Bitcoin ETFs net flows cross $16B, led by BlackRock – What’s next for BTC?

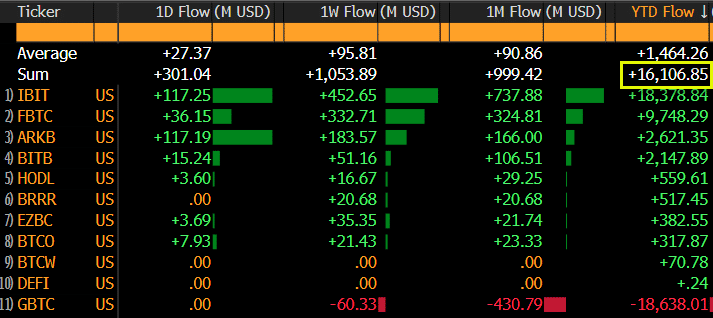

- US spot BTC ETFs hit $16 billion in net flows, outperforming estimates in a record six months.

- BlackRock’s IBIT tops with over $20 billion in net assets and $18.6 billion in net flows

Undoubtedly, the U.S. spot Bitcoin [BTC] ETFs (exchange-traded funds) have been a resounding success in the history of the crypto market.

The BTC ETFs hit a new milestone, $16 billion in net flows within six months, outperforming estimates by Bloomberg analysts, which projected $12–$15 billion in net flows in 12 months.

Reacting to the fête, Bloomberg ETF analyst Eric Balchunas acknowledged that their estimates had been cleared.

“YTD net total (the most imp number in all this) has crossed +$16b for first time. Our est for first 12mo was $12-15b, so already cleared that with 6 months to go.”

Interestingly, the recent BTC recovery above $60K also saw renewed inflows into the ETFs.

Balchunas added that the products were in “two steps forward” mode after netting +$300 million on 15th July and about $1 billion on a weekly adjusted basis.

BlackRock leads BTC ETFs

BlackRock has recorded remarkable growth amongst the US spot BTC ETFs. On Tuesday, the firm’s iShares Bitcoin Trust (IBIT) netted $260 million in net flows and hit $1 billion in daily trading volume value.

Soso Value data revealed that BlackRock was the best performing BTC ETF as of press time, with $20.9 billion in assets. Grayscale’s GBTC and Fidelity’s FBTC came in second and third in terms of net assets.

BlackRock still led in terms of net flows, which stood at $18.6 billion, followed by Fidelity at $9.8 billion.

BlackRock’s explosive growth tipped Nate Geraci of ETF Store to claim that advisors and institutional investors were joining the ‘party.’

“iShares Bitcoin ETF now over $20bil in assets & taking in a quarter bil on a random Tuesday…*$20bil*. *6mos* after launch…Advisors & inst’l investors clearly showing up to this party.”

Will Mt. Gox’s repayment derail the party?

Meanwhile, Mt. Gox has moved a considerable amount of BTC to Kraken for repayments to victims, stroking new fears after last week’s German BTC dump.

However, most market analysts suggested that Mt Gox’s distribution was “overestimated,” especially given the likely launch of the U.S. spot Ethereum ETFs next week.

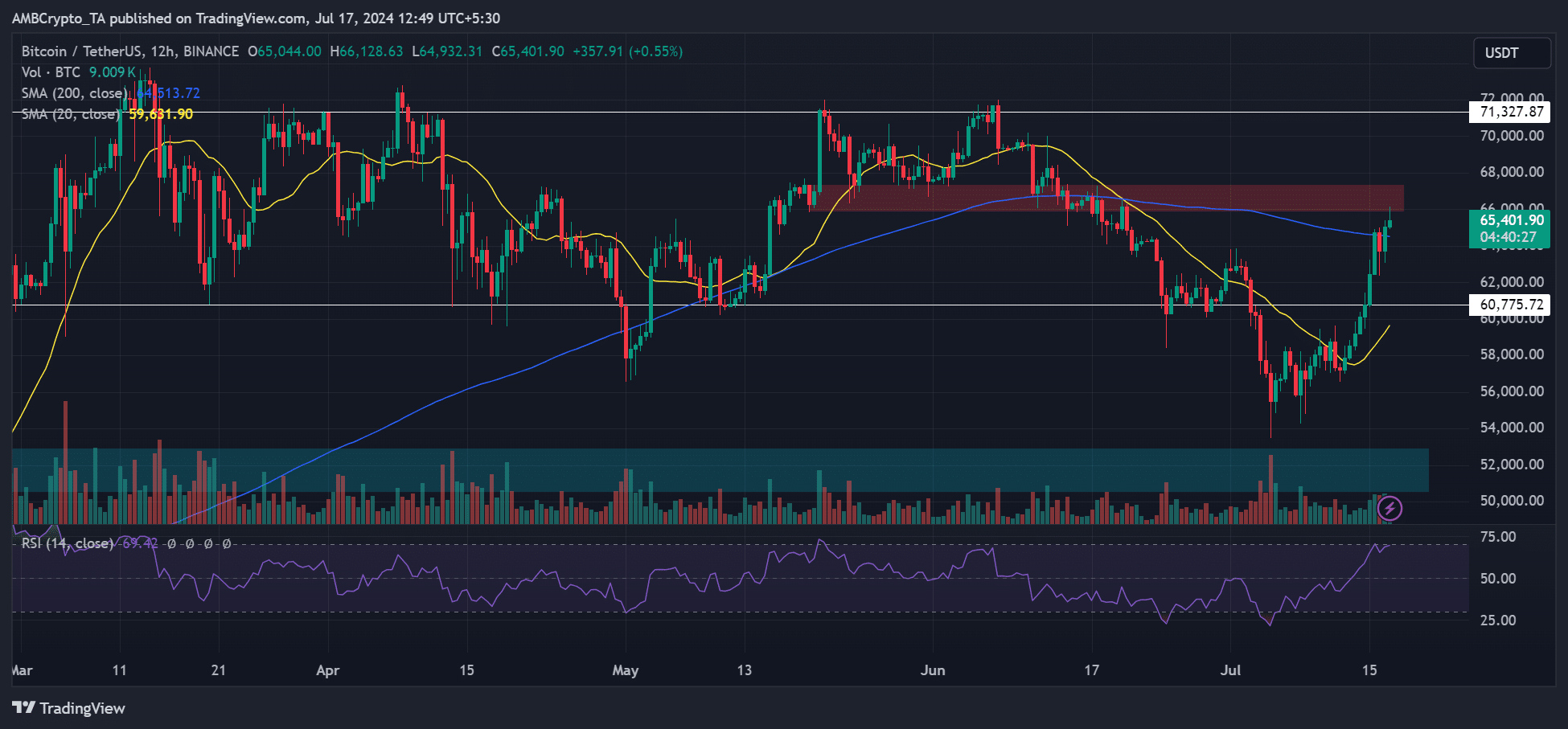

On the price charts, BTC was bullish and above short and long-term price trends, denoted by 20-day SMA (Simple Moving Average) and 200-day SMA.

It traded at $65.4K but hit key resistance and breaker block area (marked in red). A convincing move above the obstacle could accelerate a retest of the range-high at $71K.

Glassnode’s founders echoed the same bullish outlook, albeit with reservations if negative news hit the market.

“Our key risk/reward chart shows recovery towards a bullish environment. The Bitcoin Risk Signal has recovered but remains in high-risk territory.”