Dogecoin – How its MVRV may have saved its short-term price action

- DOGE’s price appreciated significantly over the last 24 hours

- Traders saw the recent decline as a buying opportunity

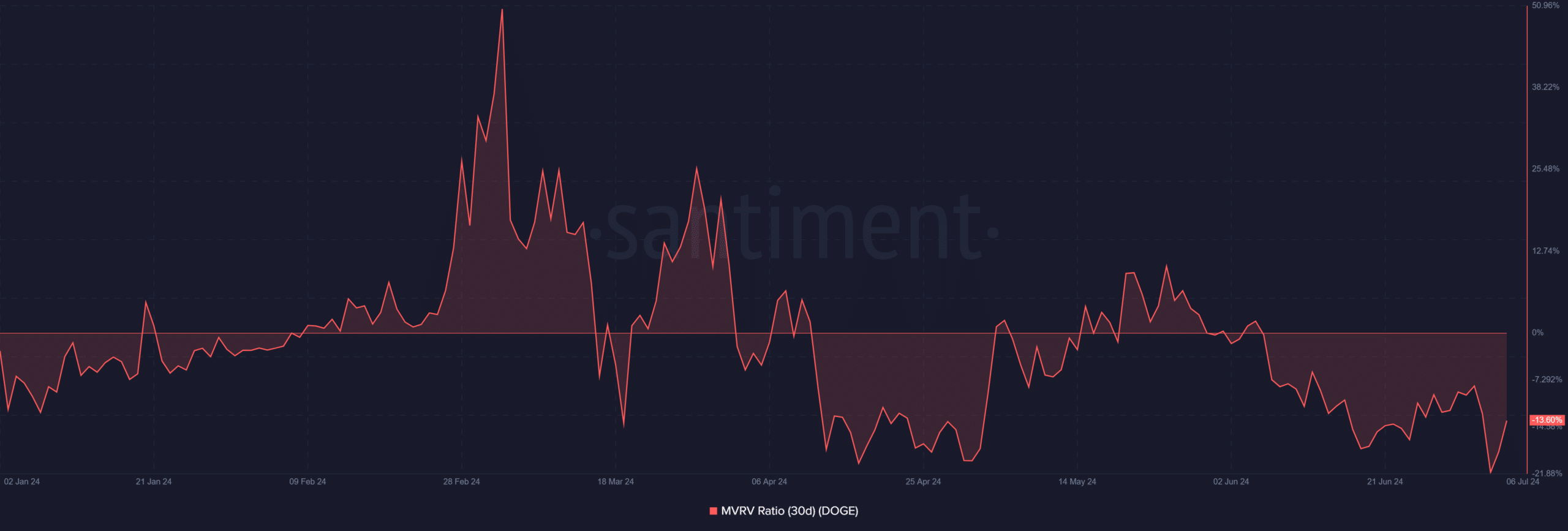

On the back of the latest market-wide decline, Dogecoin (DOGE) recorded the most significant fall in its 30-day Market Value to Realized Value (MVRV) ratio. However, this wasn’t the case at press time. In fact, there has been a noteworthy shift over the last 24 hours, with DOGE showing signs of a rebound too.

Analyzing the memecoin’s MVRV

According to Santiment, Dogecoin’s (DOGE) MVRV noted the most significant decline among nine assets. In fact, the 30-MVRV hit a low of -19.7% on the charts.

This metric, which compares the market value of an asset to its realized value, pointed to a significant drop in DOGE’s valuation. The drop is in comparison to the average purchase price over the past month. Often, this can be seen as an indication of a potential undervaluation or that the asset might be oversold.

DOGE’s MVRV over the last 24 hours

Over the last 24 hours though, there has been a notable reversal in the aforementioned metric, with the MVRV ratio for DOGE climbing to approximately 13.6%.

This positive change might be a sign of recovery in valuation, possibly driven by sustained buying interest.

Traders and investors might be capitalizing on perceived low prices, pointing to renewed confidence in the asset’s potential value growth.

Dogecoin sees a slight recovery

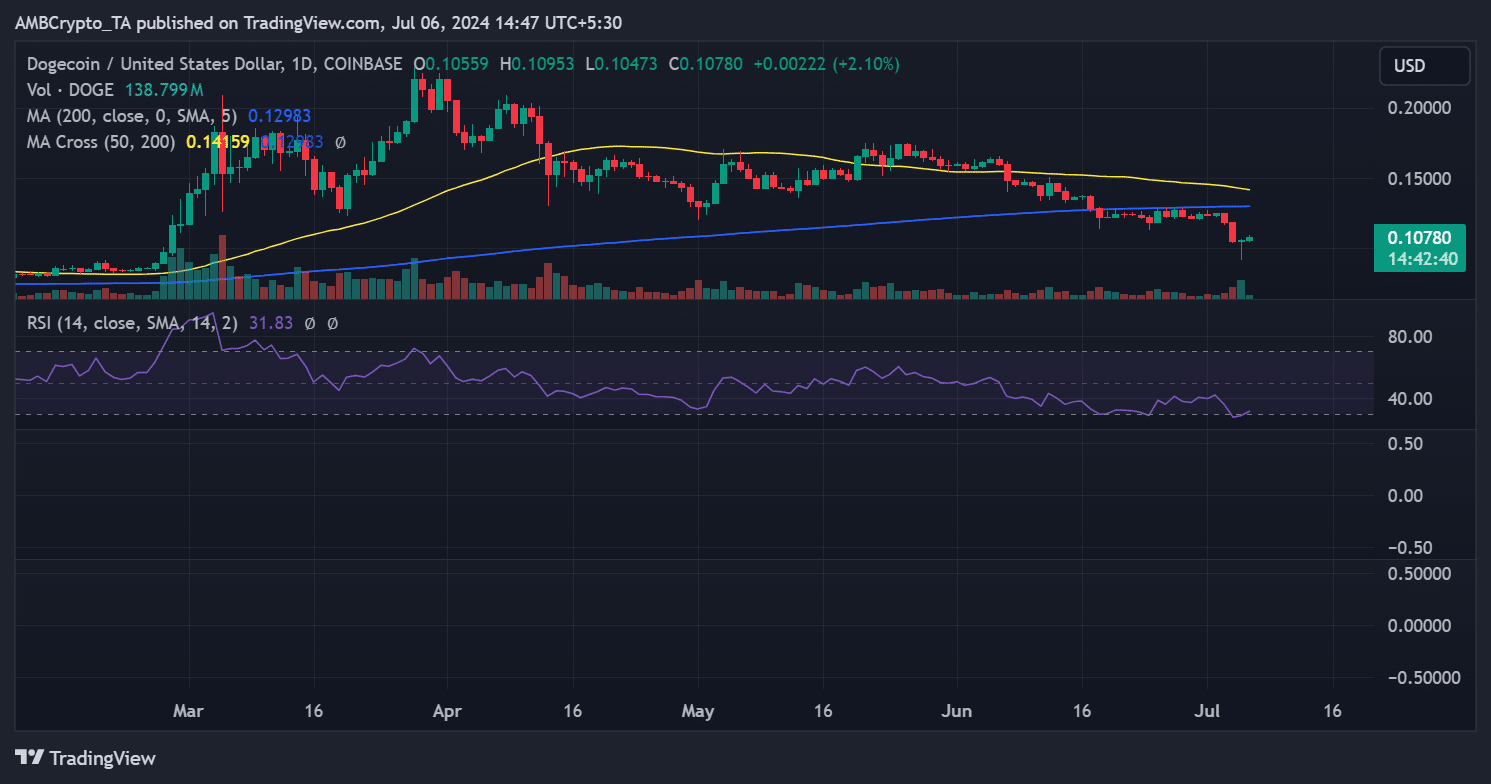

Finally, AMBCrypto’s recent analysis of Dogecoin revealed a modest uptick in its price over the last 24 hours. On 5 June, DOGE was trading at around $0.105, having risen by approximately 0.6%. At the time of writing, it was trading at about $0.107, reflecting a more significant uptcik of over 2%.

Additionally, the memecoin’s Relative Strength Index (RSI), a key indicator of market momentum, recorded a major finding too.

The RSI had previously dipped below 30, signifying that DOGE was in an oversold condition. This is often considered a strong bearish trend.

– Is your portfolio green? Check out the Dogecoin Profit Calculator

However, at press time, the RSI had risen slightly above this critical threshold, indicating a minor recovery on the charts.

The RSI’s movement might suggest that while Dogecoin still exhibits signs of a bearish trend, there has been a subtle shift toward recovery. Especially as buying interest rises across the board. This could alleviate some of the downward pressure on its price.