Bitcoin’s post-crash analysis: What went wrong for BTC in the last 24 hours

- Overleveraged traders engaging in JPY carry trade may have had their hands in the Bitcoin cookie jar.

- Direct and indirect exposure influenced crypto performance as BOJ hiked rates.

The tsunami of Bitcoin’s [BTC] sell pressure, which occurred last week and spilled over into the trading session on the 5th of August, appears to have run its course.

The markets have seen a slight recovery in the last 24 hours.

The fact that the crash was not limited to Bitcoin and crypto left many wondering what in the black swan was happening.

Many analysts observing the situation have come up with answers to explain the widespread selloffs in multiple markets. There is one plausible explanation that has been making rounds on the internet that has merit.

A carry trade on the Japanese Yen

A carry trade describes a scenario where investors borrow a currency that attracts low interest rates, they swap it for a higher rate currency and buy assets.

The Bank of Japan has been making headlines in the last few months due to their economic policy changes. This includes shifting from negative to positive rates.

More recently, on the 31st of July, the BOJ announced a 0.25% rate hike. This propped up the Japanese Yen’s value against the U.S. dollar.

As a result, highly leveraged investors that had engaged in a JPY carry trade were forced to liquidate their assets to pay off their loans.

Was Bitcoin exposed to the JPY carry trade?

It is possible that some of the investors that had engaged in the carry trade were directly exposed to Bitcoin.

These are individuals and institutions that saw an opportunity to secure low interest loans and invest in high yield assets. Bitcoin may have been among them.

Analyst suggest that the widespread exposure across multiple industries may explain why heavy selloffs were seen across different asset classes.

The subsequent fall out from the BOJ rate hike may also have resulted in secondary exposure to crypto. Short sellers were waiting for such an opportunity to capitalize on downside potential.

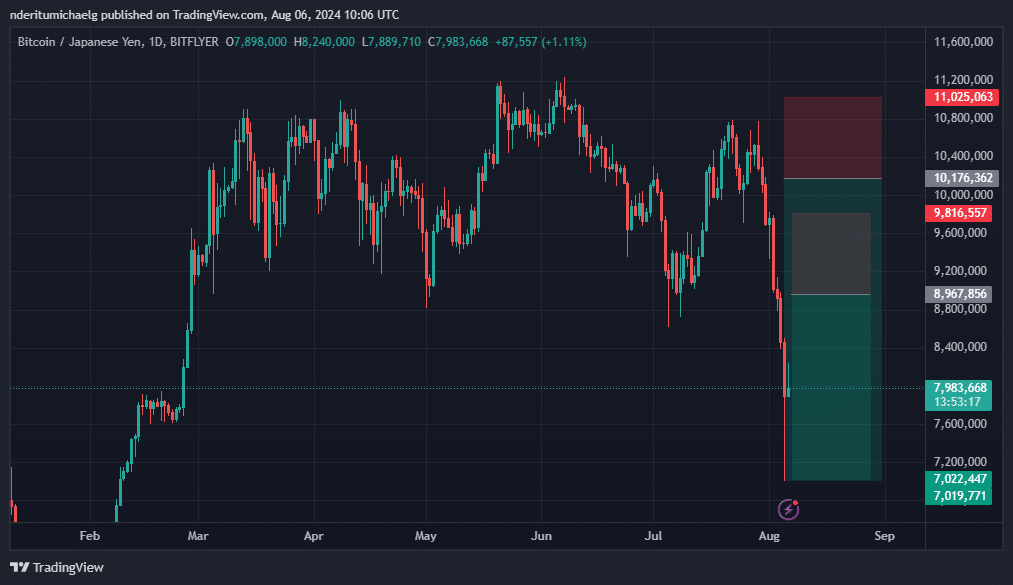

The FUD from the selloffs added more fuel for the bears. Bitcoin tanked by as much as 31% against the Japanese Yen since the 31st of July. The drop against the U.S. dollar was slightly lower at 25%.

The same reasons for the recent rash also underscore a potentially slow recovery. Nevertheless, the dip may also be seen as a potential buy opportunity.

That may not necessarily indicate that BTC and crypto, at large, are out of the woods yet.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin experienced multiple bullish news that propped up the bulls or bullish optimism in July. Another negative news event may expose crypto to yet more downside in the next few weeks.

Therefore, this uncertainty highlights a potential reason why Bitcoin’s recovery might be slower than expected before FOMO floods back in.