Grayscale Bitcoin ETF holdings go for a toss: Impact on BTC’s price?

- While Grayscale decreased its Bitcoin ETF holdings, BlackRock continued to accumulate.

- BTC’s price action remained bullish, but the trend might change soon.

Bitcoin [BTC] ETFs have once again come into the limelight as several top companies decreased their holdings. While that happened, BTC’s price action remained in the bulls’ favor.

Let’s take a look at whether this latest ETF development would have a negative impact on BTC’s price.

Did Grayscale affect Bitcoin ETF holdings?

As per a tweet by Lookonchain on the 19th of July, Grayscale, one of the largest BTC ETF holders, decreased its holdings by 845 BTC, worth more than $55.5 billion, holding 272,160 BTC at press time.

Interestingly, while Grayscale sold BTC, BlackRock added 1,616 BTC, worth more than $106 million, and held 325,449 BTC at press time, worth $21.4 billion.

AMBCrypto then analyzed Dune Analytics’ data to better understand how Bitcoin ETFs were doing. As per our analysis, since its launch, over $16 billion worth of BTCs have flown into ETFs.

In the last seven days, the netflow remained positive as ETFs added another $0.32 billion to BTC’s holdings. The total amount of BTC that was held in ETFs accounted for 4.5% of Bitcoin’s total supply.

Mentioning the top ETFs, Grayscale stood out at first, followed by BlackRock, Fidelity, and 21Shares.

How did BTC react?

While this happened, bulls continued to dominate the market at press time. According to CoinMarketCap, Bitcoin’s price increased by more than 7% in the past week.

At the time of writing, BTC was trading at $67,283.62 with a market capitalization of more than $1.32 trillion. Thanks to the recent price increase, over 93% of BTC investors were in profit, as per IntoTheBlock’s data.

AMBCrypto then planned to assess CryptoQuant’s data to find out whether the developments in the Bitcoin ETF sector would affect BTC’s price.

As per our analysis, BTC’s net deposit on exchanges was high compared to the last seven days’ average, meaning that selling pressure was rising.

Its aSORP was also in the red, which suggested that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

Additionally, its NULP revealed that investors were in a belief phase where they were currently in a state of high unrealized profits, which looked bearish.

Read Bitcoin’s [BTC] Price Prediction 2024-25

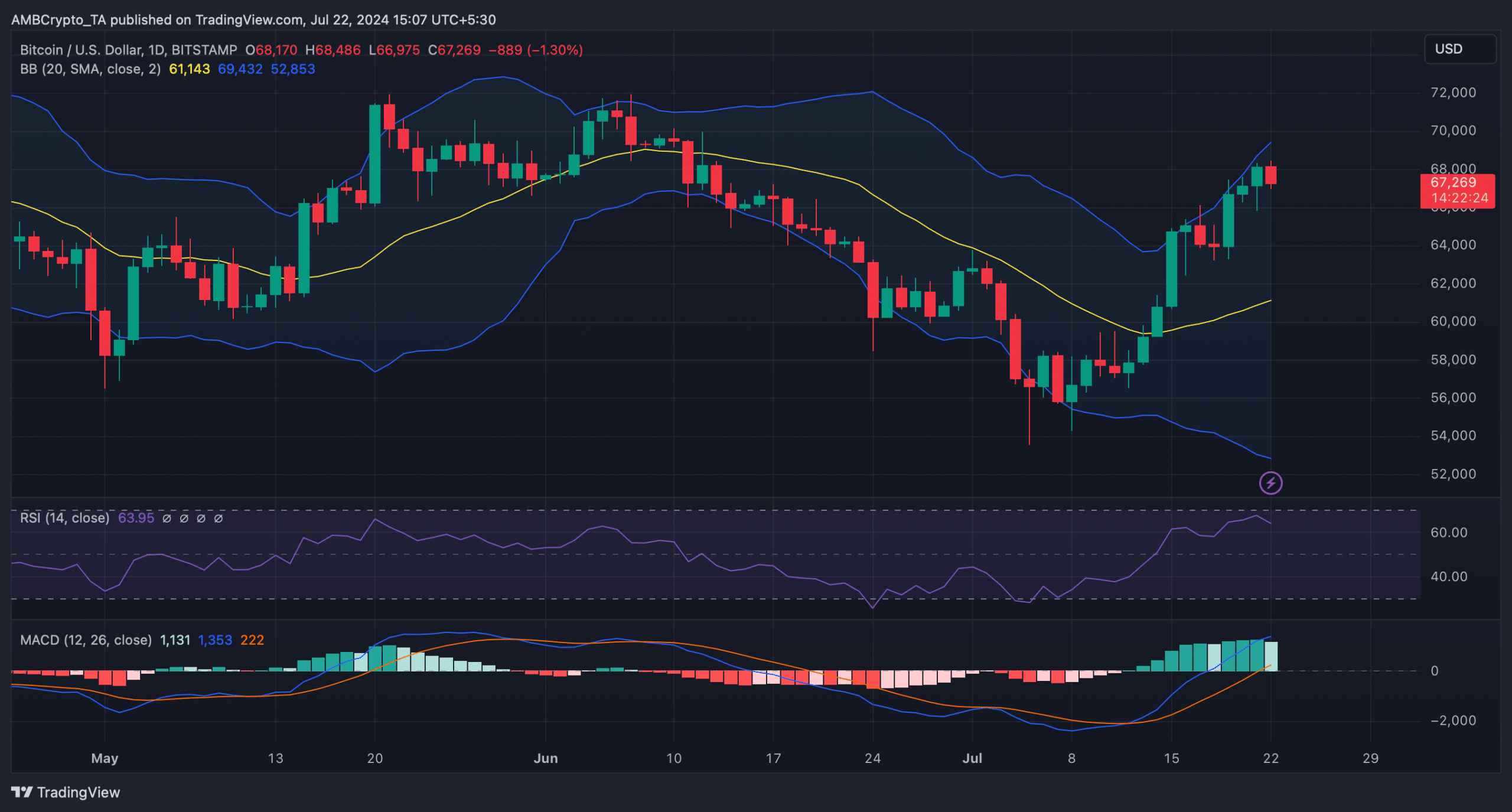

AMBCrypto then analyzed the king of crypto’s daily chart, finding that the Relative Strength Index (RSI) registered a slight downtick at the time of writing.

Moreover, BTC’s price had touched the upper limit of the Bollinger Bands, which often results in price corrections. Nonetheless, the MACD displayed a bullish advantage in the market.