XRP price struggles, but the altcoin is waiting for a breakout

- XRP faced bearish sentiment amid ongoing legal issues despite a 19.53% surge in 24-hour trading volume.

- Technical patterns suggested the potential for an upward movement, but legal uncertainties weigh heavily on XRP’s price.

XRP has continued to struggle due to the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC).

As of the press time, XRP was trading at $0.4802, reflecting a slight increase of 0.31% over the past day, according to CoinMarketCap.

Meanwhile, the market cap was $26,738,837,168, marking a 0.32% increase and positioning XRP at rank #7. The 24-hour trading volume has surged by 19.53% to $924,854,796.

XRP: Market sentiment

Analyst Avon Marks recently tweeted about the potential for a significant price movement in XRP.

According to his analysis, XRP formed a Symmetrical Triangle or Pennant Pattern with descending volume, suggesting a possible continuation of the previous uptrend.

He noted,

“Yes, you’ve probably seen a similar pattern setup many times on $XRP, but with the way prices are coiling/shaping up combined with where they’ve come from (historical data) and high volume plus an already confirmed Hidden Bullish Divergence, something massive can be truly nearing.”

The RSI (Relative Strength Index) has been setting lower lows while prices have formed higher lows, indicating a hidden bullish divergence. This pattern could suggest a return to the $1.44 level.

Historically, XRP has seen major uptrends, climbing over 110,000%, indicating the potential for extreme upward movement.

Avon Marks speculated that a Full Logarithmic Follow-Through could push XRP’s price to over $200, representing a more than 400x increase from the current price.

On a more conservative note, a breakout could see prices reaching $15-$20.

Spot Inflow/Outflow Analysis

However, according to AMBCrypto’s analysis using the XRP Spot Inflow/Outflow chart from Coinglass, since September 2023, outflows (red bars) have predominately over inflows (green bars).

This trend indicated sustained selling pressure, contributing to the downward movement in XRP’s price.

Now, the price of XRP has gradually declined from around $0.60 in late 2023 to under $0.50 by mid-2024. This suggests a market under persistent selling pressure despite intermittent buying interest.

The consistent negative netflows highlighted the ongoing challenges XRP faces in maintaining upward momentum.

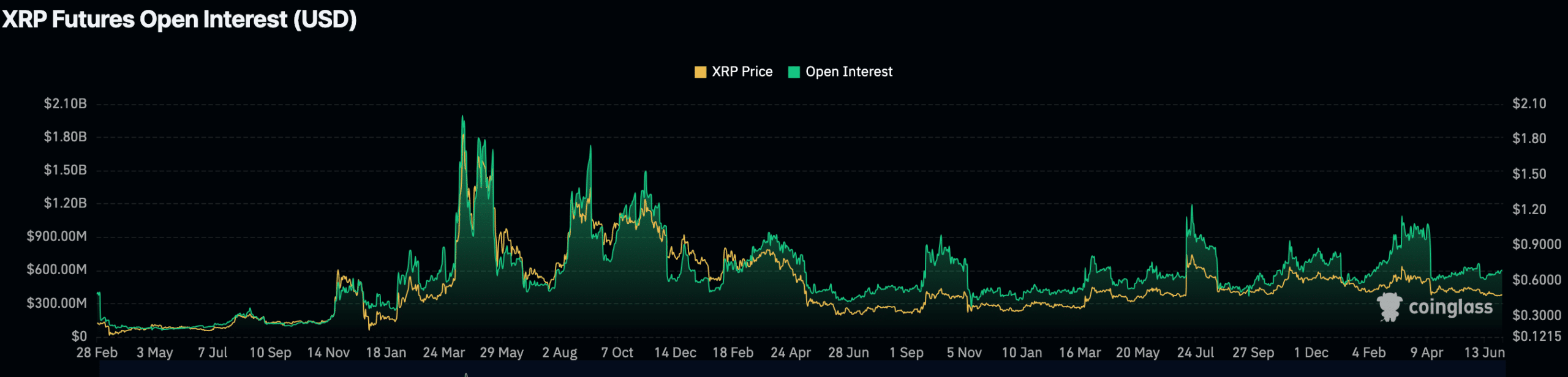

AMBCrypto looked further at the XRP Futures Open Interest chart from Coinglass, which indicated a strong correlation between open interest and XRP’s price throughout the year.

Peaks in Open Interest often coincided with significant price movements, suggesting heightened trading activity and investor interest during these periods.

Realistic or not, here’s XRP’s market cap in BTC’s terms

Periods of high Open Interest, such as in late March and mid-November, aligned with substantial price fluctuations.

This pattern implied that traders were actively positioning themselves in the futures market, anticipating potential volatility and price shifts in XRP.