Bitcoin-backed inflows cross $1B in 1 week! Crypto inflows hit $14.9B YTD

- Last week’s crypto market rally led to a flow of funds into crypto-backed investment products.

- Last week, Ethereum recorded its highest weekly inflows since March.

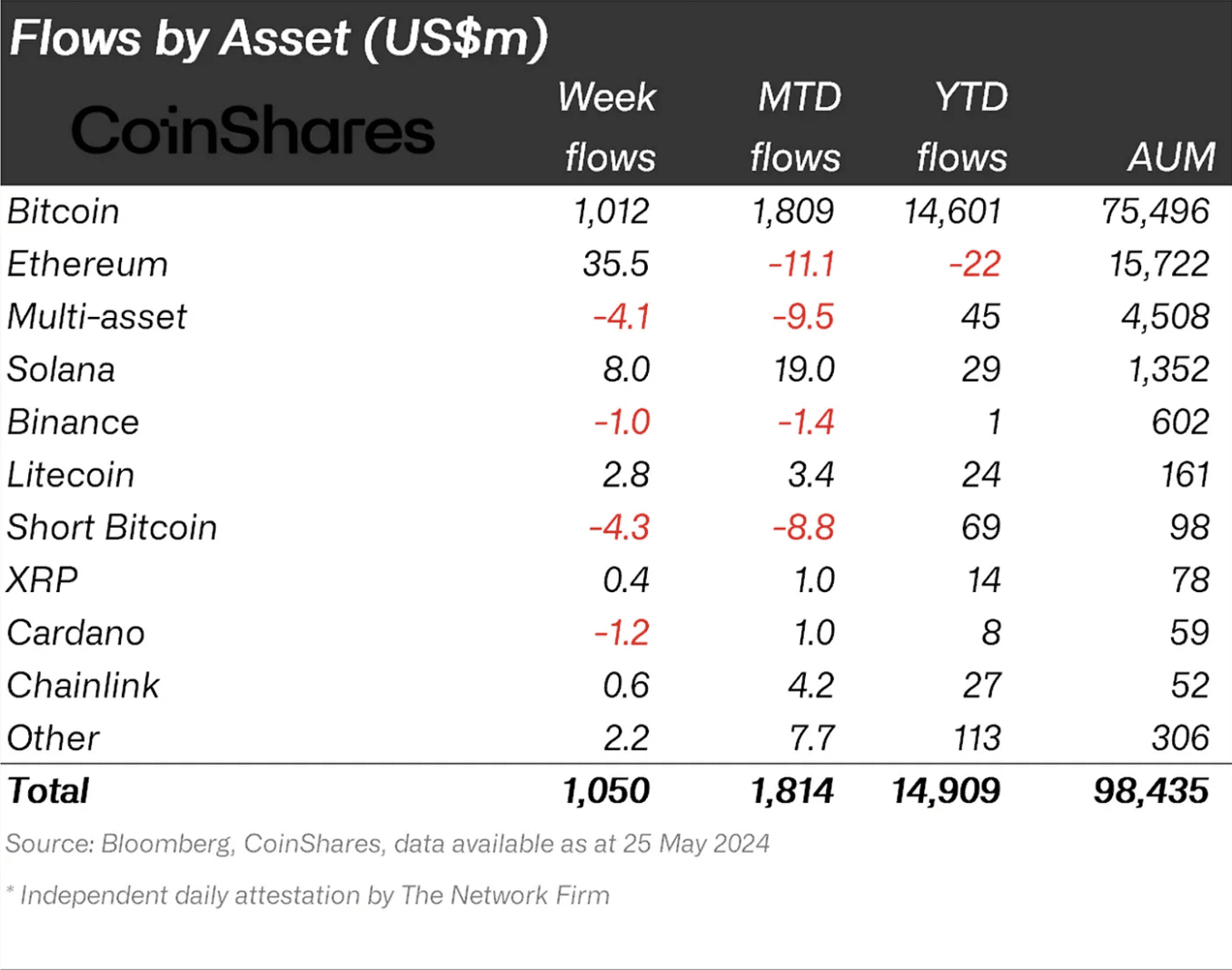

Digital asset investment products recorded inflows totaling $1.05 billion last week, marking the third consecutive week of inflows, digital asset investment firm CoinShares found in its new report.

According to the report, last week’s inflows brought the year-to-date inflows into cryptocurrency funds to a record-breaking $14.9 billion.

The digital asset investment firm found that last week’s crypto market surge positively impacted the activity around Exchange-Traded Products (ETPs).

During that period, weekly ETP trading volume climbed by 28% to $13 billion.

At the end of the period observed by CoinShares, the total assets under management (AUM) for crypto-related investment products was above $98 billion.

This marked a 7% growth from the $91 billion recorded the previous week.

Regionally, most of last week’s flows into crypto funds came from the United States, Germany, and Switzerland, with inflows of $1.03 billion, $48 million, and $30 million, respectively.

Interestingly, Hong Kong saw outflows during the week in review. According to CoinShares,

“Disappointingly, since the initial positive launch of Bitcoin spot-based ETFs in Hong Kong (which saw US$300m in the first week), there have been further outflows last week of US$29m.”

Bitcoin’s YTD inflows topple $14 billion

Last week, Bitcoin-backed investment products saw inflows of $1.03 billion, representing 98% of all inflows recorded during that period.

This pushed the leading coin’s YTD inflows to $14.60 billion, an 8% rally from the previous week’s YTD inflow of $13.58 billion.

Regarding short-Bitcoin products, they recorded outflows of $4.3 million last week, bringing their month-to-date outflows to $8.8 million.

CoinShares said this might be due to changing sentiments around Bitcoin from negative to positive.

“This is likely due to investors interpreting the FOMC minutes and recent macro data as mildly dovish, it added.”

Ethereum reaches new milestone

During the week under review, the leading altcoin, Ethereum [ETH], witnessed an inflow of $38 million into its digital asset products, representing its highest since March.

CoinShares said this was,

“Likely an early reaction to the approval of ETH ETFs in the United States.”

However, due to the series of outflows that Ethereum-backed products have experienced in preceding weeks, its month-to-date flows stood at a deficit of $11.1 million last week.