Will Shiba Inu [SHIB] drop down to $0.000018?

![Will Shiba Inu [SHIB] drop down to $0.000018?](https://ambcrypto.com/wp-content/uploads/2024/06/shiba-inu-news-1200x686.webp)

- SHIB’s network was closing in on overvalued levels, and could draw the price down.

- Holders accumulated trillions of tokens between $0.000020 and $0.000023, indicating a possible uptrend rejection.

In the last seven days, Shiba Inu’s [SHIB] price has decreased by 10.69%.

According to AMBCrypto’s analysis, this decline might continue in the near term, suggesting that SHIB holders might need to wait a bit longer before a rally appears.

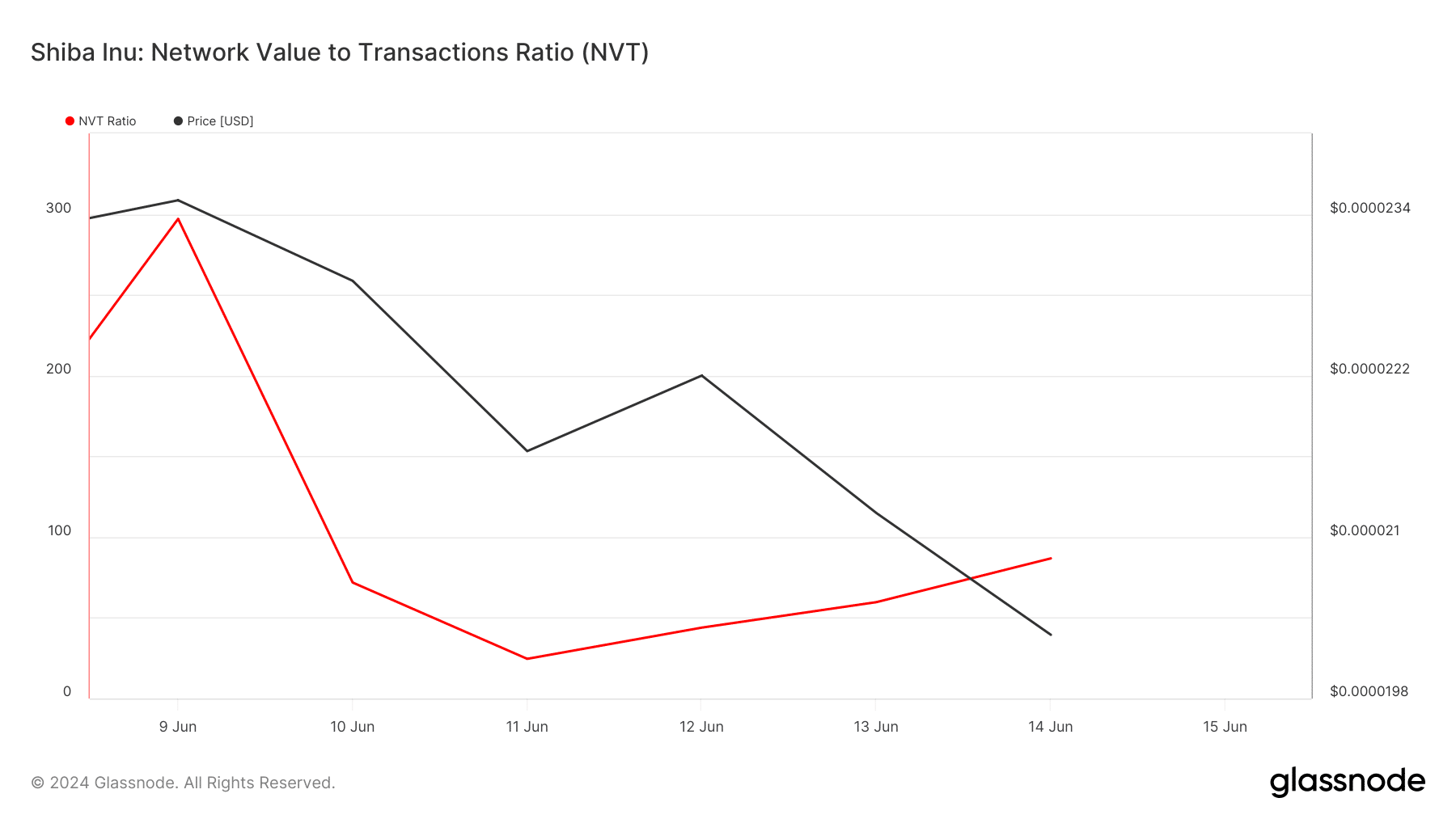

One metric fueling this thesis is the Network Value to Transactions (NVT) Ratio. A high NVT Ratio suggests that the market cap of a token is growing faster than the transfer volume.

Most times, a situation like this coincides with a market top. On the other hand, a low NVT Ratio implies that utilization of the network is outpacing the market cap.

It’s a struggling period for the token

Historically, low NVT Ratios have been known to foreshadow bullish trends. For Shiba Inu, the NVT Ratio according to Glassnode, the metric was seen rising.

On the 11th of June, the ratio was 24.58. But at press time, the reading had increased to 86.80.

This increase indicates a shifting narrative that support overvaluation of the Shiba Inu network. Therefore, it could be challenging for SHIB’s price to bounce off the lows.

At press time, SHIB changed hands at $0.000020. In a previous article, AMBCrypto had explained how the price might decrease to this level.

Now that it has come to pass, another decline might occur. This time, depending on the NVT ratio trend, SHIB could slip to $0.000018.

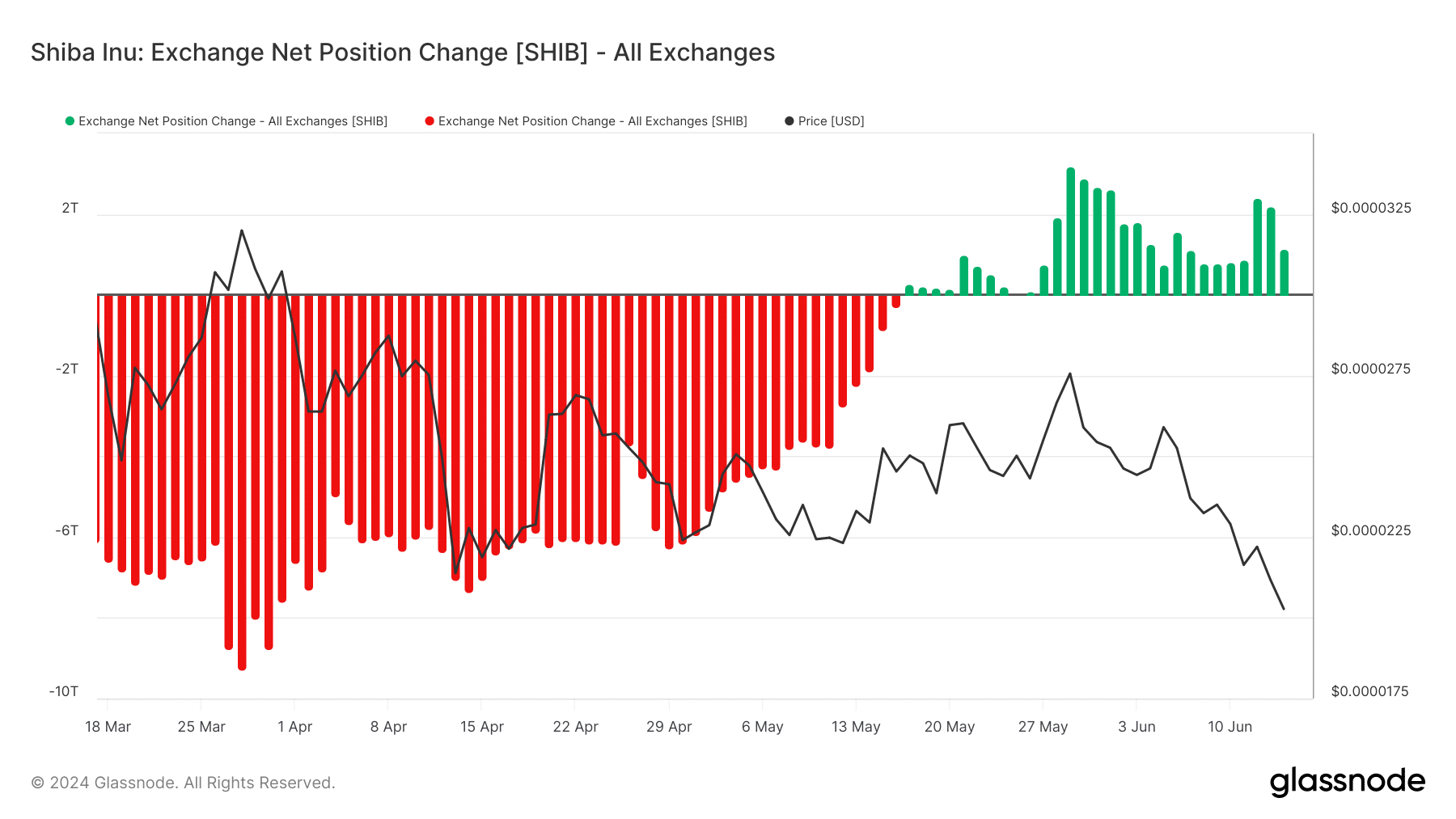

Beyond the above-mentioned metric, the Exchange Net Position Change also supported the potential fall in price.

A positive value of the Exchange Net Position Change indicator that the supply ready for sale has increased. Conversely, a negative reading implies that market participants are taking tokens off exchanges.

Holders are prepared to let go

Typically, the latter stabilize prices or leads to an increase in the short term. In Shiba Inu’s case, the Exchange Net Position Change was at a positive sum of 1.13 trillion.

This means this number of tokens are available for sale.

If this position remains the same over the next few days, SHIB’s price might be affected. Per the possible targets, the value of the memecoin might shrink to $0.000018.

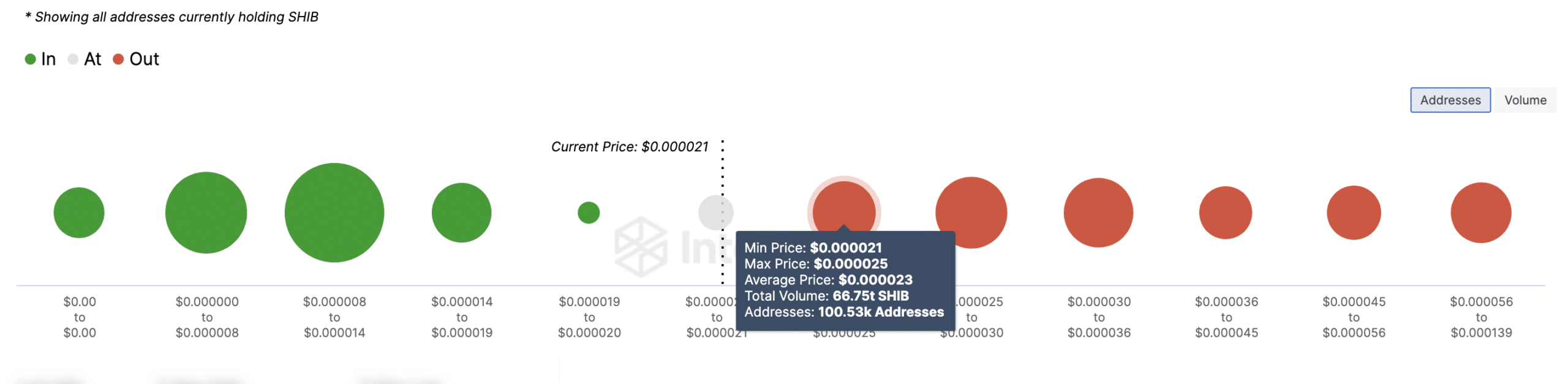

In addition, AMBCrypto analyzed the Global In/Out of Money indicator. This metric measures addresses in profit or loss and how they can act as support or resistance for prices.

The larger the number of tokens accumulated at a price, the higher the chance of acting as support or resistance.

According to IntoTheBlock, the difference between those that bought at an average price of $0.000019 and those that bought between $0.000020 and $0.000023 was wide.

Specifically, only 1,720 addresses purchased 452.80 billion SHIB tokens at $0.000019. On the other end, 100,530 addresses accumulated 66.75 trillion SHIB at $0.000023.

Read Shiba Inu’s [SHIB] Price Prediction 2024-2025

Therefore, it was evident that the token might face resistance at the upper level.

Should some of these holders decide to break even between $0.000020 and $0.000023, SHIB’s price might decrease, and the support at $0.000019 might be enough to stop the potential decline to $0.000018.