Ethereum to $3K and beyond? Yes, but on THIS major condition!

- There is a high chance that ETH could reach $3,000 or more in the coming days.

- ETH’s Open Interest has jumped by 5.5% in the last 24 hours, indicating increased interest from investors.

On the 14th of August, the overall cryptocurrency market had experienced impressive upside momentum, following the massive 4.5% price surge in Bitcoin [BTC].

Amid this bullish trend, Ethereum [ETH], the world’s second-biggest cryptocurrency, gained significant attention from the crypto community due to its notable price surge and recent breakout.

Ethereum: Upcoming levels

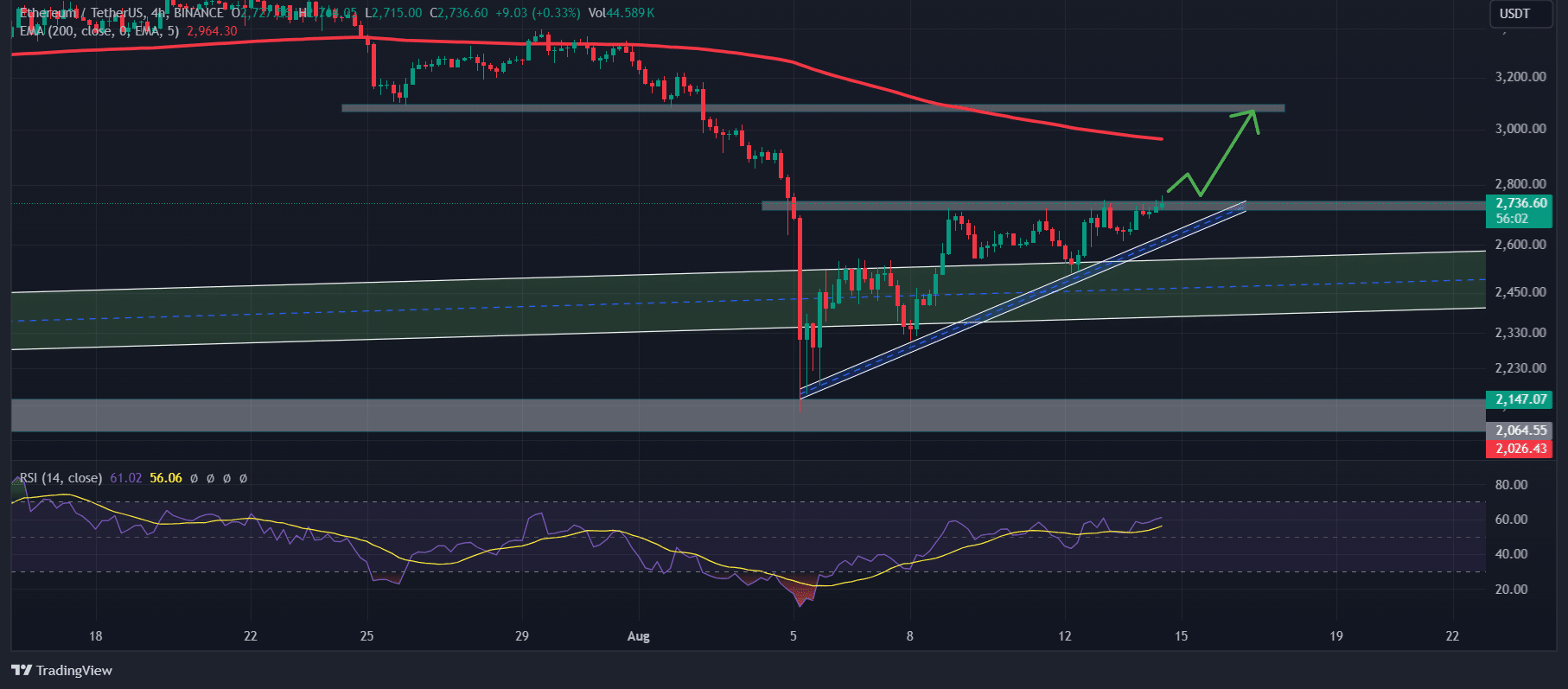

According to expert technical analysis, ETH looked bullish as it recently gave a breakout of an ascending triangle price action pattern in a 4-hour time frame.

However, this breakout occurred near a strong support level of a rising trendline.

Based on the historical price momentum since 2022, whenever ETH has reached this trendline it has always experienced a massive upside rally.

However, this breakout has shifted the sentiment to bullish and there is a high chance that ETH could reach $3,000 in the coming days.

If the bullish momentum continues, it has the potential to hit the $3,200 level.

At press time, ETH was trading below the 200 Exponential Moving Average (EMA) in a 4-hour time frame.

ETH’s technical analysis

Following this breakout, the ETH’s Open Interest has jumped by 5.5% in the last 24 hours, indicating increased interest from investors and traders.

At press time, ETH was trading near the $2,750 level, having experienced a price surge of over 4.5% during this period.

Meanwhile, its trading volume has decreased by 24%, showing lower participation from traders and investors.

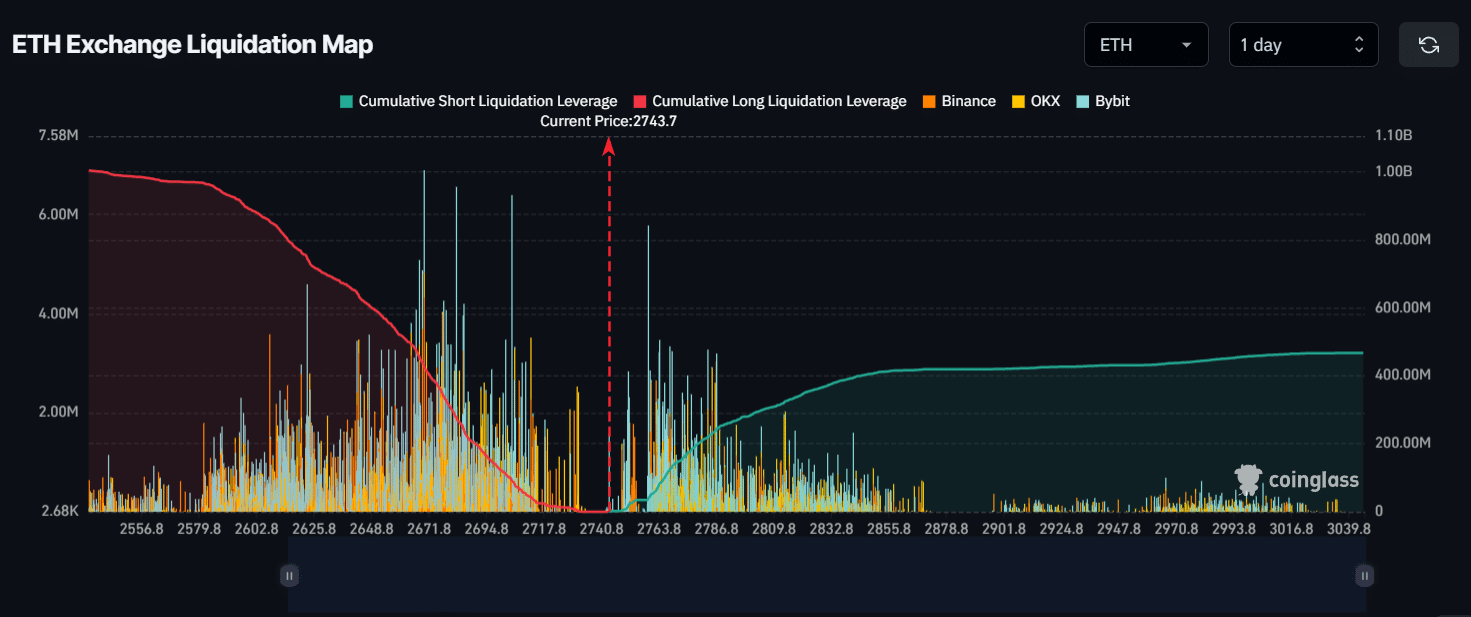

Also, major liquidation levels were at $2,670 on the lower side and $2,760 on the upper side, according to the on-chain analytic firm Coinglass.

Is your portfolio green? Check out the ETH Profit Calculator

If the sentiment remains bullish and the price rises to the $2,760 level, nearly $34.75 million of short positions will be liquidated.

Conversely, if sentiment shifts and the ETH price falls to the $2,670 level, nearly $430 million of long positions will be liquidated.