Spot Ethereum ETFs by 2 July? Analyst makes this bold prediction!

- Analyst’s remarks hinted at Ethereum ETFs possibly starting on 2 July

- Bitcoin seems to be underperforming ahead of ETH ETF approval

Following SEC Chair Gary Gensler’s promising remarks (“sometime over the course of this summer”) about the approval timeline for Ethereum [ETH] spot Exchange Traded Funds (ETFs), Bloomberg’s Senior Analyst Eric Balchunas is in the news today after he specified a potential start date.

Balchunas prediction: Reality or no?

According to Balchunas, Ether ETFs could potentially start trading in the United States as early as 2 July. He said,

“We are moving up our over/under date for the launch of spot Ether ETF to July 2nd, hearing the Staff sent issuers comments on S-1s today, and they’re pretty light, nothing major, asking for them back in a week.”

This news has sparked optimism within the cryptocurrency community, especially regarding Ethereum’s upcoming market opportunities.

In fact, the analyst also alluded to the fact that the aforementioned launch may be timed to align as closely as possible with 4 July, the United States’ Independence Day.

“Decent chance they work to declare them effective the next week and get it off their plate bf holiday wknd. Anything poss but this is our best guess as of now.”

Bitcoin ETF vs. Ethereum ETF

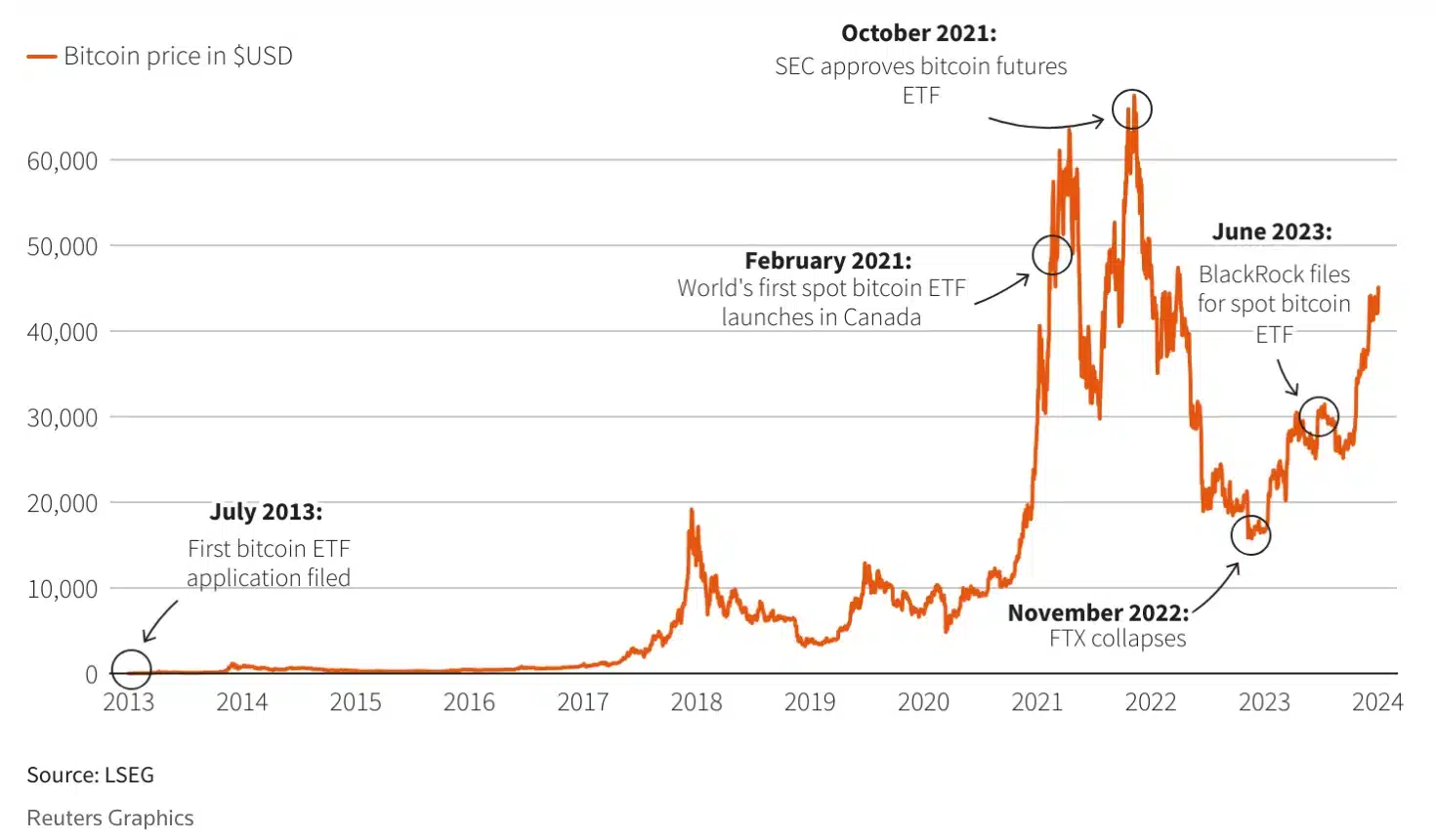

The delay in approving ETH ETFs stands nowhere close to the lengthy journey of Bitcoin [BTC] ETFs’ approval process.

All the way back in July 2013, Cameron and Tyler Winklevoss, founders of the Gemini crypto exchange, filed their initial application with the SEC to establish a spot Bitcoin ETF.

Fast forward to January 2024, after nearly a decade of regulatory scrutiny and multiple applications, the SEC finally approved 11 Bitcoin ETFs.

Drawing parallels between the approval processes of Bitcoin and Ethereum ETFs, it is noteworthy that after the BTC ETF’s approval, Ethereum saw a significant rally, rising by 9.1% while Bitcoin underperformed.

And now, with the anticipation of the ETH ETF approval, Ethereum, the second-largest altcoin, stands out amidst a market downturn.

At the time of writing, Bitcoin and many other cryptocurrencies were flashing red candlesticks on their daily charts. On the contrary, Ethereum was in the green following a modest hike of just over 1%.

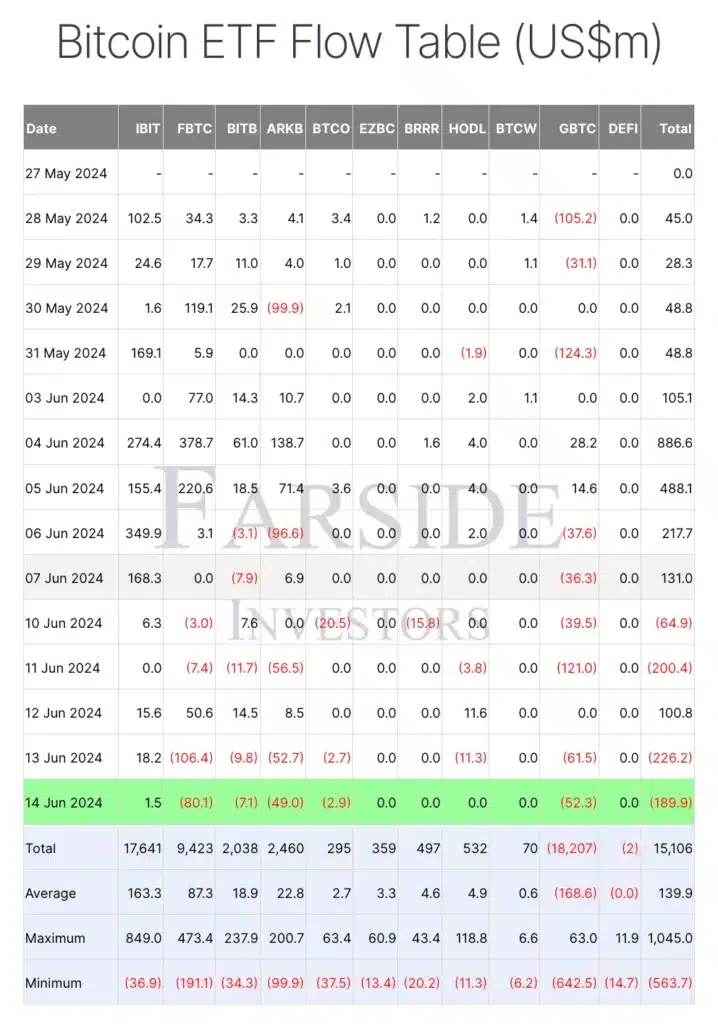

Additionally, according to a recent report by Farside Investors, spot BTC ETFs saw two consecutive days of outflows on 13 and 14 June, totaling $416.1 million.

Popular analyst Willy Woo pitched in to comment too. He stated,

Future remains uncertain

Overall, while the dynamics are consistently changing across the crypto market, it is still too early to definitively conclude whether investors are moving away from Bitcoin towards Ethereum.

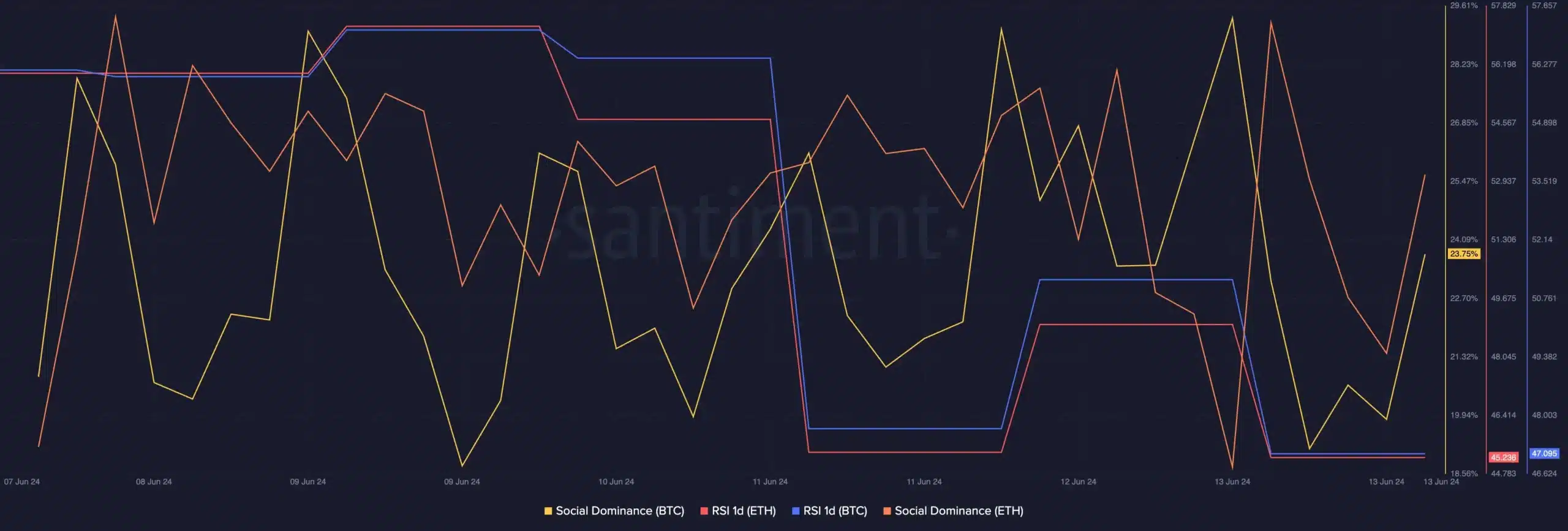

Worth noting, however, that AMBCrypto’s analysis of Santiment revealed that the social dominance metrics for both ETH and BTC were moving north. Despite this, the Relative Strength Index (RSI) remained flat, indicating no clear signs of either bullish or bearish momentum.