Ethena rallies 45% in two weeks, but bulls still have an uphill battle

- Ethena maintained a higher timeframe bearish trend.

- The buying pressure was not commensurate with the momentum shift.

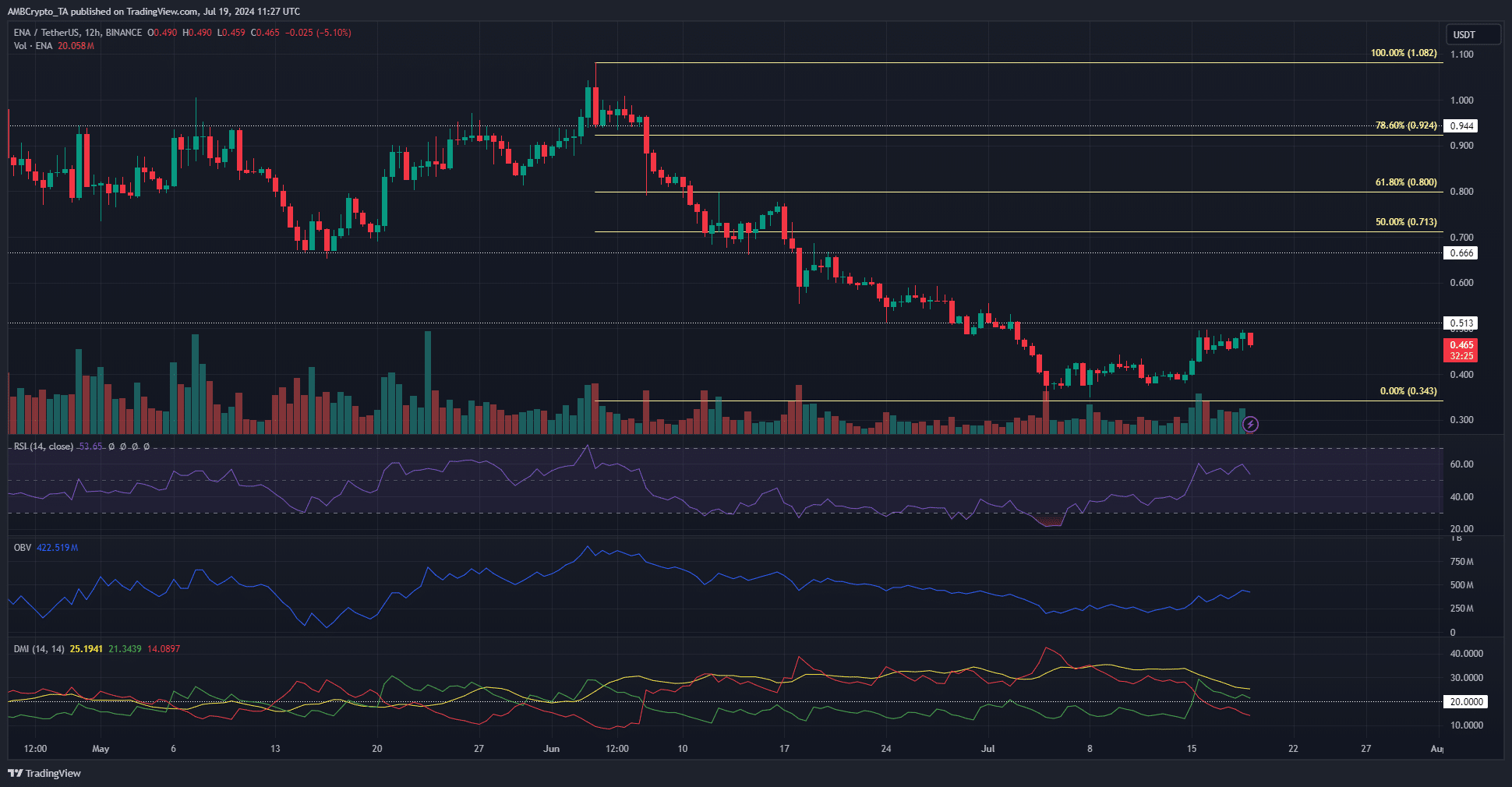

After the losses noted in the first week of July, Ethena [ENA] managed to bounce by 44.9% from the $0.343 low on the 5th of July to the $0.497 high on the 18th of July.

It was an encouraging start for the bulls, but not enough to flip the higher timeframe downtrend.

The psychological $0.5 mark acted as support toward the end of June but would be resistance for ENA on the way up. Can the buyers flip this level to support?

The bullish prospects of Ethena

The RSI on the 12-hour chart rose above neutral 50 on the 15th of July. This was an early sign of the changing momentum.

The Directional Movement Index also saw the +DI (green) crossover above the -DI (red) to show a potential trend shift.

However, a clear uptrend is not yet in sight. The recent lower high at $0.443 has been beaten. This was a market structure shift, as Ethena has formed higher lows over the past few days.

A move past the $0.5 supply zone is needed to change the long-term investor sentiment. The OBV is beginning to climb higher, which is another positive signal of buying pressure.

Traders need to be prepared for a rejection from $0.55 after the liquidity is tested.

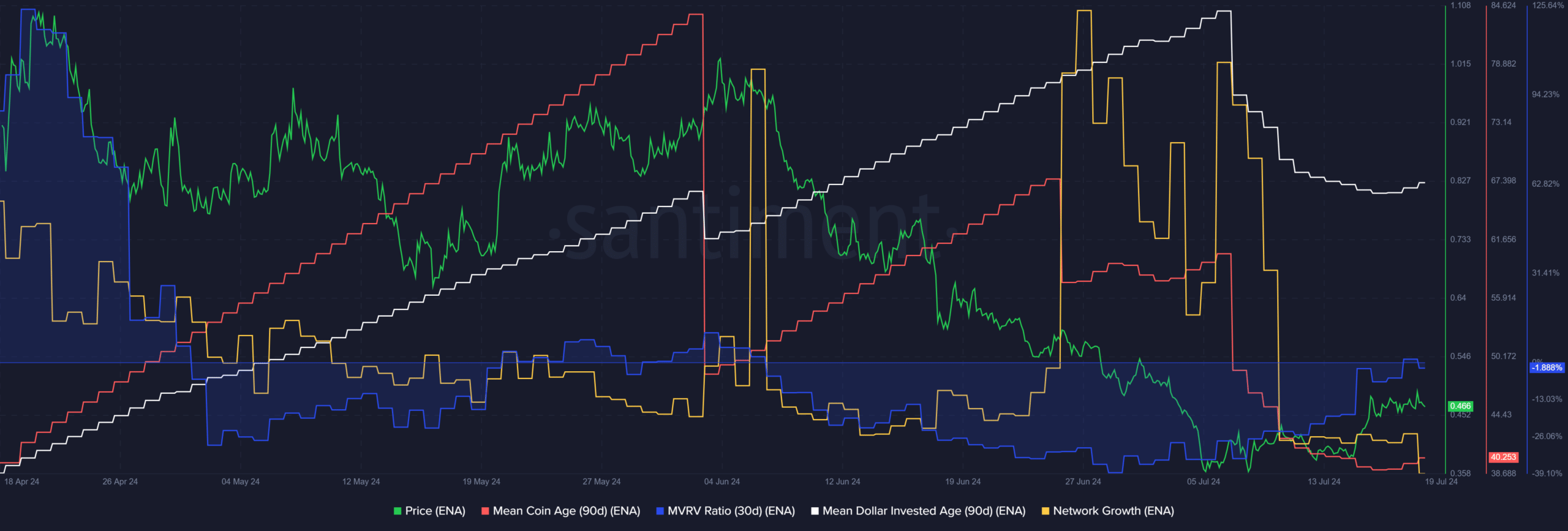

Network growth spiked before the price recovery began

Source: Santiment

The 30-day MVRV ratio was at -1.88%, which showed short-term holders were suffering a minor loss. The recovery of the short-term MVRV isn’t surprising after the price bounce of the past two weeks.

The surprise was from the strong downtrend of the mean coin age, which signaled a distribution phase.

Is your portfolio green? Check the ENA Profit Calculator

The falling mean dollar invested age implied an increased network activity and coins flowing back into circulation, which was bullish.

Overall, the metrics were bearish for Ethena. The evidence at hand does not support a strong breakout past the $0.5-$0.55 resistance.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.