8M Shiba Inu tokens gone in a day: How will SHIB be impacted?

- Shiba Inu token burn rate soared by 2,400%, reducing its total supply further.

- A Crypto analyst predicts significant price increases for Shiba Inu despite current downturn

Shiba Inu [SHIB] is currently on a bearish trend along with the overall crypto market. At the time of writing, SHIB was trading at $0.00001588, down by 3.7% in the past 24 hours and 3.1% in the past week.

This negative price performance is quite noteworthy as it comes despite the uptick in the number of SHIB tokens burned in the past day.

Details of the burn

Token burning has become a significant point of interest for the Shiba Inu community.

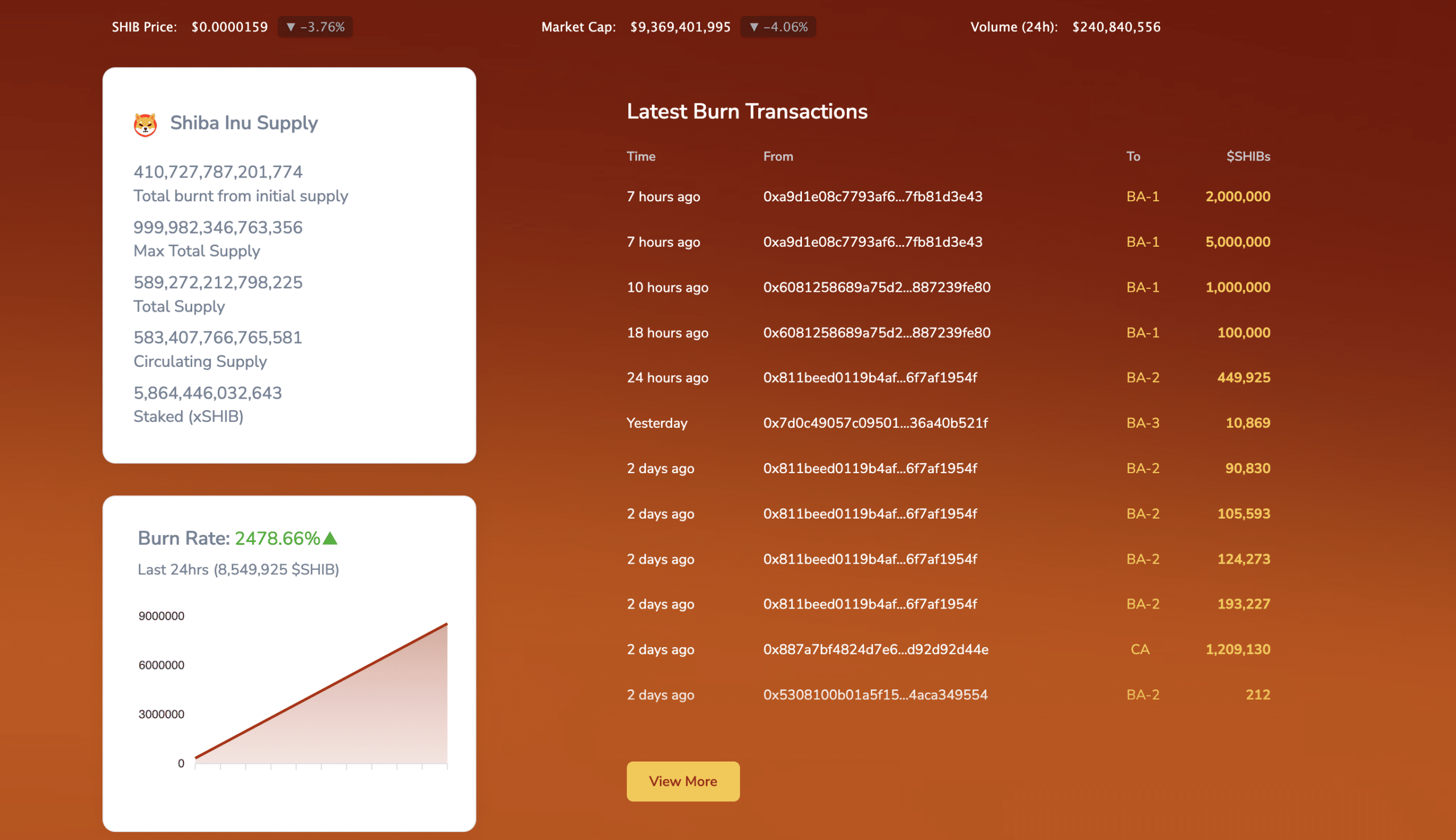

According to the data from Shibburn tracking platform, there has been a dramatic increase in burn rate, with approximately 8,549,925 SHIB tokens eliminated from circulation in the past day alone.

This aggressive approach to reducing the total supply has cut it down to about 589.27 trillion SHIB. Notably, the largest burns were initiated by the address labeled ‘0xa9,’ which removed about 7 million tokens in two separate transactions.

The phenomenon of token burning is often seen as a bullish signal by crypto investors, as reducing supply with sustained or increasing demand can lead to price appreciation.

Despite the recent price drops, the commitment to substantial burns has fueled optimism among certain segments of the SHIB community and analysts.

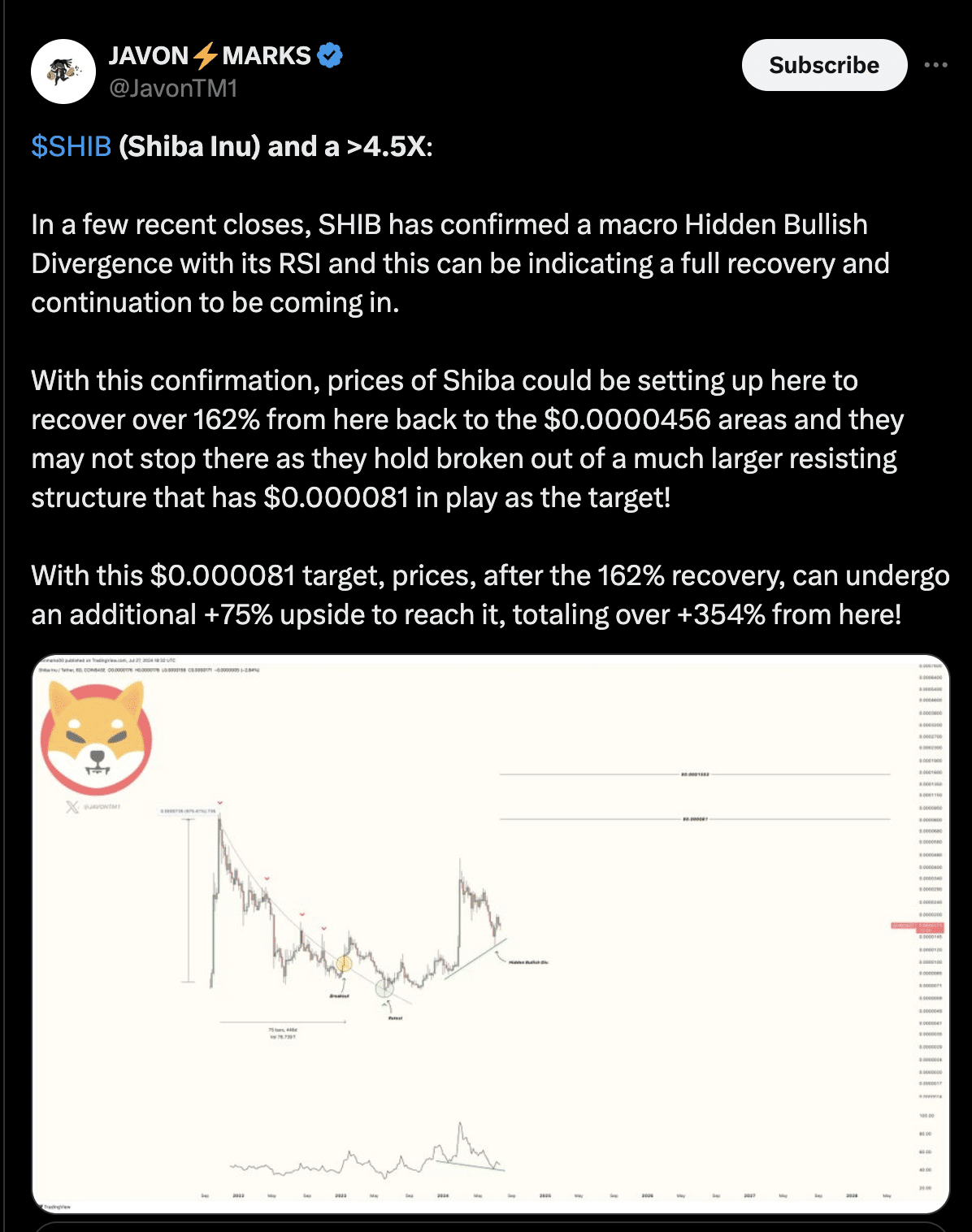

Prominent figures like crypto analyst Javon have projected significant potential rallies based on historical price movements and technical indicators such as the Relative Strength Index (RSI).

Javon’s analysis suggests that SHIB is poised for a recovery that could see its value increase by over 354% if the patterns hold true to past trends.

This analysis is supported by observations of macro hidden bullish divergences in SHIB’s RSI, a common predictive indicator of future price increases following consistent downward trends.

SHIB’s fundamental outlook

Despite the technical bullish signals, it is worth looking at SHIB’s fundamentals to see if the asset has any bullish move on the horizon.

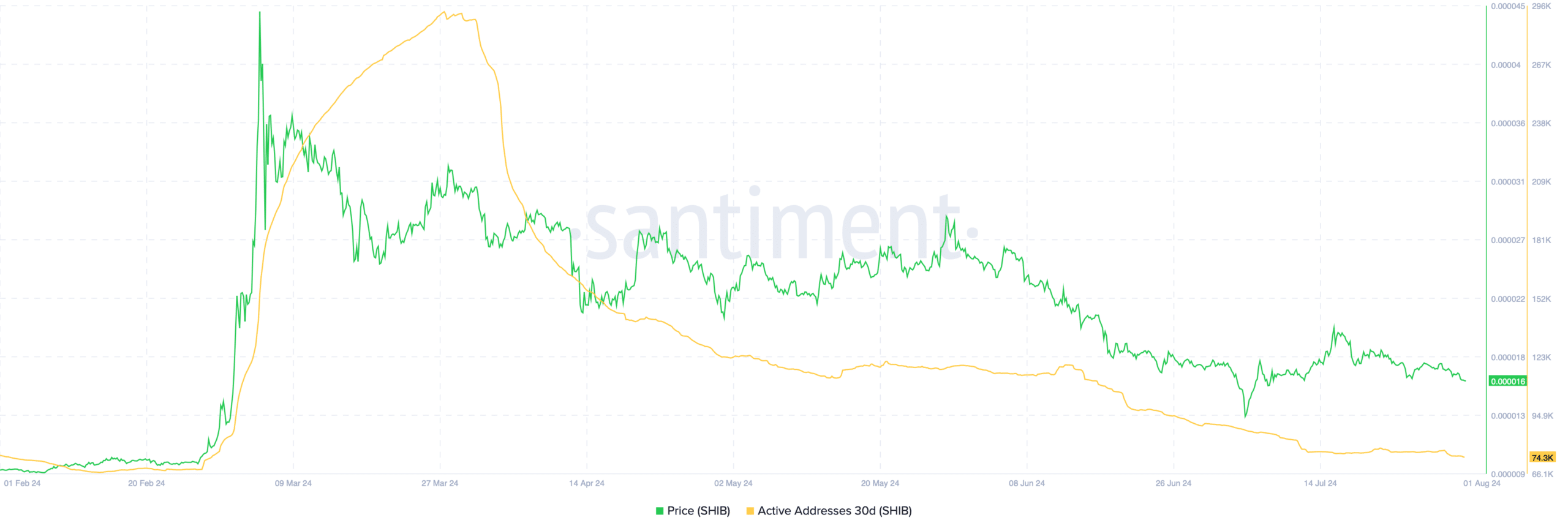

Recent data from Santiment indicates a decline in active addresses, which can be a bearish signal indicating reduced user engagement and transaction volume.

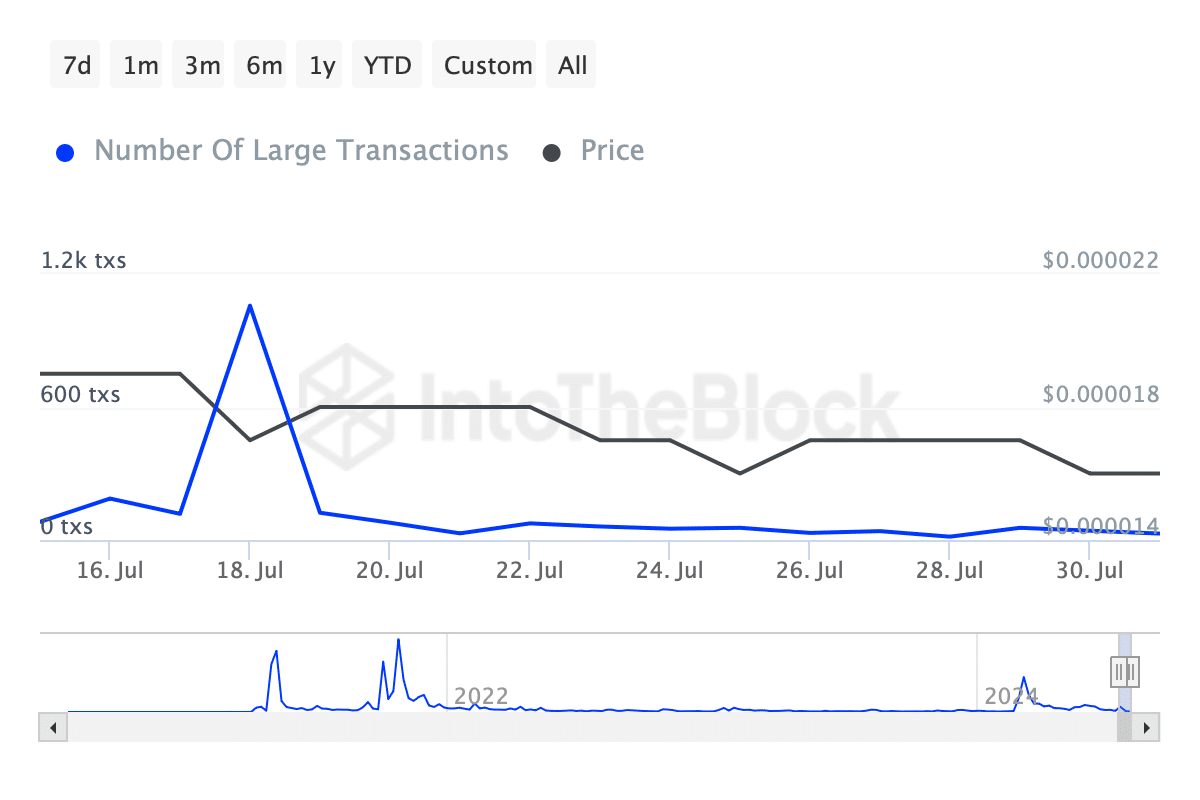

Moreover, SHIB’s large transaction activity, particularly transactions greater than $100,000 which is representative of whale movements, has seen a decline, suggesting possible caution among major investors.

According to data from IntoTheBlockfrom, from over 1,000 whale transactions as of 18th July this metric has now fallen to just 29 transactions as of 31st July.

Regardless of this grim performance from retail traders, AMBCrypto has recently reported that there are some key signs that points to a breakout

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)