XRP and Ripple’s long-term outlook – Here’s what needs to change soon

- Ripple Labs made headlines after announcing a major partnership

- XRP has the lowest total value locked among top 10 popular cryptocurrencies

It’s been a good few days for XRP and Ripple. Not only is the popular altcoin recovering somewhat on the price charts after a major bout of depreciation, but the blockchain firm made news after it announced a partnership with the DIFC Innovation Hub in the UAE. This, on the back of the firm announcing a fund worth $1 billion XRP to support the work of developers wishing to work on XRPL.

Additionally, XRP has been approved by the DFSA for use by licensed firms in the DIFC.

That’s not all either as the XRP ledger testnet will reset on 19 August at 3 AM EST for 15 minutes to improve stability.

Finally, Ripple is also preparing to launch its RLUSD stablecoin for instant cross-border payments, with XRP acting as the bridge currency to provide liquidity.

Source: X

Despite some positive fundamentals for the blockchain, however, some on-chain metrics remain negative.

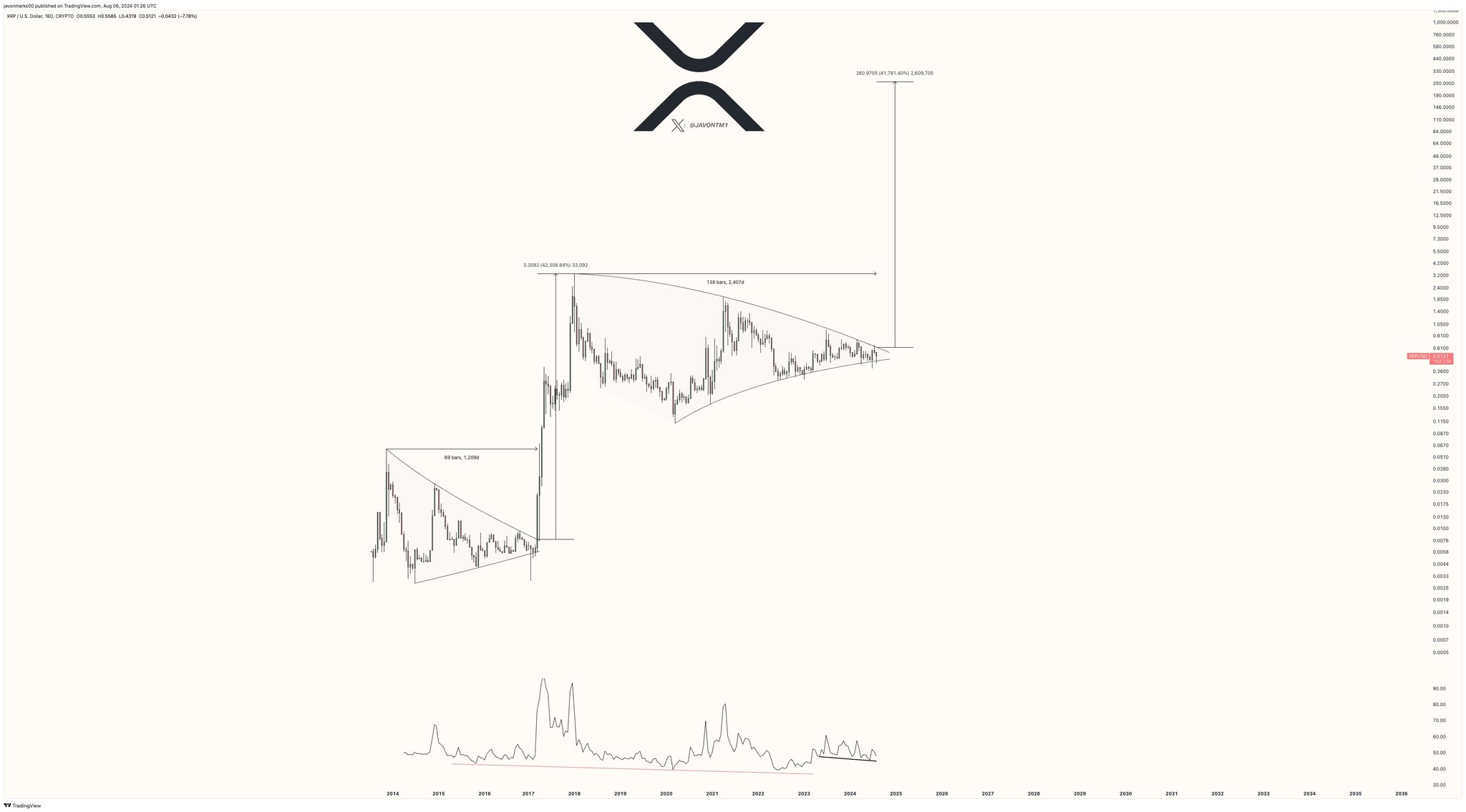

Deep dive into XRP’s 7-year consolidation

While other cryptocurrencies are hitting new all-time highs due to widespread adoption, XRP has remained stuck in a seven-year consolidation phase.

And, this prolonged period of stagnation shows no signs of ending soon. In fact, to some, the idea of XRP breaking out to new highs might be a fantasy that the crypto community needs to accept.

Looking at the charts, for instance, the descending triangle pattern seemed to suggest that the price may be more likely to drop further, rather than rise to new heights.

Simply put, this technical formation indicated that XRP could face more declines instead of achieving the anticipated breakout. This, despite the fact that the crypto has hiked by +10% in the last 24 hours alone since it doesn’t quite invalidate it’s long-term PoV yet.

An analysis of the metrics

An analysis of XRP’s long-term on-chain data, including price, social activity, network metrics, total supply, and number of holders, also suggested that its consolidation may persist.

Consider the aforementioned graph, for instance – It pictured a sharp decline, indicating minimal wallet activity. This lack of interest from investors and traders can be a sign of XRP’s prevailing stagnancy.

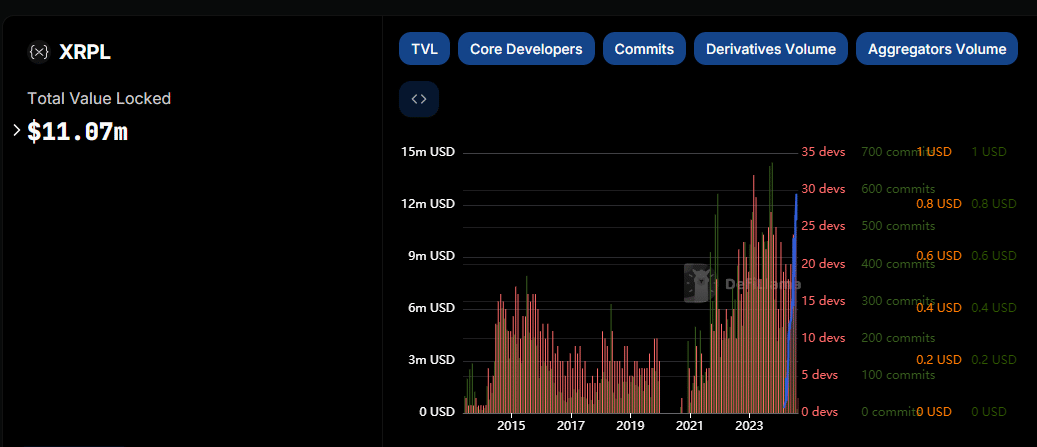

Low numbers

Here, it’s worth pointing out that Ripple has only $11.07M in total value locked.

On the contrary, the likes of Ethereum, Tron, Solana, and Binance Smart Chain have figures of $47B, $7.3B, $4.8B, and $4.1B respectively, dwarfing Ripple’s value considerably.

This can be interpreted as a sign that it is struggling, despite a $3M increase in TVL since February – A figure that is insignificant for the stature of Ripple and XRP.

Metrics like developer activity and trading volumes also alluded to the notion that XRP’s 7-year consolidation might just continue.