Ethereum ETF: BlackRock wins as Grayscale subject to ‘outrage outflows’

- Grayscale’s has a hefty 2.5% fee, 10X higher than its competition.

- BlackRock fees are set at 0.25% as the market expects outrage flows from Grayscale.

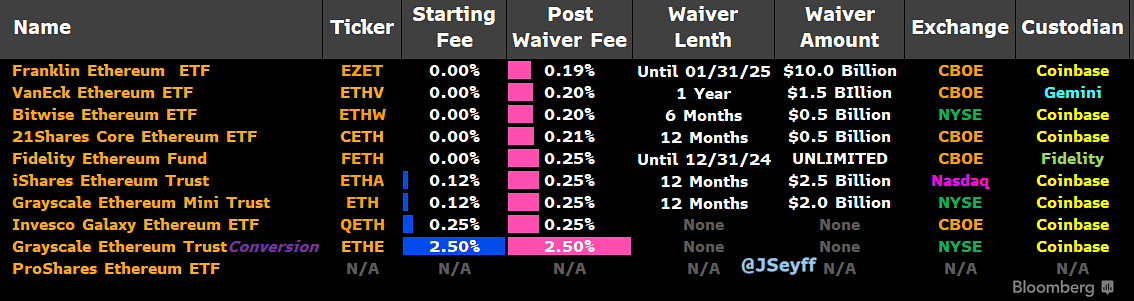

Potential Ethereum [ETH] ETF issuers updated their fee structure on Wednesday as the market prepares for potential S-1 approvals and launch of the products on July 23rd.

According to Bloomberg ETF analyst James Seyffart, about seven issuers have waivers based on either period or assets held.

However, Grayscale’s ETHE had the heftiest fees at 2.5%, while BlackRock’s iShares Ethereum Trust pegged fees at 0.25% post waiver.

Unlike BlackRock’s 0.12% starting fee for 12 months, if net assets are below $2.5 billion, Grayscale’s ETHE will maintain 2.5% throughout after the conversion of its trust to ETF on 23rd July.

Ethereum ETF fee wars

This has riled the market commentators. One observer, Nate Geraci of ETF Store, termed Grayscale’s move a ‘huge miss’ and that it was disappointing.

For his part, Bloomberg ETF analyst Eric Balchunas cautioned that Grayscale’s fees were ‘10X higher than competition’ and ‘outrage outflows’ were likely.

“Grayscale not lowering at all. This means they 10x higher than competition. Wow. Prob cause some outrage outflows. My guess is the Mini ETF will be dirt cheap tho, like maybe 15bps. Interesting dynamic at play.”

For perspective, indeed, the Grayscale Ethereum Mini Trust (ETH) had a similar fee structure as BlackRock: 0.25% with 0.12% as the starting fee. The Mini Trust will reportedly be spun off from ETHE after the conversion.

“10% of $ETHE will be automatically spun off and into $ETH. $ETHE currently has $10 billion in assets. So $ETH should essentially start it’s life with $1 billion in assets.”

However, despite the Mini Trust’s lower fees, some market observers projected massive outflows from ETHE.

Per HODL15 Capital estimates, ETHE outflows could hit 50%-60% following the hefty fees.

“Will Grayscale replicate the $GBTC fee mistake with $ETHE? If so, expect 50%-60% outflows 👇 Just over $10 Billion AUM.”

Meanwhile, SEC Commissioner Hester Peirce has stated that ETH ETF staking could be open for reconsideration amidst looming political change in the U.S.

On the price front, ETH’s recent recovery hit resistance at $3.5K. The second-largest digital asset traded at $3.4K as of press time and could only eye $4K if it cleared the $3.5K.