Can PEPE bulls turn the tide? Important levels to watch out for

- Bulls were weak but could force a sentiment shift at the Fibonacci retracement level.

- The liquidity cluster around $0.000014 is likely to attract prices to it but will need time to play out.

Pepe [PEPE] was unable to push past the $0.0000085 zone that had served as support in July.

Whale purchases in recent days did not shore up the bullish sentiment, and the meme coin was headed toward the nearest support zone.

The formation of a symmetrical triangle held some promise on the higher timeframes, but again is unlikely to support the bullish cause in the coming days.

The vital Fibonacci retracement level is the next target

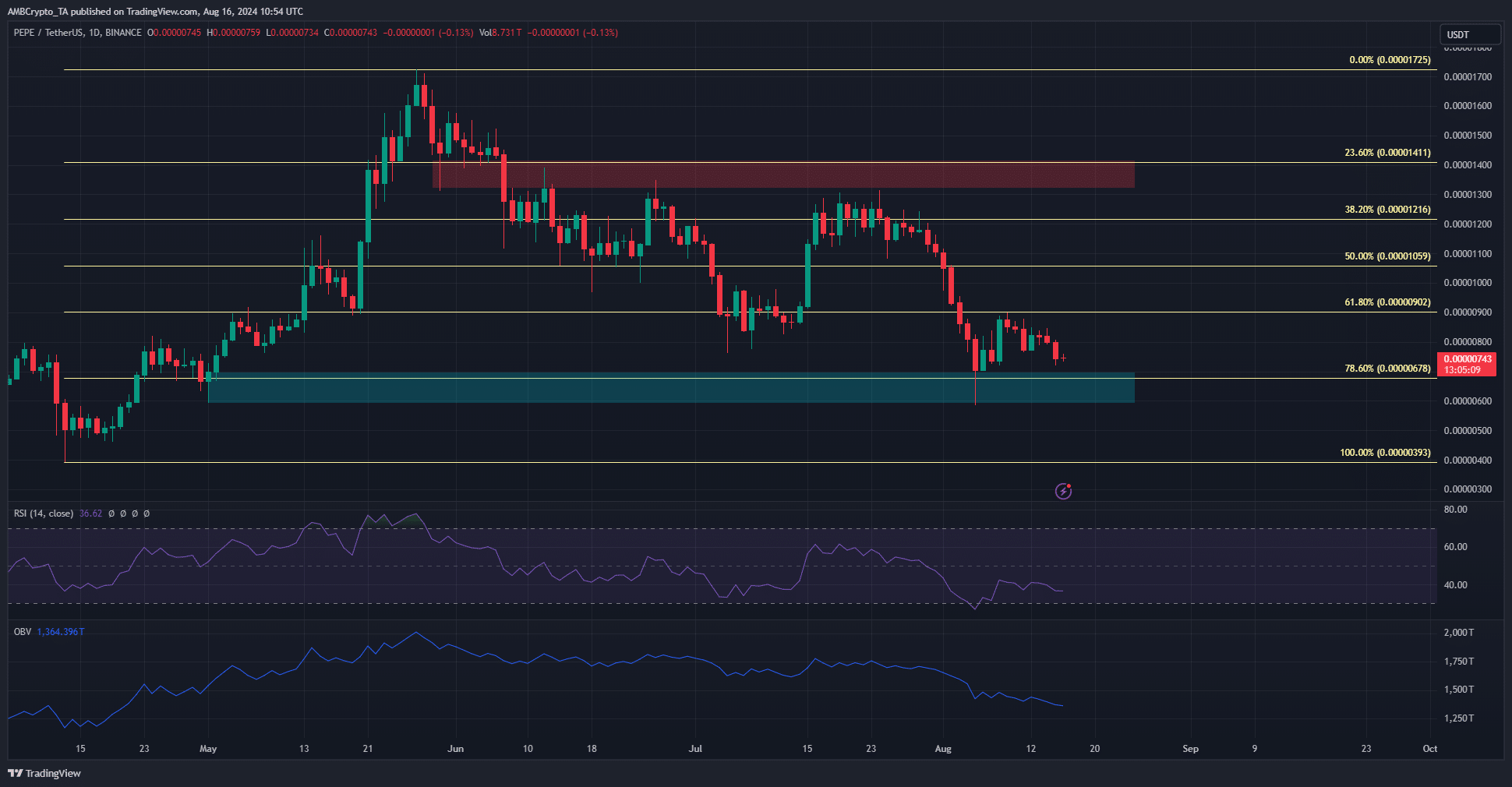

The 78.6% level at $0.00000678 is the next target. The daily RSI showed strong bearish momentum and the OBV noted steady selling volume in the past three weeks.

The sellers were so strong, it was possible that the nearby support might not hold.

PEPE bulls would be hoping this is not the case, but need to be prepared for it all the same. A price drop to $0.000004 in the next month or two can’t be ruled out.

An uptick in the OBV would be hugely encouraging, as would an RSI crossover above neutral 50. Swing traders can try to buy near the local lows at $0.000006 with a relatively tight stop-loss.

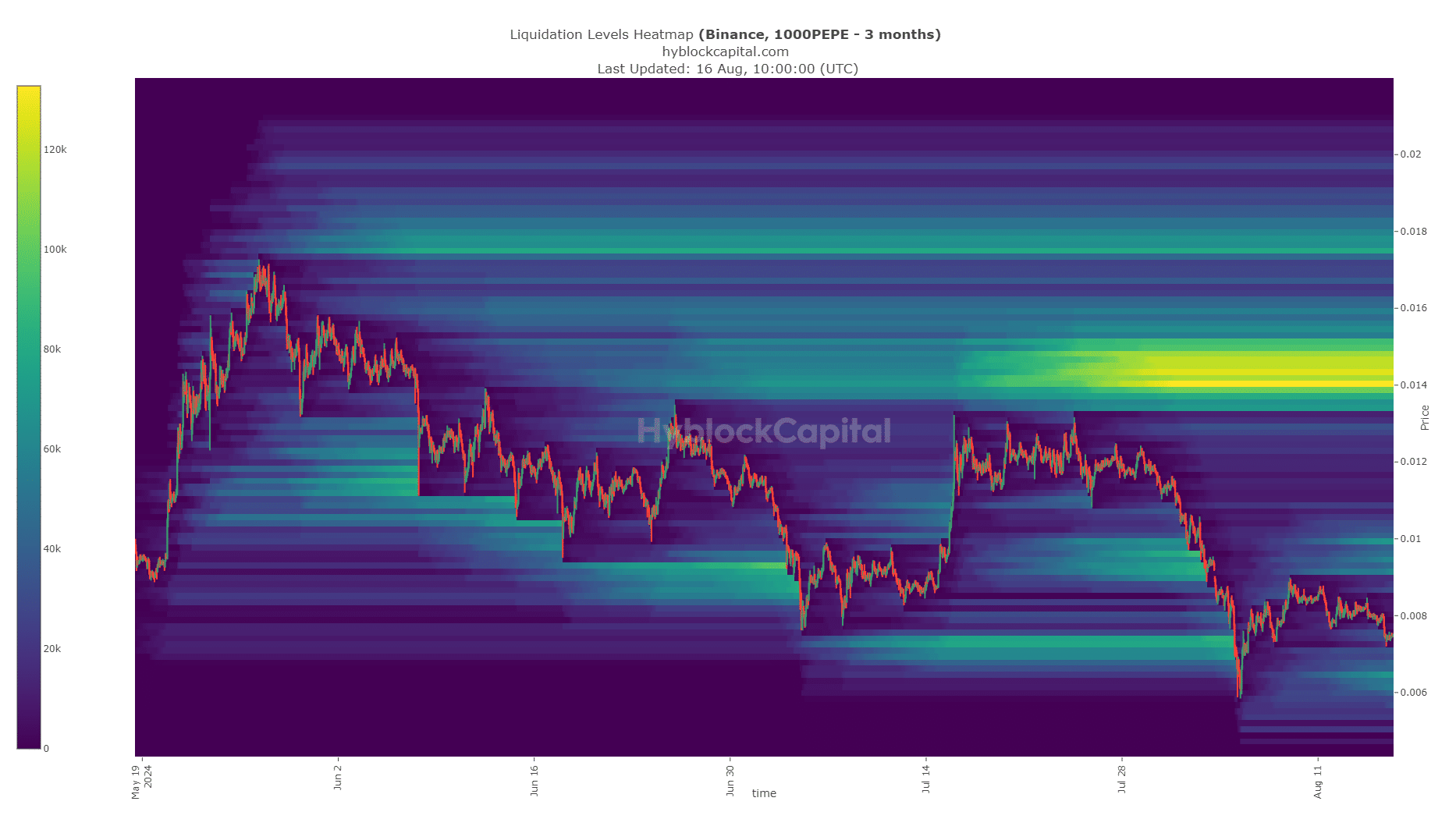

The liquidation heatmap promises a move to $0.000014

Source: Hyblock Capital

Read Pepe’s [PEPE] Price Prediction 2024-25

The 3-month liquidation heatmap showed that the area above $0.000006 had some liquidity. By contrast, the $0.000014 region glowed brightly, marking it as a far more attractive target for PEPE.

It would take time to materialize, but a sweep of the local lows at $0.000006 followed by a rally above $0.000014 could commence, provided Bitcoin can stabilize its downtrend.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion