Ethereum NFT market faces slump: Any impact on ETH?

NFT volumes begin to fall

Over the past month, the total sales of Ethereum NFTs fell by 55%. Popular Ethereum NFT collections such as BAYC (Bored Ape Yacht Club), MAYC (Mutant Ape Yacht Club) and Crypto Punks witnessed a significant decline of more than 40% in terms of sales and floor prices.

NFTs on other networks such as Solana and Bitcoin were gaining traction compared to the Ethereum network.

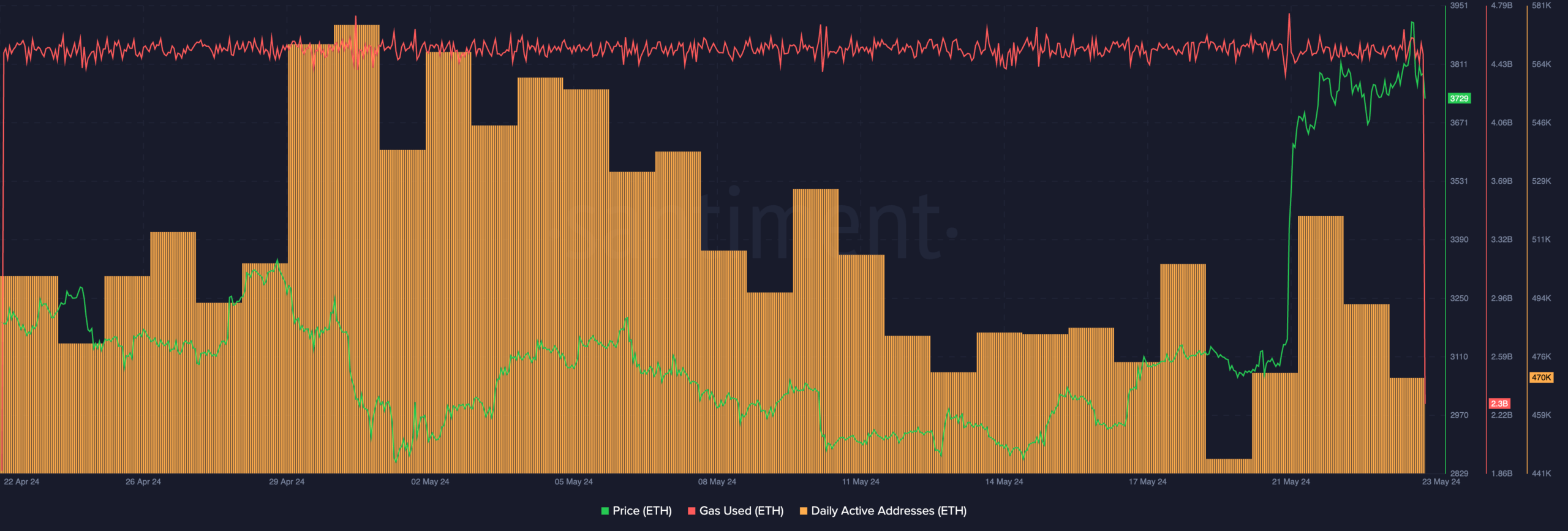

Moreover, the daily active addresses on the Ethereum network also fell significantly over the last few days along with the gas usage on the network, implying declining overall activity on the Ethereum ecosystem.

This maybe a sign that Ethereum’s popularity as an ecosystem was waning significantly.

Even though the interest in ETH due to the hype around its ETF has risen and caused the price to grow, a waning interest in the Ethereum ETF’s could cause a problem for ETH in the long run.

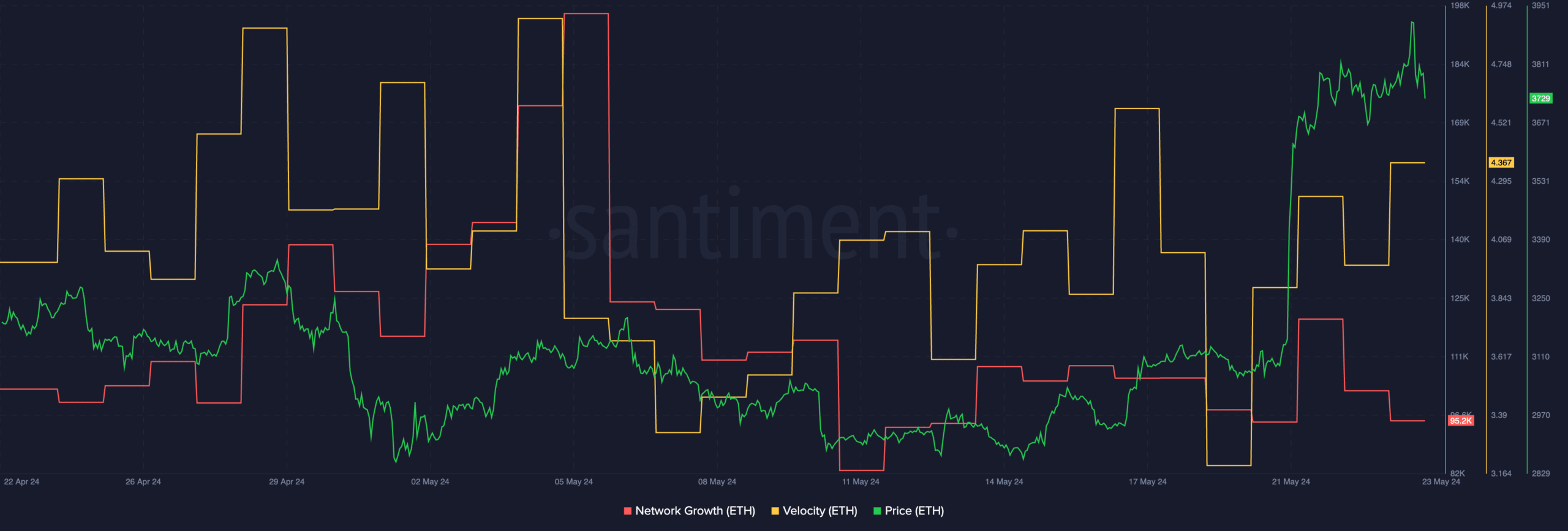

At press time, ETH was trading at $3,786.76 and its price had fallen by 0.68%. The network growth around the ETH token had fallen significantly, implying that the number of new addresses interesting with ETH had drastically declined.

A lack of interest from new addresses suggested that the market was not ready to buy ETH at its current price.

Some bulls may wait for a correction before accumulating more ETH in the future.

Additionally, the velocity at which ETH was trading at had grown, indicating that the frequency with which ETH was trading at had risen.

Only time will tell whether the price action of ETH co relates with the rising velocity, giving bulls some hope about the future.

Is your portfolio green? Check the Ethereum Profit Calculator

How are addresses holding up?

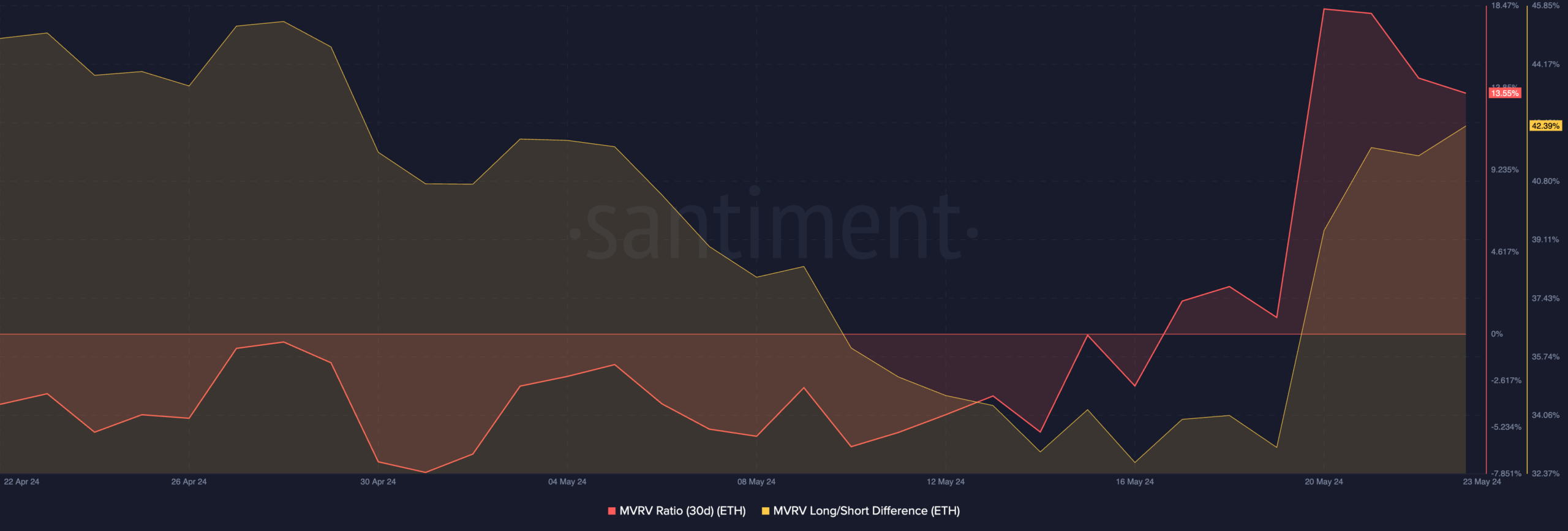

Coming to the state of the holders, it was seen that most addresses were profitable, as indicated by the high MVRV ratio for ETH.

Even though a high MVRV ratio means that more holders are incentivized to sell their holdings, the presence of long term holders showcased by the high Long/Short difference implies that a large sell-off may not happen anytime soon.