NEAR turns bearish, trading volume drops 30% – Is a pullback still possible?

- NEAR Protocol broke below the 50-day moving average, shifting to a bearish trend after a bullish week.

- A massive drop in RSI towards the oversold territory and the formation of a lower low highlighted strong selling pressure.

NEAR Protocol [NEAR] has recently experienced a bearish reversal, causing concern among investors about a potential pullback because the week preceding that was strongly bullish.

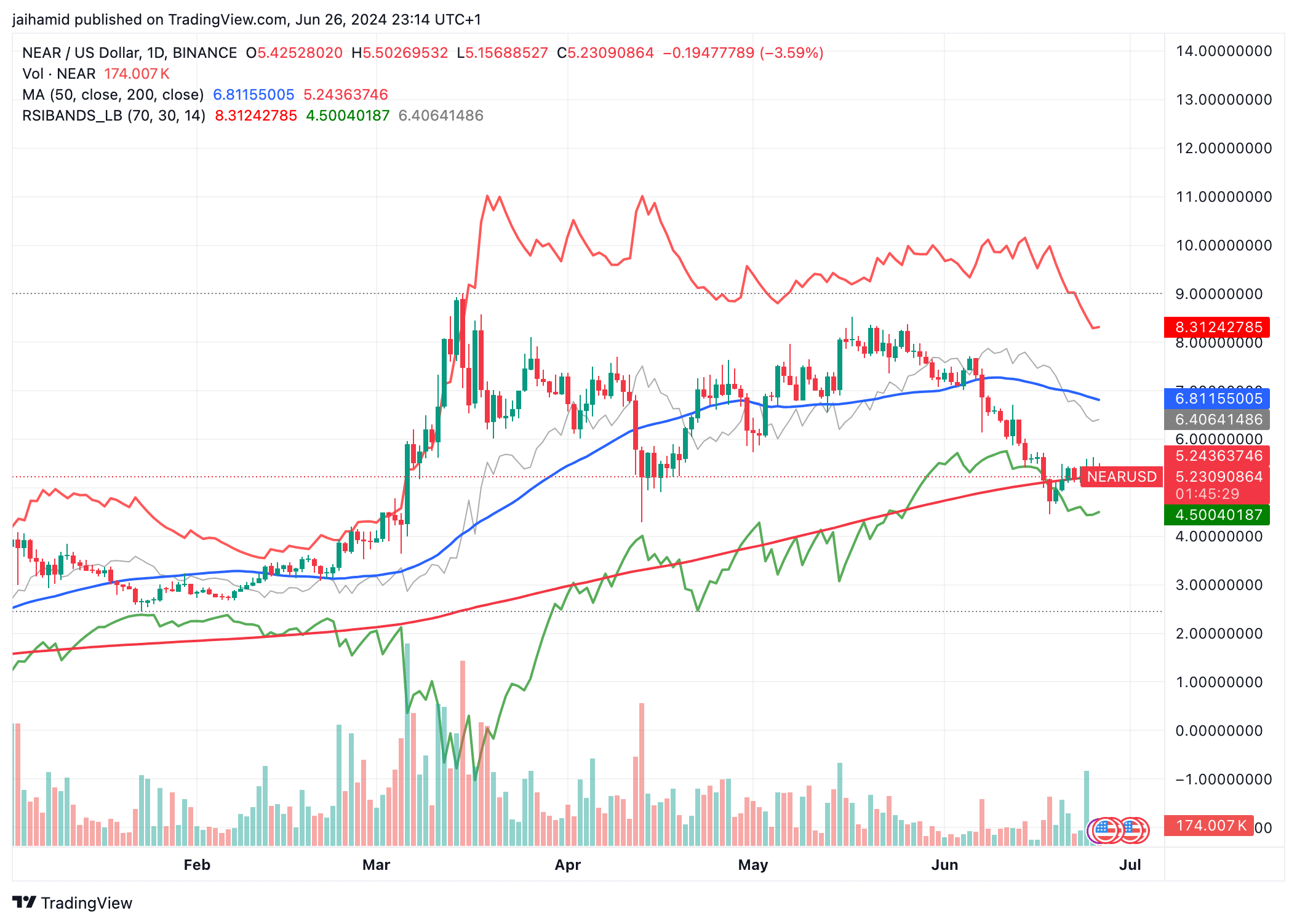

The 50-day moving average (blue line) has been acting as a dynamic support and resistance level. The price broke below this line and turned bearish.

The 200-day moving average (red line) was positioned above the press time price, reinforcing the resistance area that could limit upward movement.

The RSI (Relative Strength Index) bands indicated that the price has moved out of the overbought region, trending towards or possibly entering the oversold zone.

This suggested that the selling pressure has been significant, leading to the price drop.

Bearish signals dominate

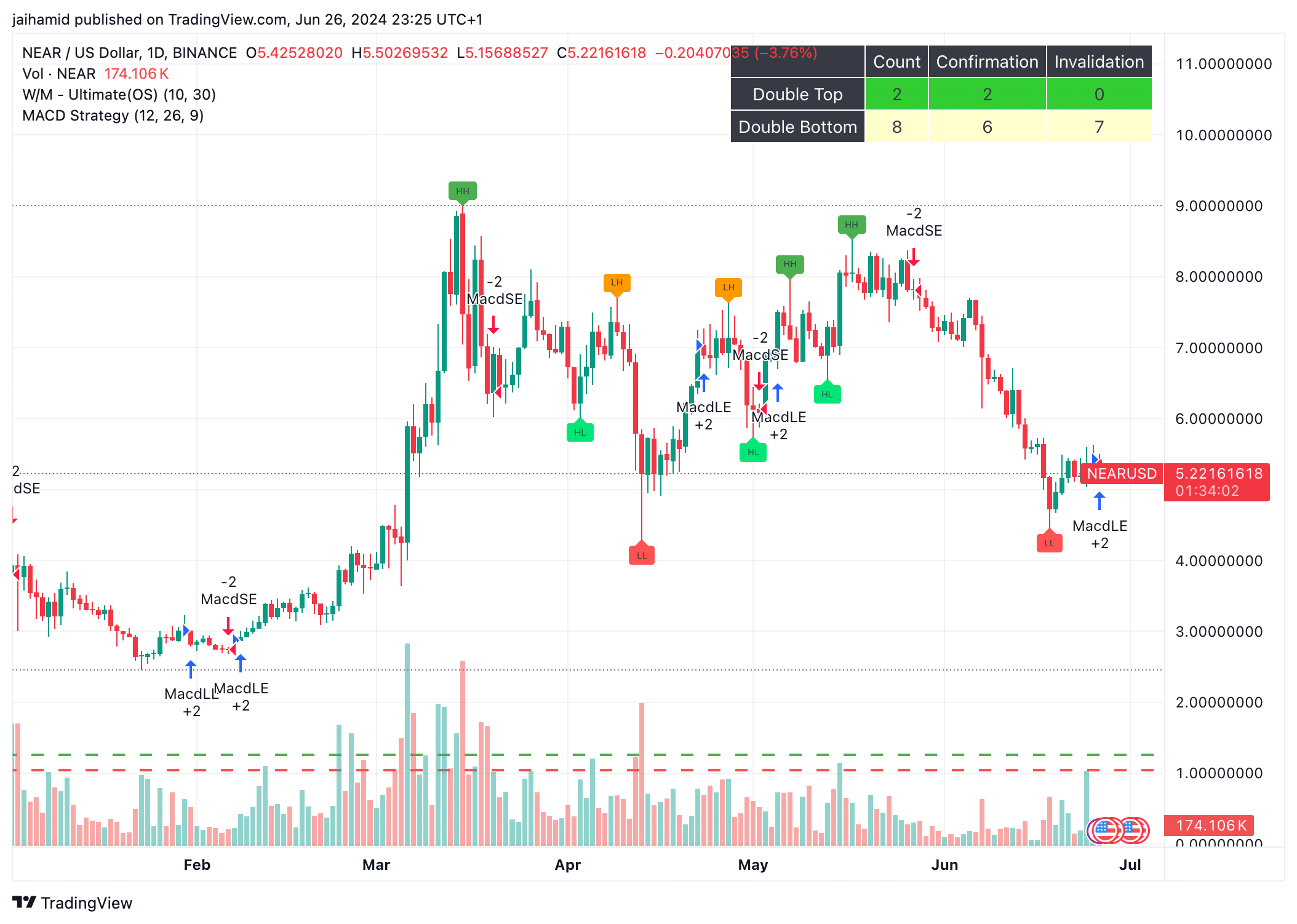

This bearish trend is further highlighted by the recent lower low (LL) which was way lower than previous lows, indicating even more incoming selling pressure.

The MACD buy and sell signals (MacdSE and MacdLE) showed frequent shifts in momentum. Recent signals indicated more selling pressure (as shown by MacdSE), meaning that the bearish momentum is quite strong.

However, there are more double bottoms (indicating potential reversals from a downward trend) than double tops. This could mean there are underlying volatility and attempts at price recovery.

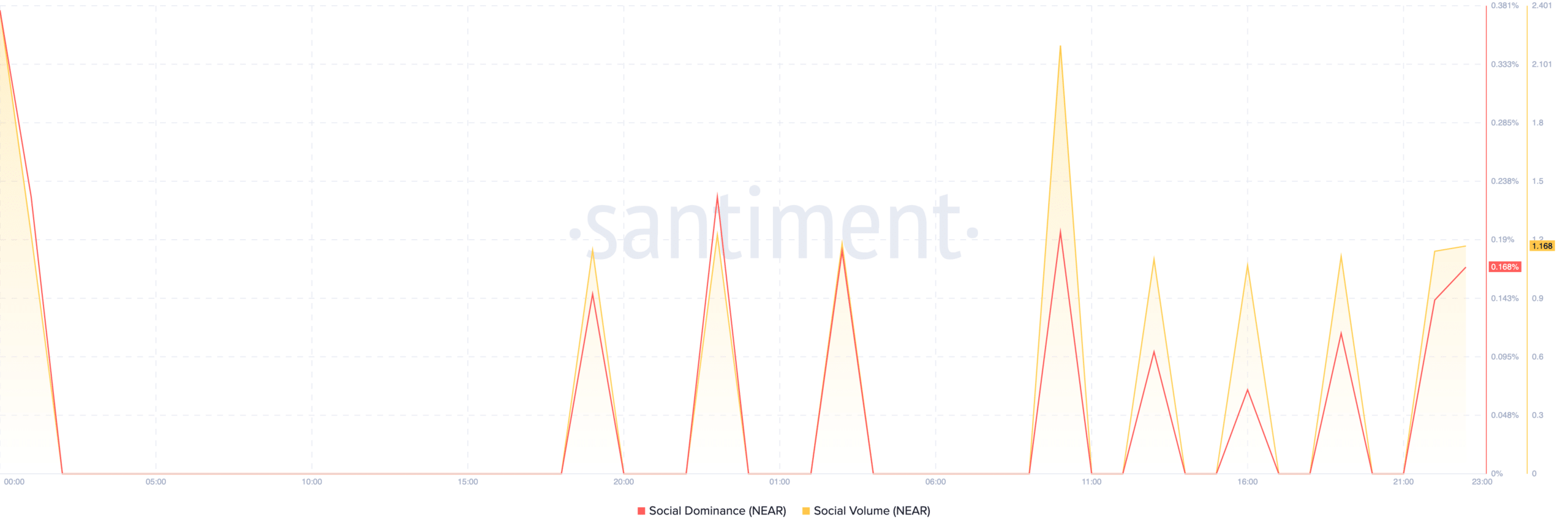

The synchronization of spikes in NEAR’s social volume and dominance imply a consensus or strong reaction among traders. NEAR’s derivatives market offers no solace.

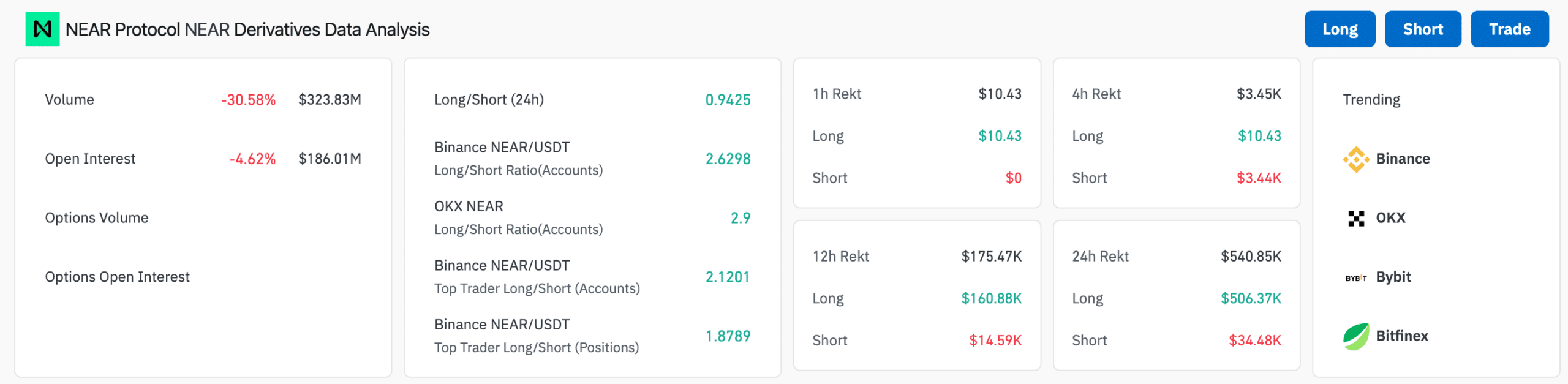

Trading volume has decreased by over 30% in the past twenty-four hours. Open Interest has declined too, by 4%, meaning traders are closing positions due to the bearish signals.

Realistic or not, here’s NEAR’s market cap in BTC’s terms

While overall market activity has decreased, certain metrics on major exchanges like Binance [BNB] and OKX indicated pockets of bullish behavior or speculative attempts at catching potential rebounds.

Given the price is below both the Ichimoku Cloud and key moving averages, and considering the dominance of short trades in recent fluctuations, a bullish reversal doesn’t seem possible in the short term.