Bitcoin exchange reserve hits 2018 low: How will it affect BTC prices?

- Bitcoin’s exchange reserve dropped to the level that was seen in 2018.

- Long-term investors were confident in BTC, but a few indicators were bearish.

Bitcoin [BTC] has once again gained bullish momentum as it was fast approaching the $60k target. This just might be the tip of the iceberg, as the coin has the potential to reach new highs soon. Let’s have a look at why that was the case with BTC.

Is a big move likely?

As per CoinMarketCap’s data, BTC’s price increased by over 6% in the past seven days. In the last 24 hours also, the bullish trend continued as the king of crypto’s price rose by more than 1%.

At the time of writing, BTC was trading at $59,256.11 with a market capitalization of over $1.17 trillion.

Meanwhile, Titan of Crypto, a popular crypto analyst, posted a tweet highlighting that BTC was following a past trend. As per the tweet, in past cycles, BTC has always reached new highs after beginning its 3rd parabolic advance stage.

To be precise, such episodes happened back in 2013, 2017, and 2021. At the time of writing, BTC had reached the support level from which it could begin its third advance.

Therefore, there were chances of this bull rally pushing BTC to an all-time high in the coming months.

Odds of Bitcoin reaching an ATH in 2024

Since there were chances of a massive bull rally, AMBCrypto planned to have a closer look at the king of cryptos’ state.

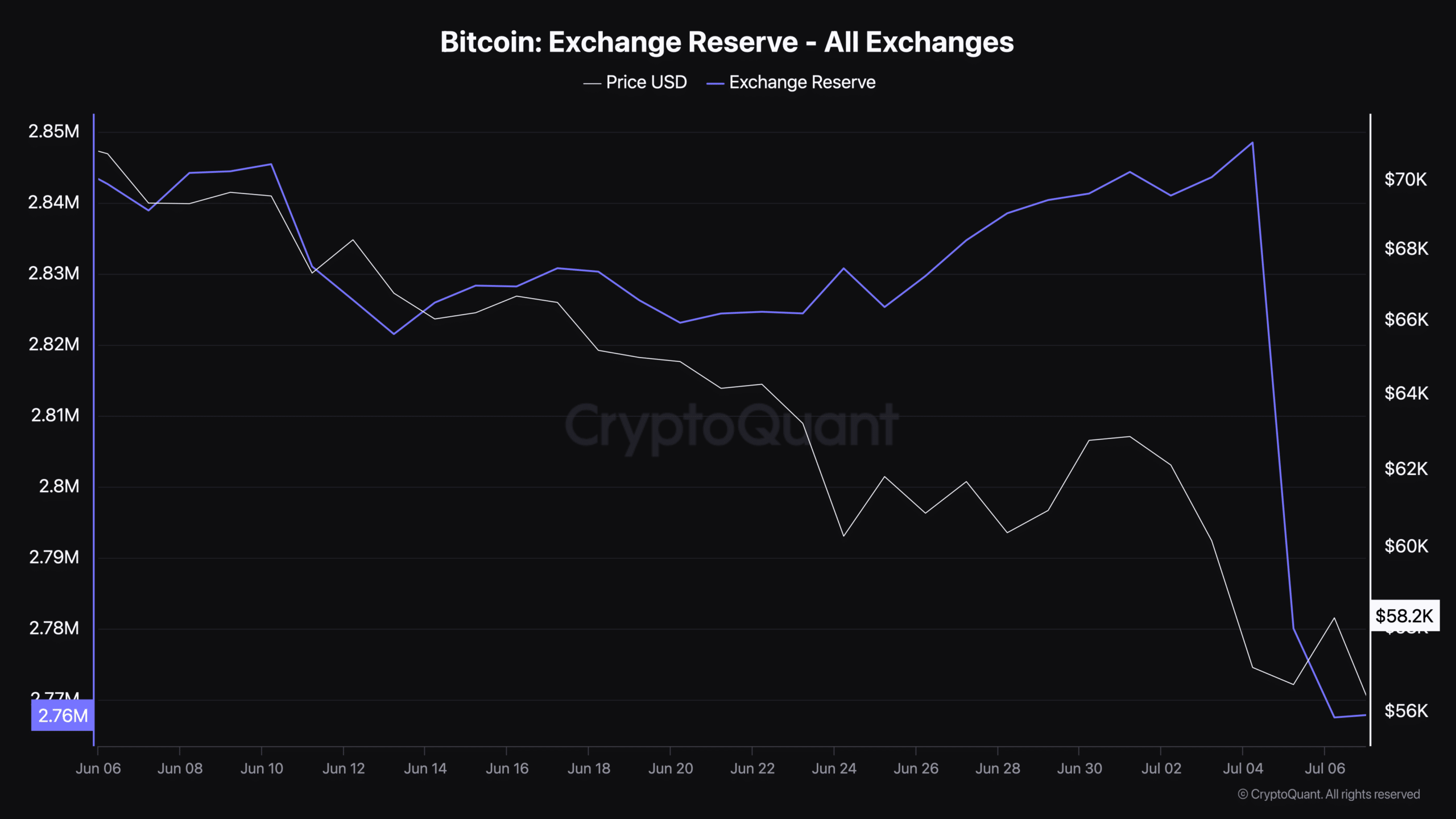

As per our analysis of CryptoQuant’s data, Bitcoin’s exchange reserve reached as low as it was seen back in 2018. This clearly indicated that buying pressure on the coin was increasing, which is considered a bullish signal.

Apart from that, BTC’s Binary CDD was green, meaning that long-term holders’ movement in the last seven days was lower than the average. They have a motive to hold their coins.

However, the aSORP looked troublesome as it was red. This suggested that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

Therefore, AMBCrypto planned to have a look at the daily chart of Bitcoin to better understand whether it could sustain this upward trajectory.

Is your portfolio green? Check out the BTC Profit Calculator

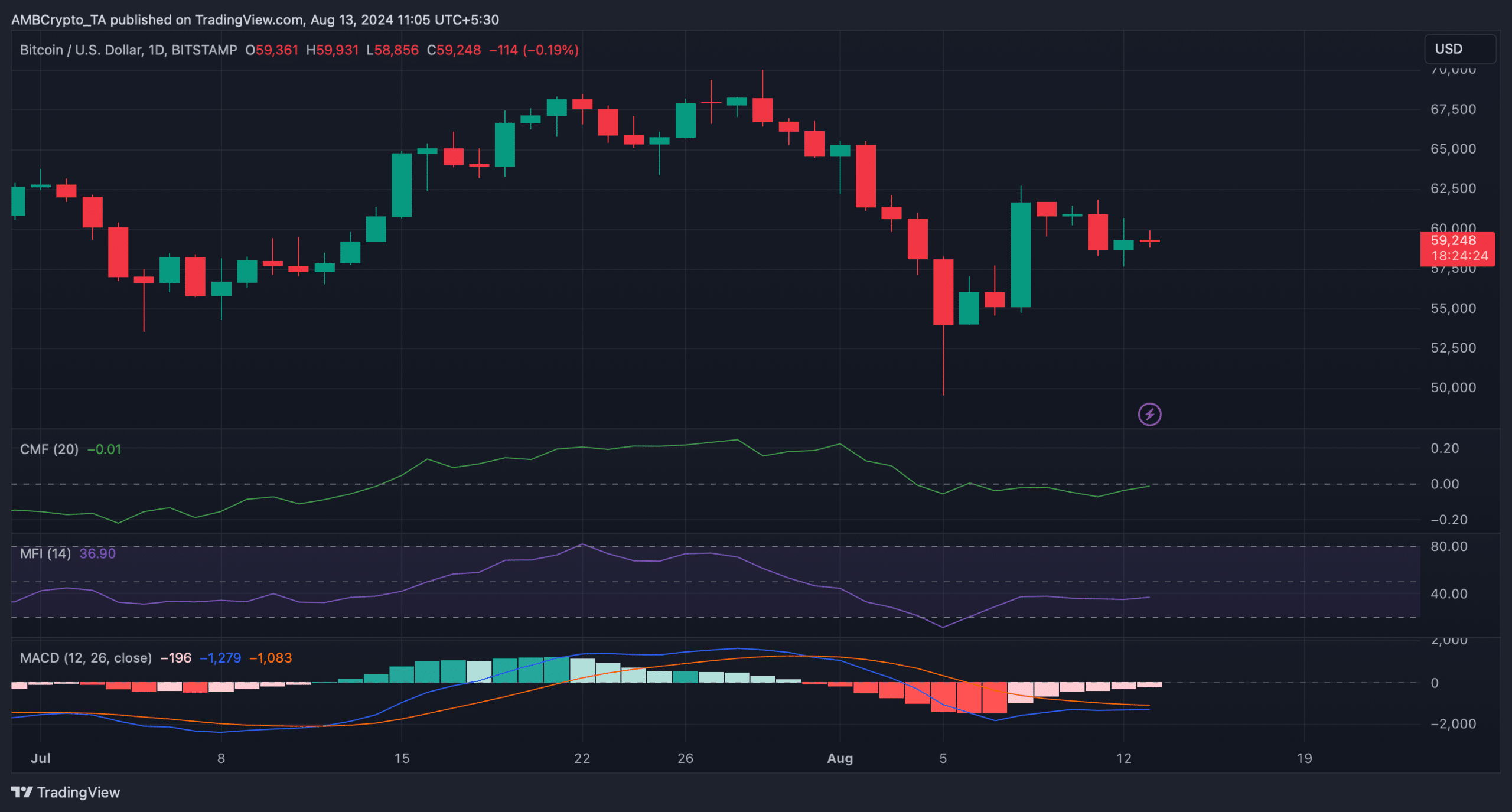

The technical indicator MACD displayed that the bulls were trying to catch up with the bears.

BTC’s Chaikin Money Flow (CMF) gave hope of a bullish takeover as it went northward. Nonetheless, the Money Flow Index (MFI) moved sideways, indicating a few slow-moving days ahead.