PEPE’s key resistance breach leads to price dip: Is a reversal likely?

- PEPE price dips by 23% after resetting a key resistance level.

- Metrics indicate a potential reversal.

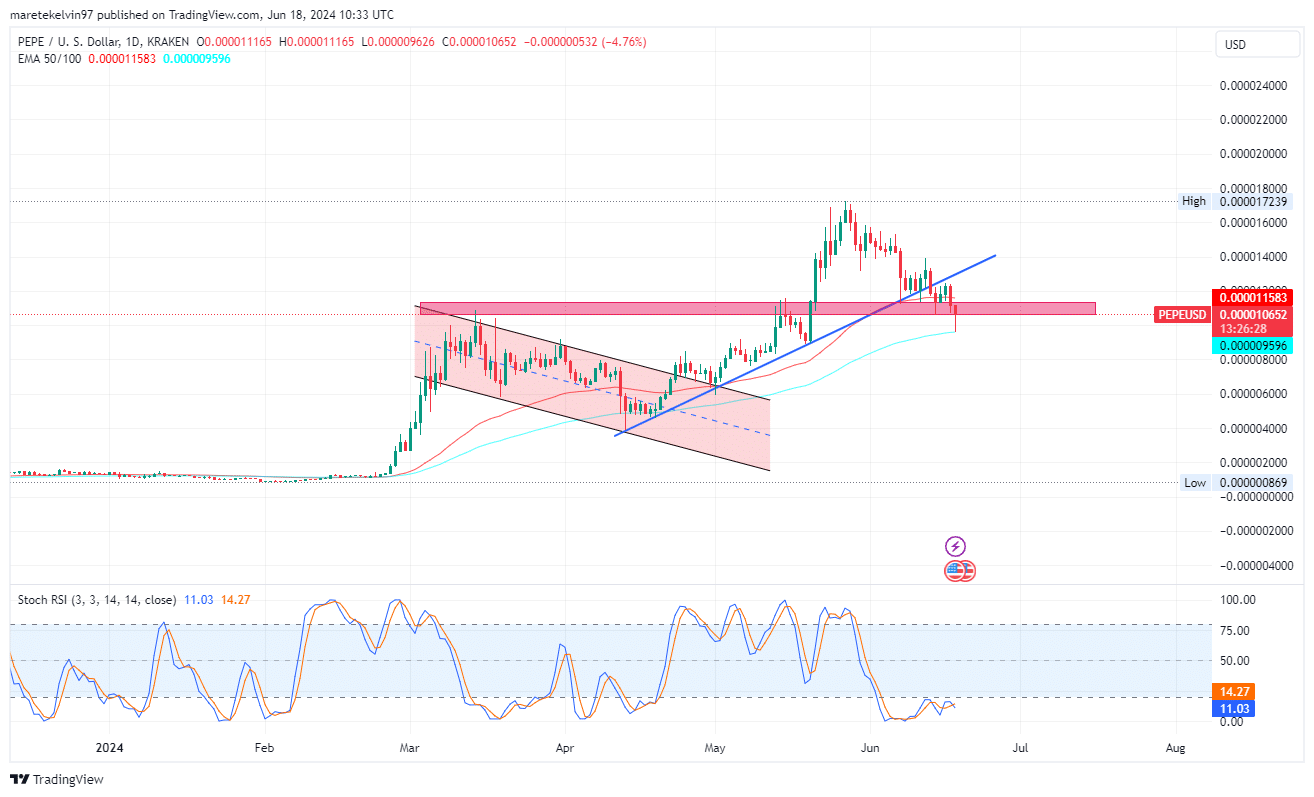

The crypto market has experienced an overall downturn, with most coins declining below their critical levels. Pepe [PEPE] was also not spared, with its price declining by 23% after retesting a trendline resistance level at $0.00001240.

The price was now hovering near a support level zone at around $0.000010652. This level is critical because it was a strong resistance zone that turned to a support zone.

Currently, the level is acting as a moving average support level. This level could provide a strong support level for price reversals.

The stochastic RSI indicates that PEPE is oversold. This implies that PEPE may experience a price reversal.

Can the whales overcome the tide?

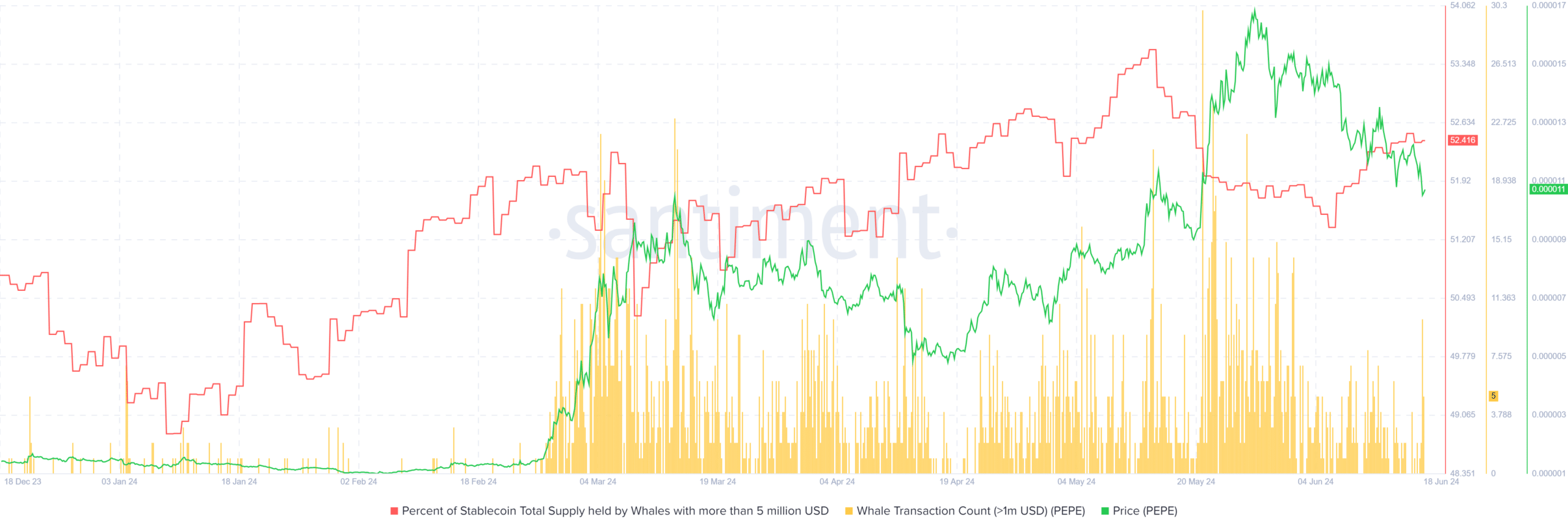

AMBCrypto analyzed Santiment’s data on whale activity to find the next price movement. The percentage of stable supply held by whales has increased to 52%.

This means that the big holders have control over the majority of stablecoins and have more influence on the price trend. This metric correlates with increased buying power, which will concurrently lead to a potential support level.

Moreover, the whale transaction count for PEPE has increased, indicating active participation from investors, a positive sentiment for a price reversal.

What liquidation has to add

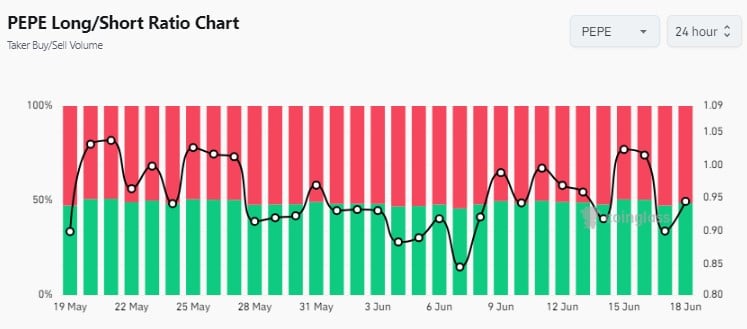

According to Coinglass data, PEPE’s total liquidation indicates a surge in volatility. Since last February, there have been spikes in both short and long liquidations, indicating market speculations and rapid shifts in sentiments.

Significant long liquidations in early March coincided with PEPE’s price drop, suggesting that market corrections to the bullish side could be on the horizon.

The long short ratio data from Coinglass has shown several spikes recently. This means that the long positions are outweighing the short positions. This may increase the bullish pressure, which in turn may result in a shift in the price.

What’s next for PEPE?

The market’s volatility is currently experiencing significant liquidations.However, there is underlying support from major investors, as evidenced by the whale activity and stablecoin supply percentages.

Read Pepe’s [PEPE] Price Prediction 2024-25

The metrics indicate a crucial support level for a potential price reversal. This will see the PEPE price surge.

However, if PEPE bearish momentum breaks the support level, the price may dip further.