Will Ethereum continue to see green as self custody rises and whales sell?

- Many Ethereum addresses withdrew their holdings on a considerable scale

- Overall interest from new addresses in ETH declined

Ethereum [ETH] recorded a major correction in price on the charts, despite the anticipation associated with spot ETH ETFs and their impending launch.

Ethereum self-custody on the rise

In fact, Santiment’s data revealed a shift in the distribution of Ethereum holdings. There’s a trend of users moving their ETH away from exchanges.

On the one hand, the top 100 exchange wallets recently dipped below their May 2018 all-time low. They are now currently holding only 8.41 million ETH – Implying a fall in the concentration of Ethereum on exchanges.

On the other hand, the top 100 non-exchange wallets were at an all-time high of 68.39 million ETH, signifying a rise in self-custody. This means that more users are now taking control of their own holdings by storing them in wallets they control directly, rather than keeping them on exchanges.

If this trend continues, it could help Ethereum’s claim to decentralization. A more distributed network, with less reliance on centralized exchanges, aligns with the core principles of blockchain technology.

However, reduced liquidity on exchanges, caused by a decline in ETH holdings, could lead to higher price volatility for Ethereum. With fewer coins readily available for buying and selling, price swings could become more significant in response to market changes.

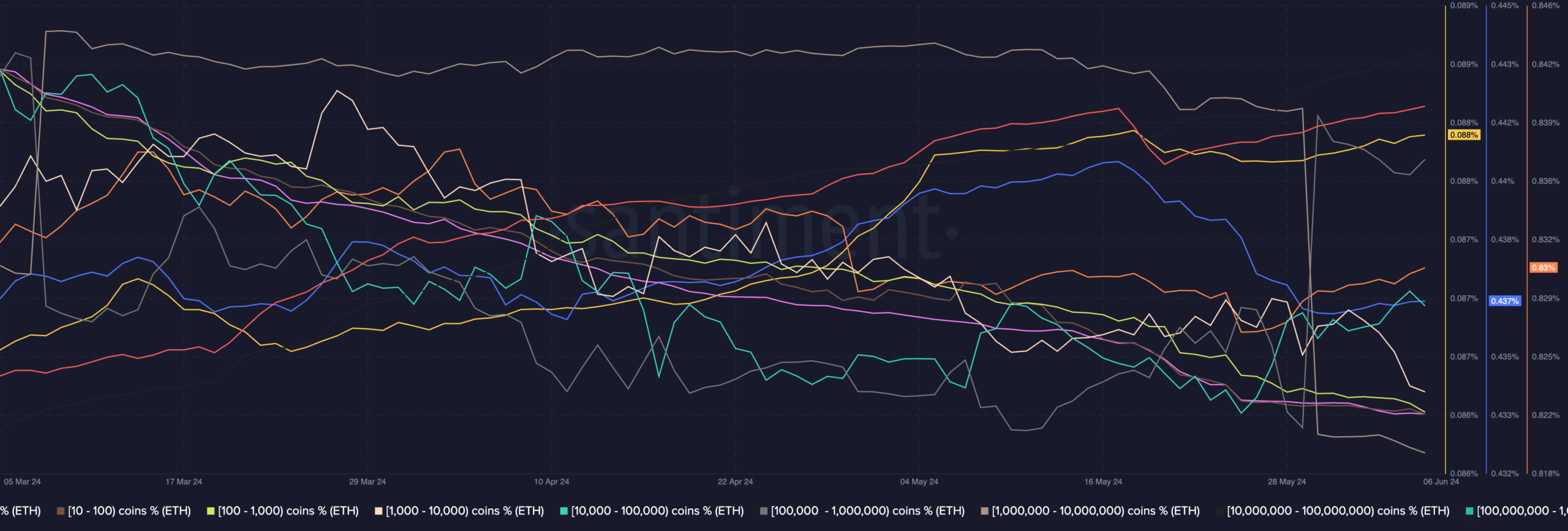

Even though higher self-custody could be seen as a positive development, there are other concerning factors for ETH too. For instance, some large addresses have been selling a significant amount of their holdings, without accumulating.

This could impact ETH’s price negatively in the future.

It’s worth noting, however, that retail investors continue to show interest in ETH, despite the dip in price.

Retail interest declines

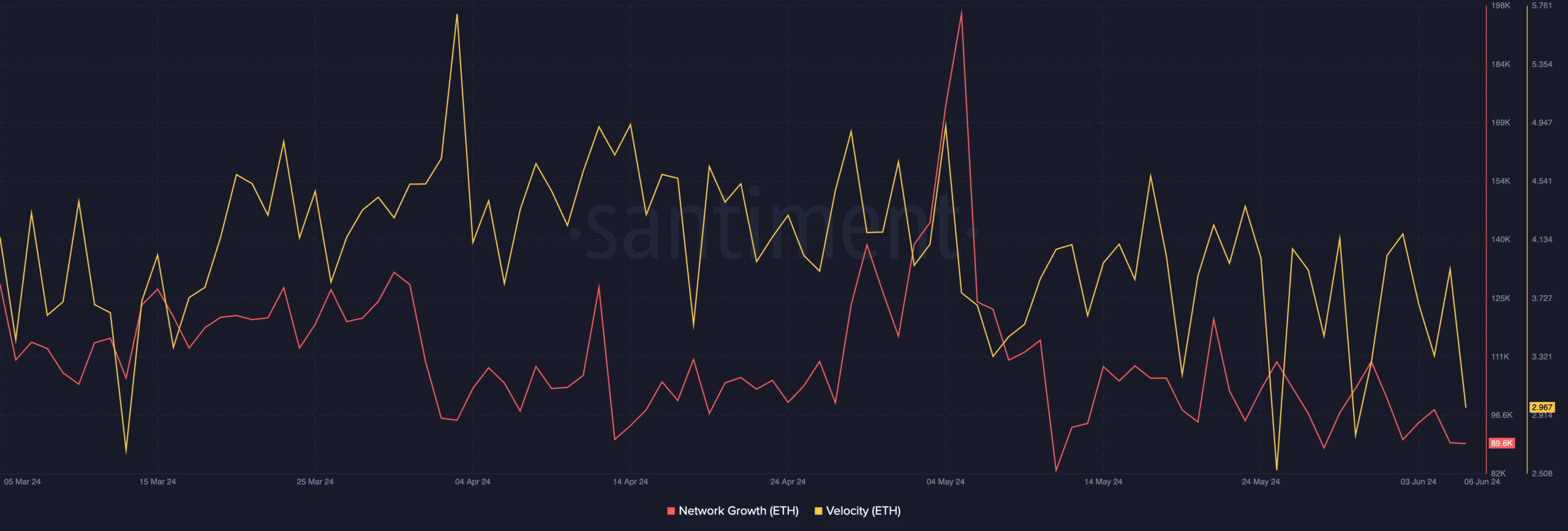

And yet, even though retail investors have been showing interest in ETH, it hasn’t been significant enough to move ETH’s price. Additionally, the network growth for ETH also declined over the past month.

This meant that the number of new addresses showing interest in ETH reduced. A declining network growth also means that the accumulation of ETH was being done by pre-existing holders.

Read Ethereum’s [ETH] Price Prediction 2024-25

Additionally, the velocity at which ETH was trading also fell over the last few days. Simply put, it implies that the frequency with which ETH was being traded declined significantly.