Analyzing PEPE’s 23% price fall – Time to take advantage of ‘fear?’

- Selling pressure on the memecoin rose dramatically over the last few days

- PEPE’s Fear and Greed Index was in an “extreme greed” position at press time

As the crypto market turned bearish, most cryptos, including PEPE, recorded major price corrections. Hence, it’s worth having a closer look at the memecoin’s current state to see whether there are any chances of this bearish trend changing anytime soon.

PEPE bears take over the market

PEPE witnessed a double-digit price correction last week. To be precise, the memecoin’s price dropped by over 23%. In the last 24 hours alone, the memecoin’s value plummeted by 7%. At the time of writing, PEPE was trading at $0.000009345 with a market capitalization of over $3.93 billion.

Notably, while the memecoin’s price dropped, PEPE’s number of long-term holders (addresses holding a token for more than 1 year) increased over the past several months.

In fact, as per IntoTheBlock, the number of PEPE long-term holders accounted for over 27% of total holders.

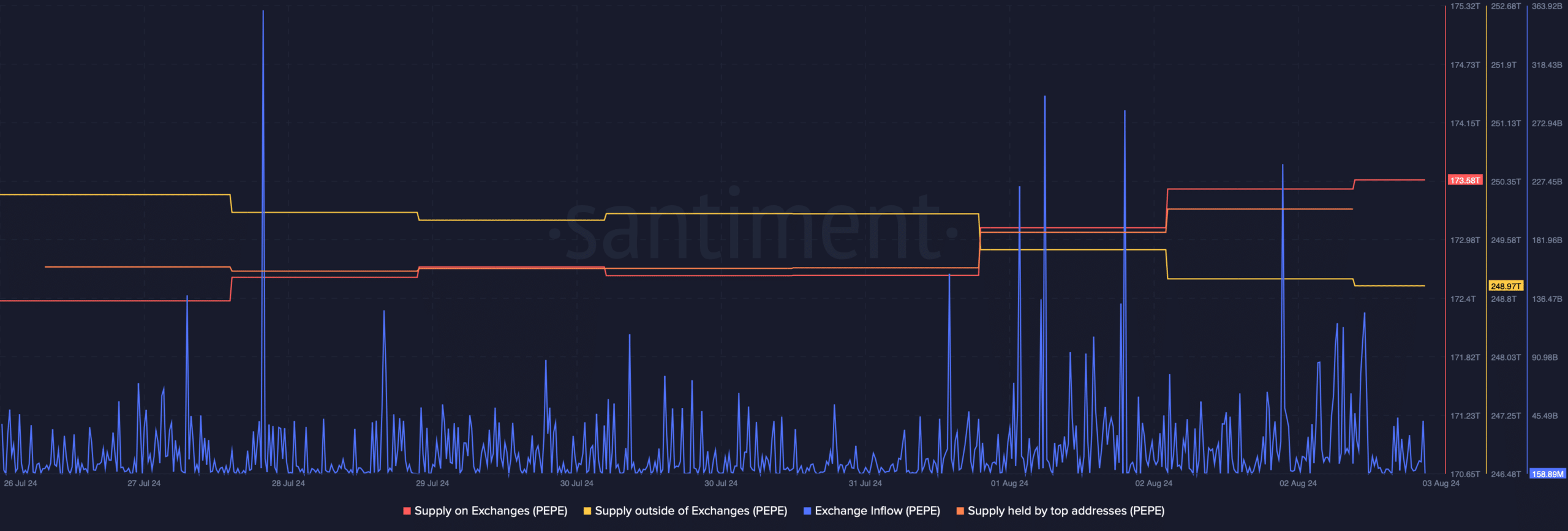

AMBCrypto then checked whether investors chose to buy this dip or not. Our analysis of Santiment’s data revealed that instead, investors have been selling.

This was the case as the memecoin’s supply on exchanges increased while its supply outside of exchanges dropped. The fact that investors were selling was further proven by the hike in its exchange inflows.

Even so, the whales followed a different route as they spurred their accumulation habits. This was evident from the increase in the supply held by top addresses.

Odds of a price hike on the charts

AMBCrypto then checked other datasets to better understand if there were any chances of a bullish trend reversal.

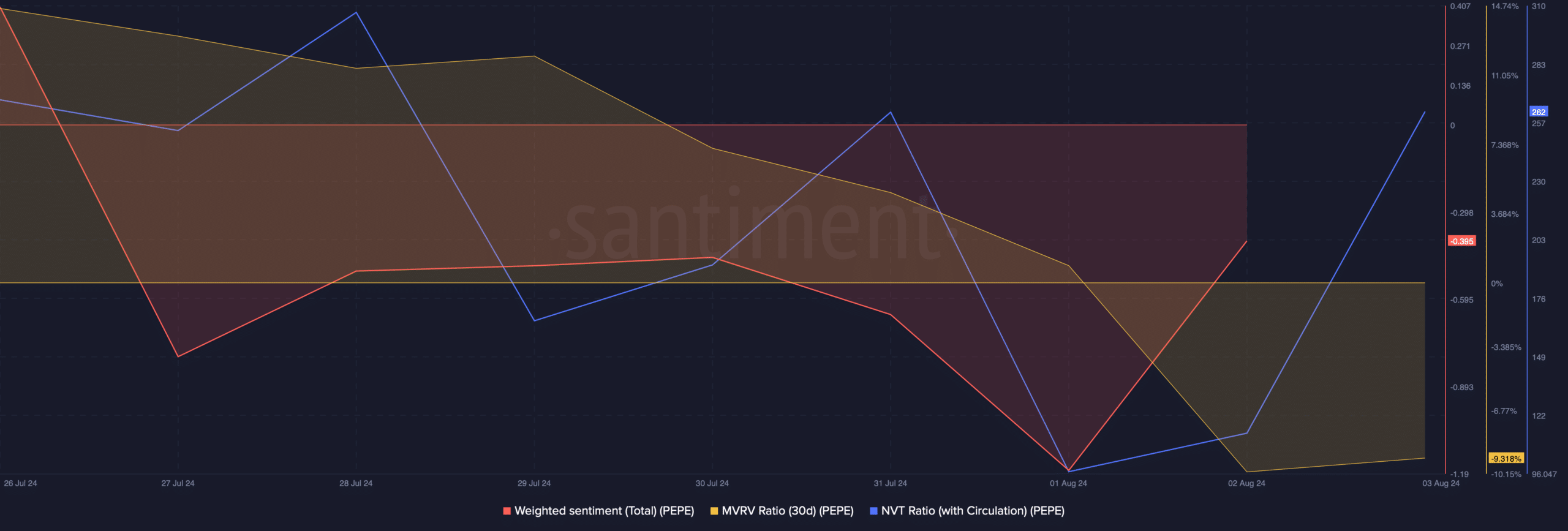

We found that the memecoin’s weighted sentiment dropped, meaning that bearish sentiment remained dominant in the market.

Another bearish metric was the MVRV ratio, which also dropped. Additionally, PEPE’s NVT ratio registered a sharp uptick – A sign that the memecoin was overvalued.

Nonetheless, the memecoin’s fear and greed index seemed optimistic.

At the time of writing, PEPE’s index had a value of 22%, meaning that the market was in an “extreme fear” position. Whenever the metric hits this level, it means that the chances of a price hike are very high.

Finally, we then took a look at the memecoin’s daily charts.

The technical indicator MACD projected a massive bearish advantage in the market. Its Chaikin Money Flow (CMF) registered a downtick, hinting at a sustained price decline on the charts.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

However, the Money Flow Index (MFI) and Relative Strength Index (RSI) moved somewhat sideways. This indicated that the market’s bearish momentum might recede in the coming days.