How Bitcoin’s crash triggered the worst losses for short-term holders

- Some holders of the coin have been hit by one of the worst losses since 2022

- Long-term holders remain profitable than short-term counterparts, indicating that BTC is still in a bull phase

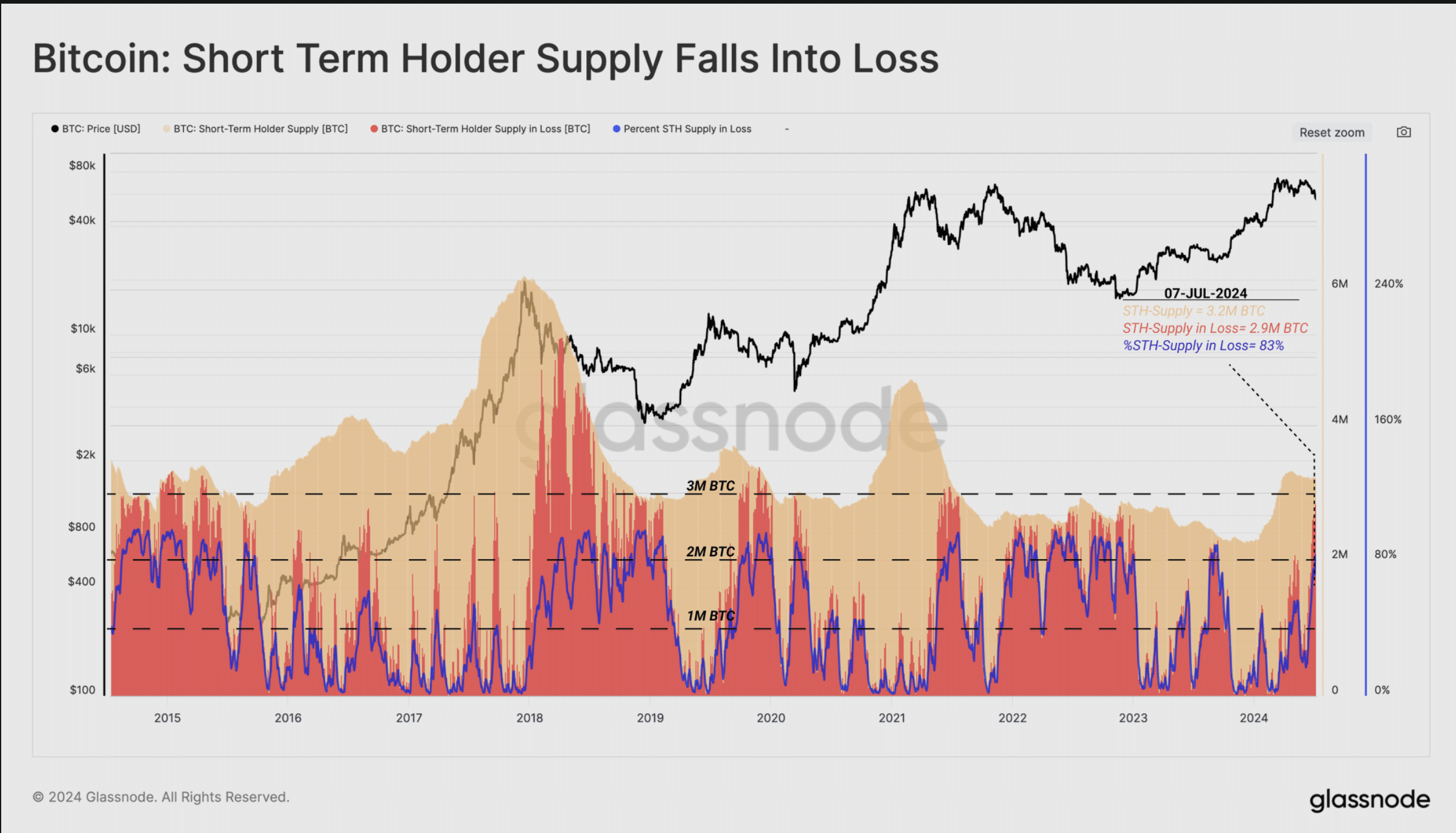

According to a recent report by Glassnode, Bitcoin’s [BTC] crash has been instrumental in driving one of the highest losses since the bear market of 2022. In fact, over the last 30 days, BTC’s price has declined by 14.45%.

In the report, the on-chain analytics platform focused on Short Term Holders (STH). These holders refer to those who have held Bitcoin for less than 155 days. Specifically, a lot of STHs have fallen into losses for about 90 days due to Bitcoin’s crash.

Are weak hands in trouble?

When compared to the last three years, this has been one of the largest financial losses holders have had. As a result, Glassnode observed,

“If we make a comparison with the market conditions seen in Q2-Q3 2021, a much more significant Short-Term Holders experienced a much more significant duration of 70 consecutive days in acute financial stress. That period of time was severe enough to break investor sentiment, and gave way to the destructive 2022 bear market.”

However, this does not imply that the Bitcoin’s crash has eventually plunged the coin into a bear phase.

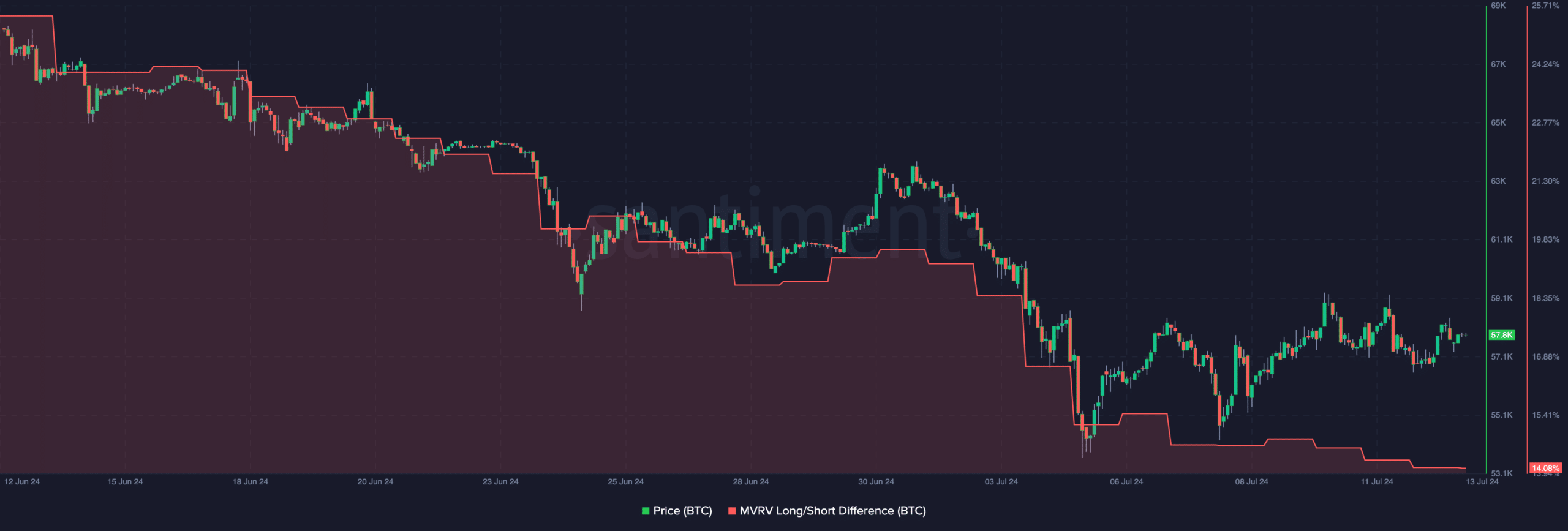

Evidence of this sentiment can be highlighted by the MVRV Long/Short Difference. Here, MVRV stands for Market Value to Realized Value. This metric measures the profitability between long-term holders and short-term holders.

Bulls stressed by Bitcoin’s shenanigans

Negative values indicate that short-term holders will realize higher profits that long-term holders. If this is the case, Bitcoin has fallen into a bear market.

However, if the difference is positive, it means that long-term holders will realize higher profits than short-term holders if they sell.

At press time, the MVRV Long/Short Difference was 14.08%.

Even though it was low compared to previous months, it does not mean that Bitcoin’s crash has forced the coin into a bear phase. Instead, the coin seems to be undergoing an unavoidable correction in the bull market.

Furthermore, hammering on the losses incurred, the report stated,

“Zooming into Short-Term Holder losses specifically, we can see a total realized loss of ~ $595m was locked in by this cohort this week. This is the largest loss taking event since the 2022 cycle low.”

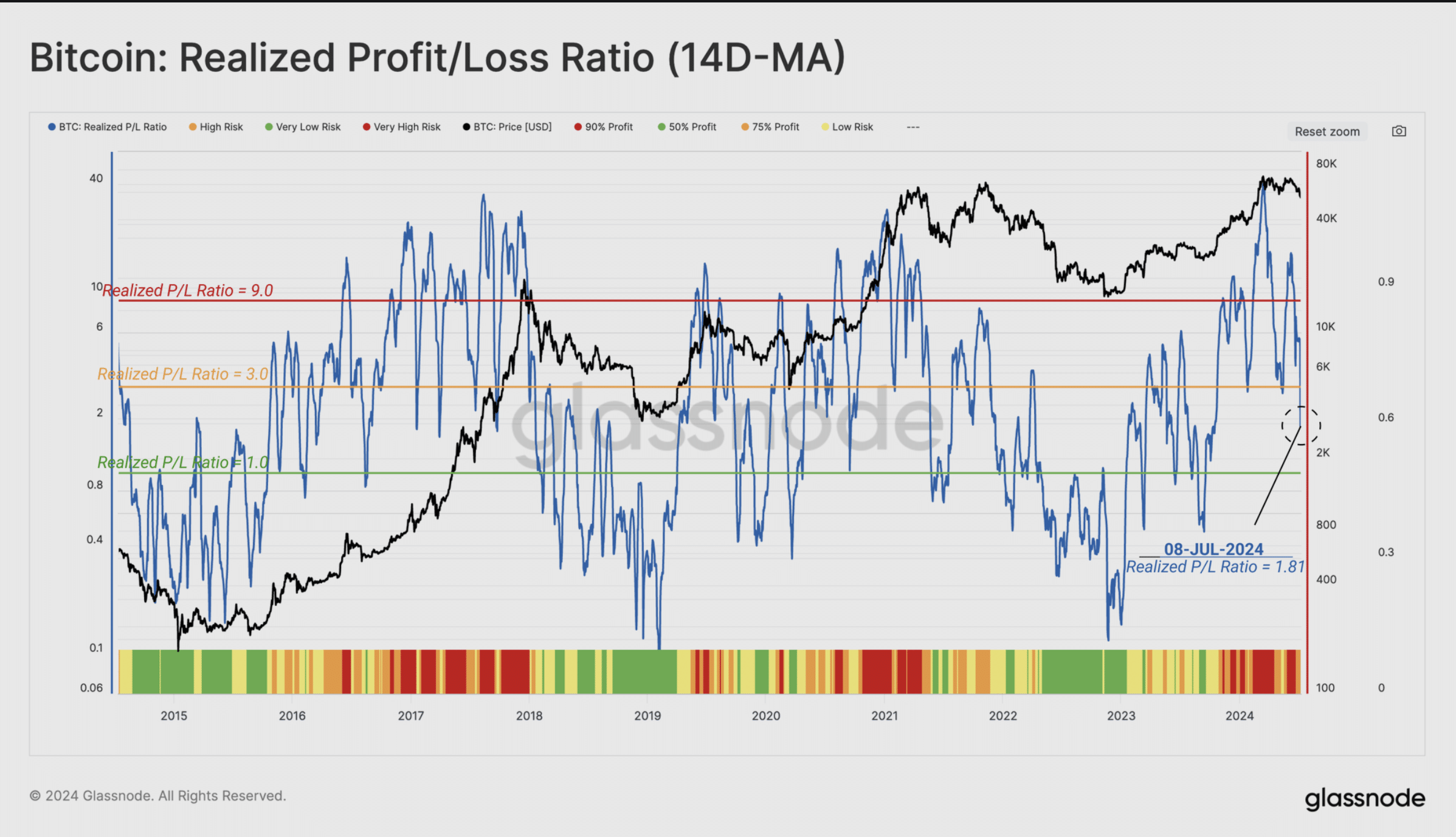

Additionally, while admitting that bulls were under pressure, the Realized Profit/Loss Ratio revealed that profitability has been almost non-existent. Typically, if the ratio is between 0.50 to 0.75, it means that Bitcoin is in a correction phase of the bull market.

Alas, as of 8 July, the metric had fallen to 1.81, implying that investors have been largely skeptical about the crypto’s potential. If unchecked or price fails to bounce, this could force BTC into a bear phase.

At press time, Bitcoin was valued at $57,848, following a very insignificant hike over the last 24 hours.

Is your portfolio green? Check the Bitcoin Profit Calculator

If the price records a bigger hike, Bitcoin’s crash could soon become a thing of the past. If it does not, however, BTC holders will risk getting weaker.