Binance, USDT, and Toncoin team up – What’s next?

- Binance integrated Tether with the Toncoin network

- Despite this update, however, the price of TON declined on the charts

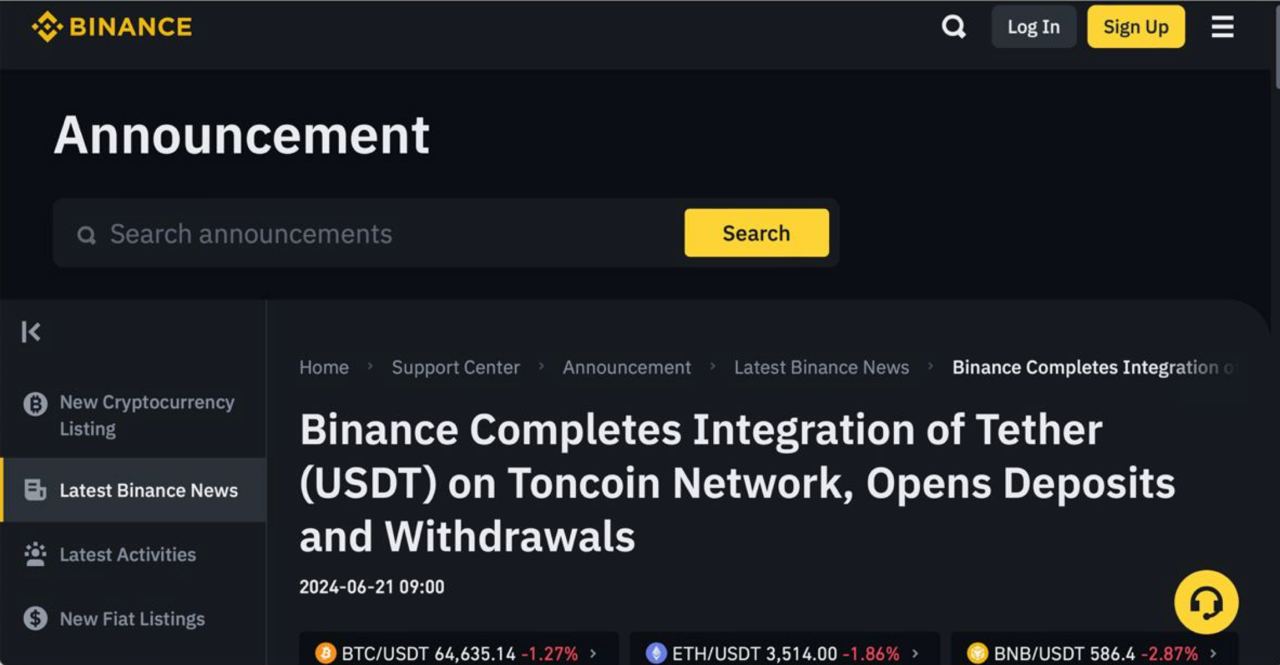

Binance has officially announced the integration of Tether on the Toncoin [TON] network. This integration allows users to deposit and withdraw USDT directly on the Telegram-associated blockchain, known for its fast transaction speeds and low fees.

Binance and Tether join hands

This integration signifies a strategic win for both parties. Binance strengthens its multi-chain offerings by incorporating the world’s leading stablecoin, USDT. USDT’s stability and immense liquidity, backed by its position as the largest stablecoin by market capitalization, injects significant value into the TON network.

Users can leverage TON’s advantages while enjoying seamless transactions and the asset management capabilities of USDT.

Additionally, Binance’s initiative aligns with its commitment to fostering a diverse blockchain ecosystem. By integrating TON, Binance empowers users with a wider range of options for managing their digital assets.

To ensure a smooth transition, Binance has provided dedicated deposit addresses and smart contract details for USDT on TON.

Some problems for TON ahead

Here, it’s worth noting that this integration comes amidst a backdrop of anticipated regulatory changes within the European Economic Area (EEA). Uphold’s recent decision to delist several stablecoins, including USDT, in anticipation of the upcoming MiCA regulations serves as a case in point.

Binance’s embrace of TON can be seen as a strategic move to navigate this evolving regulatory landscape.

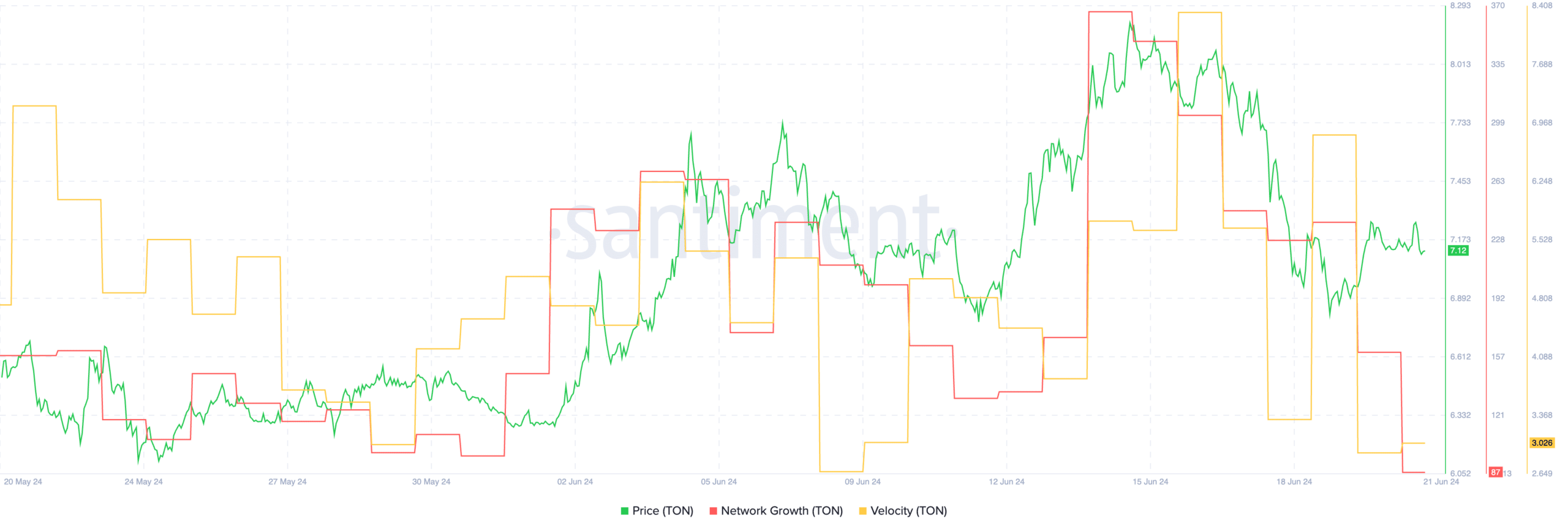

Despite these updates, however, the price of TON did not see much growth. Over the past week, the price of TON fell by 7.11%. The price decline was significant enough to change the overall trend of TON’s price movement. If the market continues to move like this, TON might bleed significantly.

AMBCrypto’s analysis of Santiment’s data revealed that the network growth around TON also fell materially over the last few days, indicating that the number of new addresses interacting with the TON token declined. Moreover, the velocity at which TON was trading at also decreased – A sign that the frequency with which TON was being moved around fell.

Is your portfolio green? Check the TON Profit Calculator

If new addresses continue to lose interest and the velocity continues to decline, hopes for a reversal for TON could diminish even further.

![Algorand [ALGO]](https://ambcrypto.com/wp-content/uploads/2025/05/EE821387-E6C9-4C21-A2AC-84C983248D2F-400x240.webp)