XRP whales rack up more tokens despite price fall: Recovery ahead?

- Data revealed that XRP whales did not join the broader market sell-off.

- Long-term holders also refrained from selling, hinting a possible price rebound for the token.

Even though the market has been in a discouraging state, Ripple [XRP] whales have decided not to fan the flames. Instead, they are opting to buy more of the token.

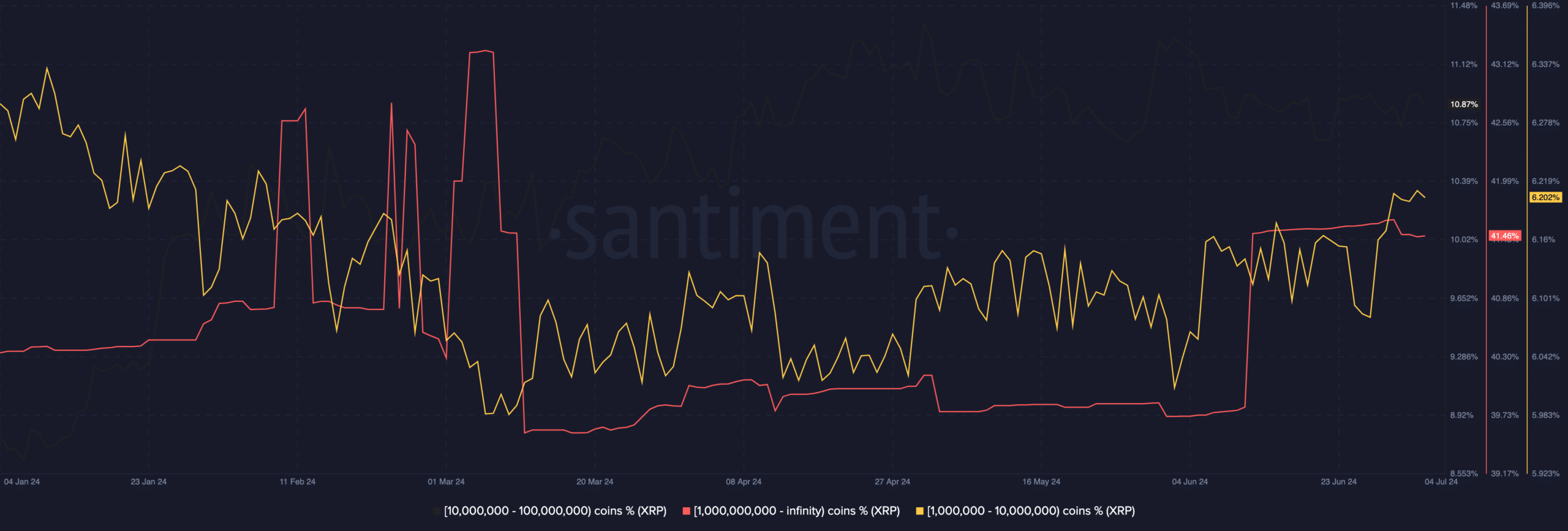

According to Santiment, the balance of addresses of XRP holders with more than 1 billion tokens was about 39.81% in mid-June. But at press time, that ratio has increased to 41.46%.

Big players offer a way out

For the 1 million to 10 group, the balance rose from 6.08% to 6.20%. Whales are entities who hold large volumes of a cryptocurrency. Therefore, their actions have a big influence on prices.

When things like the recent accumulation happens, prices stabilize from the downturn. In some cases, they rebound.

As of this writing, the price of XRP was $0.43. This was a 6.52% decrease in the last 24 hours. But with the recent whale action, the value might stabilize around the mentioned price, or possibly head toward $0.45.

However, it is important to note that whale accumulation alone would not stop the price from falling. As a result, we, at AMBCrypto, took it upon ourselves to assess other happenings on-chain.

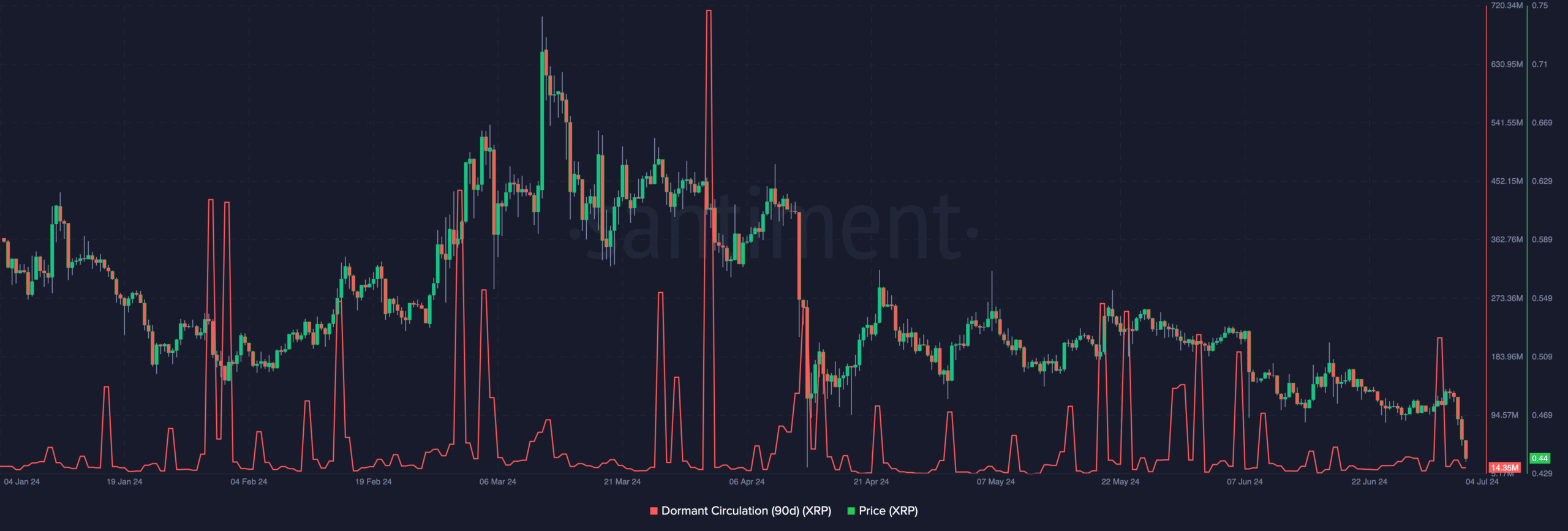

One of the metrics we looked at was the dormant circulation. This metric tracks how quickly tokens, which have been held for a long time, are engaged in transactions activity.

When dormant circulation increases, it means that old tokens are moving from self-custody to active trading. If this happens, it means that holders of the token are ready to sell.

XRP price aims to climb above resistance

Consequently, this lead to a price decrease. However, the opposite happens when dormant circulation is low, which was the case at press time. On the 1st of July, XRP’s 90-day dormant circulation jumped.

But at press time, it was down to 14.35 million. This decline means that long-term holders of the token have refrained from moving their assets out of cold wallets.

If sustained, XRP could avoid another plunge as initially mentioned.

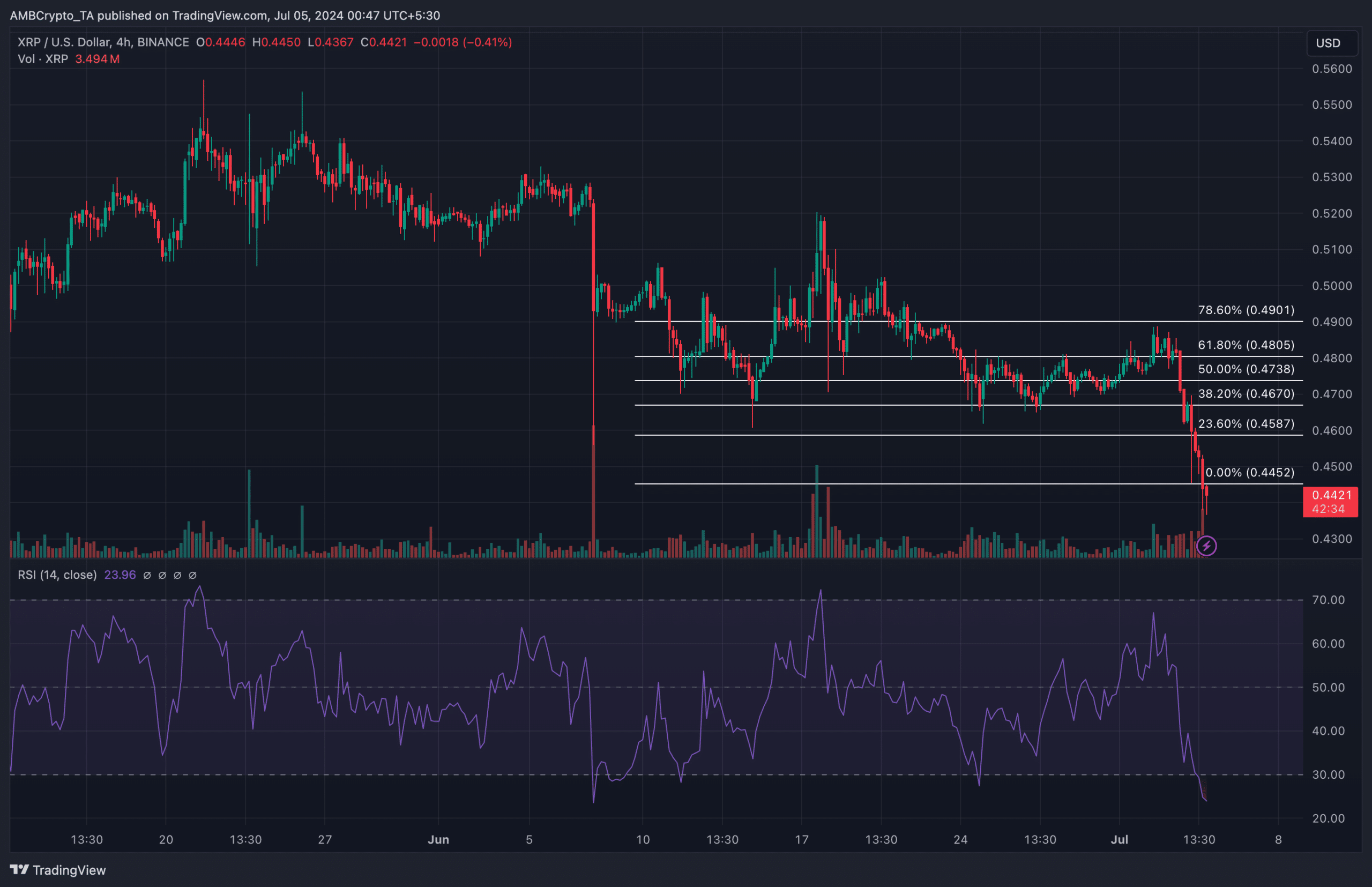

In addition, we analyzed XRP’s potential from a technical perspective. According to the daily chart, the Relative Strength Index (RSI) was 23.96. The RSI measures momentum using the magnitude of price changes.

When the reading is above 70, it means an asset is overbought. However, when it is below, it indicates an oversold condition.

Therefore, XRP was oversold, indicating that the price could be on the brink of a rebound. To check the possible targets, AMBCrypto looked at the Fibonacci retracement indicator, which spots potential support and resistance levels.

Read Ripple’s [XRP] Price Prediction 2024-2025

From the chart above, if XRP bounces off the lows, the price could key into the 23.6% Fib level, which positioned at $0.45.

However, this prediction could be invalidated if selling pressure increase and whales also join in.