PEPE vs BONK: Which memecoin is leading the charge?

- Pepe and Bonk saw historical highs in their Open Interests.

- Both memecoins have set consecutive all-time highs.

Pepe [PEPE] and Bonk [BONK] are two meme coins that have experienced notable price movements in recent weeks. Data indicates that both have seen significant activity in Open Interest.

However, one of these coins has garnered more interest in the past few days.

Pepe and Bonk see historical Open Interest

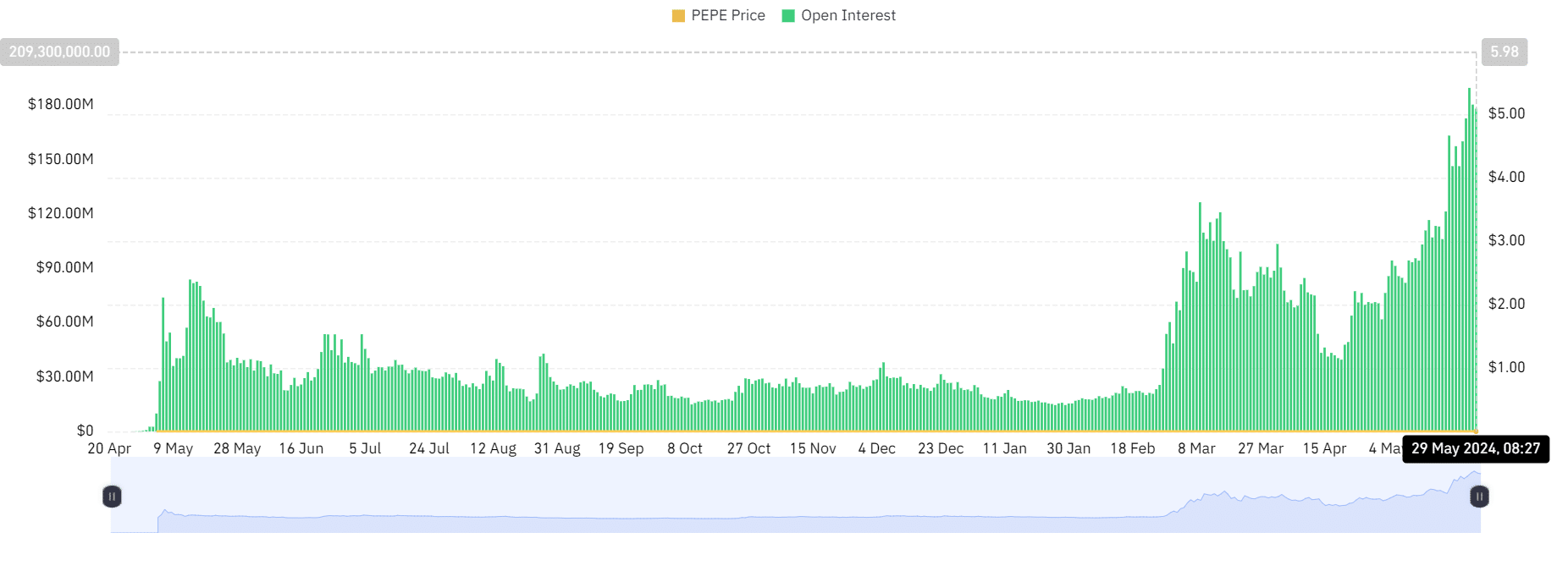

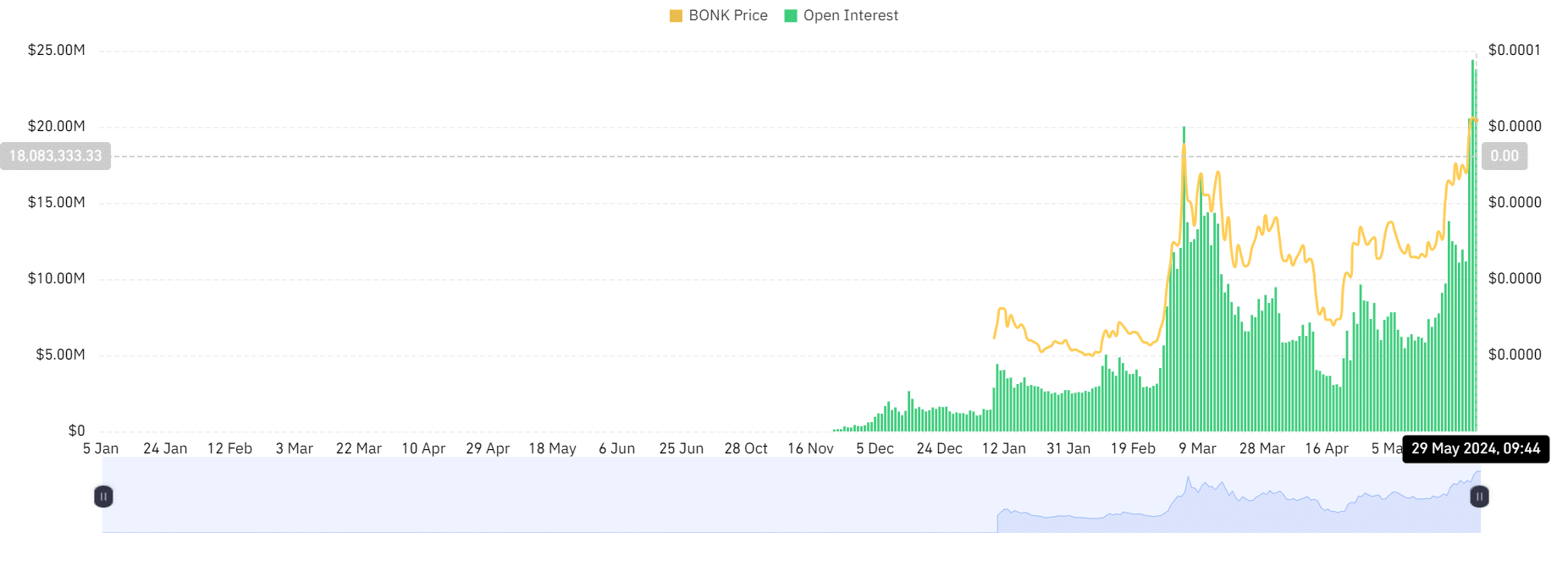

According to a recent post by Coinglass, the perpetual contracts for Pepe and Bonk have seen increased Open Interest over the past few weeks.

AMBCrypto’s analysis of Pepe’s Open Interest revealed that it reached a historical high of $189.5 million on the 28th of May. However, this figure has since declined, and was around $180 million at press time.

Meanwhile, Bonk’s Open Interest also surged. At press time, it was at its highest level ever, at approximately $24.35 million.

This indicated a significant cash inflow into both meme coins, suggesting a surge in interest over the last few days.

Additionally, it can be observed that the frog-themed memecoin has attracted more interest compared to the dog-themed asset.

Pepe and Bonk’s sentiments stay positive

Another key area where these meme coins have shown similar trends is in their Funding Rates.

AMBCrypto’s analysis of Pepe’s Funding Rate indicated that it has remained positive and was at its highest levels in nearly two months at press time, at approximately 0.0385%.

Similarly, Bonk’s Funding Rate was also positive, at 0.0303% during press time.

These metrics suggested that both meme coins were experiencing more buying pressure than selling pressure at the time of writing.

This indicated a prevailing belief among traders that the prices of these meme coins will continue to rise, leading to a dominance of buyers in the market.

How PEPE and BONK have trended

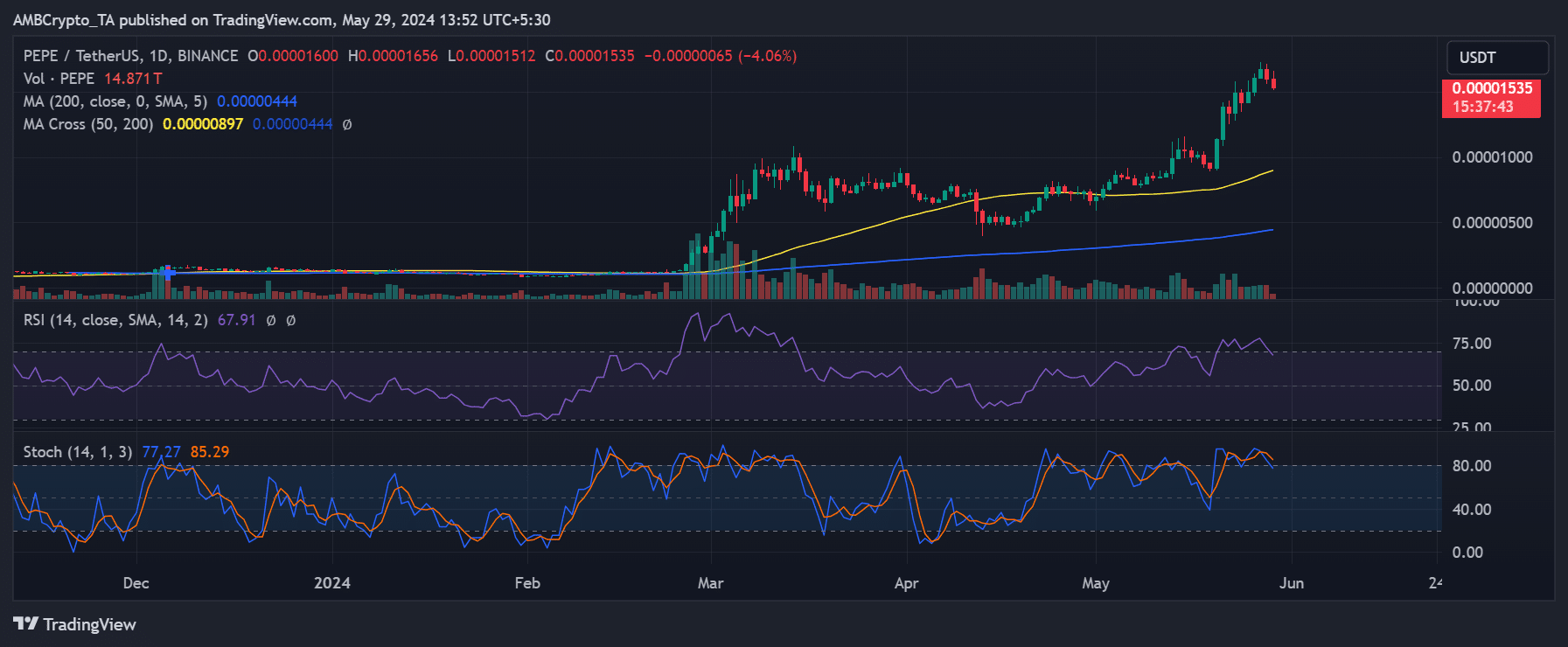

AMBCrypto’s analysis of Pepe’s price trend on a daily timeframe showed that it had reached several all-time highs in recent days. However, it has experienced a trend reversal in the last 24 hours.

On the 28th of March, the price dropped by 4.25%, and until press time, it had decreased by over 4%, trading at around $0.000015.

Despite this decline, Pepe remained in a strong bull trend. Its Relative Strength Index (RSI) fell slightly below 70, indicating it has just dipped below the overbought zone.

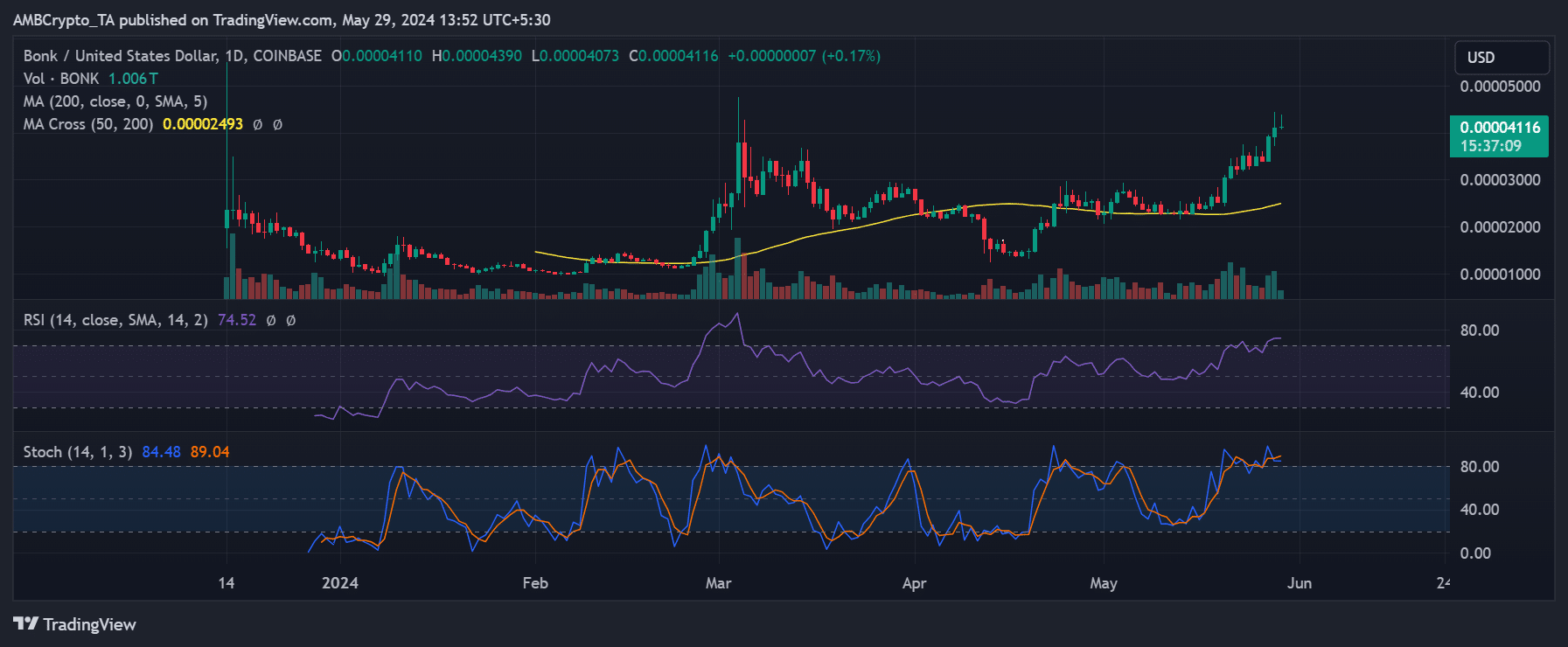

In contrast, Bonk’s chart showed that it is attempting to set a new all-time high.

Is your portfolio green? Check out the Bonk Profit Calculator

As of this writing, it was trading with a slight increase of less than 1%, around $0.000041. If this positive trend continues, it will mark the third consecutive day of a new ATH.

Bonk was also in a strong bull trend at the time of writing, with its RSI indicating an overbought condition.

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)