Bitcoin investors start stockpiling: Is BTC’s bull run close?

- While accumulation increased, BTC’s price was inching towards $70k.

- However, a few metrics and market indicators hinted at a price correction.

Bitcoin [BTC] price has once again gained bullish momentum as it was fast approaching $70k. The latest data suggested that investors have started to stockpile BTC.

Does this mean they expect BTC’s price to go up further, or will BTC fall victim to yet another price correction?

Bitcoin investors are accumulating

CoinMarketCap’s data revealed that BTC’s price had increased by over 3% last week. The bullish trend continued in the last 24 hours as the king of crypto witnessed an over 3% surge.

Thanks to that, at the time of writing, BTC was trading at $69,535.15 with a market capitalization of over $1.37 trillion.

AMBCrypto reported earlier that it was a good option to HODL Bitcoin as a few key indicators hinted at a buying opportunity.

In the meantime, Ali, a popular crypto analyst, posted a tweet revealing yet another interesting development. As per the tweet, BTC’s accumulation trend score hit 1, suggesting that investors were buying substantial amounts of BTC.

For starters, the accumulation trend score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings.

A number closer to 1 indicates buying pressure was high.

Will the king coin grow further?

Since buying sentiment was dominant in the market, AMBCrypto planned to have a closer look at BTC’s state to find out whether its latest bull rally would continue.

As per our analysis of CryptoQuant’s data, BTC’s binary CDD was green, meaning that long-term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins.

However, its aSORP turned red, which suggested that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

Additionally, we found that a substantial amount of BTC will get liquidated if BTC touches $70k. Whenever liquidation increases, it indicates that there are chances of a price correction.

Therefore, BTC might witness a price correction near $70k. If that happens, then BTC might plummet to $66k once again.

Read Bitcoin’s [BTC] Price Prediction 2024-25

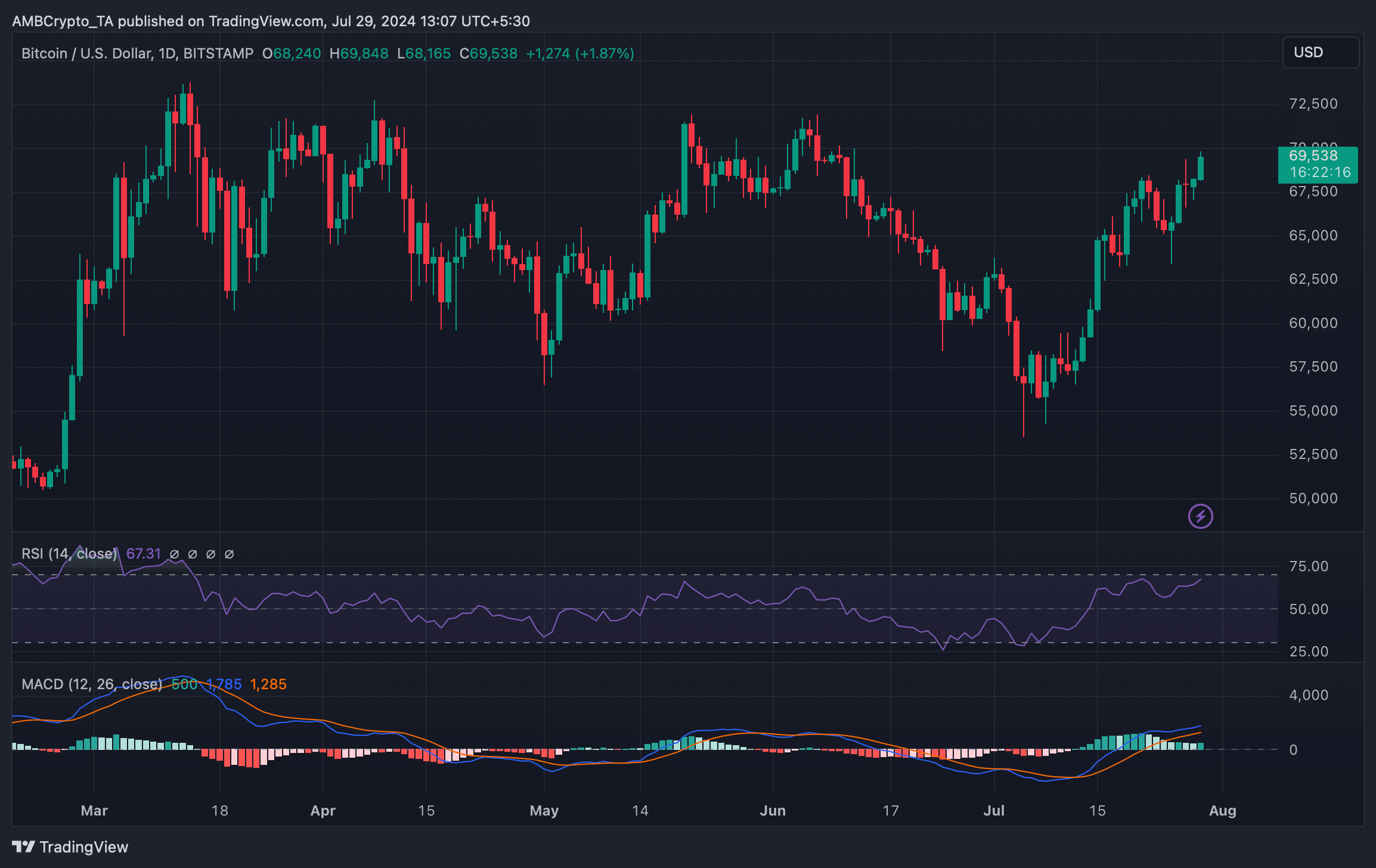

A few of the technical indicators also hinted at a similar price correction. For example, the MACD displayed the chances of a bearish crossover.

The Relative Strength Index (RSI) was about to enter the overbought zone. This might result in a rise in selling pressure, in turn putting an end to Bitcoin’s bull rally.