MATIC struggles to break past $0.75: Is $1 a pipe dream?

- MATIC faces strong resistance, struggling to maintain levels above $0.75.

- Bearish sentiment prevails as MATIC traded below the Ichimoku cloud and all three moving averages.

Polygon [MATIC] was facing strong resistance at press time, with bearish sentiment winning over the market bulls.

Over the last 30 days, Polygon’s price has struggled to stay above $0.75, experiencing a downtrend that has seen its value drop to $0.61 at press time.

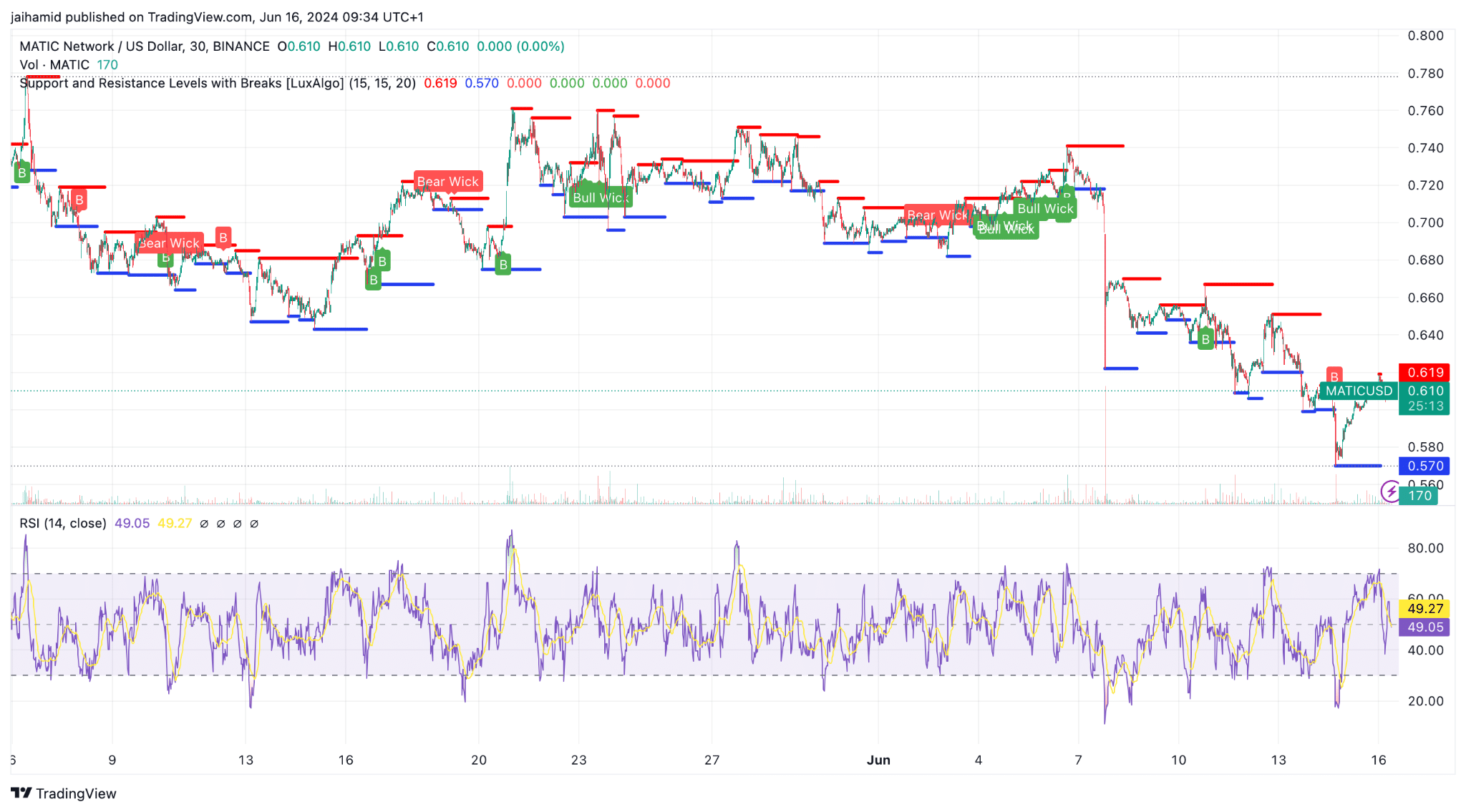

The chart below shows multiple instances of MATIC attempting to breach resistance levels marked at intervals from $0.66 to $0.75.

Despite these efforts, each rally was met with a sharp reversal, indicating strong bearish pressure at these higher price points.

On the downside, MATIC has established clear support around the $0.57 and $0.61 marks. These support levels are areas where buyers have historically stepped in, preventing further declines.

The RSI has fluctuated around the 50 mark, indicating a balance between buying and selling pressures.

However, it hasn’t ventured into overbought territory (above 70), which aligns with the lack of sustained upward momentum in the price.

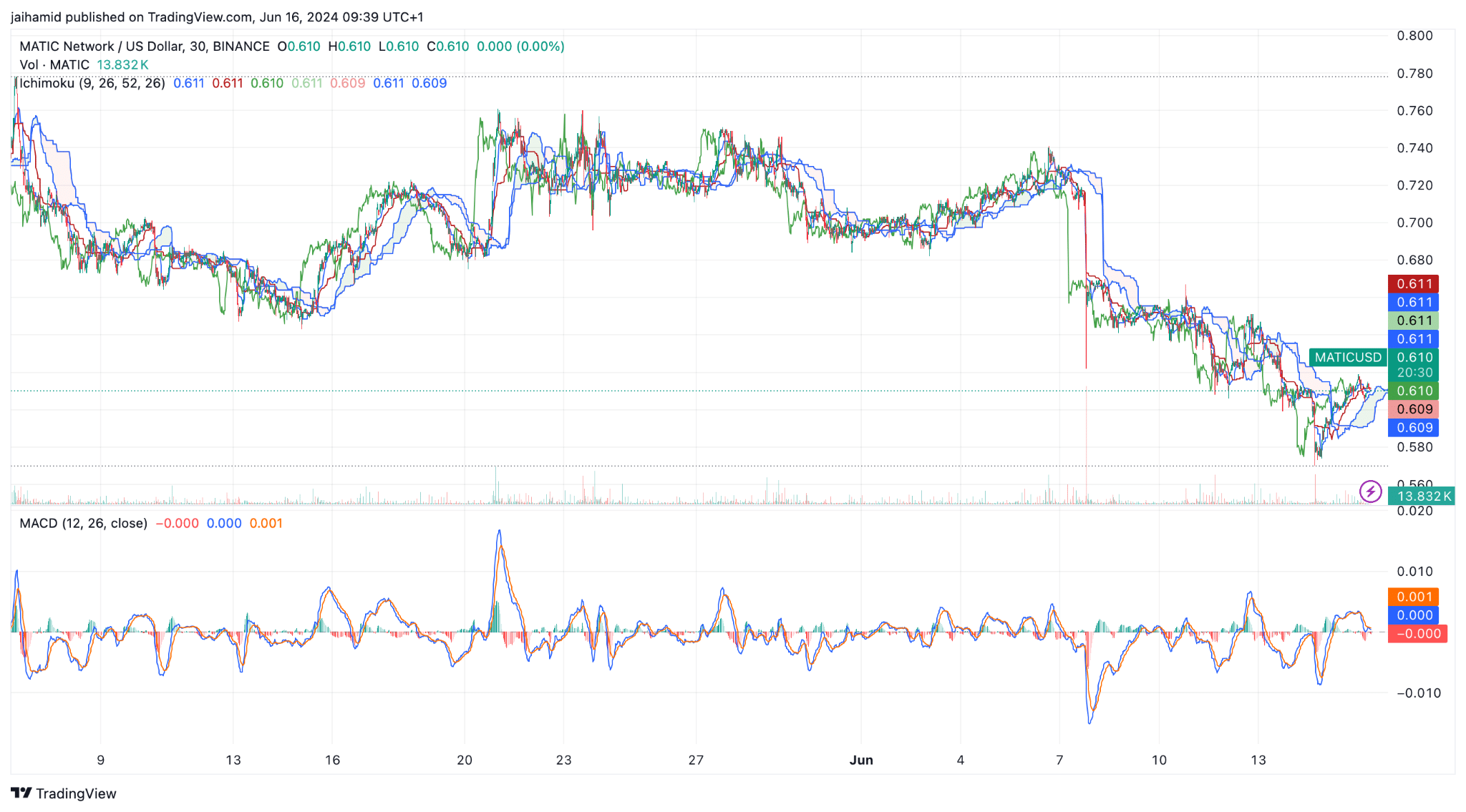

The Ichimoku cloud, visible on the chart, suggested a bearish outlook as the price moved beneath the cloud at press time.

The chart above revealed a series of lower highs and lower lows, a classic indication of a bearish trend.

The MACD line was close to the signal line and hovering around the zero line, which meant that there is a lack of strong momentum from either the bulls or the bears.

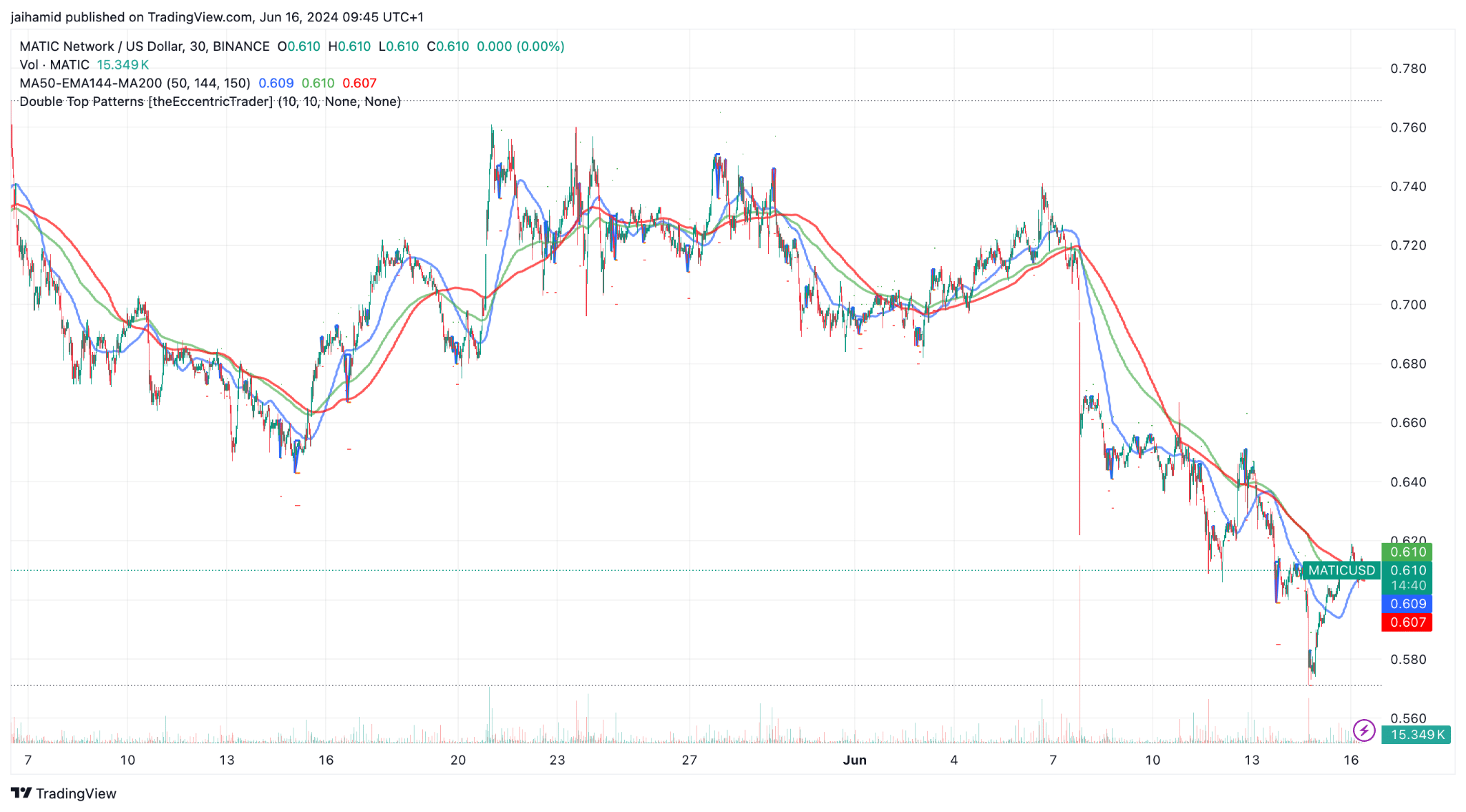

MATIC has also seen many double-top formations throughout the past 30 days.

The price was below all three moving averages, reinforcing the bearish outlook by suggesting that the overall trend was heavily driven by the bears.

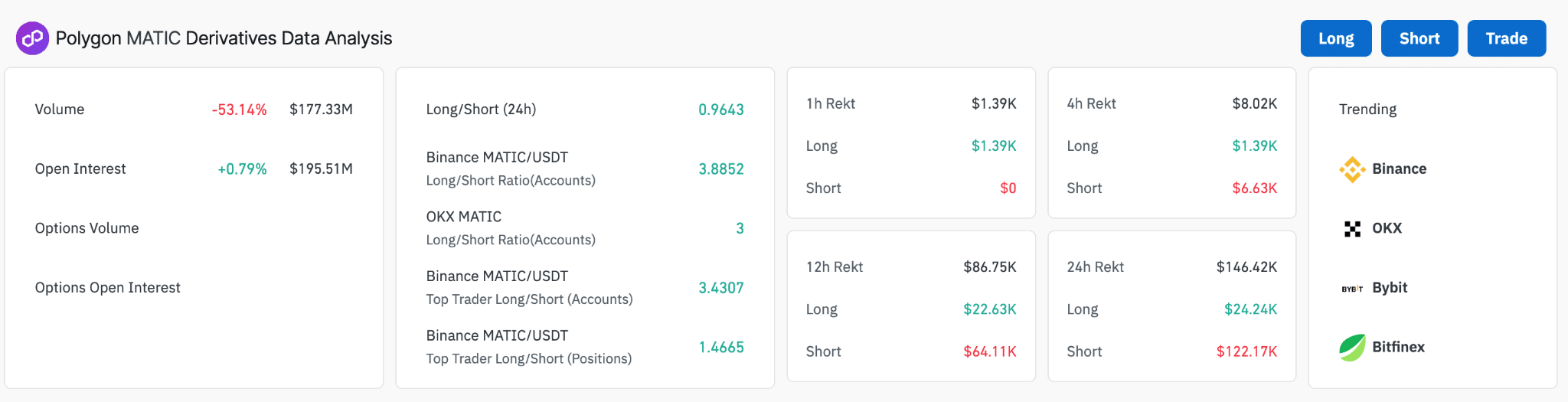

MATIC’s derivatives trading volume has declined significantly by 53.14%.

Realistic or not, here’s MATIC’s market cap in ETH’s terms

The long/short ratio on Binance [BNB] for MATIC/USDT stood at 3.8852 for accounts at press time, suggesting that more traders held long positions than shorts.

So, more traders seemed to believe in MATIC’s potential to gain i9n the long term.