Unpacking what’s next for Bitcoin as Metaplanet stocks up on 57.1 BTC

- Metaplanet buys another $3.3 million worth of BTC.

- The recent purchase is a part of the company’s Bitcoin accumulation strategy.

Over the past seven months, major crypto companies have turned to Bitcoin to boost their stock.

Amidst increased institutional interest as companies bet on Bitcoin’s future value, Japanese Metaplanet has been on a buying spree to accumulate as much BTC as possible.

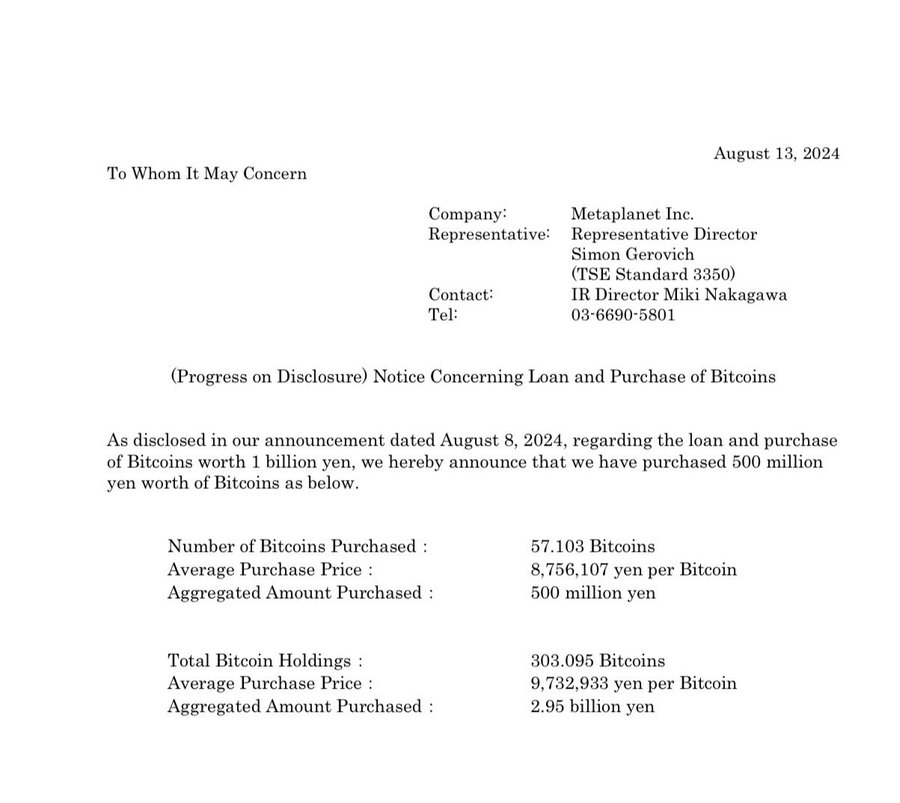

Metaplanet buys BTC worth ¥500 million

Barely a week ago, Metaplanet secured a loan of ¥1 billion to acquire more BTC. The company’s CEO, Simon Gerovich, through his official X (formerly Twitter) page, shared,

“Always be staking #bitcoin.”

The recent acquisition is a part of the broader company’s strategy to accumulate BTC. The company hopes to stake its future value in something like America’s MicroStrategy on BTC.

Metaplanet’s BTC Strategy

As reported earlier by AMBCrypto, Metaplanet has been on a buying spree to increase the total BTC holding through long-term accumulation.

The recent purchase of 57.103 worth $3.3 million brings the company’s total BTC stockpile to 303.95 Bitcoins worth $18 million. The purchase is as part of various purchases over the past months.

On the 28th of May, the company bought $1.6 million worth of BTC. In July, it purchased 19.87 BTC worth $1.7 million. In June, it purchased $1.59 worth of Bitcoin.

With another 21.877 BTC purchase, the company has ensured a continuous accumulation and holding of BTC.

Impact on Metaplanet

Notably, Metaplant’s Bitcoin strategy has made the Japanese one of the key players among global institutions.

According to data from CoinGecko, Metaplanet was at the 20th position among the largest institutional holders of BTC.

Therefore, this strategy has paid off, seeing the company stock rise exponentially. Google Finance said the stock has increased by 82.87% over the past five days.

This surge has seen the stock rise by 600.63% over YTD. This surge shows that the strategy is paying for the company.

Metaplanet has experienced a considerable rise over the past seven months, and with the projected value of BTC, the accumulation is positioned to make the company a key player.