How Binance maintains market lead despite a 22% drop in volumes

- Binance remained the most dominant exchange despite a 22% decline.

- BNB followed the general market trend with over 1% decline in the last 24 hours.

Recent data indicates Binance’s spot trading volume decreased in the second quarter. Despite this decline, it maintained its dominant position in the market.

However, it’s important to note that its dominance has diminished compared to previous years.

Mixed metrics for Binance dominance

Recent data from Coingecko analyzing the performance of centralized exchanges revealed that Binance continued to lead as the top exchange. However, its dominance has experienced some erosion.

The data indicates that Binance’s spot trading volume reached a yearly low of $424.7 billion. This decline marks a 22.7% month-on-month decrease from $549.8 billion recorded in May 2024.

Despite these fluctuations, it held a 46.6% share of the total spot trading volume among centralized exchanges for Q2 of 2024.

Also, although it saw an increase in market dominance from Q1 to Q2 of 2024, ending the first quarter with a 48.9% market share, it appears to be losing ground again.

In absolute terms, the exchange generated $1.67 trillion in trading volume during Q2 of 2024. This was a 19.8% decline from $2.08 trillion in Q1 of 2024.

Historically, Binance’s market share was over 60% around 2022, but it has significantly declined over the subsequent years.

Why Binance’s dominance has waned over the years

Binance’s journey in the industry has been marked by significant challenges, particularly concerning regulatory issues across various global jurisdictions. These regulatory hurdles have notably impacted its operations and competitive standing.

In some regions, such as Canada, Binance has had to halt operations entirely due to regulatory constraints. This retreat from key markets reflects the broader compliance challenges the exchange faces.

Furthermore, its recent legal troubles in the United States have further complicated its position.

The conclusion of a regulatory investigation resulted in a substantial financial penalty for the exchange and, even more consequentially, the imprisonment of its former CEO, Changpeng Zhao (CZ).

These developments have affected Binance’s operational stability and reputation among users and investors.

These setbacks have provided an opening for other exchanges like Coinbase and Bybit to erode some of the dominance the exchange once enjoyed.

As these competitors continue to expand and possibly capitalize on their regulatory misfortunes, the dominance might wane further.

BNB falls

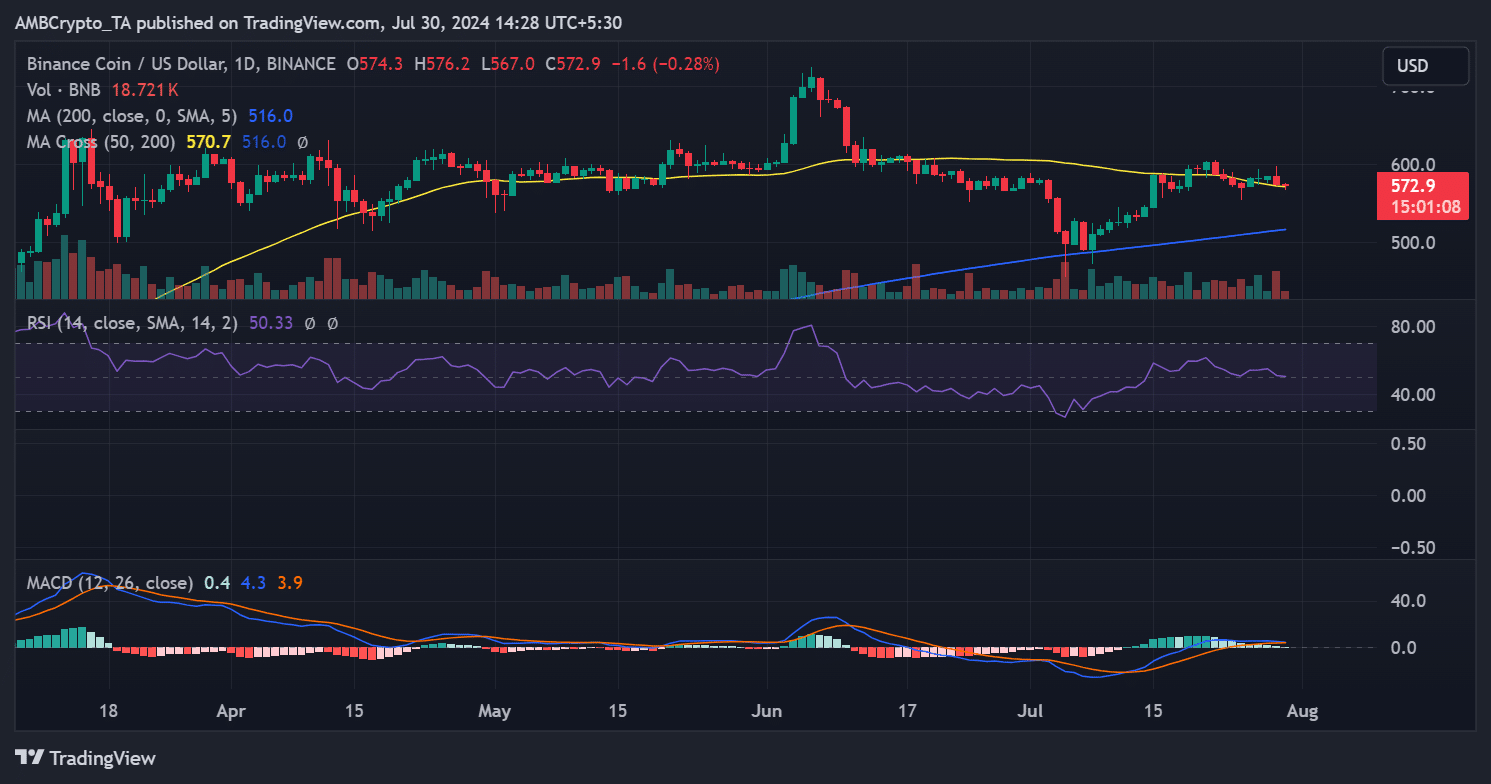

The daily price trend analysis of Binance Coin (BNB) shows that it has been mirroring broader market movements.

On July 29th, BNB experienced a decline of over 1.6%, falling from approximately $584 to around $574 by the end of trading. As of the latest data, BNB is trading at about $573, representing a slight decline of 0.3%.

Read Binance (BNB) Price Prediction 2024-25

Despite these recent decreases, BNB remained above the neutral line on its Relative Strength Index (RSI), suggesting it still holds bullish momentum within the prevailing market conditions.