Why is crypto down today? September has the answer

- Bitcoin does not have a bullish sentiment in the short term, but a move toward $67k could be likely.

- Macro news events regarding September expectations may have dealt a bearish blow to BTC.

Bitcoin [BTC] is the king of crypto, not just because it has the largest market capitalization. It is the most robust and the earliest in the market, and has been a wind vane for the sentiment over the past decade.

Its price movements influence most of the crypto market and can help answer the question of why crypto is down today.

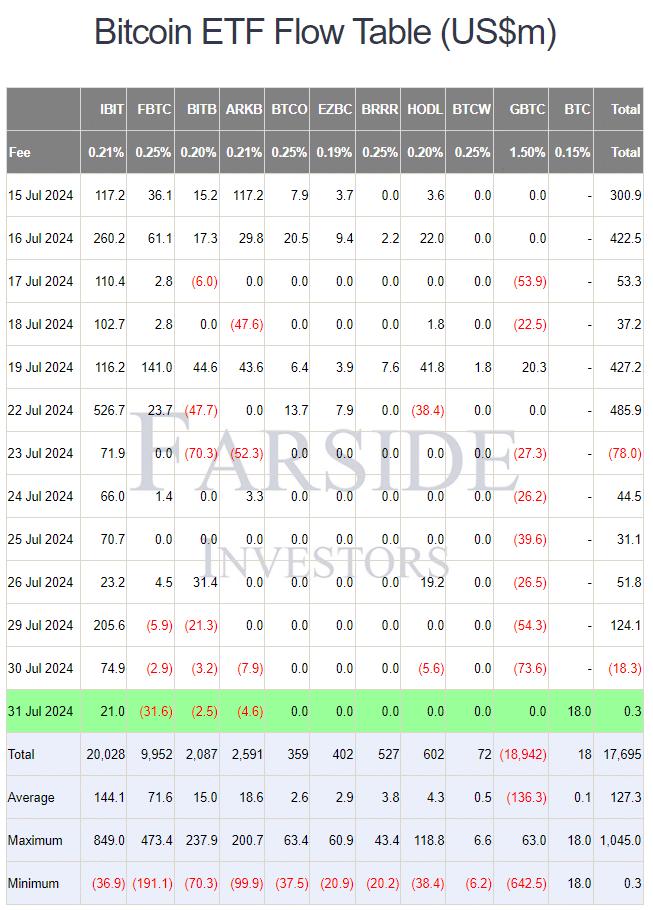

The ETF flows have been subdued over the past two days, a short-term sign of bearish sentiment. It likely will not dictate the long-term trend. That is due to liquidity and what the wider market expectations are.

The FOMC meeting threw a spanner in the works

The US Federal Reserve has not changed its benchmark fed funds rate from the 5.25%-5.5% range. While this was good news, it also did not give any positive indications about a September rate cut.

FOMC’s statement read,

“Inflation has eased over the past year but remains somewhat elevated.”

It continued,

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.”

Data from the CME FedWatch showed that the market does not expect a rate cut in mid-September. Before the FOMC meeting, this was not the case, and a 0.25% (25 basis point) rate reduction was anticipated in September.

This hawkish news might have led to Bitcoin’s prices tanking.

Clues from metrics and liquidation levels

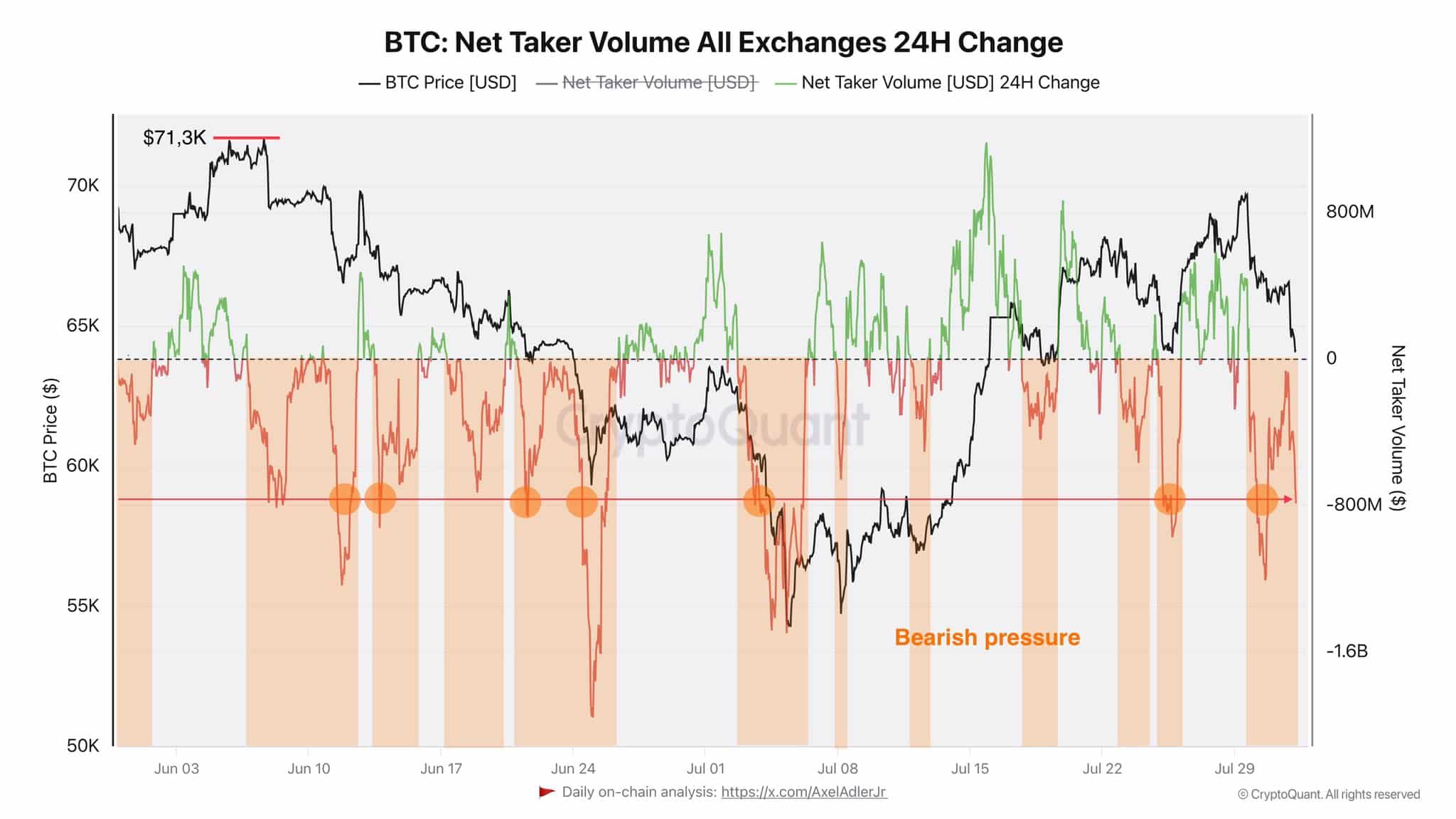

Source: Axel Adler on X

Crypto analyst Axel Adler posted on X (formerly Twitter) that the net taker volume has shown predominantly bearish pressure over the past two months.

Measuring the difference between taker buy and taker sell orders can give hints about the sentiment. For reference, taker indicates market orders and maker indicates limit orders.

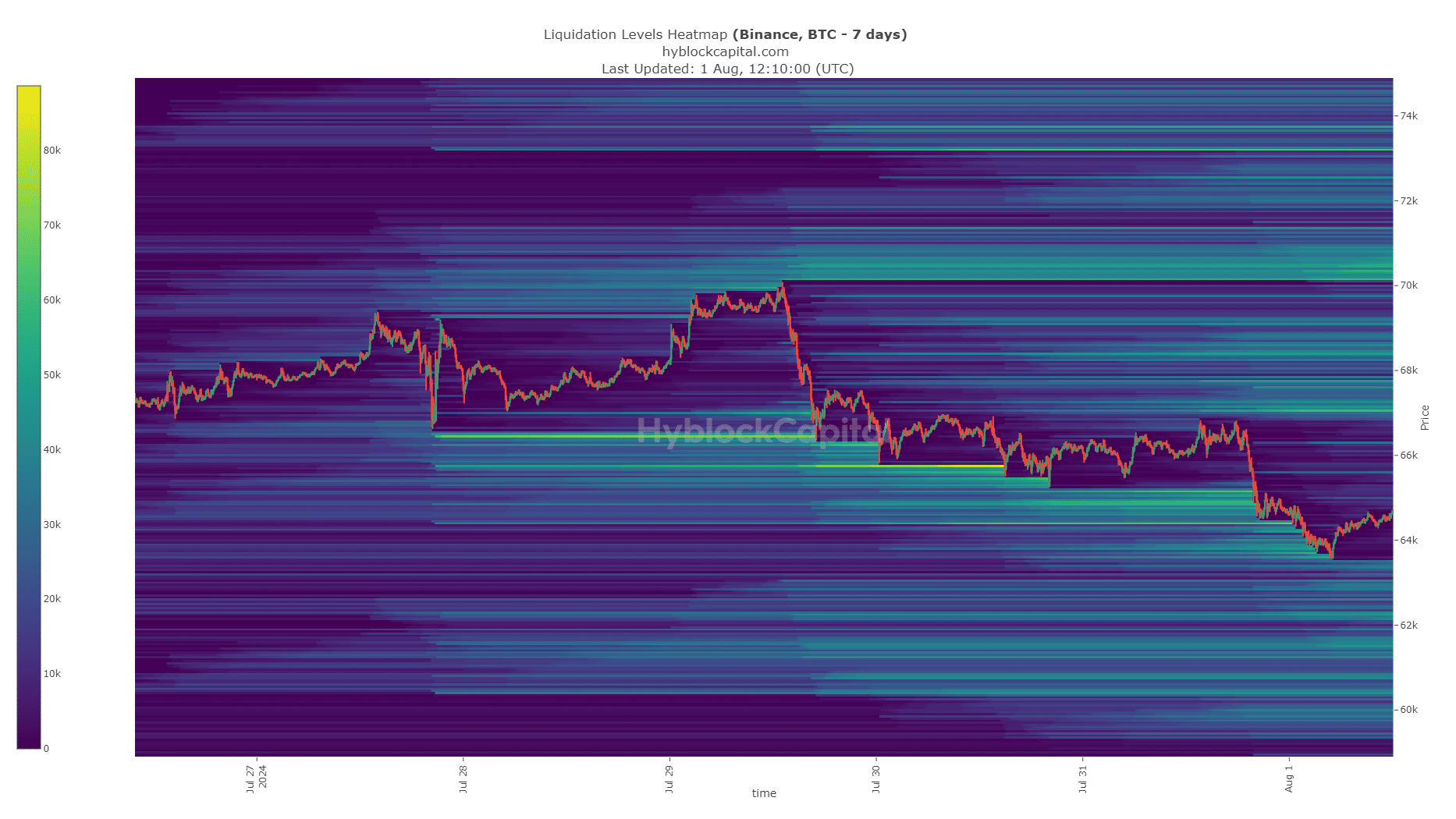

Source: Hyblock

Read Bitcoin’s [BTC] Price Prediction 2024-25

The liquidation cluster at $63.7k-$63.9k was reached, and the price has begun to move away from it. The short-term liquidation heatmap showed that $67k is the next target.

Overall, the market sentiment was bearish and the September expectations of a rate cut have been numbed. Together, they explained why the crypto market prices and sentiment were down in the past couple of days.