Solana’s BEERCOIN plunges 70%: Whale manipulation at play?

- BEERCOIN’s value declined by 70% in the last seven days.

- The memecoin showed signs of recovery.

Solana [SOL] memecoions have created much buzz off late, and BEERCOIN [BEER] is one of them.

The memecoin witnessed a major price drop, which seemed normal considering the overall bearish market condition. However, there was more to the story as the memecoin’s price gained bullish momentum in the last 24 hours.

Solana’s BEER faces a challenge

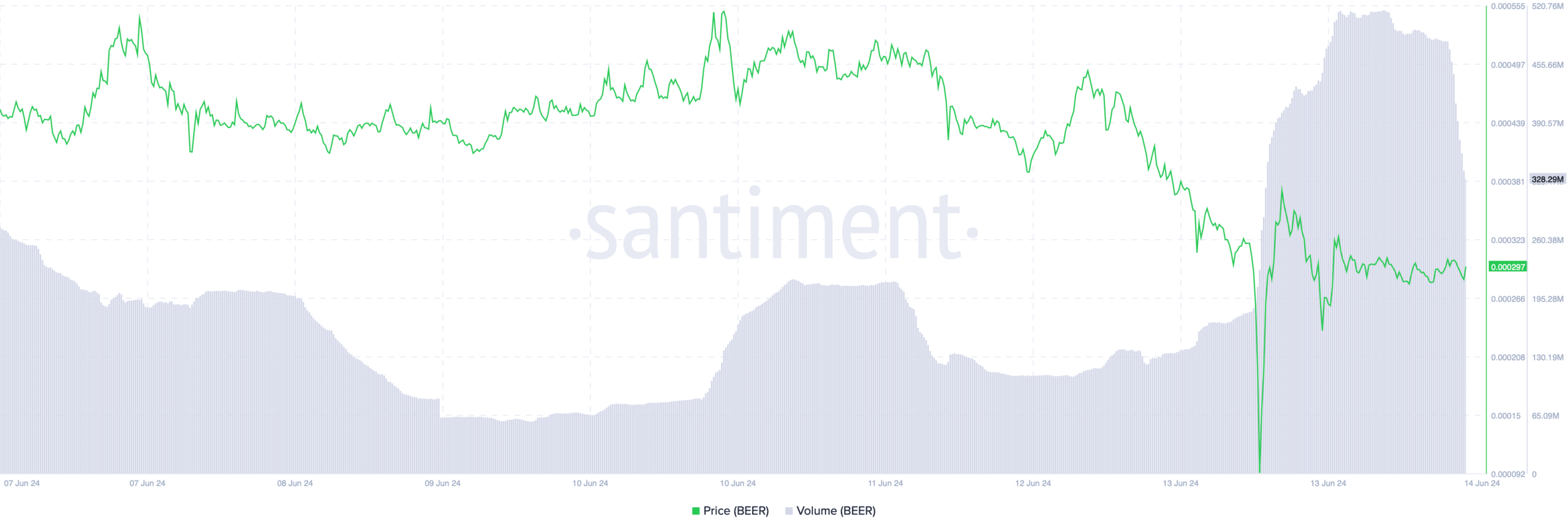

The last week was disastrous for BEER investors as the memecoin’s price dropped by 70% as it dropped to $0.00014 on the 13th of June.

SolanaFloor, a popular X handle that posts updates related to the blockchain’s ecosystem, recently posted a tweet highlighting that the BEERCOIN’s price decline was not just a mere repercussion of the market condition.

Rather a whale sold BEER worth over $10 million. This created panic among investors as selling pressure at large started to increase, causing the substantial dip in BEERCOIN’s price.

Lookonchain, however, pointed out yet another development related to BEER through a tweet.

As per the tweet, the whale that sold BEER to push its price down, started to accumulate BEER once its price reached the bottom. Such price manipulations often happen with small market capitalization tokens.

However, things started to get better for the Solana-based memecoin as its price started to recover.

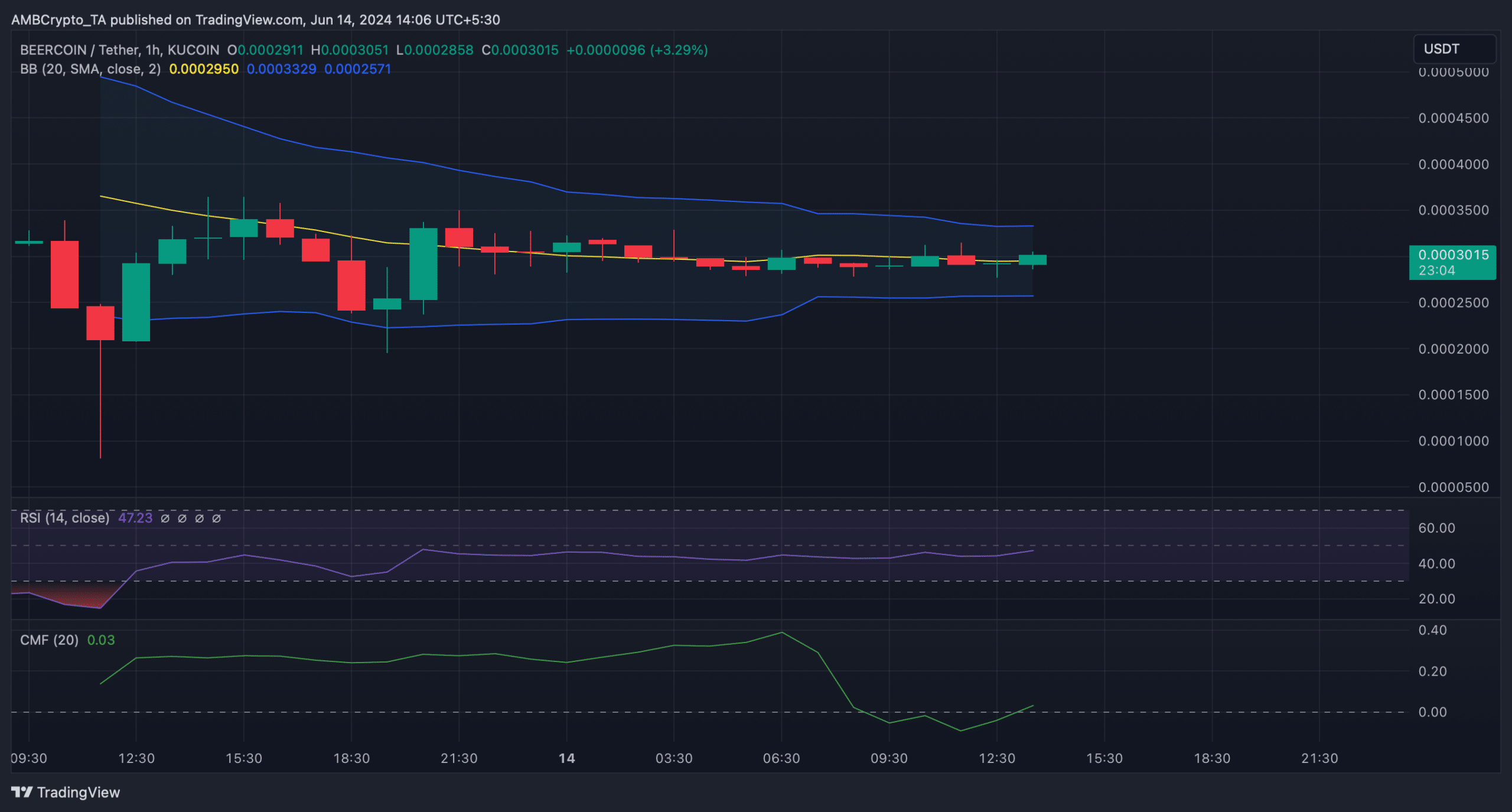

According to CoinMarketCap, BEER was still down by 11% in the last 24 hours. At the time of writing, BEER was trading at $0.0003004 with a market cap of over $165 million.

Since the price drop, the memecoin’s trading volume has also risen, which can act as a foundation for its recovery.

AMBCrypto’s analysis of BEER’s 1-hour chart revealed that its price was in a less volatile zone, suggesting that the chances of a massive price drop were low.

Additionally, both its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered upticks, which might aid in BEER’s recovery from the recent loss.

Solana’s chart remains red

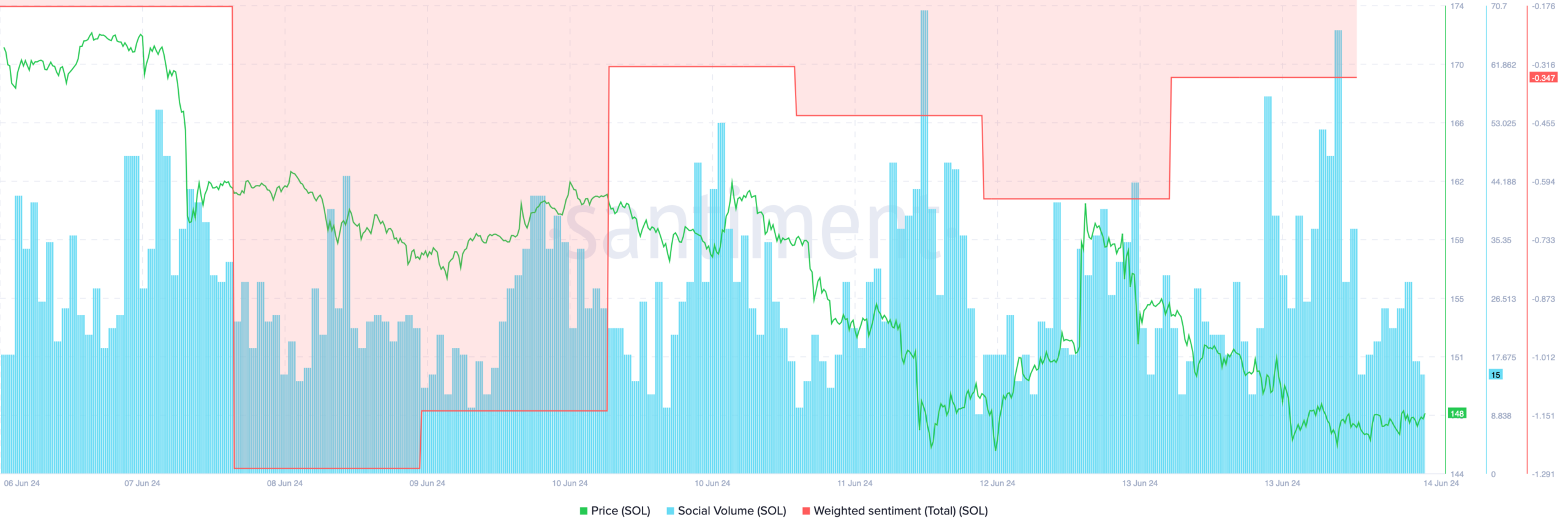

Like BEER, Solana also faced challenges as it was down by more than 2% in the last 24 hours. At the time of writing, SOL was trading at $148.21 with a market capitalization of over $68 billion.

Is your portfolio green? Check out the SOL Profit Calculator

It was interesting to note that despite the price decline, SOL’s weighted sentiment moved up. This meant that bullish sentiment around the token increased in the market.

Moreover, its social volume also remained high throughout the last week, reflecting its popularity.