Is WIF’s price heading for collapse or reversal? Charts say…

- WIF’s price dropped by 11.21% in 24 hours

- Whale activity and social volume signalled a bullish rally on the charts

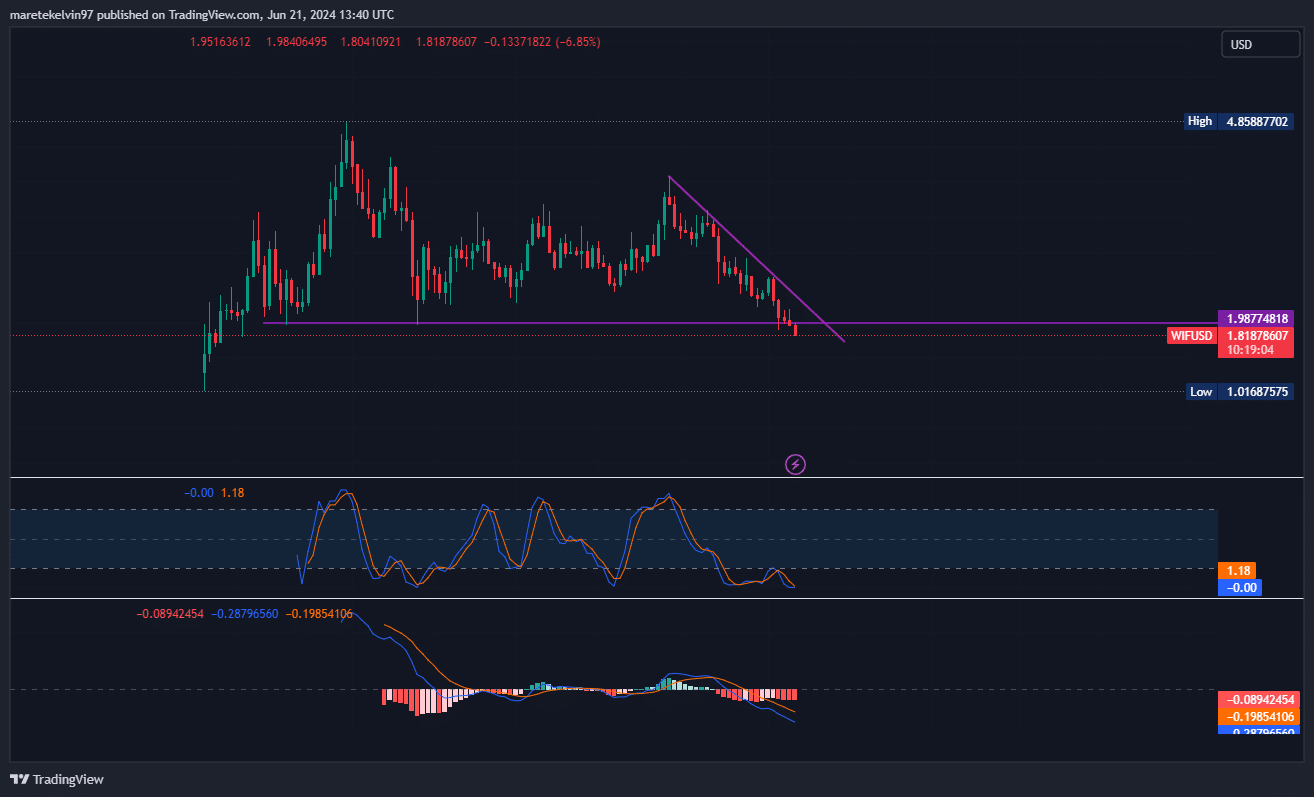

At the time of writing, Dogwifhat’s (WIF) price had a value of $1.81, following a 11.21% drop in the last 24 hours. WIF’s price had been consolidating in a descending triangle pattern after 29 May. However, WIF broke free from the triangle on 20 June, indicating that the price could plummet further.

At press time, the price seemed to be testing a key support level around $1.98. If the price breaks out above this, it could accelerate bullish momentum for a potential price surge.

On the charts, the Stochastic RSI (1.18) indicated an oversold zone. This is a sign that the level could be a critical longing point, which could form the basis for a price reversal. Additionally, the MACD underlined fading bearish pressure across the market too.

Whale activity and social volume

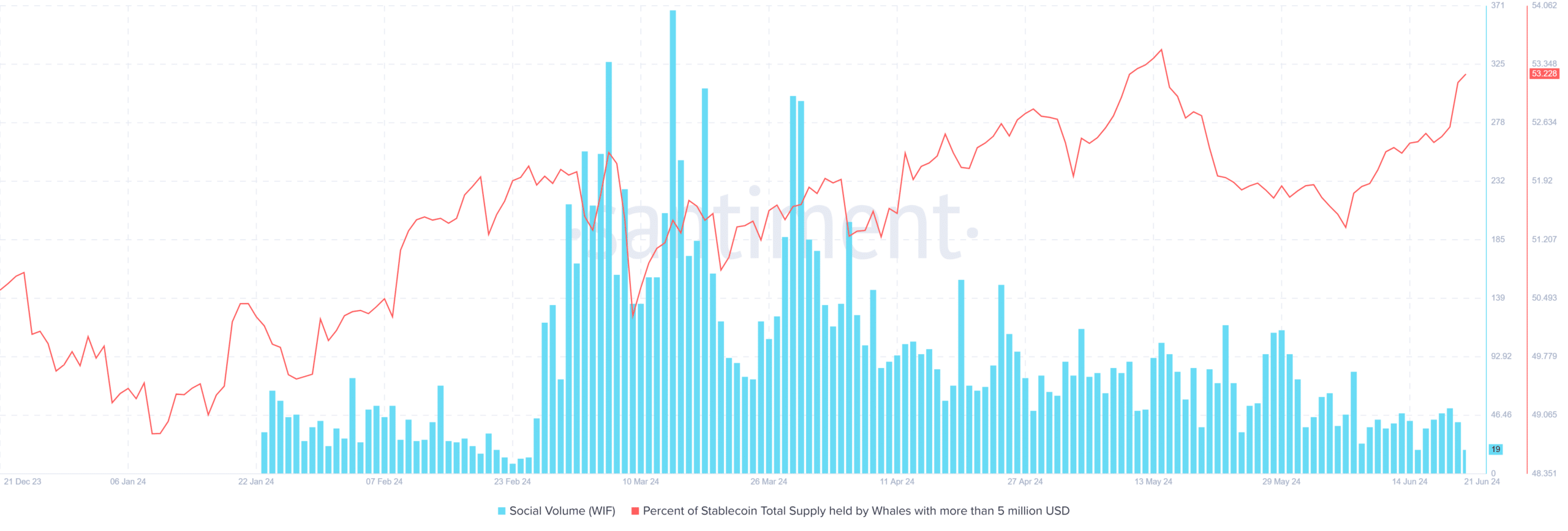

AMBCrypto’s analysis of Santiment’s stablecoin holdings by large wallet addresses highlighted several spikes in recent days. The hike in whale activity by the market’s big players could demonstrate confidence in WIF’s long-term prospects, potentially setting the stage for a reversal.

AMBCrypto further analysed WIF’s social volume, which indicated an uptick over the last 6 days. What this means is that there has been an increase in mentions and discussions across various social media platforms . The social ecosystem is positive and could provide the basis for a likely price surge.

Tag wars between bears and bulls

Additionally, Coinglass’ long/short ratio data indicated a relatively balanced market, with fluctuating shifts between long positions and short positions over the past few days. This equilibrium implied that traders have been uncertain about WIF’s immediate direction on the price charts.

Finally, Coinglass’ liquidation data pointed to irregular spikes in both long and short liquidations – A sign of increased volatility.

What next for Dogwifhat??

At press time, technical indicators seemed to lean towards building bearish pressure, while significant whale accumulation and social volume provided bullish signals. Simply put, WIF may be at a vital decision point, with the potential for significant movement in either direction.