Why hasn’t Bitcoin mooned yet? Exec blames THESE key players

- BTC could be muted because key players are dumping, per Capriole Investments founder.

- The Bitcoin miner crisis persists and could be a key headwind for the recovery of BTC.

After peaking at $63.8K on 1st July, Bitcoin [BTC] has weakened and dropped to a low of $57K on 4th July. That was a 9% decline in July and marked the fourth consecutive month of sideways movement since Q2.

What’s causing the plunge?

Charles Edwards, founder of crypto hedge fund Capriole Investments, claimed that the weakening BTC was partly due to ‘key players’ dumping holdings.

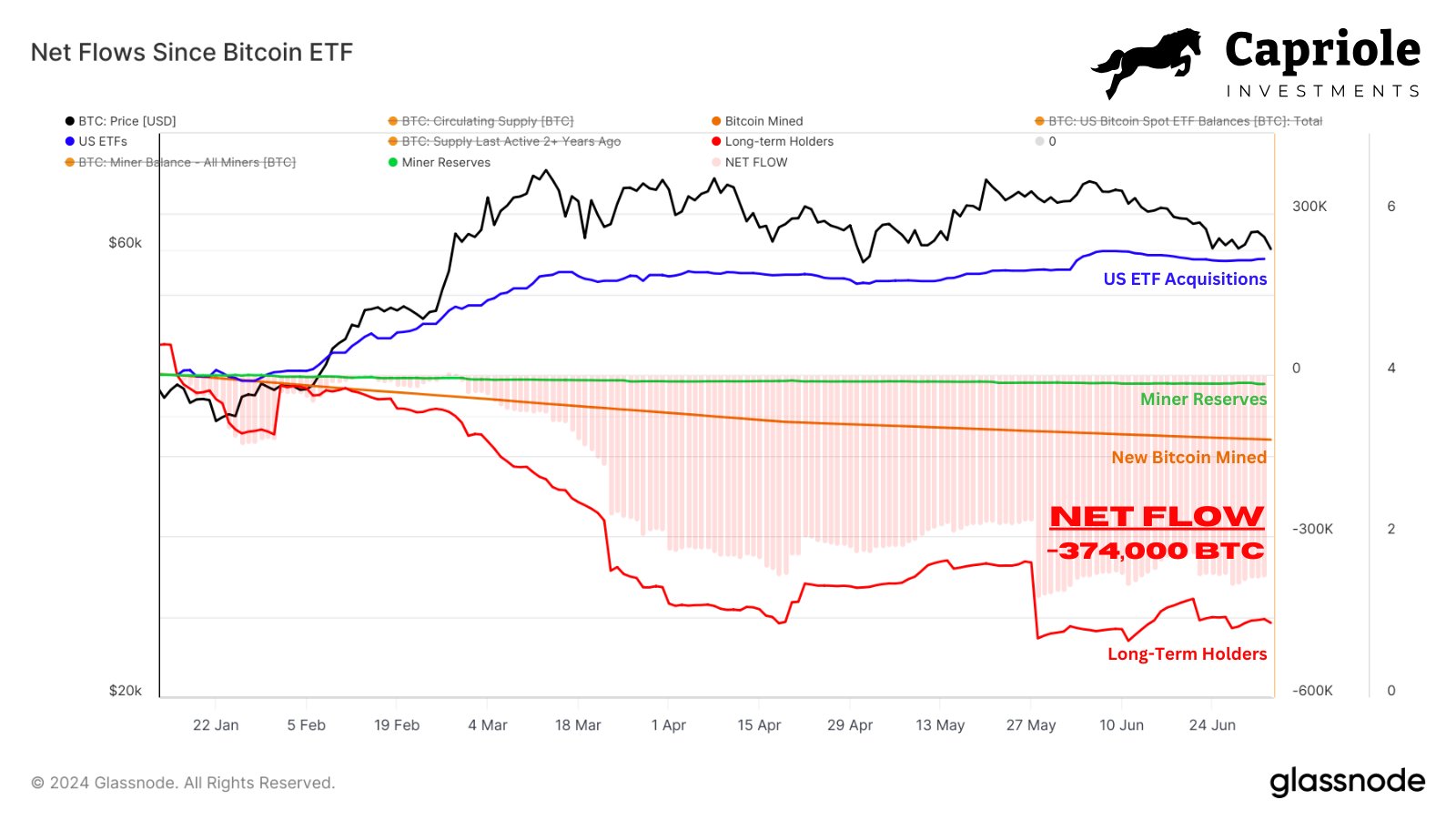

‘This is why we haven’t mooned yet… When you look at the data of the 4 most important players in Bitcoin, we have net flows equivalent to $24B being dumped on the market in 2024’

Edwards’ perspective was based on demand and supply from BTC miners, ETFs, and long-term holders (LTH). Based on these three entities, about 374K BTC, worth above $20 billion, has been dumped in the market, per Edwards.

When the LTH metric was adjusted from +2 years to 155 days, the net outflow was about—$40 billion, per Edwards.

Additionally, when Grayscale’s GBTC outflows are factored in and removed, the overall dump across the three entities amounted to $18 billion worth of BTC outflow.

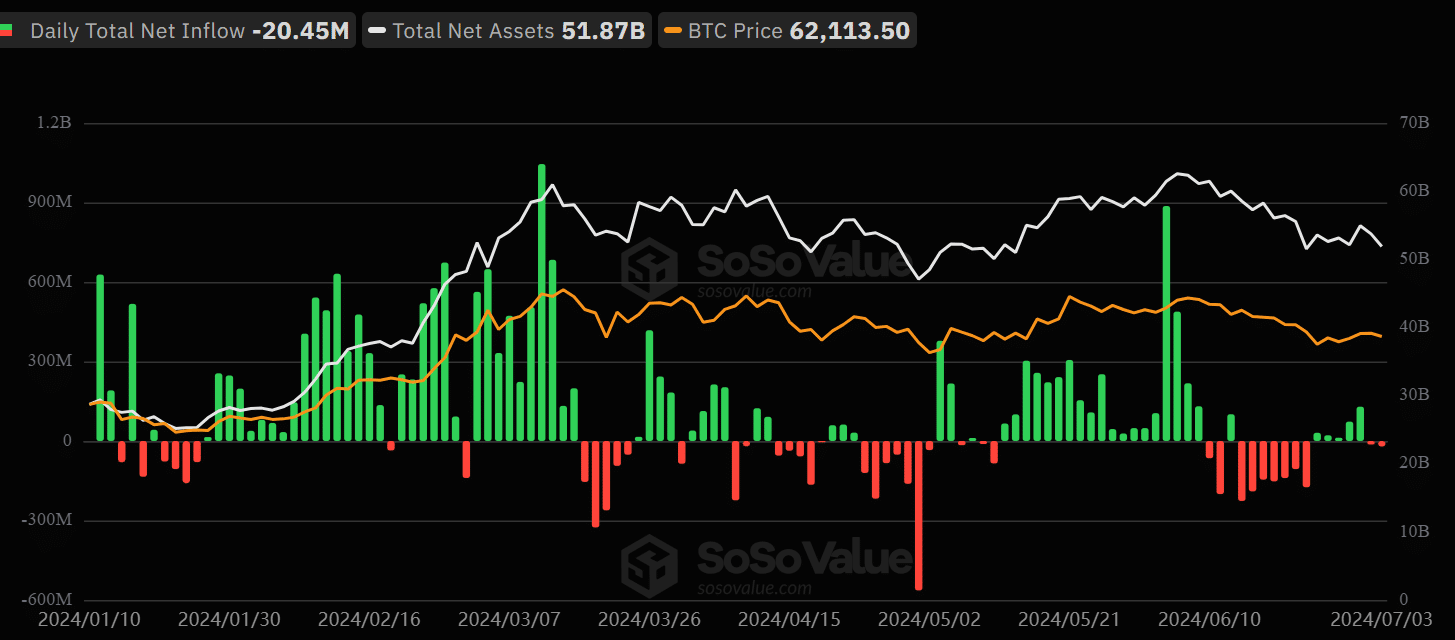

AMBCrypto’s evaluation spot BTC ETF flows revealed that net flows fluctuated considerably in Q2, unlike the steady positive flows recorded in Q1. The stagnating demand from ETFs, thus, corroborated Edwards’ thesis.

Another key entity mentioned in the analysis, BTC miners, was still deep in a profitability crisis after the halving event. As a result, struggling miners could dump more of their BTC holdings to stay afloat.

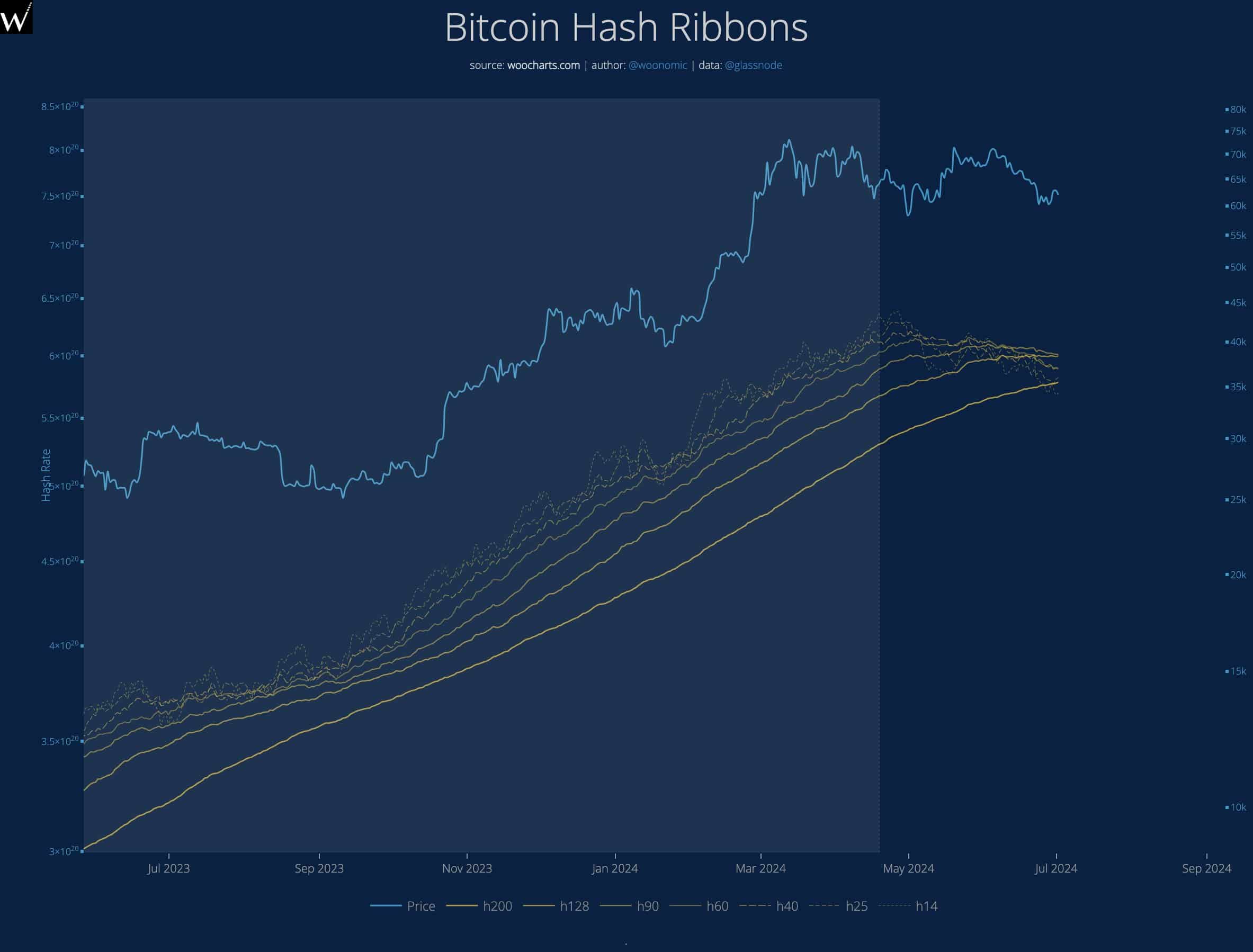

The miner crisis could further delay the bullish reversal for the largest digital asset, noted Willy Woo.

‘Every day, I look at 7 squiggly lines to see if it’s time. Nope, not yet. Miners are still bleeding out, writhing in pain.’

For perspective, the Bitcoin Hash Ribbons are moving averages that signal when hash rates drop, specifically during miners’ profitability crises.

Although they also historically signaled a market bottom, the metric has yet to recover and further reinforce BTC’s weakening market structure.