$500K Bitcoin forecast – Analyst maps out BTC’s bull run timeline

- PlanB uses the Stock-to-Flow model to predict Bitcoin’s surge to $500,000.

- Recent Bitcoin consolidation near $70,000 sets the stage for a bullish trend, according to PlanB’s analysis.

Bitcoin [BTC] continues to hold the spotlight, especially following the recent market consolidations.

Despite its current trade slightly below the $70,000 mark, with minimal fluctuations in the past week, renowned crypto analyst PlanB has shared insights that might herald a significant uptick for the cryptocurrency.

PlanB, a seasoned analyst known for his precise predictions, outlined a potential surge in Bitcoin’s price post the latest halving event.

In a detailed analysis, he utilized his proprietary Bitcoin Stock-to-Flow model (S2F), alongside other chart indicators, to draw parallels with previous bull cycles, suggesting a burgeoning bull run is on the horizon.

Understanding the S2F model and market cycles

The Stock-to-Flow model, which measures the current stock of a commodity against its flow of production, indicates that Bitcoin is gearing up for an exponential rise.

According to PlanB’s latest analysis, the close of last month above $67,000 signals the dawn of a new cycle, potentially mirroring the post-halving surges seen in previous years.

The analyst’s projections put Bitcoin at a staggering $500,000 in the upcoming cycle, emphasizing the pattern followed in past bull runs.

This prediction is supported by PlanB’s examination of the Bitcoin Market Cycle indicator, which corroborates the entrance into a bull market phase.

However, the analyst advises patience, suggesting that the real momentum will commence once a rapid price ascent begins.

This was further affirmed by the Relative Strength Index (RSI) readings, which currently resemble those seen before the 2012 bull run, indicating early stages of a bullish trend.

Adding to the bullish outlook, PlanB discussed the Bitcoin 200 Week Moving Average (WMA), which is trending upwards—a sign traditionally viewed as a precursor to a bull market.

The 200 WMA’s alignment with current market signals suggests that Bitcoin could soon breach the $100,000 mark.

Moreover, the Bitcoin Realized Price indicator, which assesses the profit ratio of coins moved on-chain, aligns with historical data to further support the bullish scenario.

PlanB expects that Bitcoin’s price will not fall below $64,000 before it embarks on the anticipated rally.

Tracing PlanB’s Bitcoin predictions

PlanB is not new to making bold forecasts in the cryptocurrency space.

With a history of accurate predictions, the analyst gained recognition for his foresight in 2020 when, despite widespread skepticism and a market flooded with fear, uncertainty, and doubt (FUD), he predicted Bitcoin would reach $55,000.

True to his projection, by 2021, Bitcoin not only hit that mark but soared past it.

However, financial markets are inherently uncertain, and not all of PlanB’s predictions have materialized as expected. For instance, he has long maintained that Bitcoin would reach the $100k milestone.

Although he forecasted this achievement for 2021, Bitcoin fell short of this target. Despite not reaching the anticipated $100k, Bitcoin still achieved a significant milestone by surpassing $69,000 for the first time that year.

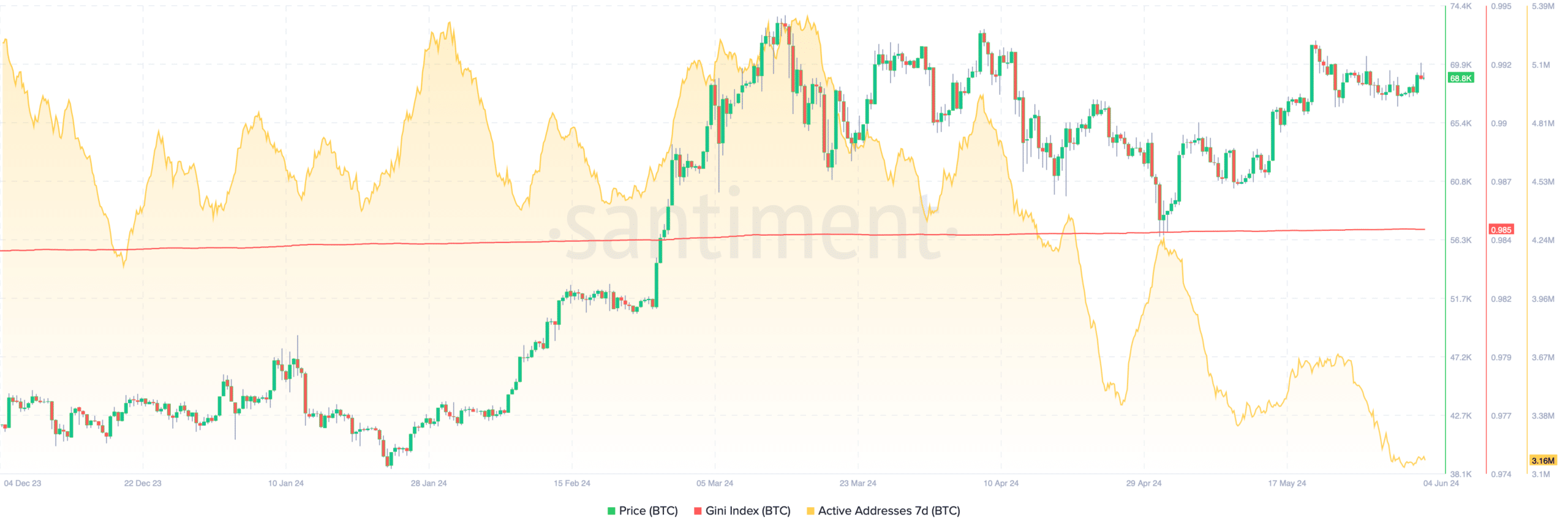

As PlanB revisits his $100,000 Bitcoin forecast, it’s crucial to examine the underlying fundamentals. Market data from Santiment shows a declining trend in Bitcoin’s 7-day active addresses, suggesting a possible decrease in market participation or trading activity.

Concurrently, the Gini index of BTC stands at 0.985, indicating a high concentration of wealth among holders, which could impact price volatility and trading behavior.

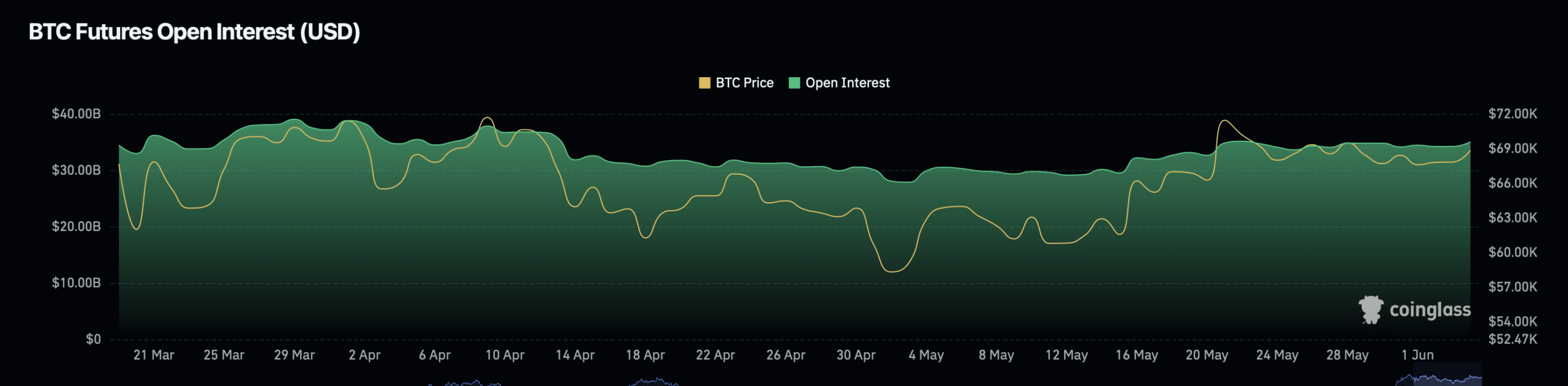

On a more positive note, Bitcoin’s open interest—a measure of the total number of outstanding derivative contracts that have not been settled—has shown significant growth.

Over the past 24 hours alone, this metric increased by 1.36%, with the total valuation rising to $35.83 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

This increase, along with a nearly 25% surge in open interest value during the same period, points to a bullish sentiment among traders.

Supporting this optimistic outlook, AMBCrypto reported that Bitcoin has formed an asymmetrical triangle on the 4-hour chart, a formation that typically precedes a significant price movement, potentially propelling BTC to as high as $74,400.