Is Solana at risk of a price reversal? What historical trends say

- Solana jumped 4.5% in the last 24 hours, reaching highs not seen since April 2024.

- At press time, bulls were more prominent compared to short sellers, indicating that short sellers were exhausted.

The overall cryptocurrency market looked bullish at press time, with top crypto assets performing impressively.

In addition to this strong performance, Solana [SOL], the world’s fourth-largest cryptocurrency, gained massive attention as it broke out of the crucial resistance level of $187.

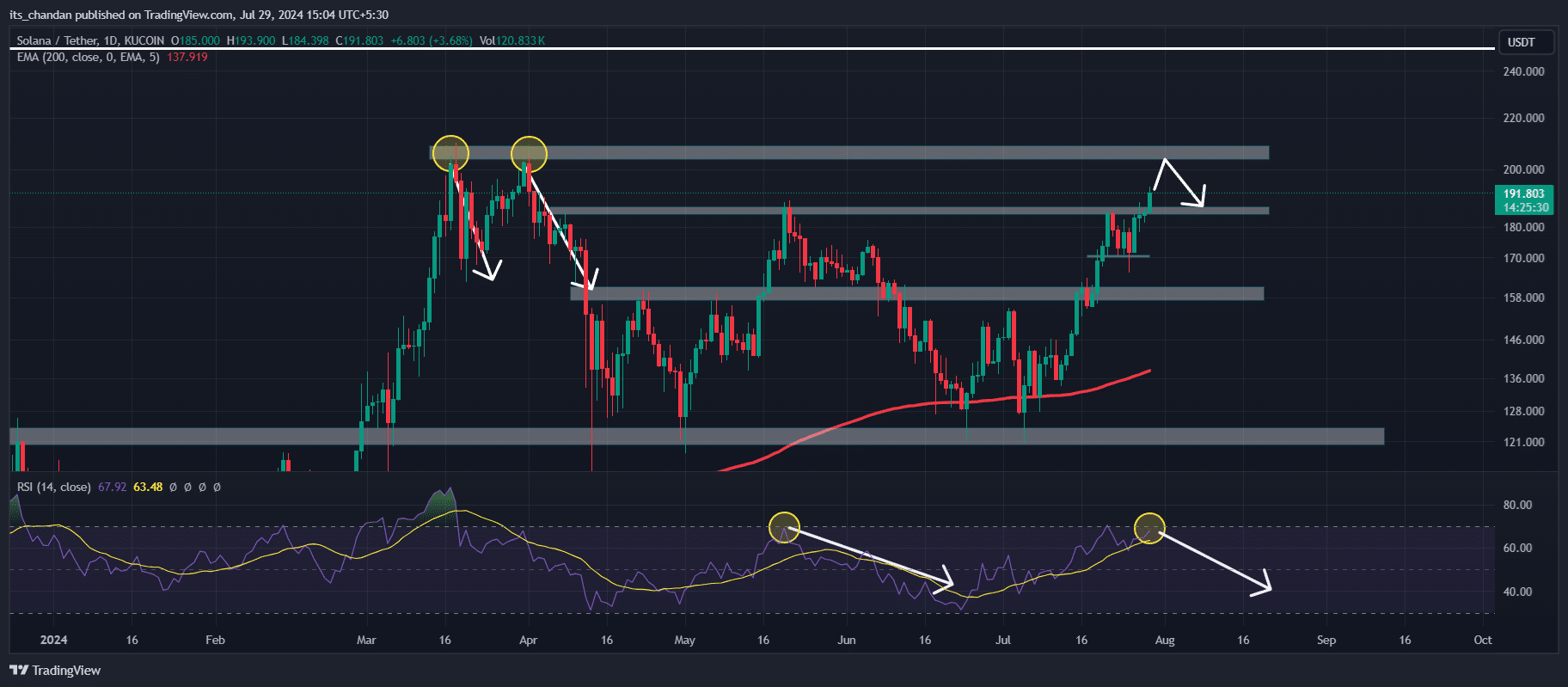

Solana price reversal concerns

Following SOL’s crucial breakout, there is a high chance that it could rise to the next resistance, which is near $204.

However, there is also a concern among the new investors about a potential price reversal from this upcoming resistance.

According to the historical data and price action, whenever SOL has reached the $204 level, it has consistently experienced a notable price reversal.

Since March 2024, SOL has reached this level twice and experienced a significant price reversal each time, which is the reason for the concern among new investors.

As of writing, SOL is trading near $192 and has experienced a 4.5% upside move in the last 24 hours. Despite an impressive price surge, trading volume has dropped by 18% over the same period.

This decline in trading volume might indicate that investors and traders are conscious of the resistance level due to the historical price reversal.

Technical analysis and upcoming levels

According to expert technical analysis, SOL recently broke out of the crucial resistance level of $187, and was heading toward the next resistance level of $204 at press time.

Following this breakout, there is a high possibility that SOL could reach the $204 level in the coming days.

However, technical indicators such as the Relative Strength Index (RSI) are in the over-bought zone, signaling a potential price reversal.

The stochastic level was also in the over-bought area, with its value above 80 at press time.

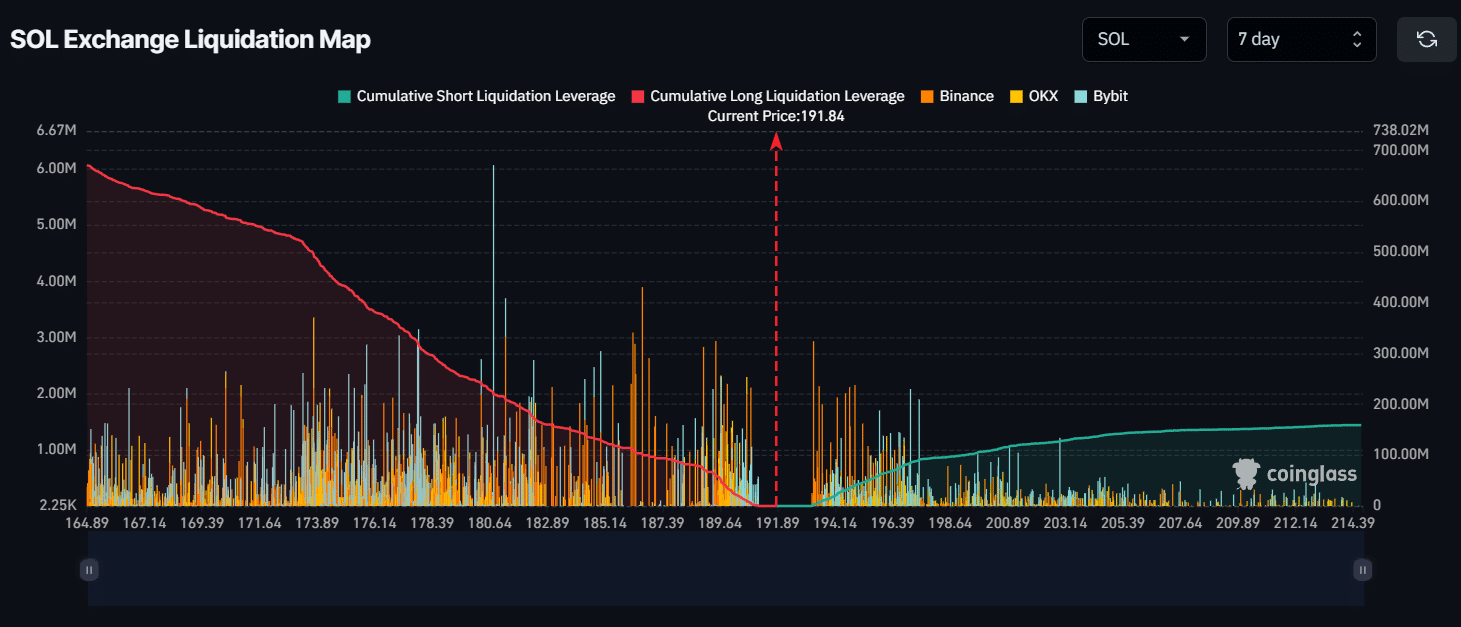

Also, major liquidation levels emerged near the $180 and $203 levels.

According to data from an on-chain analytic firm CoinGlass, if SOL experiences a price reversal and falls to the $180 mark, $225 million worth of long positions will be liquidated.

Conversely, if SOL breaches the $203 level nearly $132 million worth of short positions will be liquidated.

Whales’ and investors’ activity

Despite the price reversal concern, the crypto community looks bullish as whales and investors showed increasing interest in SOL.

On the 24th of July, two whales withdrew nearly $41.5 million of SOL from Binance [BNB] and staked it. This staking indicates the whales’ long-term interest in SOL.

In addition to the whales’ activity, Raoul Pal, CEO of Real Vision and a well-known financial analyst, shared in a podcast that he has shifted 90% of his liquid assets into SOL.

Realistic or not, here’s SOL’s market cap in BTC’s terms

The combined interest from both whales and investors creates a potentially bullish outlook for SOL.

Furthermore, Solana’s Open Interest (OI) has jumped by 10%, according to CoinGlass, suggesting growing interest from investors and traders.