Why Bitcoin could reach $71K in September, and $100K in December

- Bitcoin could surge above its 4-month-long price range in September.

- There has been increasing $100K per BTC calls by December 2024, per QCP Capital.

Bitcoin’s [BTC] price action has been resilient this week and remained above $60K despite massive losses in U.S. equities.

Besides, tailwinds are beginning to align in the second half of 2024 and could tip BTC to a new all-time high. BTC has been stuck within the $60K—$71K range since March, but the sideways movement could soon be over.

Is BTC ready to surge above the 4-month range?

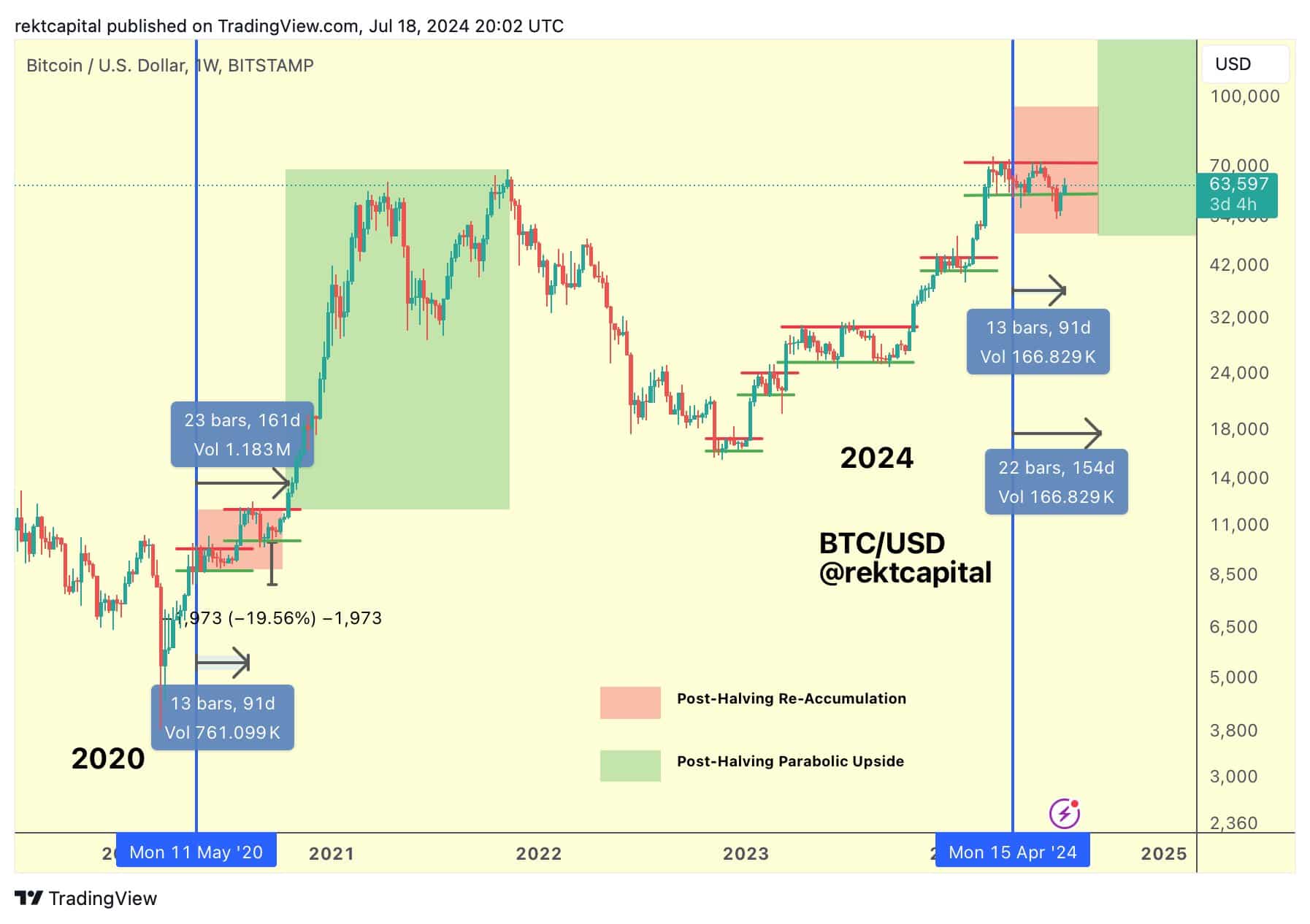

According to market analyst Rekt Capital, based on historical data, a potential breakout from the $60K—$71K range in September was likely.

“If history repeats, a Bitcoin breakout from the Re-Accumulation Range would occur in September 2024.”

The projection was based on the sideways movement that occurs after the halving event. If the historical trend repeats, this consolidation period could end in September.

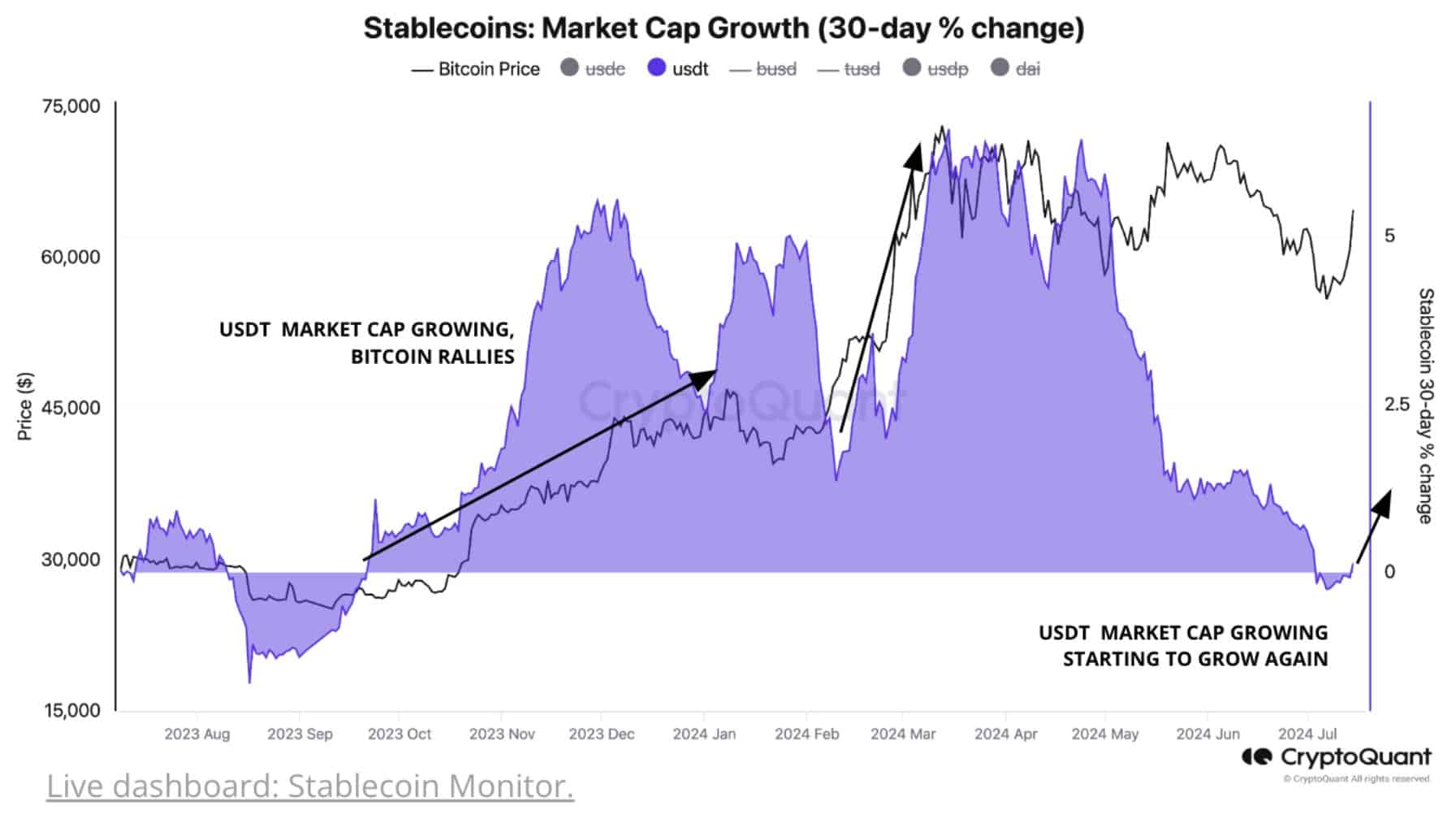

An uptick in stablecoins growth, which dropped significantly in H1 2024, supported the above break-out prospect for bulls.

“Stablecoin inflows into the #crypto markets are positive again! This is a very bullish development, historically aligning with #Bitcoin rallies.”

The stablecoin growth meant market players could position themselves for bids as market sentiment improved.

All eyes are set on September for a likely Fed rate cut. Over 90% interest rate traders expect the Fed to keep the rate unchanged during the next Fed decision at the end of July. In September, odds of rate cuts stood at 93%.

The rate cuts could fuel BTC. Further BTC rallies would be possible if Donald Trump, a pro-crypto candidate, wins the US presidential elections in November.

However, a September rate cut was not that obvious.

According to a Bloomberg report, Trump had warned Fed chair Jerome Powell not to cut rates before November to avoid giving Biden an upper hand.

“The Fed should abstain from cutting rates before the November election and giving the economy, and Biden, a boost.”

It remains to be seen whether Powell will take the warning seriously and dent market expectations.

Meanwhile, despite the resilient price action, the market remained bullish, with $100K per BTC price targets by the end of the year, according to QCP Capital analysts.

“Even with lower spot overnight, we continued to see sizeable institutional interest in Dec $100k Calls. This signals an even stronger conviction of a year-end rally as the odds of a Trump victory increases.”