AVAX enters a slump: Will $36.9 break or make its market?

- AVAX is consolidating, with its price between closely situated MA50 and MA200.

- Lack of strong momentum keeps it in a neutral zone, with potential lower supports if bearish pressure intensifies.

Once again, Avalanche [AVAX] has entered a slump with its price action. As the broader market faces a modest correction and Bitcoin and Ethereum lose some of their gains, AVAX barely made a move.

There was a balanced order between the bulls and the bears, with neither taking full control. However, the bears might slowly get the upper hand with the current trading activity.

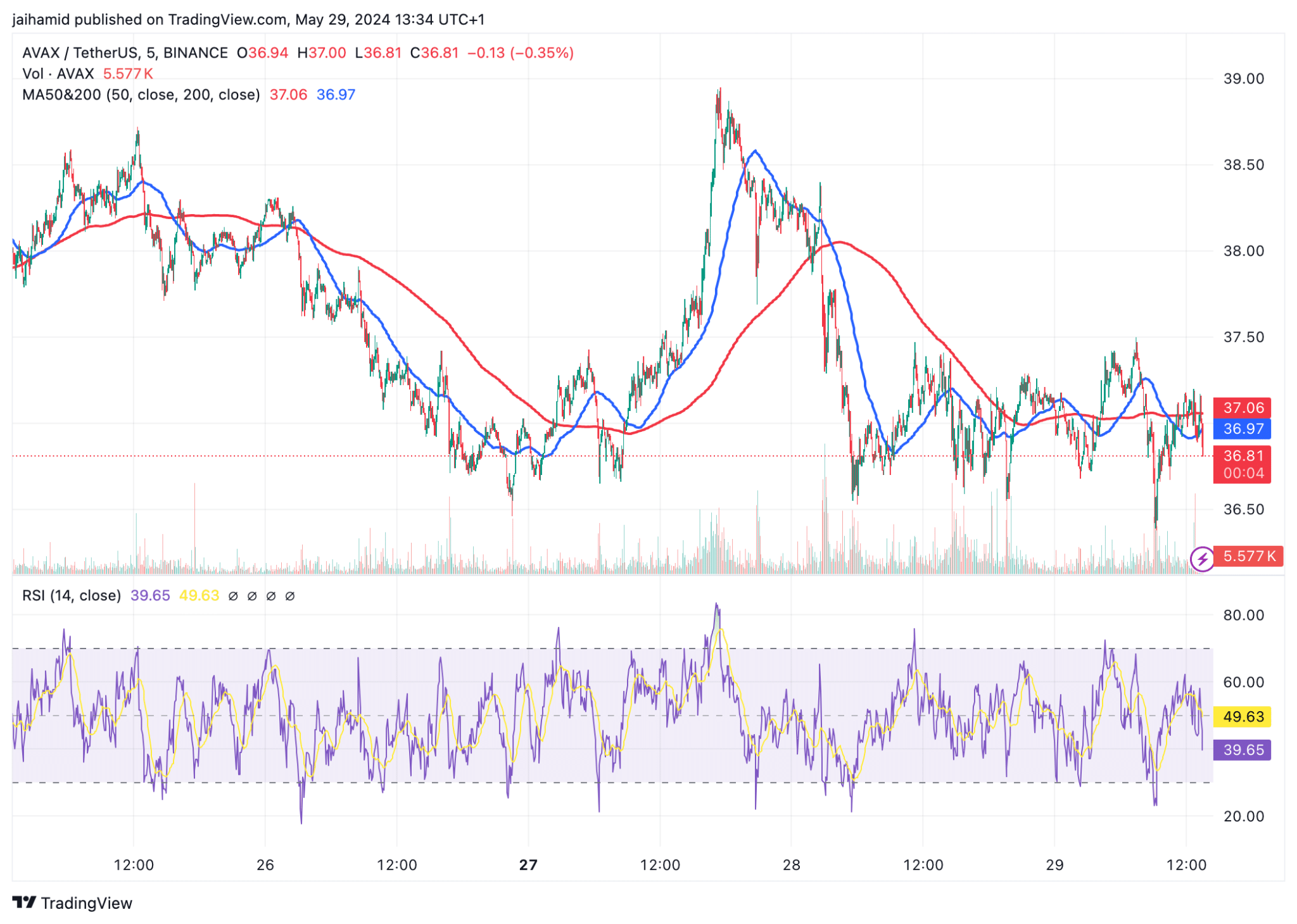

Analyzing the current trading activity on the AVAX/USDt chart, we observe Avalanche moving within a defined range marked by the interaction of its 50-day moving average (MA50) and 200-day moving average (MA200).

The MA50 at approximately $36.97 acts as a short-term resistance level, while the MA200 at $36.81 offers slight support. These closely nestled moving averages suggest a consolidation phase with tight trading conditions.

The Relative Strength Index (RSI) is at 49.63, indicating a neutral stance. There is a lack of strong bullish or bearish momentum.

AVAX must decisively close above the MA50 resistance to break out of its slump. A failure to do so could see it retest lower supports, potentially around the $36.50 area.

If the bearish pressure intensifies, particularly if broader market corrections deepen, AVAX could further test lower levels.

A movement below the $36.50 could see subsequent support near $36.00, which would be critical to prevent further declines toward the $35.50 region or below.

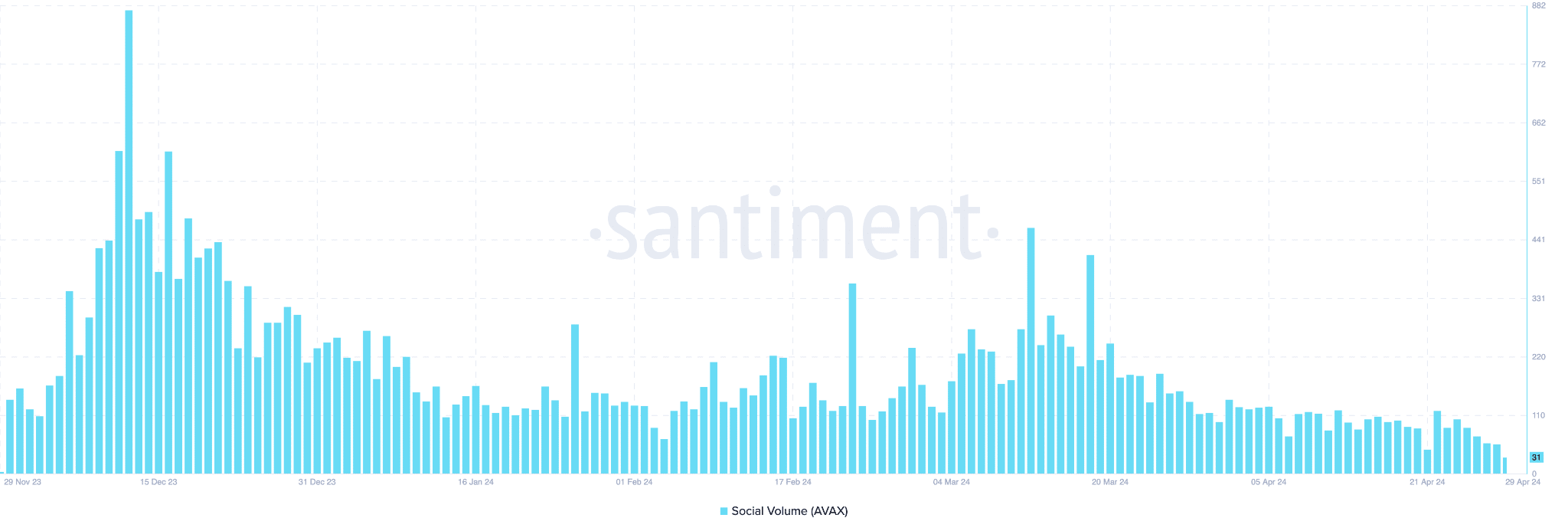

Meanwhile, AVAX’s overall trend in social volume has declined significantly, aligning with its struggle to sustain higher price levels or ignite major trading enthusiasm.

From a technical standpoint, this reduction in social engagement could imply a cooling-off period, where the bulls take a little break before pushing prices past short-term resistance levels.

Is your portfolio green? Check the AVAX Profit Calculator

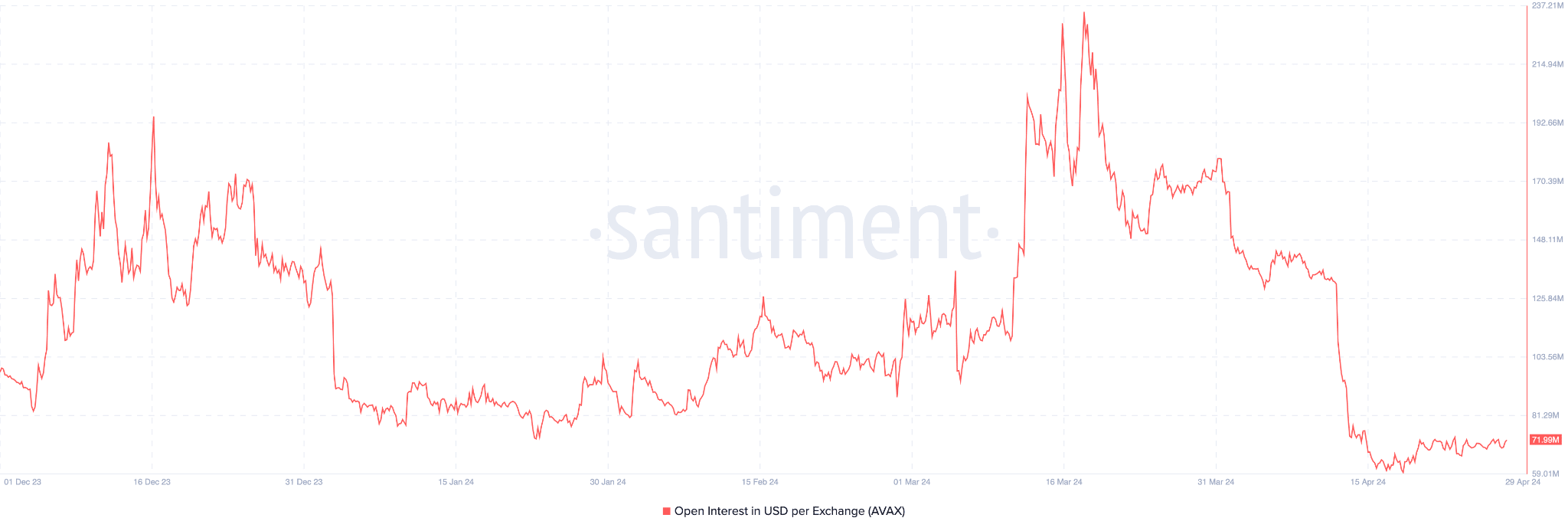

This same trend is reflected in the open interest level on multiple exchanges.

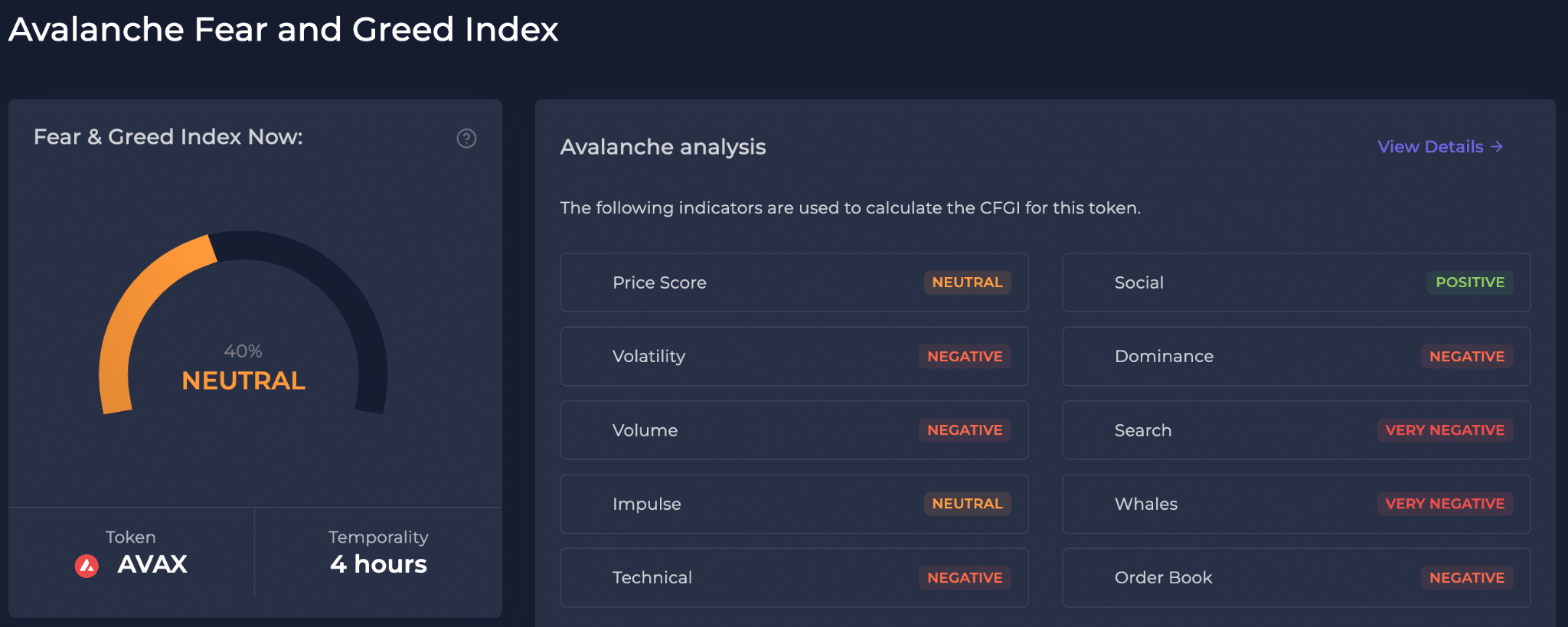

AVAX’s social sentiment reveals a market in flux with possible downward pressure due to negative views on volume and dominance. Overall, AVAX seems to have no clear path for the near future. The market will need stronger catalysts to go fully bullish.