Ethereum news today: Is Solana’s anti-MEV move ‘overstated’?

- Solana’s clampdown on MEV validators has attracted divergent opinions.

- Ethereum also faced criticism for its reported strict stance against memecoins.

The Solana [SOL] vs. Ethereum [ETH] news, which hit many crypto headlines over the last week, seems far from over.

Over the weekend, the debate between the two leading alternative L1 blockchains resurfaced after Solana clamped down on validators using MEV (Maximal Extractable Value).

In the fight against MEV, the Solana Foundation reportedly withdrew financial support from validators who engaged in the same.

But an Ethereum core dev, Ryan Berckmans, downplayed the move and called Solana ‘not a serious settlement layer.’

‘Now, the next step in their plan to solve MEV was to pull financial support from validators who extract MEV 😆. Solana is not a serious settlement layer.’

For the uninitiated, MEVs are essentially profit strategies maximized by validators by reordering, excluding, or including transactions in the block.

Is Solana’s anti-MEV good or bad?

Whether the anti-MEV update is great or not is up for debate.

On his part, Lucas Bruder, CEO of Solana-based MEV infrastructure provider Jito Labs, defended Solana Foundation’s move, stating,

‘The Solana Foundation is a staker on the network. Stakers should want to see the network be successful. why would they support something that decreases the likelihood of the network being successful?’

The executive added that the move was aimed at protecting the largest Solana user base, meme coin traders.

‘Most activity on Solana is memecoin trading, so if you screw over the main user base of the blockspace, they’ll leave, and we’ll all be sitting here with less usage wondering why tf we didn’t do anything.’

Interestingly, Solana co-founder Anatoly Yakavenko also supported the anti-MEV move as a great way to “respond to user (meme coin traders) needs.”

However, Berckmans claimed that the move was Solana Foundation’s protection of meme coin traders to maintain “competitiveness” against ETH and ETH L2s.

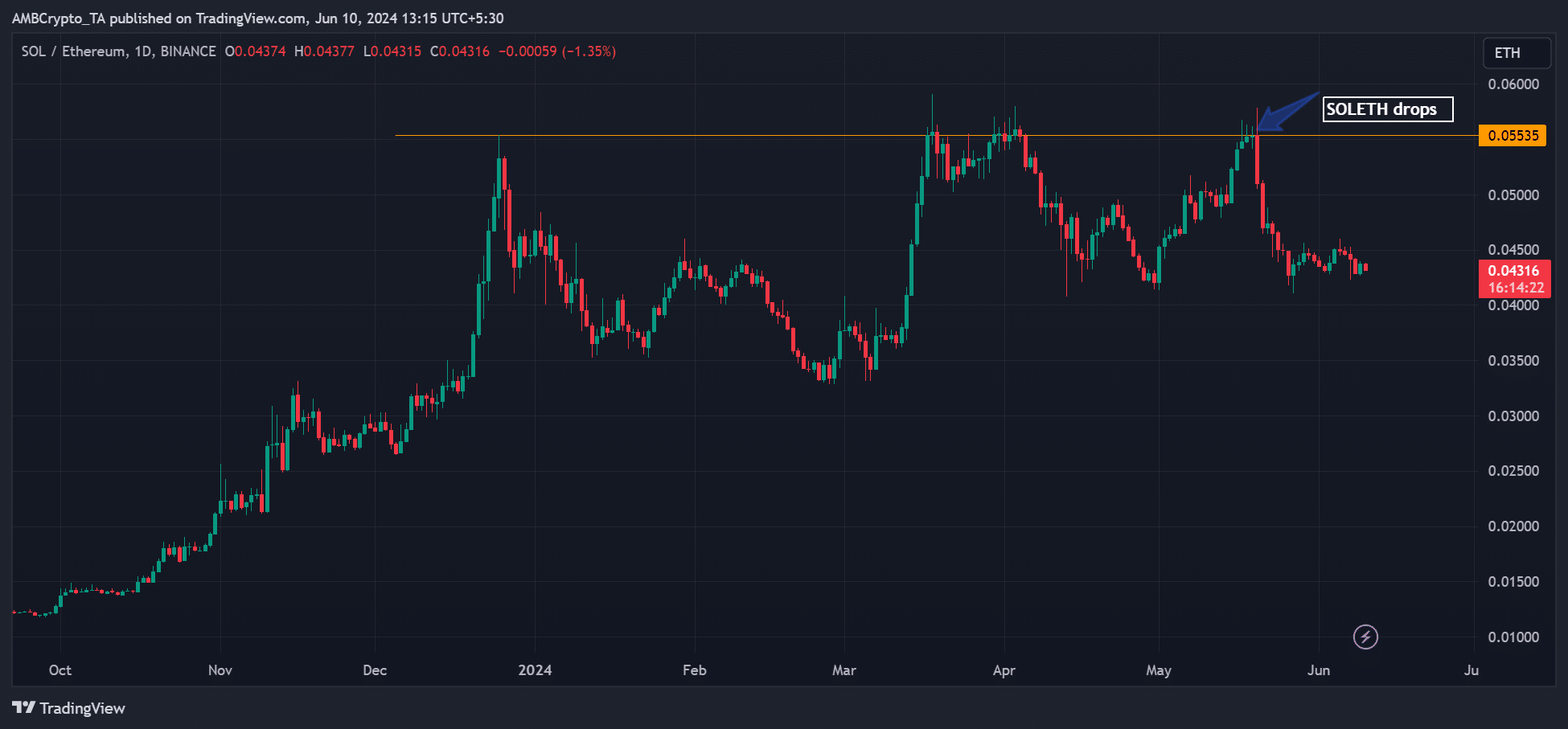

‘I think this story writes itself. The SOL/ETH ratio vastly overstates Solana’s durability as a serious competitor to either the ETH L1 or our best L2s.’

The referenced SOL/ETH ratio tracks SOL’s price chart performance relative to ETH. The ratio has been rising since October 2023 but registered a slight retracement following May’s surprise ETH ETF application.

This means that SOL has been outperforming ETH on the price charts since last year, but that could change.

More Solana vs. Ethereum news

In a separate development last week, amidst an argument between Iggy Azalea and Vitalik Buterin on celebrity coins, Wintermute CEO Evgeny Gaevoy stated that ETH could fail because of “ETH elites” and not Solana.

‘If ETH fails in the future it won’t be because “Solana is faster”, it will be because the ETH “elite” is still stuck in a massive contradiction’

Notably, Gaevoy’s reaction was based on Buterin and Uniswap’s founder stance that memecoins should be for the greater social good and not for purely financial gains.

Put differently, Solana has positioned itself as a pro-meme coin trader and launcher, while ETH has taken the opposite approach.