Bitcoin finds its footing despite German sell-off as key area surges

- Germany recently moved a large amount of its Bitcoin in the last few days.

- Daily activity on the Bitcoin network grew significantly as well.

Optimism around Bitcoin [BTC] surged in recent days as prices reclaimed the $59,000 level. However, recent moves made by the German government may cause cynicism amongst holders.

What is Germany up to?

In the last 24 hours, there was significant activity in the German government’s cryptocurrency wallet. The wallet transferred out 6,307 Bitcoins, valued at roughly $362.1 million.

However, it also received 2,810 BTC, amounting to $161.6 million. This suggests that the German government may have been engaged in selling some of its Bitcoin holdings.

The net difference translated to a potential sale of 3,497 BTC, worth approximately $200.5 million. Following these transactions, the German government had 23,964 BTC remaining, valued at around $1.38 billion.

Selling a significant amount can inject additional sell pressure into the market, potentially leading to a temporary dip. This effect could be amplified if the market is already bearish and reacts negatively to the news.

However, the impact might be mitigated by several factors. If the government sells gradually, it can minimize the immediate price drop.

A strong overall market with high buying activity can easily absorb the additional supply.

It’s also worth noting that the market may have already priced in some of this impact, considering the previous large sale of seized BTC by Germany in June.

Will the bulls bleed?

Analyst Ki Young Ju highlighted the absence of a long squeeze in the current Bitcoin cycle. In a long squeeze, a sudden price drop forces long holders to sell, potentially accelerating the decline.

To gauge the possibility of a long squeeze, analysts use the long/short squeeze ratio. This ratio, calculated as hourly liquidation volume divided by total taker volume, indicated an imbalance between long and short positions.

While Bitcoin witnessed short squeezes near $66,000 this year when short sellers were liquidated and squeezed out, the prior cycle saw four long squeezes around $55,000.

Ki Young Ju’s observation suggested the current cycle might be ripe for a long squeeze, potentially impacting Bitcoin’s price movement.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

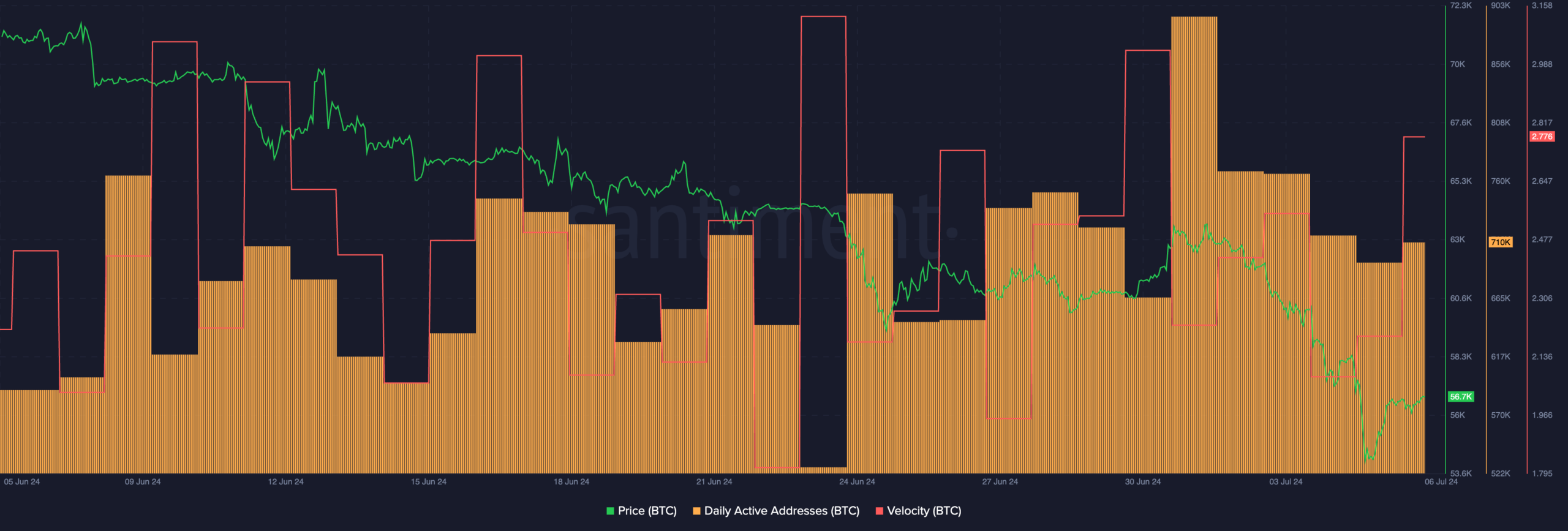

Daily activity for Bitcoin rises

At press time, BTC was trading at $58,989.30 and its price had grown by 2.97% in the last 24 hours.

The number of daily active addresses on the Bitcoin network grew materially over the last few days, indicating that interest in Bitcoin’s ecosystem also grew along with BTC’s price.