BNB struggles amid market panic: Will THIS group gain the most?

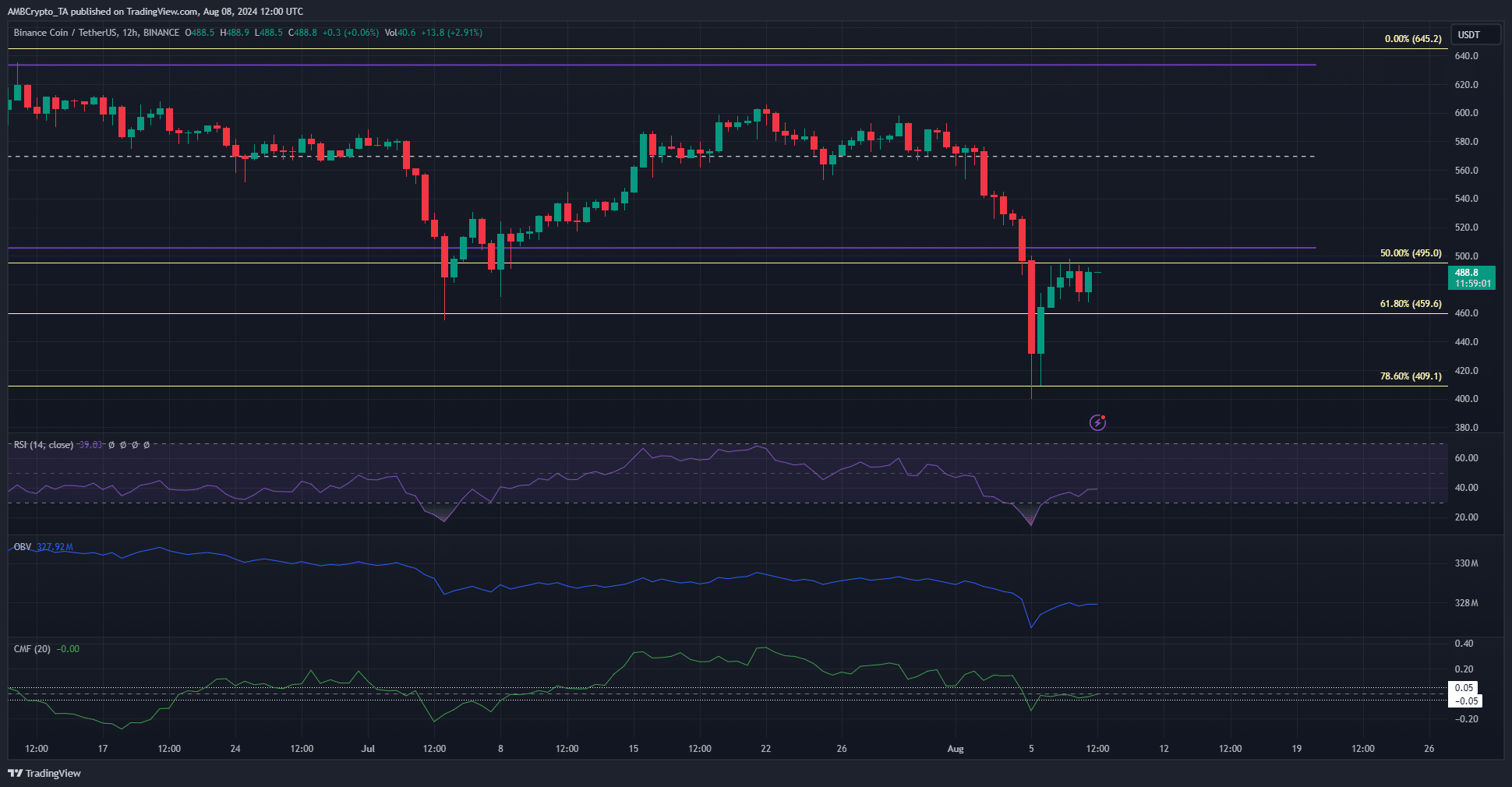

- Short sellers can enter a trade after a minor price bounce followed by a rejection.

- A sustained move beyond $514 would overturn the bearish thesis.

Binance Coin [BNB] was impacted by the harsh bearish sentiment across the market. It has not initiated a recovery, and its social media sentiment remained negative.

Speculators were not convinced the exchange token was likely to make gains in the near term.

Analysis of the Binance inflows and BNB’s price action also painted a bearish picture. Here’s how traders can navigate the next few trading days.

Inflows reflect market shock and panic selling

Binance inflows metrics from DefiLlama showed that, since the 5th of August, there have been $5.37 billion worth of inflows to the centralized exchange.

These inflows were likely the result of panic in the market and reflected crypto transfers with the intent to sell.

This has bearish implications for the market, including the exchange token BNB. The recent legal troubles for Binance do not help the bulls’ case either.

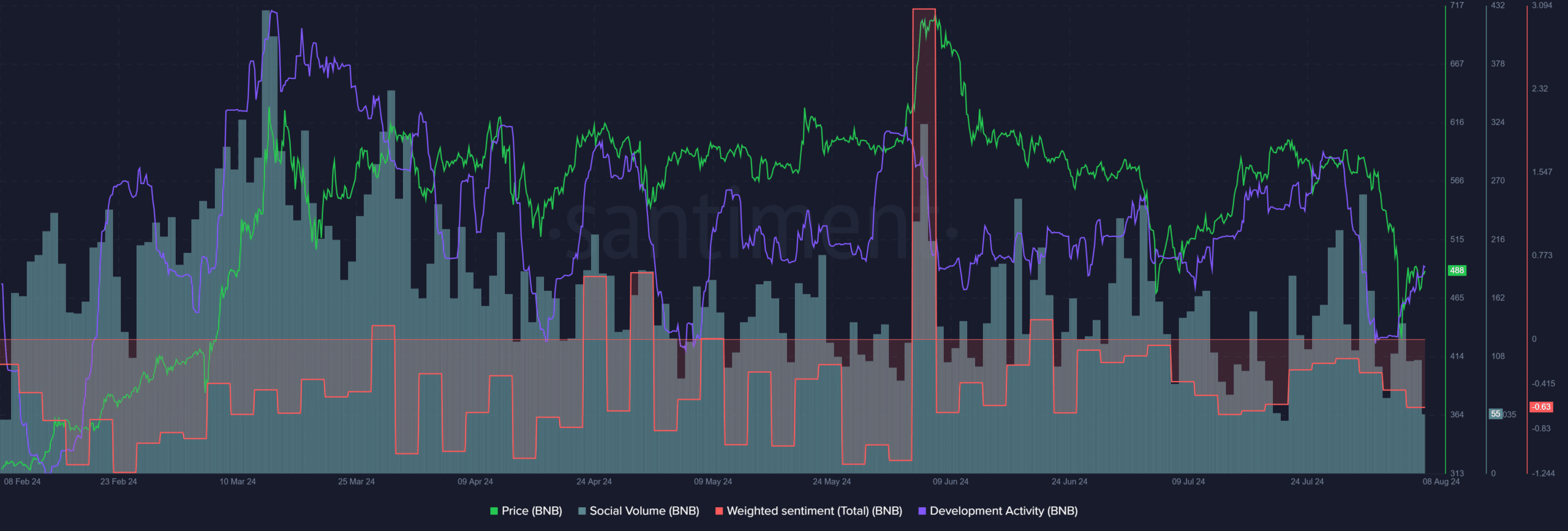

Source: Santiment

The Weighted Sentiment was negative and social volume has dipped over the past ten days. The development activity has been relatively consistent since May but saw a sharp drop over the past two weeks.

This could concern investors.

The token prices were below the range lows at $505 and maintained their bearish bias. The OBV was pointed lower but the CMF was neutral, and its drop back below -0.05 would be a sign of caution for buyers.

Gauging the potential for a short-squeeze

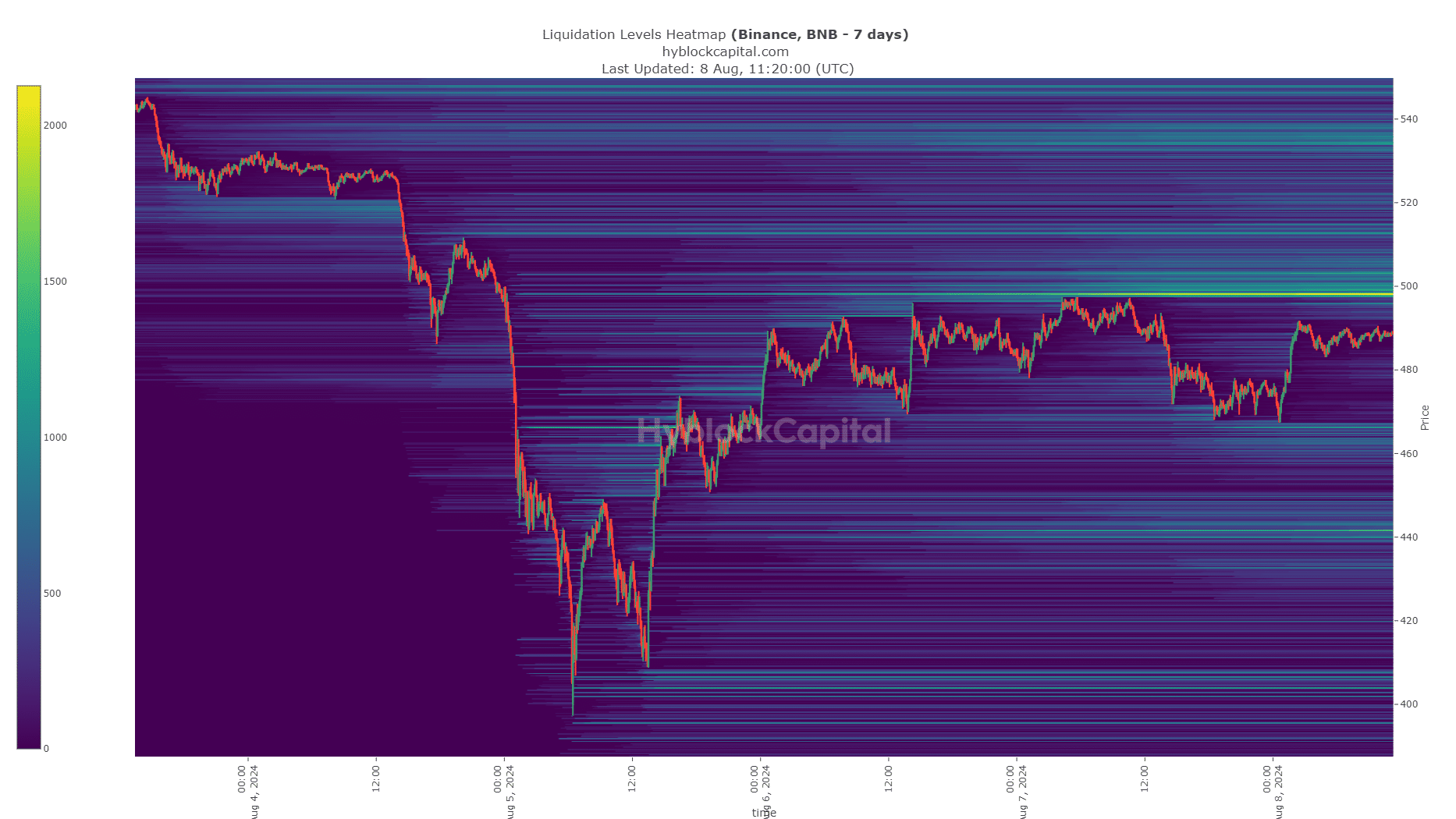

AMBCrypto observed that the global long positions percentage for a 3-day look back period showed 2.19% long positions for BNB. This showed that speculators were predominantly bearish, fueling a short squeeze.

Source: Hyblock

The liquidation heatmap supported this idea. There was a band of liquidity at the $497 level, stretching up to $502. This liquidity could attract prices higher.

Read Binance Coin’s [BNB] Price Prediction 2024-25

Overall, the sentiment on social media and in Futures markets was firmly bearish. Technical analysis showed that $505-514 was a bearish order block on the 12-hour chart.

Therefore, traders can anticipate a bearish reversal from this zone.