Pepe, Shiba Inu whales stir the pot with $26M exchange deposits

- SHIB and PEPE saw large deposits on the Binance exchange.

- The memecoins have remained in a bear trend.

The analysis of Shiba Inu [SHIB] and Pepe [PEPE] memecoins revealed that there were significant deposits into exchanges from certain addresses.

The deposits suggest potentially increased selling pressure or preparation for trading. However, despite these heavy inflows, the overall exchange flow data for these memecoins tells a different story.

Pepe and Shiba Inu whales make huge deposits

According to data from Spot On Chain, two significant “whale” transactions involved the deposit of nearly $26 million worth of Shiba Inu and Pepe tokens into the Binance exchange.

Specifically, the Shiba Inu whale deposited over 1 trillion SHIB tokens, valued at more than $18 million. This amount represented all the SHIB tokens that this particular address had acquired.

The data further revealed that this address acquired the tokens in 2023 and realized approximately a 79% profit from the sale.

The data from Spot On Chain also highlighted that another whale deposited 700 billion PEPE tokens, valued at over $7.8 million, into the Binance exchange.

Despite this large deposit, the whale retained an additional 800 billion tokens, estimated at over $9 million.

Interestingly, the data indicated that the address was sustaining about a 15% loss on its remaining PEPE tokens.

Contrasting daily Pepe and Shiba Inu flow

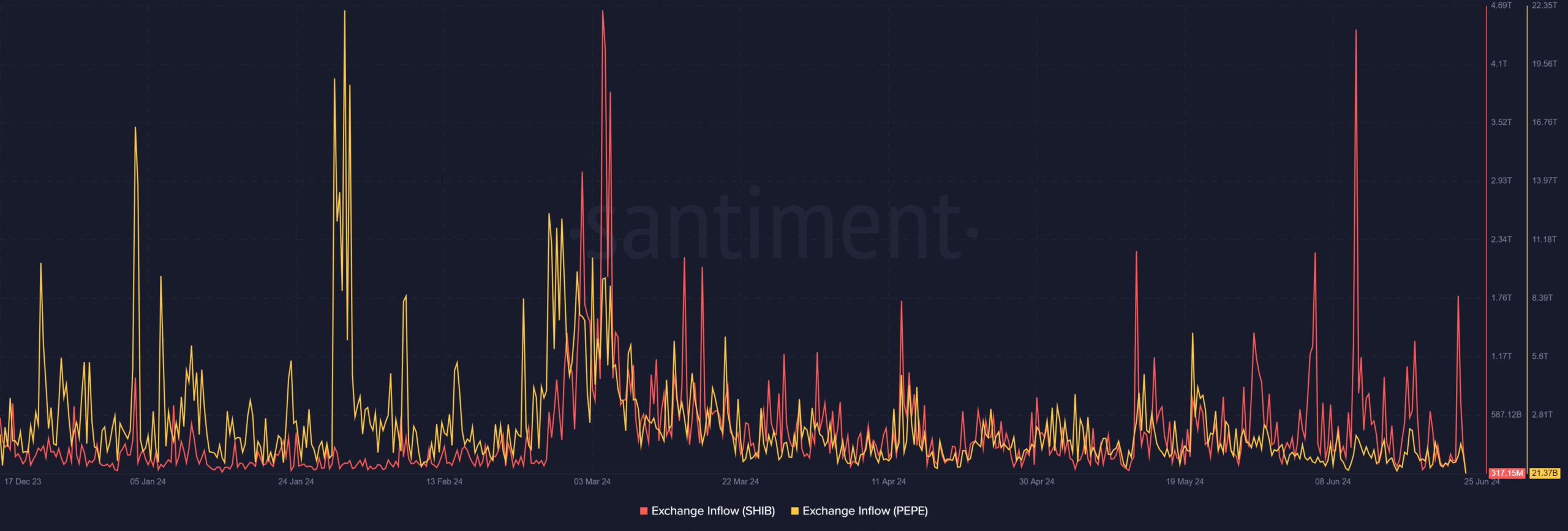

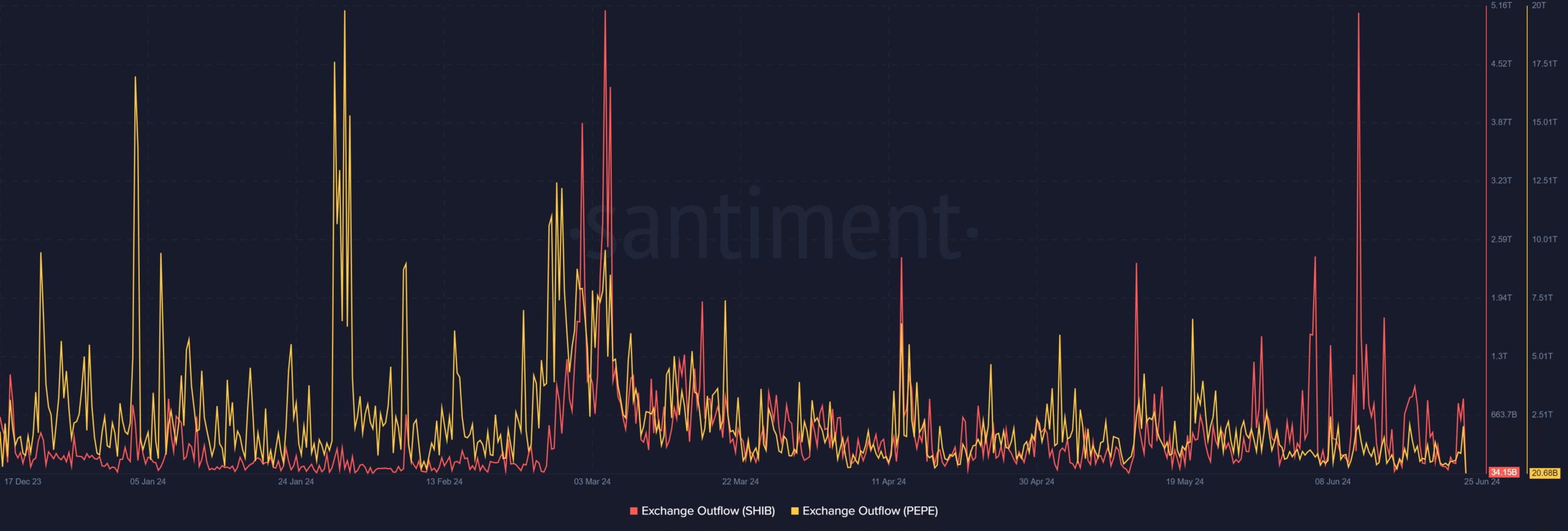

The analysis of exchange flow data for Shiba Inu on Santiment revealed a significant spike in exchange inflow on 24th June.

The chart showed that the inflow volume reached over 1.7 trillion SHIB tokens. Conversely, the outflow volume on that day was significantly lower, at around 790 billion tokens.

As of this writing, the situation appears to have reversed, with outflows now exceeding inflows. The outflow volume was approximately 842 billion tokens, compared to an inflow of around 229 billion tokens.

The analysis of Pepe’s exchange flow dynamics presents an interesting scenario. On 24th June, the inflow to exchanges significantly exceeded the outflow, with more than 1.4 trillion tokens entering exchanges, compared to less than 900 billion leaving.

However, the current situation has shifted similarly to SHIB, with outflows now surpassing inflows. The latest data shows that over 2 trillion tokens have left exchanges, while inflows are nearly 923 billion.

This shift towards higher outflows suggests that despite the significant tokens moved onto exchanges by whale addresses, there has yet to be a subsequent market dump.

SHIB’s and PEPE’s bear trend continues

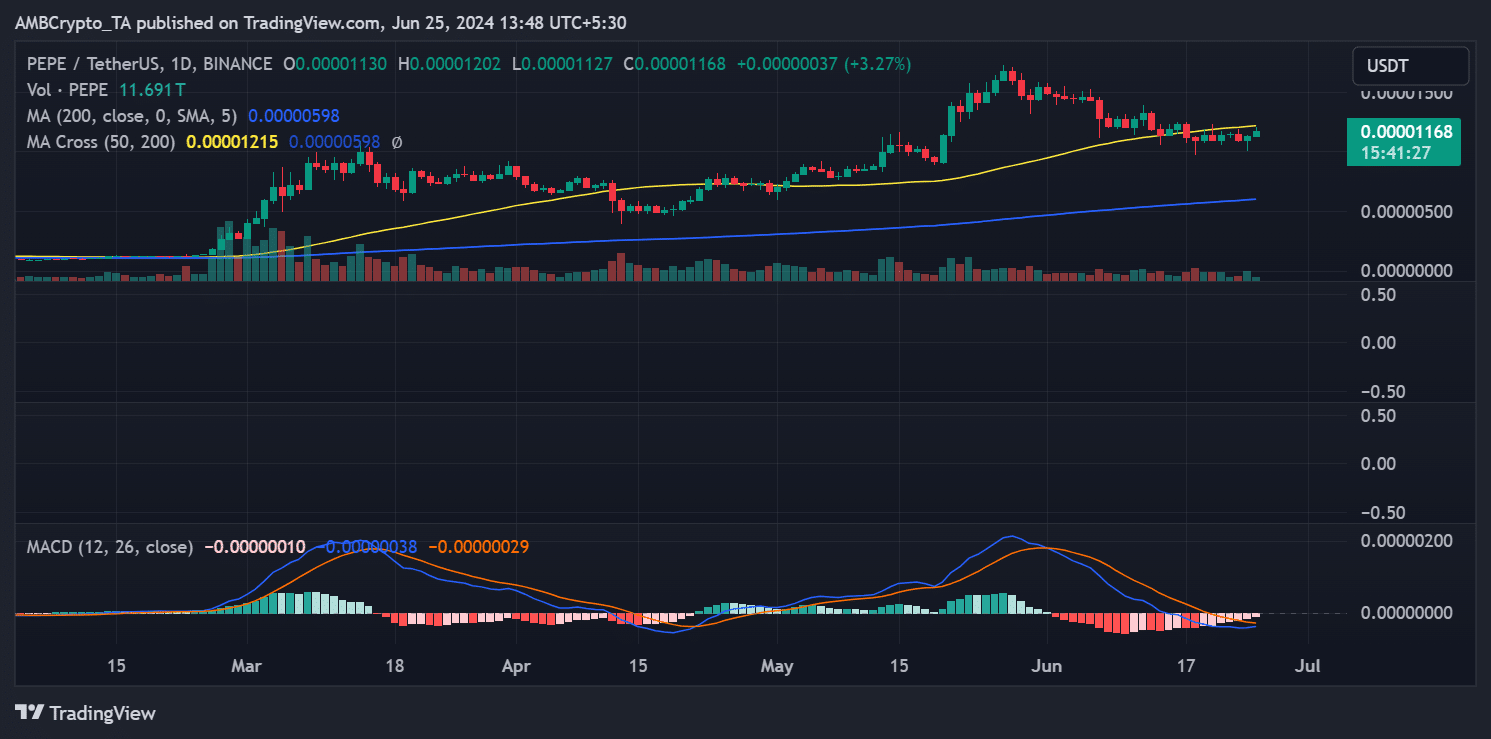

The analysis of Pepe on a daily time frame showed promising trends in its recent price movements. At the close of trading on 24th June, it recorded a 3.57% increase, trading at approximately $0.0000113.

Continuing this positive momentum, it has seen another increase of over 3%, reaching around $0.000016 as of this writing.

Despite these gains, its Relative Strength Index (RSI) remained below the neutral line, indicating that it was still technically in a bearish trend.

The recent analysis of Shiba Inu presents a more challenging market situation compared to the upbeat trends in Pepe. The chart indicates that Shiba Inu closed with a loss of 2.80%, with its price falling to around $0.0000170.

Since then, it has seen a slight uptick, trading at approximately $0.0000171.

Read Shiba Inu (SHIB) Price Prediction 2024-25

Furthermore, the Relative Strength Index (RSI) for Shiba Inu is below 30, which strongly signifies a bearish trend.

An RSI value below 30 not only indicates that the asset is in a bear trend but also suggests that it is currently in an oversold condition.