Cardano: 309 $1M transactions in 24 hours! ADA to surge?

- ADA’s whale activity jumped on 5th June.

- This caused a brief uptick in the altcoin’s price.

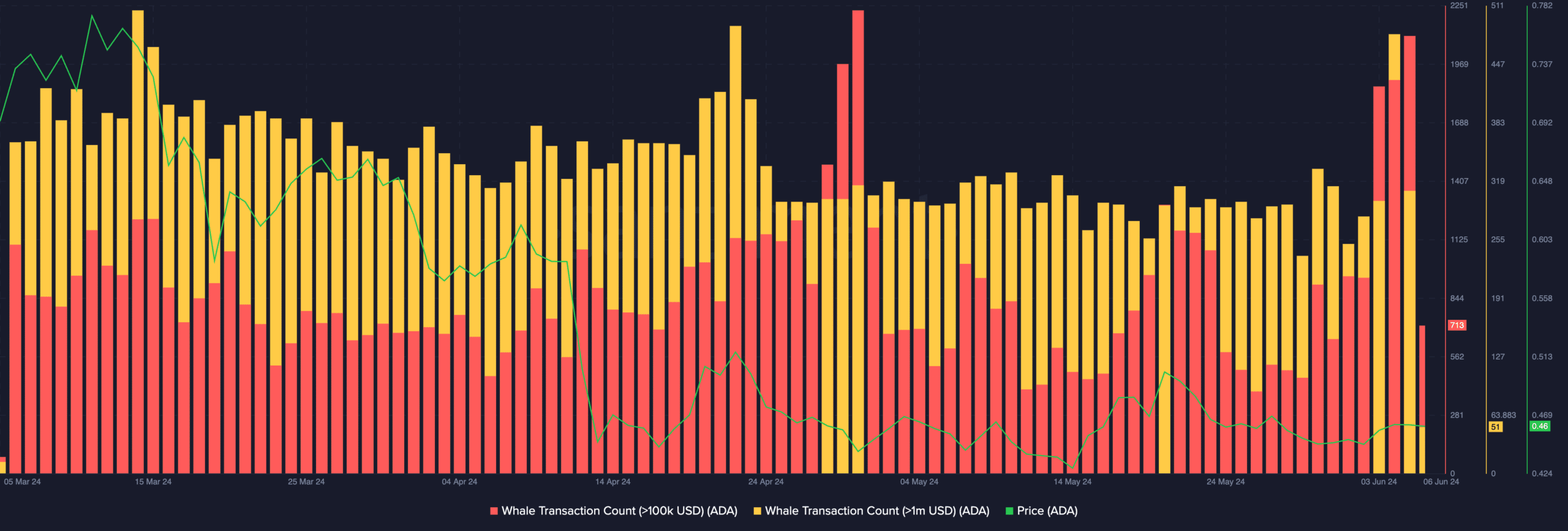

Cardano [ADA] saw a spike in whale activity, resulting in a brief surge in its price during the intraday trading session on 5th June, according to Santiment’s data.

According to the on-chain data provider, the number of ADA transactions valued above $1 million totaled 309 on that day. This represented the altcoin’s single-day highest count since 30th April.

Also, ADA recorded 2106 transactions worth more than $100,000 on the same day. Data from Santiment showed that the number of ADA transactions valued above $100,000 had doubled this week compared to the usual 2024 averages.

ADA bears continue to dominate the market

The surge in ADA whale activity led to a brief rise in its price during the trading period. Per Santiment, ADA closed the day at $0.46.

However, according to CoinMarketCap data, the coin has since shed some of these gains. It exchanged hands at $0.45 at press time.

An assessment of the altcoin’s key momentum indicators showed that ADA’s selling pressure outweighs any bullish bias toward it. For example, its Relative Strength Index (RSI) and its Money Flow Index (MFI) were 48.32 and 47.29, respectively at the time of writing.

At these values, these indicators suggested that market participants preferred to sell their coins rather than accumulate new ones.

Further, ADA’s declining Chaikin Money Flow (CMF) confirmed the uptick in selling pressure. At press time, it trended downward and was positioned below the zero line at -0.07.

This indicator tracks how money flows into and out of the coin’s market. When its value is negative, it is a sign of market weakness, as it signals capital flight from an asset’s market.

While the whales may have successfully triggered a brief rally in ADA’s price, the bears continue to exert more influence.

Readings from the altcoin’s Directional Movement Index (DMI) showed its positive directional index (green) resting below its negative index.

When these lines are arranged this way, bear strength outweighs bull power in the market.

Despite the low possibility of any significant price spike in the short term, ADA futures traders have maintained a bullish outlook. The coin’s funding rate across cryptocurrency exchanges has remained positive.

Read Cardano’s [ADA] Price Prediction 2023-24

Funding rates are used in perpetual futures contracts to ensure the contract price stays close to the spot price.

When an asset’s futures funding rate is positive, it is a bullish signal. It suggests that there is more demand for long positions, as more traders are buying the asset with the expectation that its price will climb.