15% and 112% – What these percentages mean for WIF’s price

- WIF was knocked off the $3-zone after prices collapsed in the last 24 hours

- Price can now fall as low as $2.53 on the charts

Following its violent crash, dogwifhat’s [WIF] price might slide further down the charts, according to AMBCrypto’s analysis. At press time, WIF was valued at $2.57.

The altcoin’s press time price suggested WIF fell by 15.56% in just 24 hours. Before WIF cratered, however, the memecoin had attempted to retest $3.40. Once it hit $3.30 though, the massive decline began, indicating that bulls lacked the strength to validate the upswing.

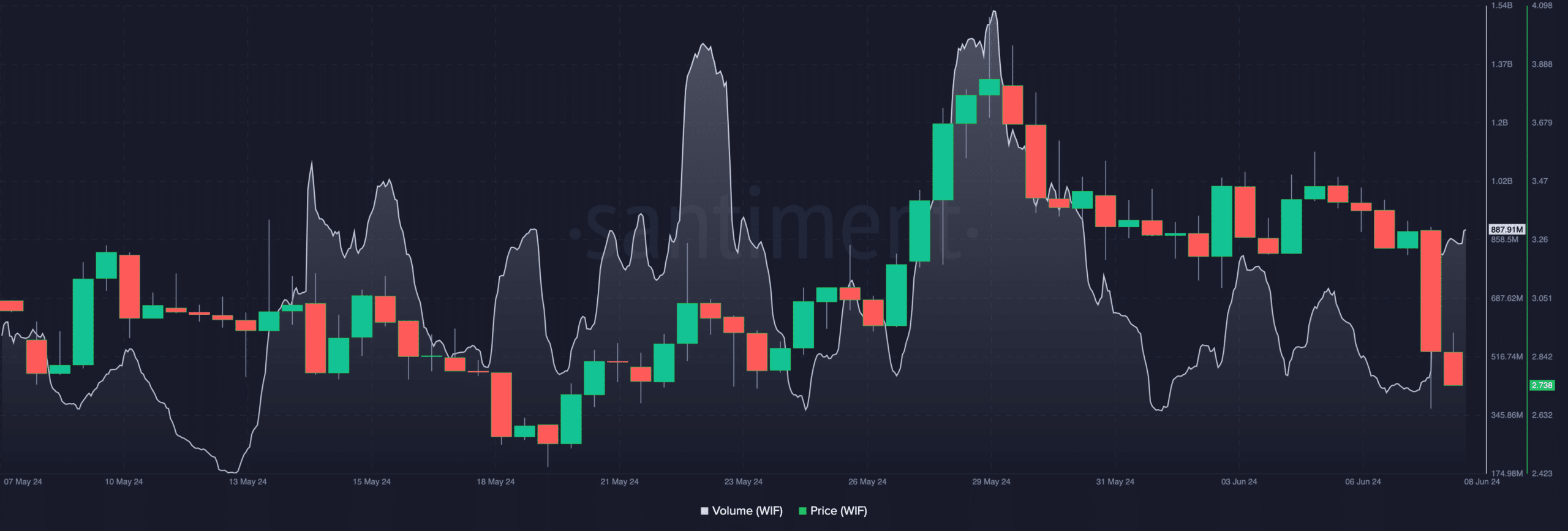

Here, it’s worth noting that WIF recorded a surge in volume when the price fell. In fact, according to Santiment, the trading volume hiked by an incredible 112% in the last seven days.

Sellers are giving WIF a hard time

Rising volume indicates interest in a token, and an increase in buying and selling. For WIF, the hike in volume alongside the price decline implied that selling pressure was intense.

Should the volume continue to increase while WIF struggles, the price could drop as 2.53 – The next underlying support. If bulls can defend this support level, the price might bounce.

However, failure to resist bearish pressure could send the price down to $2.34. The token’s recent trend has been contrary to the momentum it displayed during the last week of May.

At that time, the token rallied to $4, with predictions flying around that the price might surpass its All-Time High (ATH) of $4.85. However, the cryptocurrency could not achieve that. At press time, the memecoin was 43.36% down from its ATH on the charts.

Technical setup is within a close range

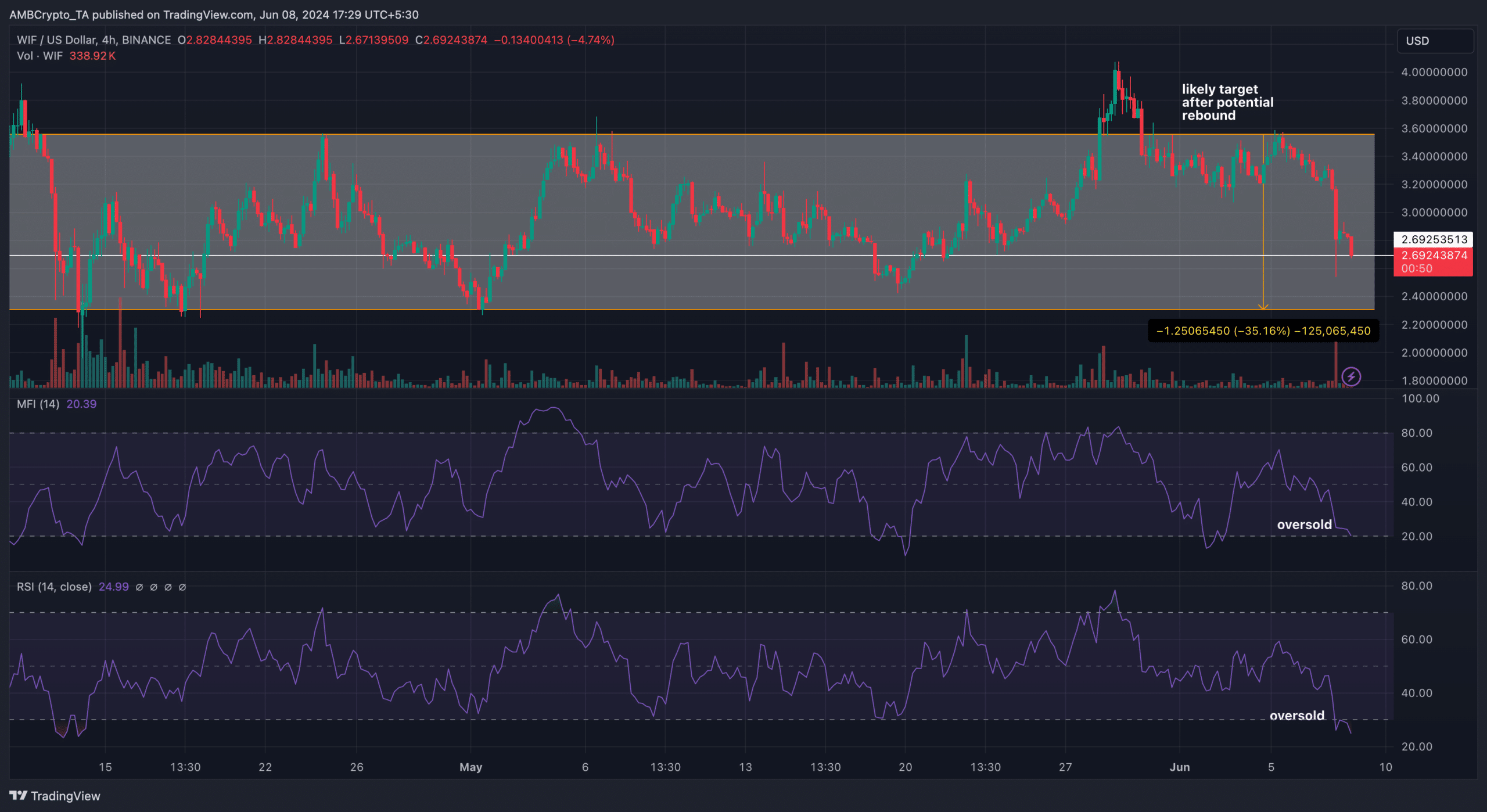

AMBCrypto also analyzed WIF’s potential from a technical perspective. According to the 4-hour WIF/USD chart, the Relative Strength Index (RSI) was 24.99.

The RSI measures the momentum around a token. Values of 30 or below indicate that an asset is oversold. On the other hand, a reading of 70 or above, indicate an overbought status.

Therefore, WIF’s condition suggested the token was oversold. Hence, the price could bounce. However, analysis revealed that it might happen without another decline to $2.45.

Apart from the RSI, the Money Flow Index (MFI) was another indicator that revealed that WIF was oversold as the reading was 20.40. For the MFI, a reading over 80 implied that the price was overbought while at 20, it indicated an oversold point.

However, the price decline could serve as an opportunity to buy the memecoin at lower prices. From the look of things, buying WIF between $2.30 and $2.69 could be a good idea.

If buying pressure increases, the price might rebound on the charts and a target of $3.55 could be plausible. However, traders might need to watch out.

Realistic or not, here’s WIF’s market cap in PEPE terms

In a case where selling pressure exceeds the usual, the price of WIF might slide lower than the target. Also, if this happens, the bounce off the lows could be harder, and a pump beyond $4 might be possible in a few weeks.