Ethereum’s balancing act: Whale deposits vs. exchange reserves

- Ethereum whales have been active with deposits in the last few days.

- ETH has been on a decline after failing to sustain recovery attempts.

In recent days, Ethereum [ETH] has experienced varied price movements, with attempts at recovery frequently negated by ensuing declines.

Concurrently, there has been a notable influx of ETH into exchanges, a movement largely attributed to whales transferring large volumes.

While the immediate assumption might be that these large inflows could lead to price drops, further analysis sheds additional light.

Ethereum whale deposits more ETH

Recent data from Lookonchain revealed that a whale wallet deposited 10,000 Ethereum coins, valued at over $31 million, to the Binance [BNB] exchange.

This transaction continued a pattern for this particular whale address, which has transferred a total of 30,000 ETH, worth more than $94 million, to Binance since the 1st of July.

This wallet is among several that have moved large volumes of Ethereum to exchanges in recent days.

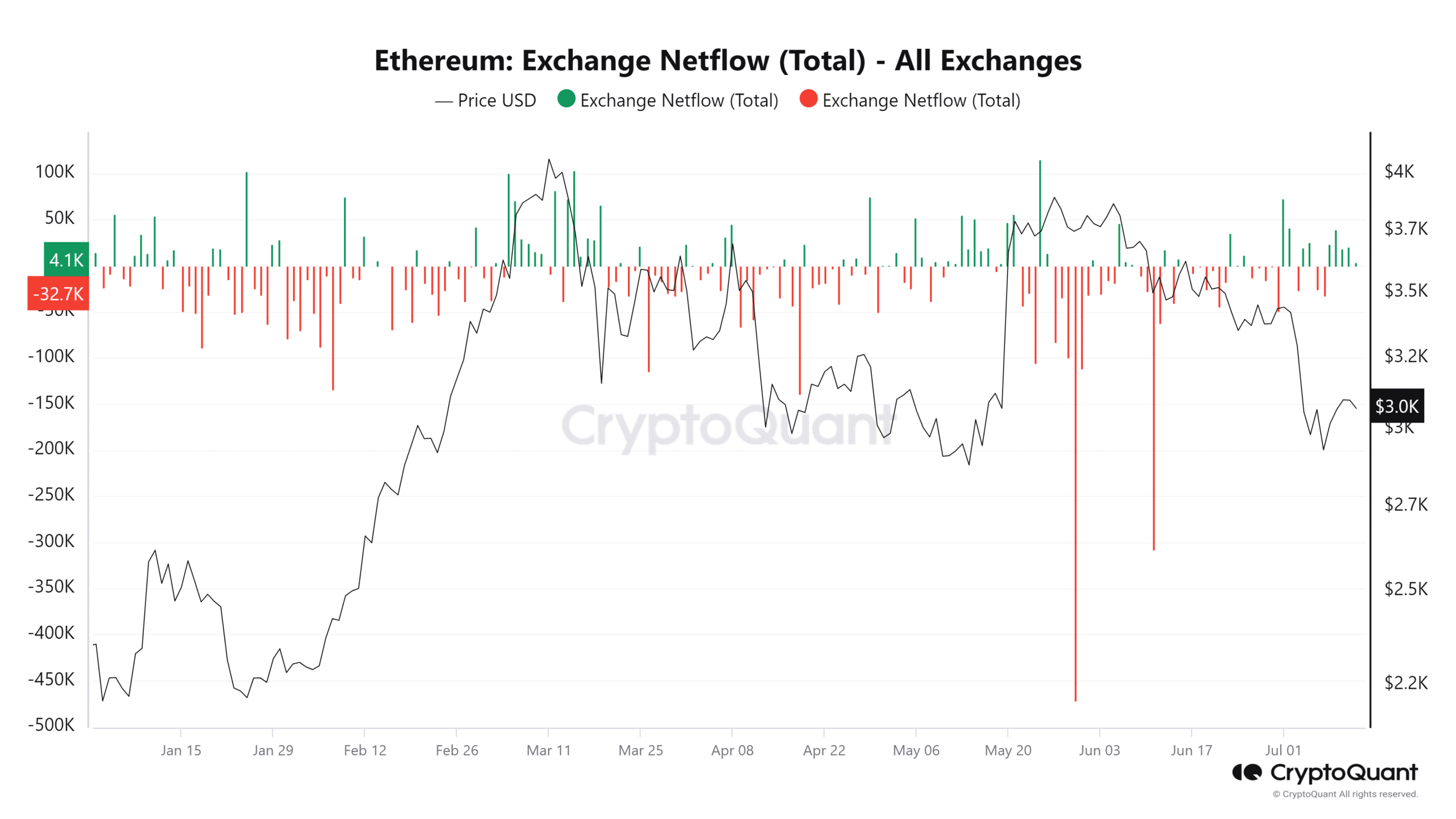

Increase in Ethereum net deposits

AMBCrypto’s analysis of the Ethereum netflow via CryptoQuant indicated that there have been more inflows than outflows on exchanges since the beginning of the month.

The data highlighted a significant influx at the start of the month, with over 72,000 ETH (approximately $250 million) entering exchanges.

Throughout the month, there have only been three instances of net outflows. This trend suggests that more Ethereum has been deposited than withdrawn in recent days.

Additionally, it appears that substantial deposits by large whale accounts have significantly contributed to this pattern.

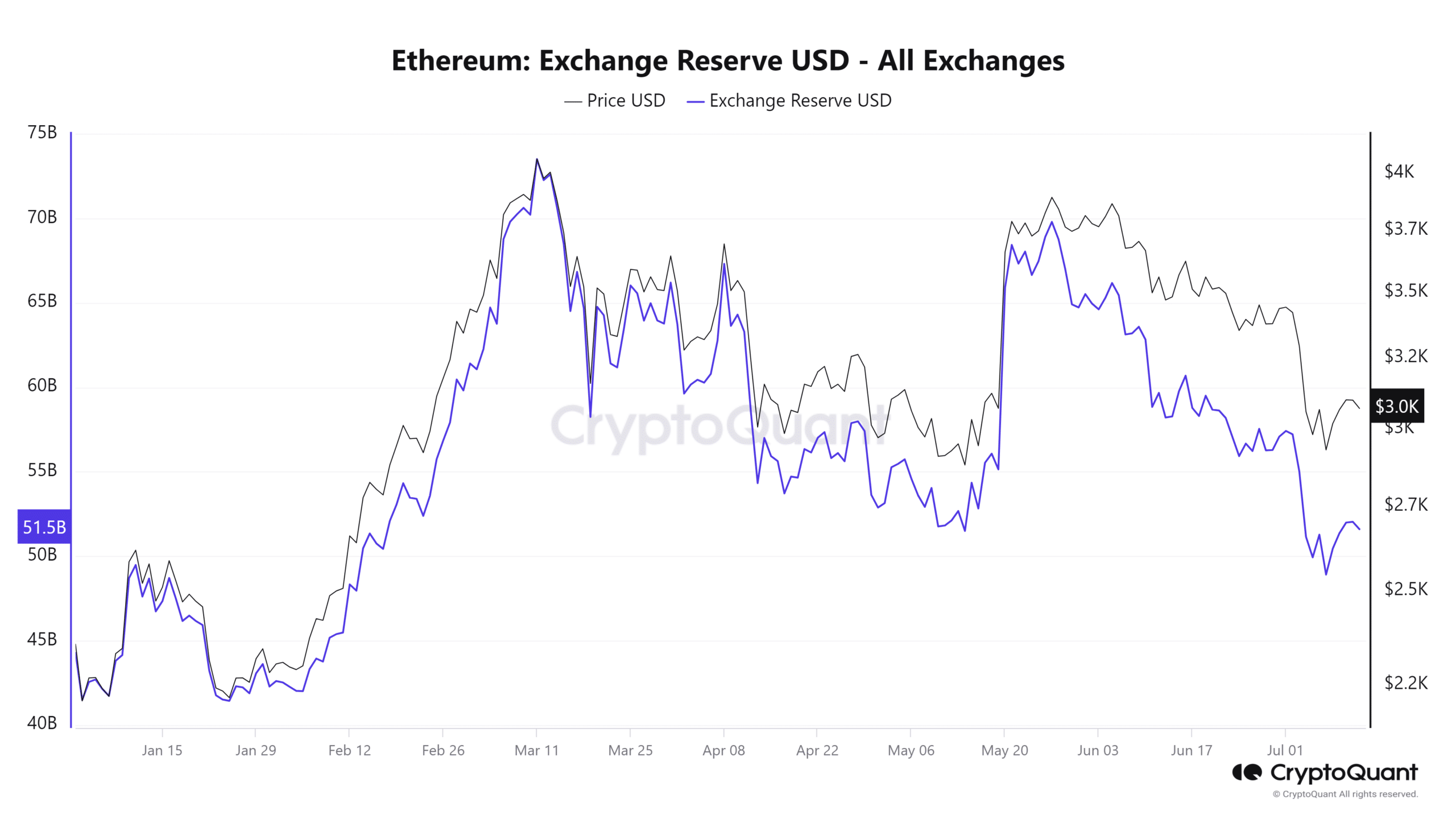

Exchange reserve remains at decent levels

Despite the recent surge in Ethereum inflow to exchanges, the overall exchange reserve has not shown a corresponding increase.

Analysis of the exchange reserve chart revealed that while there has been a modest uptick in the last few days, it was relatively minor compared to the overall decline.

At press time, the reserve stood at about $52 billion, down from over $57 billion at the beginning of the month.

This suggested that the decline in Ethereum’s value may have influenced the reduced dollar valuation of the exchange reserves.

Read Ethereum’s [ETH] Price Prediction 2024-25

Additionally, although there has been an increase in Ethereum volume, it has remained fairly stable, with figures hovering around the 16 million range. So, the changes in volume have not been substantial.

As of this writing, Ethereum was trading at approximately $3,071, experiencing a slight decrease of nearly 1%.