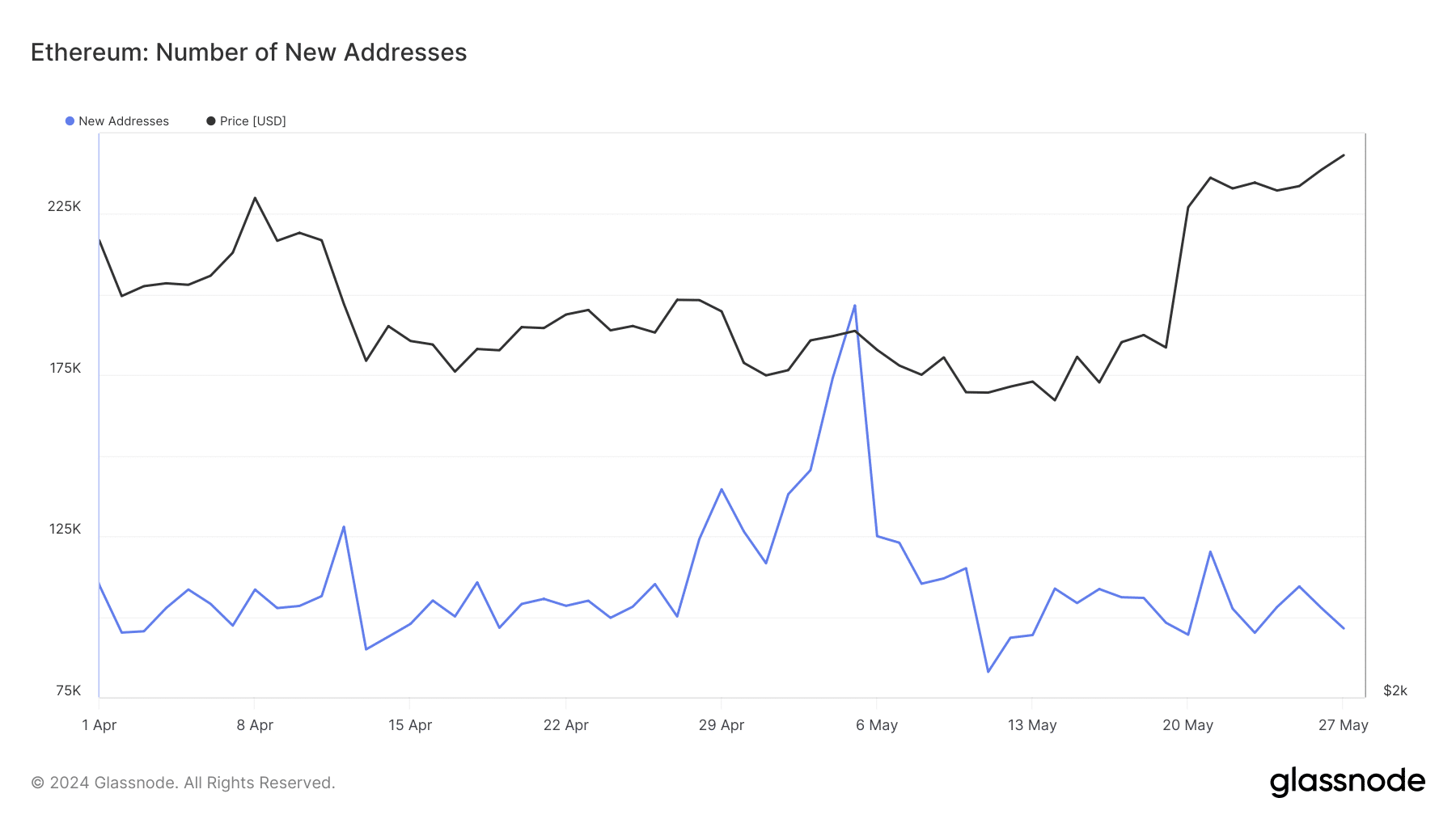

AMBCrypto’s look at Glassnode’s data indicated a recent decline in the number of new Ethereum addresses, which could signify a slowdown in new participant inflow to the network.

However, our look at Ethereum’s daily chart revealed that the asset recently converted a major resistance level into support, potentially setting the stage for further gains and possibly breaching the $4,000 mark.