Bitcoin at $61K – All the reasons why the market is ‘cooling down’

- Bitcoin’s price around $61k is a victim of market cooling, summer slowdowns

- Mt. Gox unlocks and government sales raise some supply concerns too

The crypto market hasn’t had the best of times lately. This was the case at press time too, with the industry’s total market capitalization falling to $2.26 trillion at press time. As expected, Bitcoin, the world’s largest cryptocurrency, led the way, with BTC down by almost 1% on the charts.

Bitcoin and the market’s top altcoins weren’t the only ones affected though.

The memecoin market, for instance, also registered a downturn, with its market capitalization falling by 1.33% to $47.89 billion. In fact, trading volume dropped significantly by 19.31% too.

Now, various factors have contributed to this market-wide decline, both market-specific events and broader economic influences. Hence, it’s worth looking at these factors.

Market cooling after positive ETH ETF news

The positive news about the potential trading of Ether (ETH) ETFs has led to a cooling period in the crypto market. United States’ Securities and Exchange Commission is reportedly close to approving ETFs tied to the spot price of Ether, with expectations for approval as soon as 4 July.

While this anticipation initially drove market optimism, the subsequent market adjustments have contributed to the ongoing downturn.

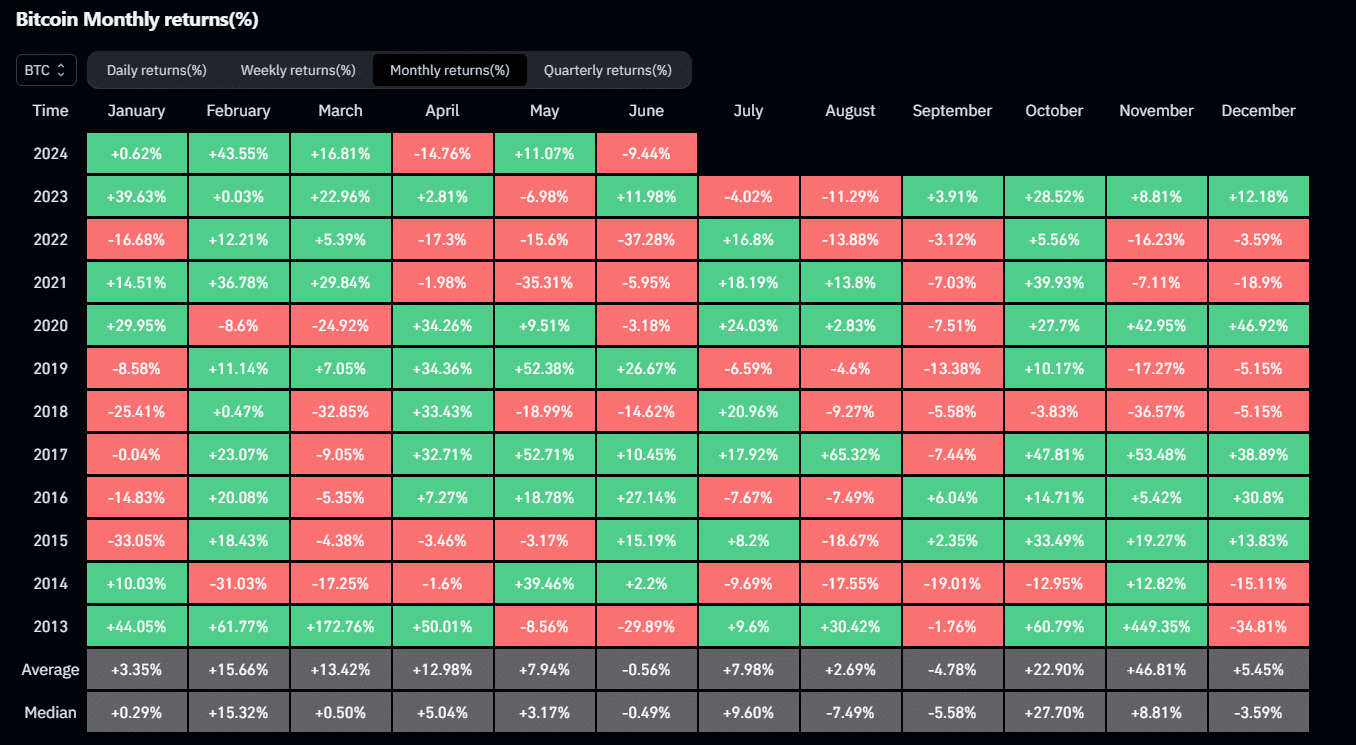

Moreover, seasonal trends and reduced trading activity during the summer months are also affecting the market. Historically, June has seen mixed performances from Bitcoin, with an average return of -0.56%. Simply put, it has been one of the weakest months for the cryptocurrency.

The same was recently highlighted by popular market analyst Dan Crypto Trades.

It can thus be argued that the fall in trading volumes during the summer vacation period is leading to less market activity and greater volatility.

Concerns over Mt. Gox and government selling

The market is also facing concerns about the potential impact of the Mt. Gox unlocks and selling activities by government bodies. In fact, the same was highlighted by QCP’s latest weekend brief on the state of the crypto market.

Now, some believe these supply concerns might be overstated. Even so, the potential influx of Bitcoin from these sources is causing uncertainty and contributing to bearish sentiment.

Support levels and future projections

Despite these bearish headlines, however, Bitcoin’s support level around $60,000 has shown resilience. If this support level weakens though, we might see the crypto decline further. By doing so, BTC might possibly test the lower levels around $50,000.

In fact, QCP analysts went on to say, ,

“We could test lower towards 50k levels but the market will find strong support there, as interest from TradFi continues to permeate given the general regulatory easing across the world.”

That being said, the anticipated launch of spot ETFs for other major cryptocurrencies like Solana (SOL) could spark renewed interest and provide some market support.

In light of the prevailing market conditions, analysts recommend strategies for navigating the downturn. For Bitcoin, generating yield in a sideways market has been suggested, with the potential to make directional bets in Q4.

For Ether, taking a short-term bullish position ahead of the ETF launch might be advantageous.