Dogecoin’s 8% jump: Does it signal an end to the bear trend?

- Dogecoin surged by 8% in the last 24 hours.

- Metrics indicate a potential reversal at the $0.1145 key level.

Dogecoin [DOGE] has been on a wild ride over the past four weeks. As the broader cryptocurrency market witnessed volatility, DOGE was also engulfed in the price swings, leaving investors concerned about its future.

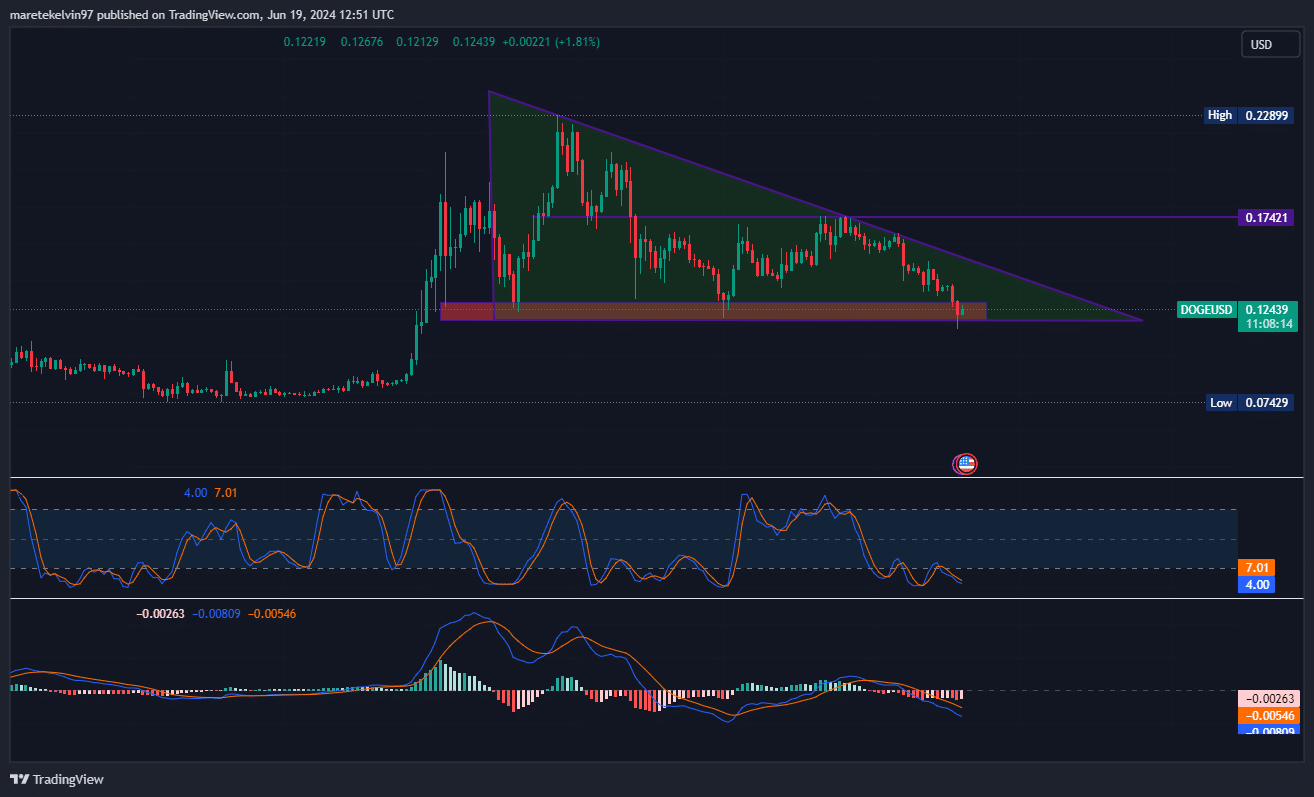

DOGE’s price has dropped by 32% in the last two weeks. The descending trendline indicates a bearish market.

However, the recent price movements suggest a potential bullish reversal as the price has surged by 8% in the last 24 hours.

Dogecoin was trading at an average price of $0.1247 at press time. Its 24 hour trading volume stood at around $851.62 million, with a market cap of $18.03 billion.

The stochastic RSI indicates an oversold zone, which could precede a bullish reversal. However, the moving average convergence divergence indicator shows fading bearish momentum, as the recent bearish bars are fading with time.

Social volume and development activities to fuel a reversal ?

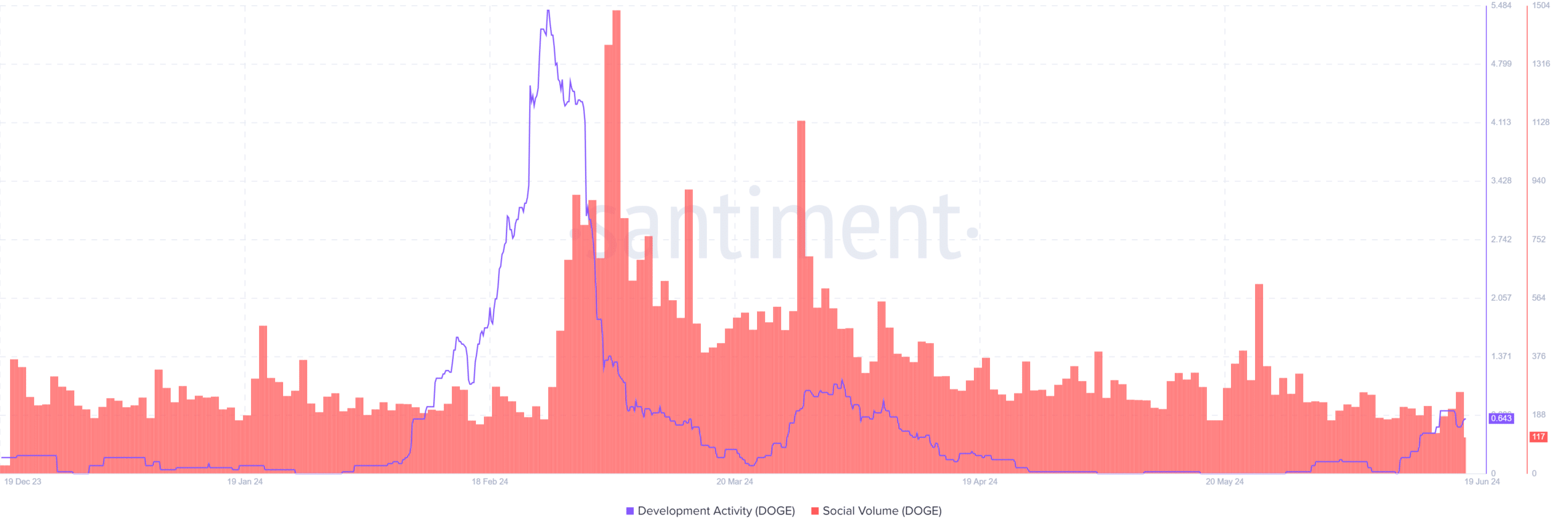

Santiment’s data indicated a spike in DOGE’s social volume and development activities.

This spike suggests a renewed interest in the Dogecoin community. The surge in development activity could signal ongoing improvements related to DOGE, which could potentially attract more investors.

Liquidation and short squeezes

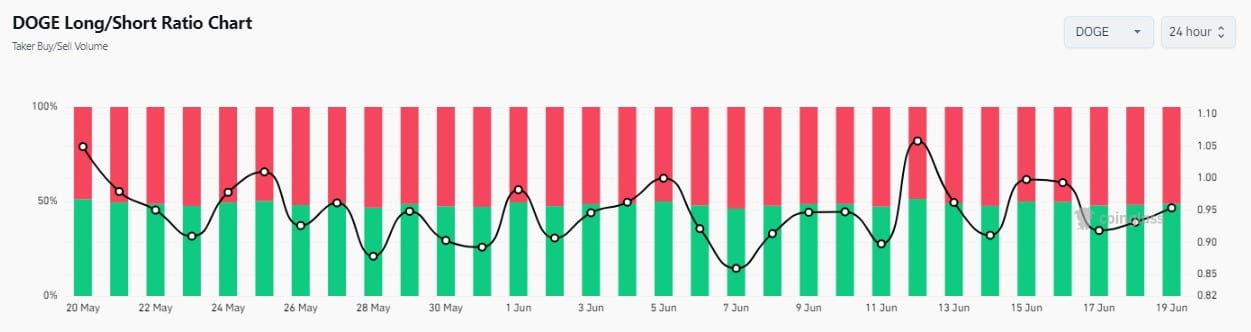

According to Coinglass’ liquidation map data, DOGE had several spikes in both long and short liquidations, suggesting extreme volatility and potential short squeezes.

This scenario can fuel rapid price surges, as seen in the recent DOGE rally.

Is your portfolio green? Check out the DOGE Profit Calculator

Additionally, the long short ratio data show a positive trend, indicating that long position investors are in control of the market. T

he buying pressure at this crucial level may intensify the bullish pressure on Dogecoin, hence surging the price.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)