As Bitcoin sell pressure eases, miners reap the benefits: Here’s how

- Bitcoin’s hash rate approached an all-time high, signaling miner confidence.

- Miners, in the meantime, transitioned from “extremely underpaid” to “underpaid” status.

Bitcoin [BTC] miners are making attempts to get back on track as the hash rate comes close to its all-time high.

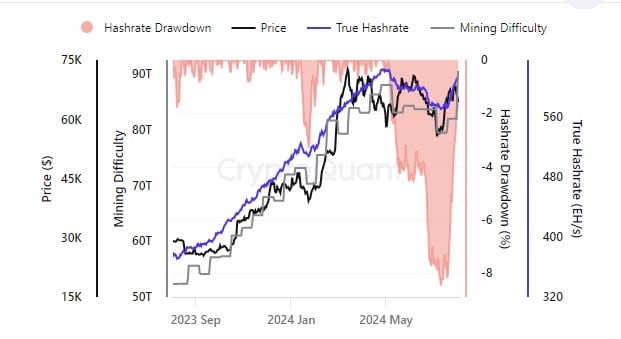

After months of a tough market, the Bitcoin hash rate was at 2% off its all-time high at press time, indicating renewed optimism for the network. This has driven up the hash rate and increased miner profitability.

In turn, this will reduce the selling pressure that has been weighing down the market.

Hash rate rebounds, but can it sustain?

The hash rate of the Bitcoin network has been significantly revived. According to the CryptoQuant, the rate was rapidly approaching its peak.

It is a comeback following a downturn when inefficient miners were forced to shut down their operations because they were not making any profits.

The recent price rally appeared to have drawn in miners, since the hash rate is now stable and even beginning to rise.

Miner profitability is changing from dire to just challenging as mining activity increases.

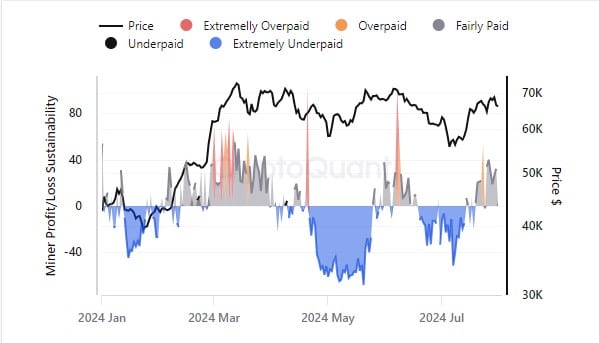

AMBCrypto’s analysis of data from CryptoQuant indicated that since the 20th of April, after Bitcoin’s halving, miners have been seriously underpaid.

Although prices started recovering, the profit-loss sustainability indicator has shifted to a less harsh position, suggesting that miners might be getting back on their feet again.

This may eventually reduce the necessity for them to sell Bitcoin in order to pay for costs and hence stabilize the market.

Easing selling pressure

The improvement in miner economics might result in diminished selling pressure for the industry.

Historically, in times of low profitability, miners have had to sell their Bitcoin to meet the costs of operation. Based on present patterns, miners could retain more of the coins they mined, and this may boost Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024-25

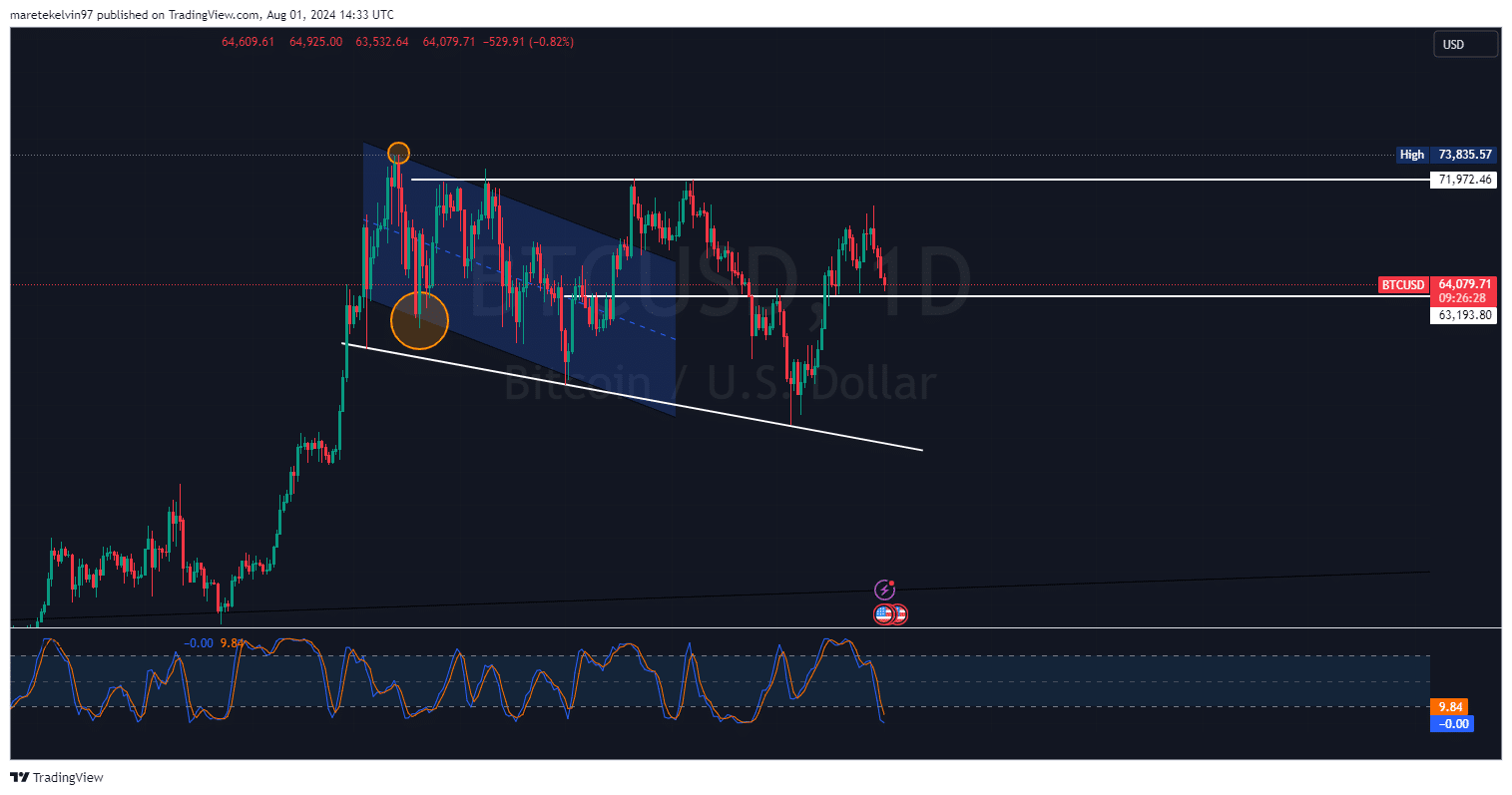

The most recent price movement highlighted that Bitcoin hovered around the $64,000 level, approaching a key support area. If miners sold less, it could help prevent further drops below the critical support point of $63,000.

As Bitcoin miners navigate the post-halving landscape, hash rate growth, miner profitability, and selling pressure will play a key role in determining whether Bitcoin is to retain support over $63,000 or keep on declining.